Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSpent approx 5 hours on the phone today with 3 QB experts. The first two I got cut off before getting a resolution. The last one I was able to convince there's a bug in the report. She told me she was going to email me a case number so I could track the problem investigation and resolution but that was approx an hour ago and I have had no such email.

So... in approximate terms my client's Q1 actual sales total gross was $67k but the STLR reported $50k as the gross sales. There's a similar discrepancy between the actual "non-taxable" sales and the STLR reported non-taxable sales. Can someone please get this bug fixed?

What I have come to understand is the Sales Tax Liability Report (STLR) only includes in "gross sales" sales receipts that included a taxable item and the "non-taxable" amount on the report is only the non-taxable components on the sales receipts that also contained a taxable amount. Are you with me? or does this just sound like and Irish riddle? (it does to me)

In the end I was able to prove out my theory by exporting all sales to excel, grouping them by sales receipt number and deleting all the receipts that had a taxable component and then sum what was left (all receipts that did not include a taxable line item). Really - QB should have been doing that work, instead I spent about 5 hours repeatedly looking at the same collection of reports with 3 different people (and at times on hold while they talked with a tier one expert on their line) to not get any help. I offered a theory as to what could explain the difference and was left to work through that myself.

Lastly - the STLR NEEDS to include sales to exempt customers so that clients can report total gross sales, non-taxable sales, taxable sales and sales to exempt customers correctly.

Does anyone know how to get a case number for this? I have spoken with the experts on the phone and each time told I would get a case number via email but have not received one.

Hi there, @KatnissBookkeeper.

I suggest checking your spam and junk folders first to ensure that the email with the case number isn't there.

If you haven't received it, I recommend getting in touch with our Customer Care Team and ask for the case number before the end of the call.

