Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThank you! Will try this out and i'll get back to this thread should I encounter any error. Much help!

I did the instructions you outlined, however, an error message appeared and says that "The account you are trying to use has been deleted" Could you please advise? Thanks.

Good to see you back, @mrafael.

I'm here to help you fix this error and make sure that you'll get back on track.

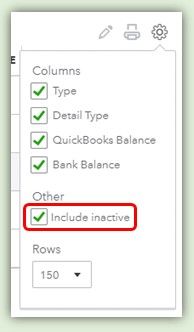

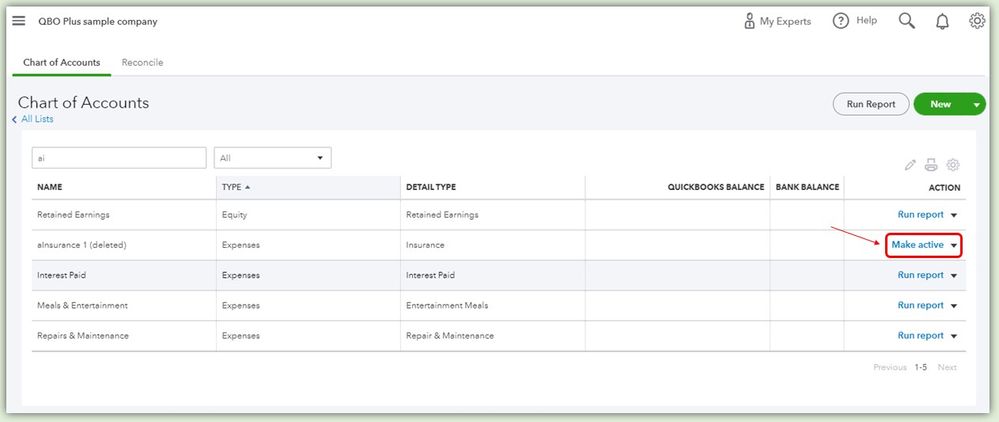

This error you've encountered happens when the system recognizes the Expense account as inactive. We are going to make it as active again so that you can continue the process to remove the billable expense. I'll guide you through the steps and I also added some screenshots for your reference.

Once done, you can follow the steps provided by my colleague @Angelyn_T to remove the check mark in the billable column in your expense transaction.

Should you want to see the list of the billable charges, you can run the Unbilled Charges report. Then you can customize it to easily locate the information you want to see. For more information about the steps, you can check out this article: Customize reports in QuickBooks Online.

Please don't hesitate to comment below if you have other concerns. I'll gladly help you. Stay safe out there.

My question pertains to Quickbooks Desktop. When creating a new invoice, I click "Add Time/Cost" so I can clear the unbilled expenses. I do not want the expense to appear on the actual invoice so I click "hide". The problem is, it still appears on the invoice. What am I doing incorrect?

Welcome to the Community, LADLER.

You're on the right track to hide unbilled expenses from your invoice. However, there's a few additional steps that have to be performed to achieve this result.

I'll guide you through what to do once you've clicked Add Time/Cost:

1. Open each tab and look for the Hide column.

2. Select the ones you'd like to remove from your invoice by ticking their checkboxes.

3. After selecting everything, hit OK.

4. Click Clear.

Now your costs that haven't been billed will cease to be visible on the invoice you're creating.

You can find many useful resources in our QuickBooks Desktop help article archives.

If there's any other questions, please don't hesitate in reaching out. I'll be here to help. Have a great day!

That does not work. I have tried and they still show up.

Thanks for joining in this thread, @Steveste.

Once you open the Add Time/Cost icon in your invoice and check the Hide boxes for the billable expenses in the Expenses tab, this will automatically unbilled your expenses that were marked as billed.

However, if these steps don't work on your end, there may be a data issue within your company file that might cause this behavior. No worries, I'll be providing you some run some troubleshooting steps that can help you get back to your task.

First, update your QuickBooks Desktop to its latest release. Doing this will resolve some minor issues in the program. Here's how:

Once done, follow the recommended steps provided in the conversation above to remove your unbilled expenses.

However, if you're still getting the same issue, I recommend running the Verify and Rebuild Data tools. The Verify Data self-identifies the most commonly known data issues within a company file, while Rebuild Data self-resolves most data integrity issues that the Verify Data finds.

Please know you can always come to the Community for all your QuickBooks needs. Wishing you all the best. Stay well.

Do you know how this works for QBO? I do not have the option to Hide. I tried adding all the billable expense to the invoice, then clearing the lines of the invoices and selecting the option to no, keep them when the question "would you also like to unlink the billable items" appears. Looks like this will remove the billable expenses, but QBO won't let me save a $0 invoice so I'm not able to complete my process.

I should also mention that I do not have the option to uncheck a billable box. I navigate to the billable transaction in question and there is no billable box. I've check my account settings on QBO, but I do not see any settings to "mark all checks as billable."

