Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello-

I have used the "Prepare 1099" feature in QB Online where is prepares, files and mails the forms automatically for 1099-Misc. Will this also now happen with 1009-NEC in QBO and/or be a second open to use?

Also, I do not understand the difference in reporting these two 1099's. All "Independent Contractor's" over $600 are allocated to get a 1099-Misc. Will this automatically change to knowing it needs to be 1099-NEC now? Or do I have to create a new Chart of Accounts and update/fix all the previous bills from this year?

Thank you,

CrossR

Solved! Go to Solution.

Allow me to provide a few information about 1099-NEC, CrossRiver.

For now, we haven't received any update on when the 1099-NEC will be implemented in QuickBooks. Our product engineers are closely monitoring and working on complying with IRS regulations.

In the meantime, you can continuously use the Prepare 1099 feature in QuickBooks Online (QBO) until further notice. I also encourage you to visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day.

Since these 1099's have to be prepared by Jan 31, 2021 when can we expect the update on QB since I prepare these forms myself with my program which is a 2019 QB.

Hi there, LC1210.

Currently, we don't have the specific time-frame as to when will be the completion of the updated Form 1099-NEC in QuickBooks Online. Our product engineers are making sure that QuickBooks is compliant with all the IRS regulations when it comes to filing the tax forms.

To learn more about the 1099 form and how you can prepare for the 2020 tax season, kindly check out this article: What is a 1099 and do I need to file one?. It includes topics about 1099-NEC, 1099-MISC, and steps on how to e-file your 1099's to name a few.

I'm also adding this IRS article for further details about 1099-NEC: Instructions for Forms 1099-MISC and 1099-NEC. It contains the complete set of instructions and the latest information about the form.

In the meantime, you can visit our QuickBooks Blog from time to time to keep updated on our latest QuickBooks updates and future enhancements.

Please let me know if you have other concerns. I'm just around to help. Take care always.

Allow me to provide a few information about 1099-NEC, CrossRiver.

For now, we haven't received any update on when the 1099-NEC will be implemented in QuickBooks. Our product engineers are closely monitoring and working on complying with IRS regulations.

In the meantime, you can continuously use the Prepare 1099 feature in QuickBooks Online (QBO) until further notice. I also encourage you to visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day.

Since these 1099's have to be prepared by Jan 31, 2021 when can we expect the update on QB since I prepare these forms myself with my program which is a 2019 QB.

Hi there, LC1210.

Currently, we don't have the specific time-frame as to when will be the completion of the updated Form 1099-NEC in QuickBooks Online. Our product engineers are making sure that QuickBooks is compliant with all the IRS regulations when it comes to filing the tax forms.

To learn more about the 1099 form and how you can prepare for the 2020 tax season, kindly check out this article: What is a 1099 and do I need to file one?. It includes topics about 1099-NEC, 1099-MISC, and steps on how to e-file your 1099's to name a few.

I'm also adding this IRS article for further details about 1099-NEC: Instructions for Forms 1099-MISC and 1099-NEC. It contains the complete set of instructions and the latest information about the form.

In the meantime, you can visit our QuickBooks Blog from time to time to keep updated on our latest QuickBooks updates and future enhancements.

Please let me know if you have other concerns. I'm just around to help. Take care always.

agreed, time frame is tight to have these done and to clients and meet the january 31 deadline, so I would hope all QB updates are complete by mid-December so that we can begin in a timely manner !

I am very disappointed in QB's response to getting 1099-NEC up and running! This is December already and people need to prepare for year end and not have to worry about whether or not QB is going to get this done by January. How will we know if and when QB is up and running correctly? Year end anxiety is starting and this issue is making it worse. Please QB, come through for all of us!!

I don't see any "solution" although it shows as "solved". Clearly, we do have to file 1099-NECs. I do not see that Quickbooks has made this update to my software so that it has a format, the way it does for 1099-MISC. Not everyone files online for their clients. WHEN will Quickbooks have this form formatted? And, why is there a delay (1099NEC requirement has been publicized for a while).

Looks like QB has no intention of resolving this for tax year 2020 (Jan 31, 2021 for us to file). I just played with a 2019 1099-MISC, and if you change your Box 7 people to Box 3, it seems to line up with the 1099-NEC Box 1 -which is where they need to be reported. I haven't yet received a 2020 1099-MISC so don't know if there are changes on that form vs the 2019 version. If you file by paper, just xerox the current form and see how things line up and test print it. That's what I did.

My state requires electronic file and all the instructions I am finding on QBO on how to set these up to process are contradictory. Anyone have any ideas?

Hey there, @Stretch Shapes, thanks for joining in on the conversation!

To be clear, we can only file federal forms via QBO. The 1099 E-file service is only for federal 1099-MISC and 1099-NEC filings.

For more information about what states require a 1099 filing or support combined filings see Does my state need Form 1099-MISC to be filed? You will need to contact your state agency for more information and learn how to file.

If you need assistance setting-up and e-filing your federal forms, these articles should help!

If you have additional questions on this or anything else within QuickBooks, know I'm here to help!

I did an update on my QB Pro Plus 2021and now there are zero files in my 1099's report! What do I do?

Hello @jp599,

You're on the right track in updating and installing the latest version of QuickBooks. Let me help share information about how you can prepare your 1099 NEC forms.

To start with, you'll have to modify your chart of accounts and create a new account to be used to track the payments made for your 1099 - NEC forms.

That being said, learn more about how you can prepare the form with the detailed steps outlined in this article: Learn what you need to do in QuickBooks if you need to file both a 1099-MISC and 1099-NEC.