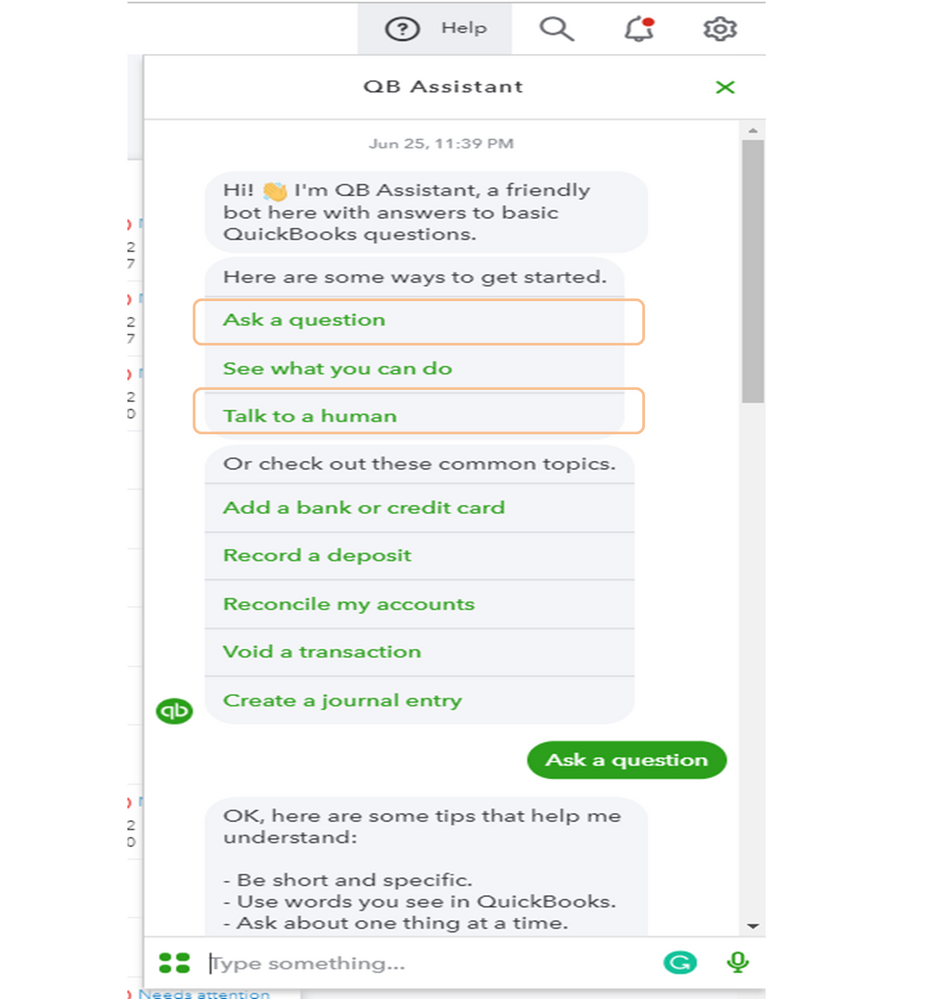

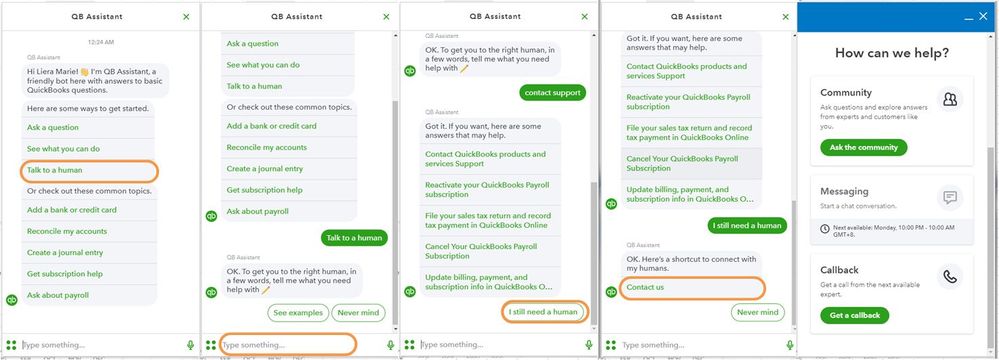

Here's how to get in touch with them:

To ensure that you'll be assisted on time, check out our support hours.

Also, consider visiting this link to view our latest resources that can help your business during these changing times: Small Business Help.

Keep me posted if you have additional QuickBooks Online concerns. We're always here to help you. Have a great day, PlumBookkeeperCO!

Hi

Not in junk or spam

Obviously feeling a bit frustrated here. I'd really rather not call back for a 4th time and wait for a long time to get someone live and then noodle through hours of looking at the same reports repeatedly to have them conclude they don't know or the call be cut off.

I do know. The STLR has a bug in it and it needs to be fixed.

Thanks.

This is not the impression we wish to leave you with, @KatnissBookkeeper.

Rest assured, the best course of action is to reach back out to our Online Support. They can get you the information that you're looking for about the issue, either by attaching you to an investigation so you'll receive email notifications about updates and when the issue is resolved or going through more troubleshooting and fixing the problem. You can follow my colleague's @CharleneMaeF steps on how to get in touch.

Let me know how the conversation goes. I'll be here if you need anything else. Have a nice day!

Ashley_H

I too am having problems with the Online Sales Tax Liability Report showing incorrect values.

The earlier entry who explained how the Report does not show the correct GROSS SALES amount is accurate. To report our sales tax correctly, we need the TOTAL Gross Sales, Re-sale amount, and Nontaxable Labor amounts netted from gross to show correct Taxable Sales amount.

Please add me to this investigation and let me know when it is fixed. In the past, I could run my own reports to see what the Re-Sale number and Labor numbers were to Balance them to the STLR column for Non Taxable amounts. But for whatever reason, the report no longer includes the correct Gross or Non Taxable Amounts.

Thanks for following up on this thread, Jevans.

As mentioned by my peers, this unexpected behavior is already being worked on by our engineers. Rest assured, this is taken with utmost urgency and they’re working towards finding a permanent solution.