Thanks for following this thread, klrosebr.

I appreciate all your efforts in trying to hide the billable expenses. Let me share some insights about concealing billable expenses in QBO.

Before proceeding, the Mark all expenses as billable feature is only available in the desktop version. That’s why you’re unable to see it on the Account and settings page.

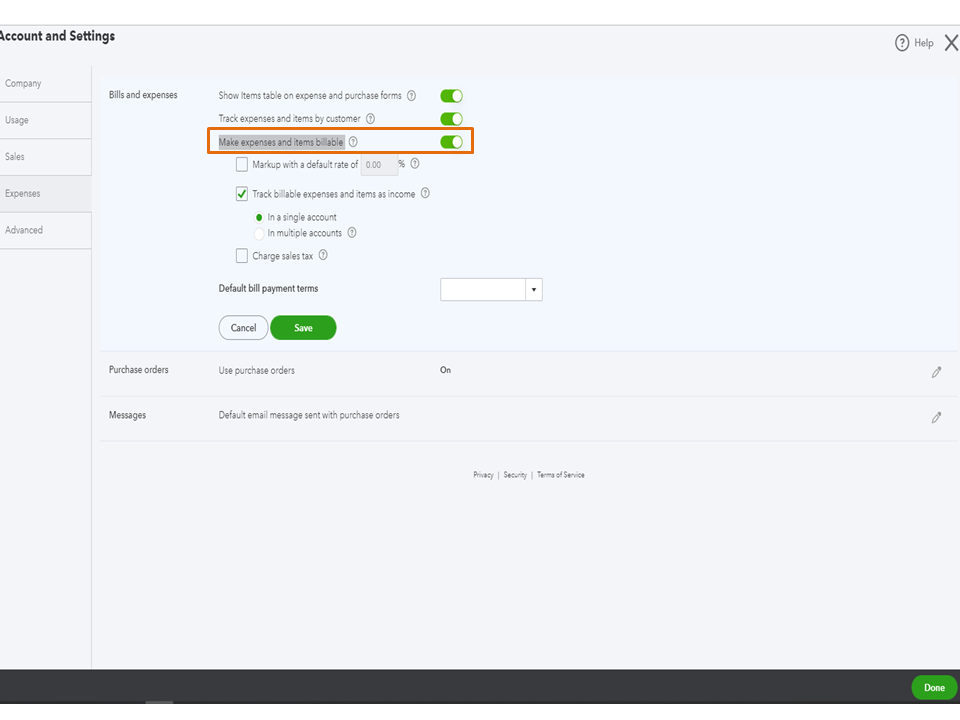

In QBO, you should be able to save a zero invoice as long as there’s a line item. If you’re unable to see the Billable box, let’s review the setup for Bills and expenses. Then, make sure the Make expenses and items billable feature is turned on.

Here’s how:

Next, you can continue hiding the billable expenses. I suggest following the solution shared by @Angelyn_T found on this thread.

Alternatively, use this link to manage your transactions qbo.intuit.com/app/managebillableexpense. When you open your company, enter it and it should look like this: qbo.intuit.com/app/managebillableexpense

Then, follow the on-screen instructions to complete the process. Let me also share these guides for future reference.

Reach out to me if you have any clarifications or other QuickBooks concerns. I’m always ready to lend a helping hand. Have a great rest of the day.

Thank you so much for the feedback. I do not see the billable options in my settings, so I don't know if it is because I am in the accountant version or the client doesn't have the correct version that allows for billable options. I attached a screenshot of my settings.

I did test out the $0 invoice theory though and that seems to work. I just had to add a line item for $0 to create the invoice and clear out the billable charges.

Almost 2 years after this is noted as being a known issue the engineers are fixing and it's still a problem.

I also am getting this error message.

What is the status on having this resolved?

Let me help you, Guavaria.

The investigation case (INV-16307) added in the thread is closed already. I'd like to know more about this, though. What specific error did you encounter? It'll help me check if there are any open cases the same as yours.

In the meantime, you can check the list of articles or topics that may help you: QuickBooks Support.

You can get back to this thread with more information. We'll reply as soon as we can. Take care!

I'm getting the same exact error as the other poster did.

"Something's not right.

This account has been closed."

I'm getting the same error message as the previous poster.

"Something's not right.

This account has been deleted."

Hi guavaria!

Thanks for the additional info. You'll encounter such an error message if the account you're trying to use is marked inactive. You'll want to reactive it so we can fix this.

You can follow these steps:

I've added some articles for your reference. These will show you how to handle expense transactions in QuickBooks Online.

Keep on posting here if you need more help. Take care!

This is awesome!! Thank you so much!

Why don't we have a troubleshooting FAQs chart to send out to Pro Advisors for these types of questions? Thankfully I looked this up and found this answer but what if I didn't? My client would have been going through each and every transaction to remove the little checkmark!

