Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI need a report that will show what a check is paying, so i paid a vendor i want to be able to see what invoices were associated with that check.

Hello accounting,

QuickBooks has lots of reports you can customize to show you the information you need.

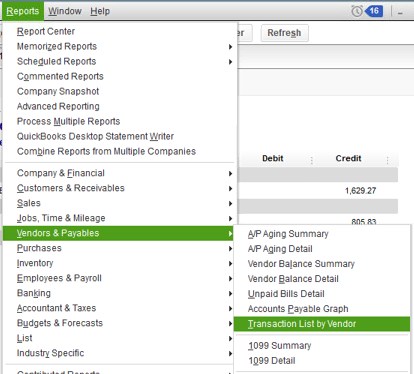

You can run the Transaction List by Vendor report to show the bills and bill payments for each vendor. Let me show you how:

Always drop by here in the Community if you need a hand.

This seemed to work for me. It will give you the amounts of the payment, etc and what it applied it to. It will even specify the amount paid for each line item on the bill(s) paid:

-From the menu bar, go to Reports > Banking > Check Detail

- Click on Modify Report button in upper left

- Specify Date Range desired

- Click on the Filters tab

- Click down arrow next to Account box, choose All Accounts

- Click on Amount, change to All

- Click on Transaction Type, choose Payment (or specify multiple transactions and select the ones you want)

- Click on Detail Level, choose All except summary

- Click OK

These instructions are for Desktop. The question is related to Online. Neither the transaction by Vendor, nor the Check Detail report show the check detail. It would be nice if QuickBooks would fix this issue.

Thanks for joining the thread, EtherealCat,

I can share a report in QuickBooks Online which will show the check details of your Vendor.

Here's how:

From there, you'd able to see the purchases by your vendor with the full details of the transaction.

I've attached some articles for additional reference:

I'm always at your back if you need further assistance in running reports. Have a great day!

Hello I have the desktop version I need help!

I need a report that gives me vendor name, invoice number, invoice date, invoice original amount, invoice balance, check numbers, check date.

I need this report when trying to reconcile vendor statements . I need to compare the vendor statement with the data I have in Quickbooks. I need Quickbooks to show me by rows (one bill per line) what bill # (column) In the vendor account name (column) is still with an unpaid amount (column showing bill amount) and which bill Is already paid (column) , and the check date (column) check number (column) used to pay it.

Any expert in Quickbooks and Ap out there! HELP!!!

Hello Nery,

You can pull up a custom transaction detail report and filter it to show the information you need. This way, you'll be able to reconcile your vendor statement with QuickBooks. Let me guide you with the steps.

You can also filter your report per vendor name and per transaction. Just go back to the Filters tab in the report.

Please see attached screenshots.

You refer to this article about customizing reports for details.

I've also added our page about reports and accounting if you need some help articles for future tasks.

Reach out to me if you need help with anything else.

Thank you for the report, but when reconciling statements is important to know the check numbers that paid for the “paid” invoices. Imagine you ran checks last Friday and for your vendor “Smart Software” account you paid invoices 1 to 10 . Monday you received Smart Software’ vendor statement listing invoices 1 to 15 as unpaid open items. You run run this report and you see that invoices 11 to 15 are still unpaid in your system but invoices 1-10 are paid...well you need to send an email to Smart Software letting the accounts receivable representative know that you sent check # ? paying for invoices 1-10. This report doesn’t show what check # paid for invoices 1-10 .A check # reference for each paid item is pivotal when doing a reconciliation. How can I get around it?

I appreciate you for going through the steps provided by my colleague above, @Nery.

I understand how important is this to you. Let me add some additional information to get you back in your business.

While there isn't a specific report that gives you all the information you need, you can export the report suggested by my colleague above to MS Excel and manually add a Check # column from there.

Then, pull up the Transaction List by Vendor report. This will show you the Bills that are paid under a check number and copy the information to your MS excel file. Let me show you how.

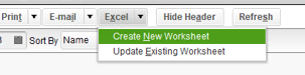

To export:

For more detailed steps, you can check out this article for reference: Export Report from QuickBooks Desktop to Microsoft Excel.

To open Transaction List by Vendor report:

Feel free to check this article to learn more about how to customize reports in QBDT: Customize Reports in QuickBooks Desktop.

As always, check out our Help articles page for QuickBooks Desktop to learn some tips and related articles for future reference.

Don't hesitate to reach out to us if you need further assistance. I'm always here to help.

Hello, I wonder if there is a way to save this report settings. If I save this way to run the report I will save time. My boss is on a vacation and I do not have access to the button memorize. Does Quickbooks desktop has a way to let me save the way I ran this report?

I would agree, Nery. Being able to create a memorized report really saves time.

Upon setting up a user, your company admin can give you either a limited or full access. We're unable to memorize it since your company admin restricted you to use this feature.

You can check this article to learn more: Areas, Activities and Access Levels.

You'll want to let your admin grant you this access after the vacation. Here's an article as your guide about modifying roles in QuickBooks.