To add your company to the investigation, you’ll have to sign up for the list of affected users. This task requires the collection of personal data for account verification. The Community is a public forum, and I’m unable to perform this task for the safety of your information.

Our QBO Care Team has tools to access your account in a secure space, so I recommend contacting them for further assistance. You’ll receive an email once there’s progress about the issue.

Let me also share the Sales tax in QuickBooks Online guide for future reference. It contains some links about the processes you can perform such as paying the taxes, information on how to apply the tax rate to transactions, and answers to frequently asked questions.

I appreciate your patience while this is being worked on. Reach out to me anytime if you need some help working in QuickBooks. I’ll be glad to assist you further. Have a good one.

I opened a case (after many more hours explaining times 2 to 2 different support folks) that the STLR is not including invoices or sales receipts that do not have a taxable line item on them. I sent them copies of all my reports that prove this to them. The case # I was given is [removed].

I feel like I have done all the legwork to report, work through (now at least half dozen times) and send the proof of my theory to support folks. Since July 10th when I got the case # I have heard nada.. zip... silence.. crickets. Maybe it's me, but it doesn't seem like a report should be this hard to fix.

Could someone please, follow up on this case and let us know when the report will be error-free? thank you.

the issue (after many hours of data extraction to spreadsheets) for me seems to be the STLR excludes any sales receipt when it does not include a taxable line item. My client sells service and parts, but sometimes only service which isn't taxable. After cross-checking, I found that was the discrepancy with the numbers. The taxable totals and tax owed both appear to be correct (so there's *some* good news).

Have you determined what invoices/sales receipts are missing from your STLR?

Plum

Thank you for your prompt reply.

The issue you reported a couple of weeks ago is currently being worked on by our product engineers. Seeing that you already contacted our Technical Support team before, that means you're already on the list of our affected users. With that said, you'll receive a notification email as soon as there's an update on this investigation about the Sales Tax Liability report.

A workaround I can share at this time is to set your products and services as non-taxable in their category.

Here's how:

Repeat the steps provided to the other products and services you sell to your customers. Then when it's time to create sales receipts or invoices, tick the Tax checkbox for any line item that is taxable.

If you want to make some changes to your reports that can meet your company's needs, you can refer to this article: Customize reports in QuickBooks Online.

I'll be around in case you need further assistance. Place a comment below, and I'll get back to you.

Hi Ryan_M

Thanks for responding.

I first reported this at the end of April this year, so not a couple of weeks ago, but anyways...

The work around is "interesting"... I enter sales receipts for my client - typically around 150 per month - to follow your workaround would be more work, granted not a ton, but definitely more work but I'm not sure that it will solve the issue...

Again - the issue is the STLR fails to recognize sales receipts/invoices that do not contain any taxable line items. Those sales receipts/invoices are just ignored. My client has a variety of situations whereby sometimes their customers have only service (not taxable) on their bill and sometimes service as well as taxable items like parts. I'm pretty sure, other QB subscribers have the same situation.

How would this workaround solve it? I'm certainly willing to try it but would really like to know how manually marking taxable items would ensure the STLR finds sales receipts that have no taxable line items (manually marked or otherwise)????

p.s. I spent yet another 1.5+ hours with a support person again doing screen shares so I could once again show what the problem was. She agreed it was a problem and was able to duplicate it on her test data but in the end said it was an engineering problem and could not assure me it would be taken care of. Again.

So, please help me understand how the suggested workaround would actually work around and secondly understand that for the liability for clients who are unaware their sales tax calcs are wrong in QB how long it's going to take to resolve.

Thank you

Plum

Hello Plum,

I see that you've been through a lot of effort to figure out how to get the Sales Tax Liability report correctly while the investigation is still open. The suggestion offered by my colleague above is only to toggle the item and may not affect the report to generate correctly.

Though, you can try an item or two to check if that would change the amount in the report. However, please take note that making the items non taxable might also affect your transaction reports with sales tax details. Another suggestion is to export the report to Excel and not use the one in QBO for the meantime while the issue is being worked on. This way, you can make some corrections in the report without changing the product and service's set up.