Or, how about adding this feature link to the Accountant's Tool Box?

Good to see you in this thread, tcalabrese4458.

I'm happy to see that you were able to find the solution you're looking for. And I appreciate you for putting your voice out and providing feedback.

I can see how having a troubleshooting FAQs chart is beneficial to send it out to your clients. Here at Intuit, we take great effort to enhance our QuickBooks product. That being said, you may want to visit our QuickBooks Blog and be the first one to know about any updates that you'll find beneficial for your business.

The QuickBooks Blog is our way of letting you know the latest features released and what the product team is working on. They update the site every time new information is available.

If there's anything else you need help with, let me know by adding a comment. I'm more than happy to assist you. Have a great day!

I was looking for an answer for this everywhere and FINALLY found a solution. When we switched from desktop to online, all our inactive clients changed to active because of the old billable expenses we had been using for tracking costs related to employee hours. (I have no idea if we were supposed to do this differently, but that is what we did and had 1000+ records to change). There is a URL you can use to clear out old billable expenses but I was getting an error that "Something is not right". Thanks to a very patient QBO rep, we identified some inactive accounts we had. We activated the accounts and ran the link again and it WORKED. It hid the old billable expenses and switched most of the inactive clients back to inactive. I still have some cleaning up to do, but this was huge. Here is the link:

qbo.intuit.com/app/managebillableexpense

I am having this same issue except with time tracking. We have unselected the billable box but we are using the customer to track the expense vs the income. It is automatically putting it in the billable expense and slowing our quickbooks down when we are trying to create an invoice for our customer. We have to be able to track the expense for labor per customer but we do not want to bill it. We have changed the preferences and this has not fixed our issue. It still appears in the billable expenses, and I read online that it is because we have a customer listed on the time tracking. But in order for our P&L's by customer to be correct we have to list the customer. I looked at our unbillable costs and there thousands of unbilled costs back from 2017. We have hidden them but how do we stop this from happening in the future???Please help.

I am having this same issue except with time tracking. We have unselected the billable box but we are using the customer to track the expense vs the income. It is automatically putting it in the billable expense and slowing our quickbooks down when we are trying to create an invoice for our customer. We have to be able to track the expense for labor per customer but we do not want to bill it. We have changed the preferences and this has not fixed our issue. It still appears in the billable expenses, and I read online that it is because we have a customer listed on the time tracking. But in order for our P&L's by customer to be correct we have to list the customer. I looked at our unbillable costs and there thousands of unbilled costs back from 2017. We have hidden them but how do we stop this from happening in the future???Please help.

Thanks for following this thread, @nroberds. I'm here to help ensure your unbillable costs stop from happening in the future.

First off, let's generate the Unbilled Costs by Job report, and your Time by Job report for Unbilled.

Now, for each customer:job name, start with an Invoice. Use the Add Time & Costs icon. You'll then see the pop-up tabs. Click each to see all the Unbilled entries waiting. Click the Hide from the far-right column. Once you Hide everything on all of the tabs for this name (don't forget to Scroll), Click OK. Now, hit Clear. At the top left, put in the Next Customer:Job and use the Add Time & Costs button.

The report refreshes with fewer entries listed on it. Keep doing this until it's all cleared.

If you need related articles, steps, and tips for future use, feel free to visit this link that contains help articles for QuickBooks Desktop.

Get back to us if you have more questions. We're always around to help you find the answers. Take care.

Ok so we have cleared all the unbillable items, but the time items keep showing up even though we are unselecting the billable check box. Why would this happen. Is there a way we can stop this. We have changed the preferences to not mark everything billable.

Hello, nroberds.

Let's isolate this case by performing rebuilding and verifying your data in case there's any damage. The Verify Data utility identifies any potential data damage issues, while the Rebuild Data utility repairs data in your company file.

If the program is in multi-user mode, you need to change to single user mode (Go to File -> Switch to Single User Mode). It is very important that you have to create a backup copy of your company file before running Verify and Rebuild Data.

Verify Data:

Note: If the verify process is successful, you are done. In case it fails due to some problem, QuickBooks will notify you to run Rebuild data.

Rebuild Data:

For your reference, see the following link to learn more about this tool: Resolving Potential Data Issues

Please let me know if you have further questions or concerns. I'll be here to help you every step of the way. You can always reach out to the Community or me anytime you need a helping hand in getting back to business. Take care!

Hello @PaysTooMuch,

Before we can accomplish your goal for today, may I ask for a few clarifications about your post upon joining this thread? With the existing engagement, most customers are talking about their billable items on the desktop version. Are you using the online of QuickBooks?

Keep me updated in the comments. Hope to hear from you soon. Take care and stay safe!

The reply that you are replying to should have shown up under the post that I was commenting on not the last one on the page, you can go back and look and see, someone was talking about online in a desktop post, I was just trying to make sure they knoew that. No need for you to further comment.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here