Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowShould a P&L report by class for year end with a profit of $604,000. I remove 1 class with a profit of $17,000. The report showed profit of $557,000?

All bills are put in before payments

I can help you handle your Profit and Loss (P&L) by Class report, @fandsinvestment.

Unapplied Cash Bill Payment Expenses are created by Quickbooks Online automatically and use cash-basis reporting. This is equivalent to cash payment income but on the expense side.

You usually use this to report the Cash Basis expense from vendor or vendor payment checks you've put in before payments.

For more details, please see this article: What's Unapplied Cash Payment?

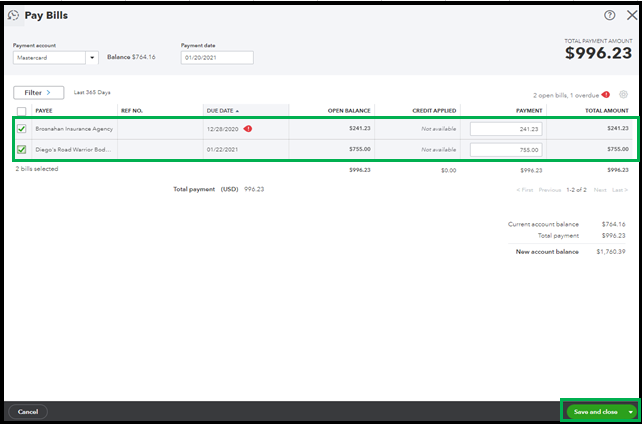

Also, please ensure to select the correct date and accounting method (cash) filters. This way, you can see the right amounts on your report (see screenshot).

If the same thing happens, you can click the amount on your report and drill down each transaction. Another option is to apply the bill payments dated before the actual payment. Let me guide you how:

If you get the same outcome, then this is likely a browser-related issue due to the saved cache. To isolate this, you can use a private browser (incognito). This session doesn't store cache or cookies in the system. Thus, a good place to fix issues like this.

You can use these shortcut keys to access one:

.

. and Microsoft Edge

and Microsoft Edge  .

. .

.Then, perform the same set of steps above again. If you got it to work this time, switch back to your original browser and clear its cache. This way, the system can start fresh again.

Alternatively, you can use a different supported web engine.

If you wish to save the current customization of this report, you can memorize it. This way, you can access a copy for future use.

I've got your back if you need more with your reports in QuickBooks. Just let me know in the comment section so I can assist you right away.

I understand what "Unapplied Cash Bill Payment Expense" is. All my bills are put in on or before the pay bill date. I am on cash method on the report. All the bills show they are paid.

I understand what "Unapplied Cash Bill Payment Expense" is. All my bills are put in on or before the pay bill date. I am on cash method on the report. All the bills show they are paid.

Thanks for updating this thread, @fandsinvestment.

At this point, I would suggest you contact our support team to securely pull up your account for further investigation into this issue.

Please reference this article for contacting our QuickBooks Online support team: Contact QuickBooks Online Support.

If you have additional questions, please know I'm just a post away. Take care!

I have talked to support several times and screen shared. Just when she saw the problem we got disconnected. Called back but got someone else and got disconnected again. When I talk to support no one knows or understands the problem!

It's all about the dates.

Even if your bills are Paid, if your Payment pre-dates the Bill, it will go to Unapplied Bill Expense.

Bills are Accrual based Transactions because they use Accounts Payable.

You could alternatively use "Expense" rather than the Bill feature. Otherwise, correct the dates for the Bill and Bill Payment to be the same date or the Bill dated prior to the payment.

HI, that worked for me, had same issue. But why!! If a payment is assigned to the bill (paid early / late) then why should the mismatch of dates result in "unapplied"??

Thanks for joining us here in the Community, @tanahmed01.

Let me share additional insights about the unapplied bill payment expenses in QuickBooks Online.

The Unapplied Cash Bill Payment Expense shows up if a bill payment for a vendor is recorded before entering the bills, or if you entered bill payments without matching them to bills. These are the reasons why payments will appear as unapplied.

To prevent this matter from happening, make sure that the payment is recorded after the bill is created. Know that the bill is an accrual based transaction while the Unapplied Cash Bill Payment Expense is cash basis. You may consider using the expense transaction to keep your records accurate.

For more details on how to select the accounting method of your reports depending on the information that you need, including how to manage unapplied cash bill payment expense on your profit and loss, please see these references:

I'm always available to talk about bill payments or with QuickBooks. Feel free to reach back out to me if there's anything I can assist you with. Keep safe!

I am having this same issue with a credit card bill and payment. In my case the payment date does not predate the bill date, all bills and payments are linked. The really strange thing is the most recent bill entry is showing on unapplied cash bill payments as well. I spent over an hour screen sharing and the rep couldn't help me and was asking me to start deleting credit card transactions.