Here's a sample screenshot:

We appreciate your patience while waiting for the permanent fix. I hope your day is good. Take care and stay healthy.

SarahannC

Thank you for your reply. Logically (to me), it doesn't seem like Ryan's suggestion for a workaround would work. Perhaps adding a fictitious product that is taxable to all invoices/sales receipts that do not naturally have a taxable line item (but putting $0 against that item) might be a more logical solution but I think that would be a huge time waste and ultimately would require going back and deleting that item on all the sales receipts once the report is fixed.

Meantime, I have been pulling a sales transaction report for each quarter and comparing it with Sales by Product/Service Summary and then using the Taxable Sales Detail report to identify any/all discrepancies. I deliver to my client Gross sales, Gross Non-Taxable Sales, Gross Taxable sales, Sales tax amount by jurisdiction (for their reference and budgeting) and Sales to tax exempt customers for each sales tax period so they are able to make their submission correctly. As you know, STLR should do all that (if the exempt sales were added to it and it was an accurate report).

So, until the report is fixed I will have to eat the extra time it takes for me to prepare reports any clients I have in this situation. Fortunately it hasn't cost me any clients and I am able to extract the correct information.

Doesn't it make sense for something this important that QB subscribers be notified that the report cannot be relied upon?

Plum

Just wanted to report back - I created a new product for my customer called "Thank you for your service" and made it taxable, defaulting to $0. I added it to a recently entered sales receipt that did not have any taxable line items, having first pulled a copy of the STLR. Lo and behold, that invoice then appears in the gross and non-taxable amount columns in the STLR while the taxable and tax amounts remain unchanged.

When I delete the product from that receipt, it again disappears from the STLR.

So, there's a possible solution that might work for some folks.

Plum

Hello

So, I finally received an email regarding this issue (which was confirmed during the last support call I made as an issue) - the email said engineering were unable to replicate the issue and the case was closed.

Meantime, I still have the issue, I'll bet others do and at least one of your first-line support people agreed and confirmed with her test database that it was a problem (she also mentioned QB was having problems in general with sales tax calcs).

What are the next steps? This needs to get resolved.

Thank you

Hello, @KatnissBookkeeper.

I understand the impact of any delay in resolving this on-going issue with the Sales Tax Liability report.

Since the issue is not yet resolved, I'd recommend contacting our Customer Care Team. This way, you'd be added to the newly created investigation about the incorrect Sales Tax Liability report (INV - 49070).

Here's how to get in touch with them:

Please let me know how it works. Looking forward to hearing from you.

I have been having this problem for a very long time. I thought I made a mistake in how I had the "tax exempt" setting for the customer but I have tried several combinations and my sales are NOT showing up in the sales tax report. Thank goodness I only have a few sales in my 2 sales tax payable states so I can manually go through the orders to find the applicable orders and will have to manually values. The reports don't work at all. Although there is a "non-taxable" column in the reports there is nothing there. It's worthless.

Is there an ETA on this being fixed? It's hard to file sales tax accurately if the software isn't generating the #'s needed correctly.

Thanks for joining the thread, @knowah.

I have some information about the incorrect numbers on the sales tax report. I've checked and verified the case mentioned above (INV - 49070). It's already marked as closed and resolved.

Let me share with you the steps to make sure your report is collecting the right info. Here's how.

First, verify the product/service item has the non-taxable sale selected for the category. Go to Gear, and then select Products and services. Edit the item in question, and make sure that Sales tax category is Nontaxable. See image below.

After that, mark the Tax column when creating an invoice. This way, your non-taxable sale will reflect on the sales tax liability report.

If you're still experiencing the same result, please contact our QuickBooks Customer Care Support so we can investigate further. Please follow the steps provided by my colleague above @IamjuViel.

In case you need help with other tax tasks, click this link to go to our general tax topics with articles.

Keep me posted if you still have questions or concerns. I'll be around to help. Take care and have a good one.

