Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Hi @DWM52,

When you delete an account in Chart of Accounts that have a balance, this will create an adjustment to zero the balance.

Please ensure, when deleting an account, move the transactions to another account to prevent the system to automatically create an adjustment.

If you have any other concerns in QuickBooks, you can always tag me in the comment section. Have a good day.

Hi @DWM52,

When you delete an account in Chart of Accounts that have a balance, this will create an adjustment to zero the balance.

Please ensure, when deleting an account, move the transactions to another account to prevent the system to automatically create an adjustment.

If you have any other concerns in QuickBooks, you can always tag me in the comment section. Have a good day.

It was an acceptable answer, but I do not know how to mark it as such.

I have a similar issue I hope you can help with. I have several old credit card accounts that we did JE's to bring to zero at year end and the cards were closed. So the accounts had zero balances and cards closed - perfect.

Two months later QBO made an automatic entry on these accounts giving them all small negative balances with an entry to the 3000 Equity account, with the memo being "Created by QB Online to adjust balance for deletion." The next year end we again zeroed out the balances and again several months later, QBO made an automatic entry to the 3000 account and gave all the old credit cards small negative balances.

Can you tell me why this is happening and how I can close these accounts once and for all and not have QBO make these entries?

Hello @Hburke,

It seems you have created a separate post with the concern saying you need help with your credit card accounts. My colleague already shared response about how you can resolve on the other thrad.

I've have here the link for easy navigation:

Keep me updated in the comments if you have any other questions. Stay safe!

Hi -- When these 'created by QB Online to adjust balance for deletion' then show up on my P&L as income, how to I fix that? The invoice was voided so the thought was that these creations would NOT show up as recordable income. Thanks!

I'll share some details on how to handle your voided transactions, @ABYoung9844.

You'll want to click the recordable income in your Profit and Loss report and delete it. This way, it'll no longer show in your report.

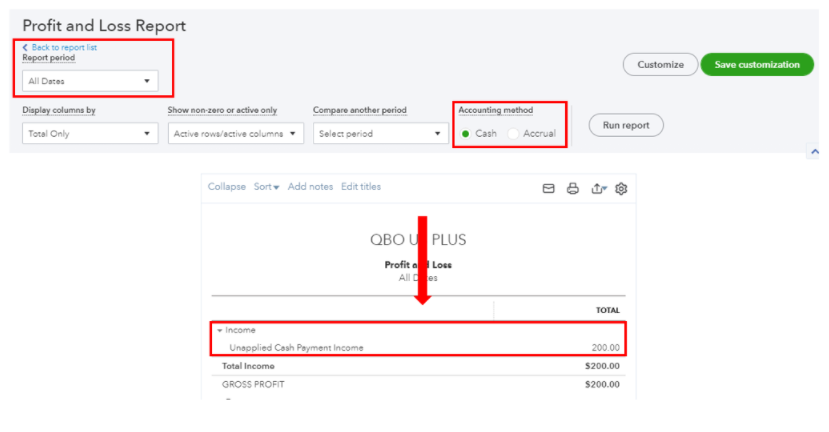

Moving forward, ensure there is no payment link to the invoice when voiding it. Unlink payments will still be recorded and tag as Unapplied Cash Payment Income in your Profit and Loss report.

To view this, you'll need to run your Profit and Loss report in a Cash Accounting method.

Moreover, I encourage you to check with your accountant on other ways to handle your recordable income. This way, we can prevent messing up your accounts. If you don't have one, you can visit our ProAdvisor page and we'll help you look for one from there.

Once you're all set, feel free to use these links for future reference. These can guide you on how to modify your reports and match your accounts seamlessly:

Do you have other questions about managing your reports and invoices? Keep me in the loop by leaving a reply. I'm always here to answer them for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here