Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThere is a "deposit" field on my invoices right after "total due" and right before "balance". If I enter a number here, it reduces the Balance Due. My question is: Is this used to indicate a deposit that has already been paid? Or is it to indicate that I require a deposit now, meaning customer isnt expected to pay the full invoice amount at once?

I would use it if the latter, but the former wouldnt suit my needs.

Thanks in advance

Solved! Go to Solution.

It's nice to see you in the Community, haskenazi1.

QuickBooks provides different ways to help manage your finances and reflect how your business is doing. I'm here to further discuss the deposit field of your invoices.

The Deposit field is an optional portion you can enable and add to your invoices. It is mainly use to subtract a customer deposit from the total to calculate the balance due.

For your question, this fits best to the first scenario you've mentioned. It generally indicates a deposit that has already been paid by your customer. You can remove this field from your invoices by turning it off from the Accounts and Settings page.

Here's how:

That's it! You should now be able to use this field accordingly.

If you have other questions about the process, don't hesitate to let me know. I'll be around!

It's nice to see you in the Community, haskenazi1.

QuickBooks provides different ways to help manage your finances and reflect how your business is doing. I'm here to further discuss the deposit field of your invoices.

The Deposit field is an optional portion you can enable and add to your invoices. It is mainly use to subtract a customer deposit from the total to calculate the balance due.

For your question, this fits best to the first scenario you've mentioned. It generally indicates a deposit that has already been paid by your customer. You can remove this field from your invoices by turning it off from the Accounts and Settings page.

Here's how:

That's it! You should now be able to use this field accordingly.

If you have other questions about the process, don't hesitate to let me know. I'll be around!

In addition to this question, I have received a deposit from my customer and recorded it in an Other Current Liabilities account I have created called Customer Upfront Retainers. Will using this Deposit field when invoicing the customer reduce this Liability account accordingly? How do I tell QBO to use the correct Liabilities account?

Hello there, PaperPanda.

Let me share with you some information on how to handle upfront retainers in QuickBooks Online (QBO).

There are two ways to apply upfront deposits or retainers to invoices. You can either enter the upfront deposit or retainer as a line item on the invoice or apply the upfront deposit or retainer as a credit.

Here's how to enter an upfront retainer as a line item on an invoice:

Here's how to apply an upfront retainer to an invoice as a credit:

To be more familiar with managing retainers in QuickBooks Online (QBO): How to record a retainer or deposit.

That's it. Don't hesitate to get back to me if there's anything you need. I'm always here to help you some more.

My issue is that I have filled out the deposit amount but when I hit save it says..

"You need to specify an account to credit the deposit to." Its already given me the balance due including the deposit deduction but won't let me go any further. I don't need anything else. I just need to save the invoice to send later.

Thanks for joining this thread, 1142.

There may be accounts that weren't saved when creating the transaction reason why you're getting the error. Let's review the invoice transaction and make sure you enter the complete information.

If the error persists, I recommend performing some basic troubleshooting steps. Let's start by opening your QuickBooks account in incognito/private mode to check if it caused by a browser.

Here are the keyboard shortcuts to open a private browser:

If it works fine with a private browser, I suggest clearing your browser's cache to start fresh. Otherwise, try using other supported browser.

Keep in touch if there's anything I can help you with aside from this. I'm always around to provide further assistance.

Hi

I am getting warning message

you need to specify an account to credit the deposit to

please answer ASAP

[removed]

Hello there, @629786.

You need to select an account to get past this warning message and save the invoice successfully. Let me show you how:

For additional reference, I've attached some links for options to receive and categorize customer payments in QuickBooks Online:

Let us know how I can help you further by clicking the Reply button below. Have a great day ahead.

This does not work.

Good Evening, @abrothers.

Thanks for joining in on this thread. Since you've already tried the steps my colleague provided, then I recommend contacting our Customer Support Team. They have additional tools to help look further into your account to resolve these types of problems. Here's how:

If you run into any trouble along the way, just let me know. I want to make sure that you get this issue resolved as soon as possible. Have a great day!