I just have to say that this 'workaround/fix' is completely ridiculous! WE pay INTUIT a tremendous amount of money each month/year [online versus desktop] for a product we can, supposedly, trust to add and subtract properly. I mean really, at the heart of all this overly complicated programming this is supposed to add and subtract WITHOUT ERROR.

That you would leave us hanging by not being able to guarantee correct numbers just makes us look like idiots when report totals 'magically' change when we look back as you make 'mysterious' code-changes behind the scenes.

We, the Bookkeepers/Accountants/struggling Small Business Owners of the Nation, are left holding the bag in unpaid hours upon hours upon hours... trying to figure out why our clients' books are f'd up when it's really all your fault for not properly testing and testing your products NOT with problems that have expected results but with actual problems you can easily cull from the hundreds of complaints online!

First time participating on this thread:

We have the same problem. My colleague was using the Sales Tax Liability Report for our first few state filings (Indiana) when I realized our Gross Sales amounts were wrong. We had to go back and amend all of our filings. I concur with the thread that the "Gross Amount" column appears to be only reporting the total of the transactions that have taxable line items; it is not the total gross sales which would include non-taxable plus taxable line items. Thus, the "Non-Taxable Amount" column in all of our reports always shows zero for a value.

We have struggled to find an easy way to look at the non-taxable amounts together with the taxable amounts due to this problem.

One thought for Intuit coming from a novice: could it be that this report is only looking at the "product" line in order to filter the results? It seems that many of the support posts go back to changing product-level meta-data to correct this. All of our products are "taxable" so changing this flag at the product level doesn't seem like the right solution for us. We get into "non-taxable" transactions when we are shipping items to other states in our online store. It seems like the product type should not be the determinant for this report. Shouldn't the report filter be looking at the taxable amounts at the transaction level instead?

Hi there, @mick_indy. Thanks for explaining your issue in such great detail.

I've check this issue that you're having about the sales tax category and this is a known issue that our team is currently working on. Rest assured that our engineers are currently working on an immediate fix.

I encourage you to reach out to our Customer Care Team This way, you'll be added to the list of affected users and get notified of the latest updates and progress of the investigation through email. Just provide this investigation number INV-52368 to the representative.

Here's how:

To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. For more information, check out our support hours and types.

Additionally, you can check out the article about sales tax in QuickBooks Online for more in-depth information.

Keep us posted if you have other concerns, @mick_indy. We're always here to help. Have a great day!

I also have this problem and unfortunately I didn't realize it until after I submitted filings for 2020. I noticed it just now for the Q4 2020 filing for one of the companies. Do you realize how ridiculous and incredibly critical this error is for those of us who prepare Sales and Use Tax Filings for Clients? I now have to go back for every single client and create amended filings for every quarter of every year in order to properly remain in compliance! How you can NOT show the correct gross sales amount on the Sales Tax Liability Report?? That is a fundamental figure that needs to be reported to Tax Agencies! This is going to take so many hours to go back and correct.

You absolutely NEED to notify all of your subscribers that this is not correct! This has major liability ramifications on QB if anyone is every audited and these figures are found to be incorrect by a Tax Agency!

QB Online was displaying non-taxable sales correctly when I pulled a November report on December 18.

Now in mid-January my December report is having the same issue described by original poster. Non-taxable sales are not reporting correctly.

Additionally, historical reports displaying online no longer show non-taxable sales that were correctly on reports printed at time of sales tax payment.

Get your engineers to reinstate coding changed in the last month. This is a major fault. Intuit is leaving itself liable for a major class action lawsuit and possible fines by state tax agencies.

oh my god, I am experiencing similar issues. non-taxble items are not flagged correctly and I just cant match up the taxable sales detail report ( which I also supposedly customize that for non-taxable), with our profit and loss and the tax liability report. There is a glitch there, I have been wasting alot of hours and still can not figure it out.

in my case I see some items perfectly showing up and some are skipped on some reports. I am planning to call Quickbooks on monday. Wish me luck? after reading this thread, I am already dreading it.//

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here