Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

"(Error code:0)" "Failed to subscribe please try again later." and "Unable to process your request at this time"

I Googled the error message and nothing is coming up. Anyone have advice on a workaround?

Hi, @croyston311.

Upon checking, I've found out that there's an ongoing investigation and that other users also encountered the same error message when trying to re-subscribe to payroll upon attempting to e-file 1099s.

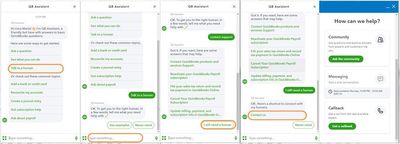

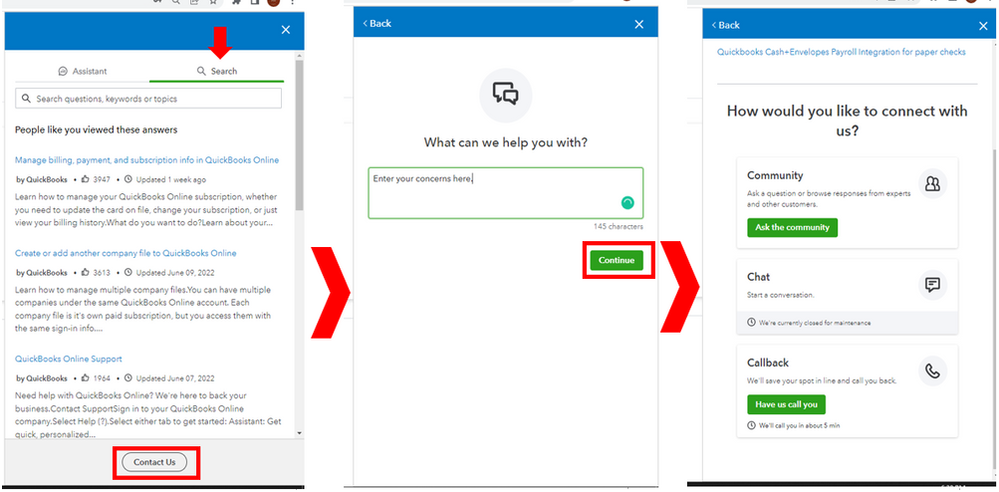

With this, contacting our QuickBooks Online Payroll Support is our potential solution. Here's how you can reach out to them:

For now, there aren't any available workarounds to fix this issue, but they can add you to the list of affected users and update you once there's a possible resolution.

On top of that, here's an article you can review to help you find out which payroll taxes and forms your QuickBooks Payroll subscription pays and files for you: Payroll taxes and forms QuickBooks Payroll does for you.

Feel free to get back here in the Community for more concerns about payroll-related tasks. We're always here to help you in any way. Take care always.

Thank you for your reply.

What does this mean "when trying to re-subscribe to payroll upon attempting to e-file their 1099s."? I'm not trying to re-subscribe to the payroll module.

Hello there, @croyston311.

Let me add details regarding the error you received when e-filing 1099s.

Please note that the error you receive when you submit your 1099 forms using Quickbooks usually occurs when re-subscribing to payroll. Hence, having an active subscription is essential to electronically file your 1099 forms successfully.

However, I recommend contacting our customer support team if you've encountered the error, though you have an active subscription. You can follow the steps provided by my colleague above to connect with them.

On the other hand, you can review this material to help determine who needs 1099s, the payment totals, and more: Create 1099 reports in QuickBooks.

Don't hesitate to click the Reply button for additional questions when filing 1099s or other related concerns in QuickBooks Online. We're always here to help.

Its seeming more and more like QBO is trying to force all users to pay for the payroll module when we have no need for it but ONLY need to be able to e-file our 1099s.

I just got through a long convo with the help desk and she mentioned that it's a known problem with Visa cards (even if QBO pays successfully every month on your Visa card), so if you have a different brand of credit card, or can enter your bank details for a direct bank transfer of payment, then your transaction should go through.

Good luck!

Using a different card doesn't work. Using a different browser doesn't work. Using incognito mode doesn't work. Have spent a few hours already this year with QB support. Just like last year, am unable to eFile 1099s. Either QBO support is completely useless, or this is a big scheme to try and get people to pay for their Payroll product.

Did you ever find a solution? I am currently experiencing the same issue!

I completely understand the importance of submitting your 1099s, abandonbrewing, especially during this filing season.

Upon checking our system, we have an ongoing investigation about the error code you've encountered when filing the form. Please be assured that our engineers are working diligently to resolve this issue.

I recommend contacting our QuickBooks Support Team so that you'll be added to the list of affected users. This way, you'll receive email updates on the investigation's status and be notified once it's been resolved. I've included the steps to contact support below.

To ensure you'll be assisted on time, please see our support hours.

I appreciate your understanding on this matter. Please know that I'm determined to get this resolved.

I am pretty fed up with the whole situation. When you actually call and let them know that you read this on a feed and were told to contact them to be put on a list, they have NO idea what you are talking about. Nothing is getting resolved and it's a complete waste of time. They think they can fix it themselves and that "we" are just doing something wrong. Maybe the company needs to put out a memo to it's help desk so everyone is on the same page and they quite wasting our time.

