Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI need to create a sales report showing total sales and sales tax, broken down by city, state and zip code. I have been stumbling around for a while trying to modify various reports with no luck. Any help would be most appreciated! Thanks.

Solved! Go to Solution.

Hello, @Mindi1.

You can generate and customize the Sales Tax Liability report. I can guide you in doing so.

The Sales Tax Liability report displays the following information:

Here's how to run this report:

This report also displays the sales tax you owe for each state, city, or county. It is represented by each tax agency. The last column shows how much your business currently owes each tax district. You can refer to this article for more detailed instructions: Customize customer, job, and sales reports.

Also, I've added these articles to learn more ways on how you can get the most out of the available reports in QuickBooks:

Swing by here again if you have other questions about managing your reports. The Community and I are always here to help.

Hi Mindi1.

Thanks fro joining the QuickBooks Community, I'm happy to give you some feedback. The following article can provide you the steps to customize your sales reports however you need, including state: Customize sales reports in QBDT. For the steps to customize sales by state, follow along below:

If you have any other questions, feel free to post here anytime. Thank you and have a nice Wednesday afternoon.

Hi,

That did not work. I got a report still listing individual sales by date, with individual income items.

I need it to show:

San Jose, CA 95120 $xxx totals sales, $xxxxx sales tax

Gilroy, CA 95023 $ xxxx total sales, $xxx sales tax

Los Angeles, CA 91023 $xxx total sales, $xxx sales tax

Hello, @Mindi1.

You can generate and customize the Sales Tax Liability report. I can guide you in doing so.

The Sales Tax Liability report displays the following information:

Here's how to run this report:

This report also displays the sales tax you owe for each state, city, or county. It is represented by each tax agency. The last column shows how much your business currently owes each tax district. You can refer to this article for more detailed instructions: Customize customer, job, and sales reports.

Also, I've added these articles to learn more ways on how you can get the most out of the available reports in QuickBooks:

Swing by here again if you have other questions about managing your reports. The Community and I are always here to help.

Hi,

Yes, I believe this will do. Thank You! You Rock!

FYI, the reports/Report Center/Search Box did not work. I found the reports via Home/Manage Sales Tax icon. I am currently using the no-longer-supported Enterprise 17 which may be why. We will be installing 2021 this weekend.

I have Quickbooks Online and I do not see those options.

I have a farm based business. Some of my items are farm based (wool) and are non-taxable, some items are retail and some are services such as classes. I sell both on the internet and physically out of state at festivals.

My state requires me to list total sales, out of state internet sales and other non taxable items. So far I have not found a way to do this in one report. Please help.

Thanks for posting here, @3CreeksFarm,

If you want to pull up a list of all sales with all other information for your state, I can help find a report for you. We can customize a Sales by Product/Service Detail report to get all the details you need.

Here's how:

On the report, you will notice that non-taxable items are blank in the Taxable column. Also, different classes assigned to transactions will appear there. See this:

Here are some related links that will help you run reports in QBO:

Let me know if you have any more questions with the reports. I'll be right here to guide you further with it. Have a nice day!

I need a report that shows both sales amounts (taxable and non-taxable) and the sales tax amount for a sales tax audit.

Auditor requested:

Date Inv# Customer Name Taxable Amt (Non-Tax Amt) Tax

Whatever Sales reports I run, I get every detail line of every invoice, including sales tax. Or if I run a Sales Tax Liability report and drill down to Detail, I only get sales $ or tax $ but not both in one report.

I am looking for a report that is "mid-way" between a Summary Report and a Detail Report. I don't want or need every line of an invoice, but I need each invoice not just a total by Customer or Item.

Can this be done? QBDT Enterprise 18

Thanks for joining the thread, @FL_Guru,

Regarding your report preference, the option to add a Non-taxable column on sales reports is currently unavailable. The only indication if the entry is not subject to tax is the code under the Sales Tax Code column.