In the meantime, you'll want to manually filter and sort the report just like what you're doing. If you have the access already, here's how to create a memorized report.

Hope this help, Nery. Let me know if you need anything else.

I found a report that does that and printed it. It's called a Vendor - Payment Check Detail report. My only problem is that I can't find to run it again. Anyone know where I might have found this report? I am using a desktop version of Quickbooks.

Thanks!

I can help you to locate and run that report again, Yankeegyrl.

I'm unable to see a Vendor - Payment Check Detail report. We can pull up Check Detail and create your own customized report.

Also, it could be that this is a memorized report. If so, we can go directly on your Memorized Report List. You can follow these steps:

Here are some of the articles you can read for reference:

Comment again if you have more questions.

Thank you so much for this! I do use desktop. On transaction type I choose every one that looked like a payment or bill and I filtered NAMES. Works great!

I had the same question and found the perfect report in QBO: Bills and Applied Payments

This report is missing one critical feature, it doesn't itemize any vendor credit memos used within the check payment.

For example, Acme, Inc has three open payables invoices ($100/each) along with two available credit memos ($50/each). You owe Acme a net of $200. Each invoice and each credit memo has a reference number. When you "pay bills" you elect to pay all three invoices but only utilize one of the available credit memos - sending a check for $250. The bill payment stub reflects the correct reference numbers (invoice and credit) but the check detail report fails to fully document the use of the credit - it simply changes the "paid amount" on the report, which doesn't quite meet my definition of "detail".

Anyone in the retail/resell business likely has merchandise returns (overstock, damages, etc) so a report that includes ALL of the detail would be appreciated.

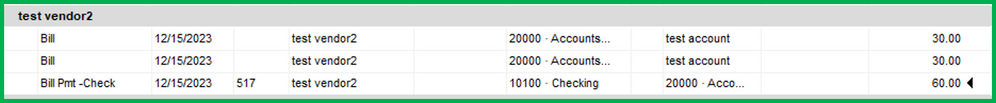

I agree with you. I had a vendor who applied some credits wrong and I was needing a report to show what invoices and credit memos were taken on each check. I realized that QB does not do this in an easy fashion. To show what I need the report to do, I have attached the report I have created with the instructions earlier in this thread and ran one check to apply two credits to two invoices. As you can see, the report does not list the credit memos individually, they just apply "behind the scenes" . I attached the check stub to show what I need to report to look like..... Can you let me know how to adjust my report to make it look like my check stub? I run QB Enterprise btw. Thank you.

Hi there, myersjl42.

I'm here to share some information about how reports work in QuickBooks Desktop.

Currently, the Customization feature only allows modifying of data, adding or deleting columns and information on the header/footer, and personalizing the font and style of the report. That said, you'll want to consider exporting it to an Excel file so you can change the overall layout design of the report to look like a check stub. Here's how to do it:

I also recommend reading these articles to ensure that you'll get the most out of QuickBooks Desktop's reporting capabilities:

Fill me in if you have any other concerns or report-related questions. I'll always have your back.

That only works if you're clearing invoices with a bill payment. As soon as you mix in using a bill credit the report no longer makes sense. Vendors assign credit memo numbers much like they do invoice numbers, and that data lives within QB, but the credit number never makes its way onto the check detail report - and there is no way to get there in the current reporting capacity.

I use QB desktop and I am trying to find a way to show what bills and bill credits were used when I pay a bill. I have tried check detail report and transaction by vendor and I can't get the bill credits to show up even though in the filter I have it selected for the type.

Let me provide the steps on how to view credits applied to bills, pdsarizona.

You can run the bill transaction history to get the data that you need. Let me show you how:

Here are the steps:

You can also pull up the Transaction List by Vendor report to see the vendor's payment, bill, and the credit's applied. Simply customize the transaction type.

Here's how:

Additionally, you can find these transactions in the vendor's profile. The credit is posted in the Balance Total column.

I've also added these articles for future reference:

You can always get back to me if you need more help vendor credits in QuickBooks Desktop. I'm always glad to help you.

The second option for the report is what I need and have done, and the Bill Credits DO NOT come up. What I get is the Paid Amount column and the Original Amount column are different because of the application of the Bill Credit but it never shows the bill credit which would have a memo/explaination. Would it make a difference whether you were cash or accrual?

Hi pdsarizona,

I appreciate your screenshot. I'd like to add information about the report you need.

I understand that you want to know which vendor credit was applied to your bill. However, we're unable to create a report for this. The only way to find out which credit was applied is to check the Transaction History (Ctrl+H) of the bill, as stated in the first option in MaryLandT's response.

On the other hand, the Check Detail report cannot provide this information as well because it only shows the final payable amount after the credit is applied. And, this is a check detail report so it's only showing the final amount paid with the check. Changing the report basis or accounting method won't have any effects either.

Our only option is to manually track this in Excel. You can export the Check Detail report to Excel. Then, add another line or column where you can enter the details of the applied credit.

I'm just right here if you have additional questions about your report. Take care and more power to your business!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here