I use American Express and it is still erroring out.

I have been on the phone with an agent for over 45 minutes. They have not idea what is going on. I have 25 QBO accounts, all but two were able to file 1099's with out an issue. I have two that are still erroring out.

The only reply I received back from them was to make sure our phone number and address were formatted correctly. *eye roll* The lack of concern on their part about this whole mess is pretty disgusting. I will never recommend their product!

I can see the urgency of e-filing your 1099, erbrel.

As per the status of the investigation about the error you're getting, it is still in progress.

I know it's been a while, but rest assured our engineers are prioritizing in resolving this issue to get you back on track as soon as possible. I suggest getting in touch with our Customer Care Team again and providing the ticket number INV-96793. They can add you to our notification list and keep you updated on the progress of the investigation.

To reach them, click the ? Help button at the top-right corner and select Contact Us to talk with a live agent. Ensure to review their support hours to know when agents are available.

Additionally, I'm including this article to help answer the most commonly asked questions about 1099s in QuickBooks: Get answers to your 1099 questions.

Thank you for your patience and understanding while we look into this further. If you have any further concerns, feel free to reach out. Have a great day.

I am still having the same problem and have tried everything? Are there any updates as to why the problem is still not fixed?

I understand all your frustration regarding the submission of 1099, @greenheronbookkeeping. Let's ensure you're able to submit it in QuickBooks Online (QBO).

I've checked our records and found that the investigation of this error is already closed. Therefore, I recommend contacting our Customer Support Team. By doing so, they can securely access your account and further investigate the problem.

Here's how:

I'm also adding this article to further guide you on how to troubleshoot possible 1099 issues in QuickBooks: Troubleshoot common 1099 issues. It includes topics about incorrect amounts showing on your 1099s and vendor reports.

Leave a comment below if you have any other concerns or follow-up questions about filling 1099. I've got you covered.

Hello. I have been trying to efile my 1099s on and off since Monday (today is Friday). QB directs me to a third party website called Zenwork tax 1099. I cannot get the 1099 forms to populate from the QB data.

I have spoken with QB payroll support several times. The last go around I had with Diego who told me that QB payroll support had no training for Zenworks and that I should call them for support. What is going on??

Hello, @scouse.

The Zenwork is a third-party application specifically designed for e-filing 1099 forms with QuickBooks Desktop (QBDT). To ensure a smooth process for populating these forms with your QuickBooks data. Let me share the next steps you need to take.

Since this operates as an external application separate from QuickBooks, I recommend reaching out to their support team for comprehensive guidance on populating your 1099 forms. To contact Zenwork, visit tax1099.com and scroll to the Contact Us Today to Efile your IRS Tax Forms with Ease section. There, you’ll have the option to use the chat feature for immediate assistance or send an email for detailed support. They can provide the specific steps and insights you need to successfully complete the e-filing process.

Moreover, you can check this article for more detailed information about importing your data into Tax 1099: Create and file 1099s with QuickBooks Desktop.

Additionally, here's a helpful article about checking your historical tax payments and forms in QuickBooks: View your previously filed tax forms and payments.

Let us know if you have further questions about managing your 1099. We'll be right here to help you anytime.

It is very frustrating to learn that I need to use a 3rd party app to efile 1099s when I can file w2, w3, 940, 941 etc, directly from QB with ease.

That QB palms me off to another app, which I now need to learn, just pushes me over the edge - I am done with QB!!

Hi,

I am also having this issue, I have spent 4 hours going round and round on this.

What is the root cause solve? It is a bit disingenuous to say QB offers 1099's and I am unable to produce them with a week to go.

What is the root cause solve here to get my 1099's filed?

Please advise.

Timely submission of 1099 forms is essential to avoid possible penalties, pbin-ngit. Let me clarify the reason behind the issue and share the necessary information you need for successful reporting.

If you're referring to the error messages mentioned in the thread, they occur when you're trying to resubscribe to Payroll. Please know that you need an active Payroll service to file 1099s in the program. Given that there's a report for this error code, the users encountering the issue contacted our live support team by following the steps provided by my colleagues above.

However, if you have activated the Payroll service and are still unable to file 1099s, I recommend contacting our live experts directly. They have the specialized tools to pull up your account securely and determine the root cause of why you cannot produce the forms. I'll show you how.

Please note our operating hours so you can reach us at your convenience. Refer to this article and select QuickBooks Payroll: Get help with QuickBooks products and services.

Otherwise, add Payroll to your QuickBooks subscription to start processing forms and taxes. You can then get started with QuickBooks Online Payroll.

Additionally, create 1099 reports in QuickBooks to know which of them needs one.

Furthermore, check out this material for a detailed solution in case you need to add workers or change figures: Troubleshoot missing contractors or wrong amounts on 1099s.

Ensuring compliance with the 1099 filing regulations is our priority. For more questions about the preparation, add them below. We'll be here to address them for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here