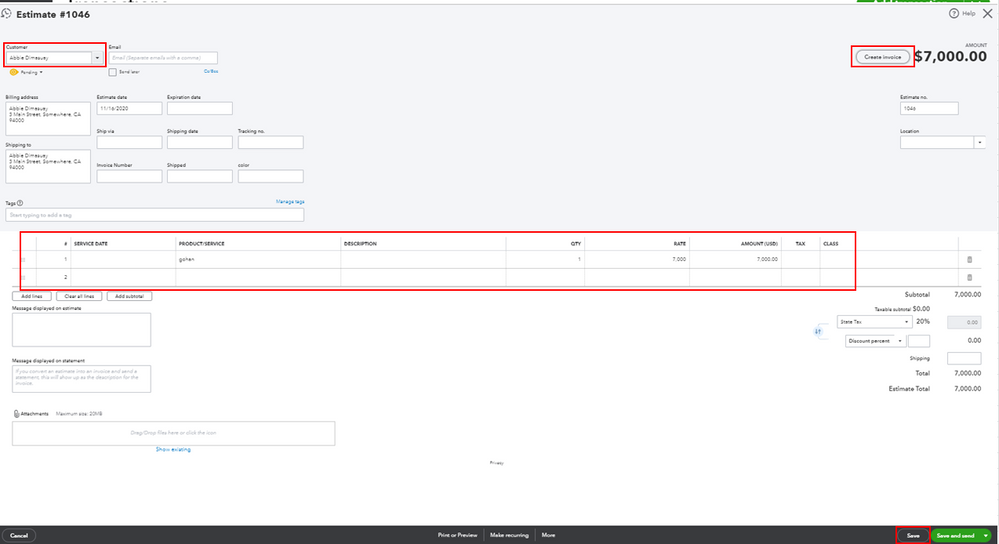

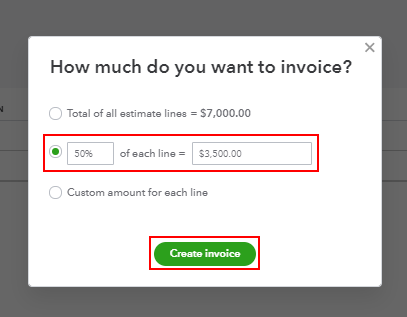

When you use the second solution mentioned above, does that work similarly to "recording a payment" from the invoice itself? So let's say I have an invoice that's $7,000 for a job. I require 1/2 upfront, 1/2 upon completion. I can make the whole invoice, then go into the customer and input the $3500 credit as you described. To my understanding, I would then go and record a bank deposit for that $3500 for whichever day I deposit the amount into my bank. Then when the remainder is paid, I could record the other $3500 payment as usual under the invoice, and again record a bank deposit for the appropriate day so that my bank records will match and I won't end up with double the income showing when I try to reconcile my account.

Hello there, @tricoteuse.

Recording an upfront deposit only applies if your customer pays you before performing any services. In your case, you can create an estimate for the $7,000 and invoiced the half amount. Here's how:

I'm adding this article for more details: Set up and use estimates.

Just in case you'll start reconciling your accounts, feel free to check out this article for the detailed steps and information: Reconcile an account in QuickBooks Online.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day.

The problem is that when you received the Deposit from the customer, it should be posted it to a Liability account (proper accounting practice). In the invoice form, it does not allow you to select the liability account for the deposit - only asset accounts.

I am having the same problem! I properly charged the deposit to the liability account. That makes perfect sense. Now I have created the invoice and I entered the amount of the deposit in the deposit box right below the invoice total, so the invoice balance reflects that deposit. But when I save the invoice, I get that message that says I have to specify an account to credit the deposit to, but it does not tell me how to do it. It's driving me crazy!

Hello, Ruthanne Cape Cod.

I appreciate you letting us know the results of the steps you've done. Don't worry I am here to help you.

Here's how:

Doing so will decrease the amount in your liability account and apply the credit to your customer which is now your income.

For future reference, you can check this article that provides helpful steps on how to reconcile: Reconcile an account in QuickBooks Online.

Let me know if you have additional questions about deposits. I'm always here to help.