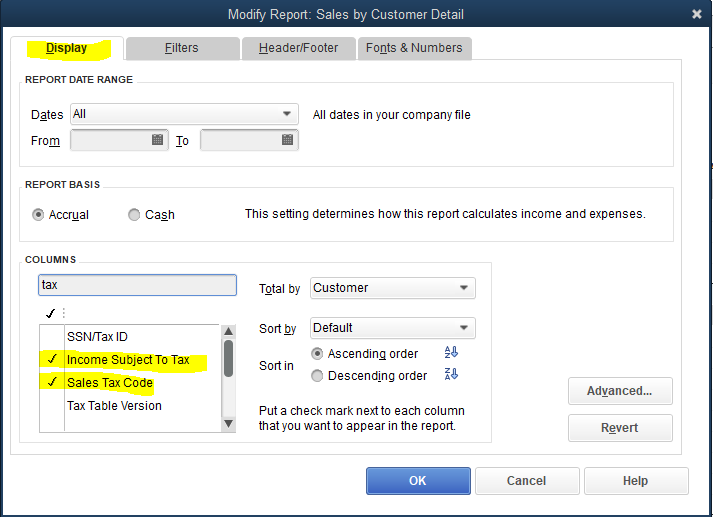

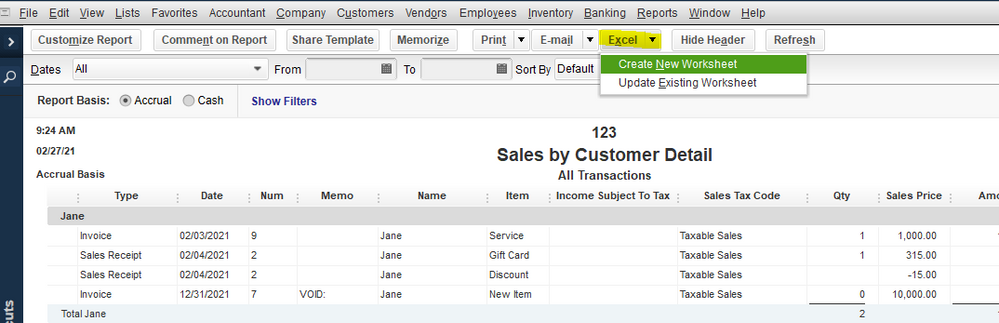

While this is currently unavailable, you can export the report to Excel and manually modify the columns from there. To open an Excel report, follow the customization steps below:

Here is the link for the complete details on how to export your report: Export reports as Excel workbooks in QuickBooks Desktop

Please touch base me again if you need further help with this. I'll be more than happy to assist you further with your reports. Have a good one.

I am fully versed in exporting to Excel.

My issue is really the level of detail in a report.

It's either a Summary at the Customer or Item level. Or it's sooo Detailed (every line in an invoice) that it's impossible to create a meaningful report. (My client creates over 1k invoices each month).

I need a report that will summarize at the invoice level and show both revenue and sales tax data.

Also, we are working with Enterprise 18 (not QBO).

Thanks for your reply!

Hi there, FL_Guru.

Thank you for coming back and for providing detailed information about your concern in a report that you need. I also appreciate you for confirming that you're using the Desktop version Enterprise 18 so we can share accurate details.

You can run the Custom Transaction Detail report and customize this by Total By customer and filter to Detail level in all. This way, you're able to see a summarized version of the invoice level and show both revenue and sales tax data. It also includes whether the entries are taxable or non-taxable.

here's how:

For additional information on how you can personalize the font and style of the report, you can click this article: Customize reports in QuickBooks Desktop.

Drop me a reply if you have more questions while running Customer and Tax reports in QuickBooks. It's a pleasure to assist you.

Thank you for your reply. I have already tried this report. It gives me as many as twenty lines for each invoice, including sales tax. With over 1,000 invoices every month, and an audit period of three years, this report will be far too much data to realistically review.

I need a report that will combine detail lines for a single invoice. I need total revenue and tax amt by invoice. It can be by customer but does not need to be.

If there is some way to export the information to Excel without needing to spend days combining invoice lines, that could be a workaround.

Thanks again for your assistance.

Hi there, FL_Guru.

I'm here to share some insights about how QuickBooks generates reports.

By default, QuickBooks will populate a detailed breakdown of each transaction invoice so you'll see the amount of taxable and non-taxable items. I understand that you need to combine detail lines. However, this option is unavailable in the program. Rest assured, I'll be taking note of this to improve your QuickBooks experience.

For now, you may export the report provided by my colleague, Christie Ann by clicking the Excel button. Then, manually customize its column and rows to combine the details of the invoice.

Additionally, here are some articles that you can read to help speed up the reporting process in QuickBooks Desktop:

I'll be right here to continue assisting if you have any other concerns or report-related questions. Just add the details in the comment section and I'll get back to you.

i have a new client that has to collect sales tax from his customers. I have never done this.

So my first question how do i record this in QuickBooks and where do i record this at?

Hello @Tiddle12,

Let me help share how you can start collecting sales tax for your clients in QuickBooks.

To start with, we'll have to turn on this feature first based on the product version used by your clients. Let me show you how.

In QuickBooks Online:

In QuickBooks Desktop:

In the same manner, here's a couple of articles you can use to learn more about how you can start collecting sales tax:

On top of that, I've also included the following references below for a compilation of articles you can use while working with us:

If you have any other questions, please let me know in the comments below. I'll be here to lend a hand.

I have followed your instructions for the Sales Tax Liability report. When I type that in the search bar and click the magnifying glass. That report does not populate in the list. There are hundreds of reports but not that one. Please let me know if I have something set up incorrectly or ?

Let's make sure that you're able to find the report, deb7007.

It's possible that the Sales Tax function was turned off. This can be the reason why the Sales Tax Liability report is not showing up. Follow these steps on how to turn it back on:

Once done, go back to the Report Center and check if you can already see the Sales Tax Liability report.

I'd also like to share a couple more guide articles and reference in case you might need them in you future tasks:

We're always here if you need anything else while working in QuickBooks. We'll make sure everything is sorted out.

Did you ever find out a solution?? I have a customer that's being audited and asked me to send them a copy of every invoice for the last 3 years, but there are so many. I want to generate a report that shows Invoice + Amount + tax amount.

Let me guide you on how you'll be able to view the information on your reports, bschiavoneJPI.

QuickBooks provides different reports that cater to your business needs. You'll want to run the Sales by Customer Summary report to show the sales tax information. To do this, follow the steps below:

You'll also want to customize reports in QuickBooks Desktop. In the same manner, you can create custom forms according to how you want the information to show. For more information, I've added this article for your guide: Use And Customize Form Templates.

In case you'll encounter issues when customizing templates, check out this article: Fix Common Issues When You Use And Customize Templates.

Fill me in if you have questions about running reports. I'll be right here if you need help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here