@sfasdf1 I found this post in my search for this topic. You are the only one that had an accurate description, that I saw. I have this line in my P&L. I reviewed the listed Unapplied Cash Bill Payments, and you are correct - they have different bill pay dates. These are all my RECURRING BILLS. So, my recurring bill has a bill date of 4/1 - but I cut the check on Mar 17, so I could pay the bill on time, thus creating the different dates. Do you know how I can actually clear these out from the P&L? I can't go in and PAY BILLS to remove them, because they are not in there to pay - having already been paid. It's just the system apparently doesn't make that connection, even though the actual bill shows PAID. Anyway, do you know how to clear them out of the UNAPPLIED CASH category so they don't show up on my P&L? Thanks!

Did anyone ever reply to this post? I, too, am having the same issue asmith1126 described. My credit card bill date does not predate the payment date and all bills and payments are linked. There is absolutely no reason there should be an Unapplied Cash Bill Payment Expense on my Cash basis P&L.

Hi there, ana3.

In QuickBooks, there are two accounting methods (Cash and Accrual). The Profit and Loss report will provide a different picture depending on the method you pick.

When you run a Profit and Loss report in QuickBooks Online (using the Cash method), an account called Unapplied Cash Bill Payment Expense shows. This account shows up when:

For your reference, read through these help articles to learn more:

For example, if the invoice is paid on Monday, the invoice date is Tuesday, so the Unapplied Cash Payment displays when you enter a bill payment before entering the bills. You can modify the dates of each bill and make sure that they're dated before the bill payments.

Feel free to leave a message for me if you have other questions or concerns. I'm more than happy to assist you every step of the way. Take care and have a wonderful day ahead.

Thank you AileneA - To clarify, the bill payment in this case was NOT entered after the bill. The bill is dated for December 2021 and was paid in January 2022. The bill and the bill payment were properly matched. This is the same situation asmith1126 described where neither of the two criteria (payment pre dates bill date or bill and bill payment are not properly matched) occurred but the account was still created. I have multiple examples of this happening on a cash basis and it makes absolutely no sense. Now I'm trying to close out my clients' year end books and am struggling to explain to a CPA what is in the "Unapplied Cash Bill Payment" account and how it should be treated for tax purposes. I need a fix!

Did your customer have more than one bill with the same amount?

If so, it could of matched to the wrong bill. That may explain how it went to unapplied cash payment

I was advised to set the bill date to 1/1/23 for the bill that is showing as unapplied cash bill payment on the 2022 P&L, then you won't see the unapplied cash bill payment on the 2022 P&L. This worked for us with our December credit card bill, which actually had a bill date of 12/19. When I changed to 1/1, it didn't show up in the unapplied cash bill payment account until 1/1.

On a side note, I spent an hour screensharing and was eventually told they don't know why this is happening or how to fix it.

-asmith1126

No - it was a credit card bill and didn't match any other prior or future bill. Asmith1126's latest post saying she was advised to change the bill date has worked for me in the past. In this particular case however I have a bill for December 2021 - a year that has been closed with a tax return that has been filed for an accrual based client - that was paid in January 2022. To add to the issue this client is now a cash based tax filer so I can't touch 2021 but on a cash basis for 2022 it's showing a significant Unapplied Cash Bill Payment expense that I can't intelligently explain to a CPA without understanding why QBO does this. Any guidance or explanation would be much appreciated.

I'm guessing QBO has no fix or reply to this as my last post was meant with radio silence? This is unfortunate - to not be able to explain why there is a $15k adjustment on someone's books for no reason and offering no solution is disheartening.

This happened to me also. I had my account explain it to me. I'm reaching out too he to help have he explain it better than me

Is there any update on this topic? I think this is a bug in QBO and actually creates an error on the P&L cash basis. Here's our situation which seems similar to others. We had a vendor credit from 2020, just found it and want to write it off in 2023 before we close the 2023 books. We created a bill in 2023 for the amount of the vendor credit (also tried with a JE but had the same results) and applied the credit in a bill payment to pay that bill. We expensed it as "vendor credit write off" expense. The vendor balance is now $0 (correct) but the cash P&L shows both a negative unapplied cash payment expense and a positive vendor credit write off, they cancel each other. It should show only the vendor credit write off expense. P&L is now overstated by the amount of the credit.

Hello there, Teedit. I appreciate you for joining the thread. I see that the result on your Profit and Loss report doesn't produce of what outcome you expect.

Here are potential reasons for observing unapplied cash bill payment expenses on your profit and loss:

However, since this doesn't align with your description, where there's a discrepancy between the unapplied cash payment expense and the vendor credit write-off expense. It's possible that there's a misalignment in how the transactions are recorded or applied in QBO.

I recommend reviewing the transactions you created to ensure they're accurately recorded and applied.

I also suggest consulting your accountant to verify the accuracy of your transactions. They can help you minimize errors and discrepancies in your financial reporting.

After making sure that everything is appropriately recorded but the Profit and Loss report still shows the same result, you can follow these:

You can use this article for additional tips when personalizing QuickBooks reports: Customize reports in QuickBooks Online.

Feel free to post again if you got concerns about QuickBooks reports. I will promptly provide the necessary help to ensure your QuickBooks experience is seamless.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here