That still doesn't address the fact that you should be able to use the Deposit field/box on the Invoice. Why even have it there if you can't use it and you have to create a negative line item on your invoice? Ruthanne Cape Cod, there is a field above the line items to select the account for the deposit, but none of the choices are liability accounts.

A question about using the deposit field. Once I do that and click save does that record a "payment" anywhere in qbo that would show up at the end of the day's activity or transaction list? Reason being I use DAVO to collect sales tax automatically and partial payments (using the receive payment button) always screw up this integration.

Thanks for joining this thread, soloithz23.

Allow me to share some information on how QuickBooks Online (QBO) handles your deposits.

When your deposit is recorded in the Accounts Receivable, you can apply it to the invoice. This is to keep your records in order. If you input the transaction to an income account, it will show directly to the Profit and Loss report.

Also, the accounts you utilize to track the deposit will affect how it’s reported in QBO. Since you use DAVO to collect sales taxes and partial payments, I recommend contacting their customer service.

They can review the mapping of your transactions before moving them into QBO. Reaching out to them ensures you’ll not have any issues when using the Receive Payment option.

You can bookmark the following articles for future references. These resources provide detailed information on how the Deposit and Receive Payment features work. You’ll also learn about recording a single or partial payment for an invoice.

Stay in touch if you have additional questions about managing deposits and other customer-related concerns. I’ll get back to help and make sure you’re taken care of. Enjoy the rest of the day.

This is so infuriating. This is the same problem as this thread... https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/re-how-do-i-map-the-deposit.... NOT one employee has been able to answer the question properly. Why?

Ok today happened to be the first time I used the "deposit" field all the way through to completion. Now I do not bother myself with all the different features of QBO but only what matters to me. That being said here is what I found. As I mentioned before I use DAVO to auto debit sales tax from my bank account when QBO sales are invoiced The way this works is at the end of each day QBO sends transaction data for the day to DAVO and it figures out the sales tax. This does NOT work correctly if I use the "receive payment" button to record a deposit(retainer) for the job. I can't explain why that well but the amount of sales tax calculated is always wrong if a invoice is split into multiple payments on different days. That is where the "deposit" box feature comes in handy. I recorded it there this time and DAVO did not take sales tax out that day as it did not get filed on that days transactions reports. Once I recorded final payment months later. The ENTIRE transaction was processed in QBO and DAVO saw it that night as one complete invoice payment in one day. Thereby taking the correct sales tax out. This probably does not answer other people's concerns but It was mine and I am sharing in case anyone else uses this integration.

Ok, I have a work around for those who want to use the deposit box on the invoice. I will post that response on the other thread https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/re-how-do-i-map-the-deposit....

@soloithz23 While the tax might be calculating correctly (and I have never used DAVO) you need to check on something. The deposit box is intended to reduce the balance of the invoice using a payment previously received from your client. So A., if you put 500 in that box, you are saying you previously received that $500. Where did you deposit that original $500? When you then enter $500 in the box, it requires you to deposit the $500 to some account. Where are you depositing that?

The correct accounting way is that the original $500 should be categorized to a liability account. And the $500 in the box needs to be put in that same account. However, QB doesn't allow this. So my guess is that you are going to have $500 in two different accounts that never 0 out and thus your books are incorrect.

No idea, how do I check? I have received the money physically and put into a bank account that qbo is linked to.

I checked the transaction journal and it says the deposit went into the "primary" account which is my operating account with the bank and the place it was physically deposited.

That makes sense for the deposit. But every transaction has two sides. For example, if you spend $20 at Mcdonald's. Your bank account is reduced by $20 (side 1) and you would expense it to "Meals Expense" (side 2).

So yes, the money was received and deposited into your bank account, but what is the other side. If you send me a screenshot of how you deposited it within QB I can show you how to check. :)

Yes, the money went into your bank account, but what did you post it to in QuickBooks? The transaction journal should show you a Debit to your bank account and Credit to whatever account you posted it to when you created the deposit. If it is a Deposit/down payment from a customer, it should have gone to a liability account (because you have money you haven't earned yet and you have a liability to perform a service or deliver a product). You then need to zero out that liability account when you deduct the deposit/down payment from an invoice. This is where the Deposit box won't let you debit that liability account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here