Additionally, I've also included these helpful articles for your guidance once you need to art your year-end preparations:

If you have any other questions, please let me know in the comments down below. I'll be here to lend a hand. Stay safe and well!

Posting this 12/28/20. In fact, the IRS announced this nearly 6 months ago:

IRS Tax Tip 2020-80, July 6, 2020

There is a new Form 1099-NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation.

Can you efile the CA state 1099-NEC via QuickBooks desktop?

Glad to have you back here in the Community, @skogensover.

At this time, you'll need to contact your state to learn if they require the 1099-NEC and how to file it since E-filing them in QuickBooks Desktop is not available.

To give you more details about filing forms with your state, you can scan through this link: Learn about your state's requirements for filing 1099s.

Moreover, to help you prepare your 1099-NEC forms together with modifying your accounts, feel free to visit this reference: Learn what you need to do in and QuickBooks Desktop if you need to file both a 1099-MISC and 1099-NE...

I'll be around to help if you have any other questions, @skogensover. Wishing you a prosperous new year!

Thanks-yes. California for sure requires 1099-NEC to be filed. I called QuickBooks Online and was told that the CA 1099-NEC cannot be efiled via QuickBooks Online 1099 electronic filing feature. I've read that QB desktop allows efiling of CA 1099-NEC, but I haven't tried it. I saw an independent service called TAX1099 that says it supports efiling state 1099-NEC.

When I go to print 1099 transaction detail report for for year 2020 it only shows 1 vendor??? If I hit for all dates it brings all of my vendors transactions up but nothing is showing for the year 2020 except for the 1 vendor??

Hi there, K -M.

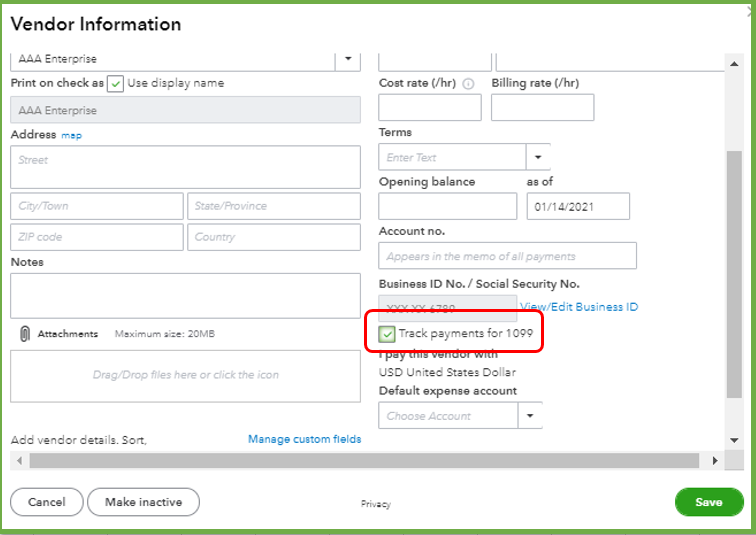

Let's ensure that your vendor is marked for 1099, so it'll show on the report.

Here's how:

Once done, try to pull up the report again.

Here are some useful articles that could help you about 1099:

Please let me know if you have further questions or concerns. I'll be happy to lend a helping hand in guiding you in the right direction. Take care and have a great day.

Is there a workaround to produce 1099-nec for quickbooks online?

Maria,

When I ask to collect my 1099 independent contractors nothing shows up.

All my 1099 contractors qualify for 1099-nec but do not show up as they were identified as 1099 recipients.

Is there a workaround?

Thanks

Tom K

Hi there, @alec4.

I'll share with you some information about the independent contractor's form in QuickBooks Online.

You can set up and map the accounts again and ensure your payments to this vendor to meet the threshold. You use 1099-NEC if you paid the contractor $600 or more in the previous year.

Also, contractors, you've withheld any federal income tax from under the backup withholding rules. On the other hand, 1099-MISC is only required $600 or more in the past year.

For more insight about this matter, check out this article: What is 1099, and do I need to file one?.

Since the independent contractor's don't have taxes withheld, I'd suggest using the 1099-MISC. Before submitting the form, it would still be best to consult with your accountant or IRS to help determine the appropriate forms to use. This is to make sure what's best for you and your business.

Also, please visit this article to know more about what states not required to file Form 1099-MISC: Does my state need Form 1099-MISC to be filed?.

Once you've confirmed, you can now prepare and file the forms. For the complete directions, visit this article: Instructions for Forms 1099-MISC and 1099-NEC.

Additionally, please browse through these articles to know how to fix if the form submits incorrectly.

Let me know if you have follow-up questions. I'm always here, ready to help.

How do I get the vendors to show up on my 1099 form?

I'm here to help get your vendors to show up on your 1099 form, FCCBusinessAdmin.

You can start by tracking their payments. Let me show you how:

QuickBooks will start tracking all of their payments behind the scenes. When you're ready to file your 1099s, you can easily add the tracked payments to the form.

If you haven't added your vendors, enter them in QuickBooks. Here are the steps to follow:

Once done, you can invite them to add their own tax info. When it's time to file, how to prepare your 1099s during tax season.

Keep me posted if there's anything else you need with getting your vendors to show up on your 1099 form. I'll be right here to help you.

Thanks-I know how to setup vendors for 1099s. I called QuickBooks support and was told there is a system wide problem with 2020 alignment of 1099-NEC. When I try to print, the vendor name shows up high in the name box, but the address is several spaces down so that it isn't readable. QuickBooks support said they will notify me when this alignment issue is fixed.

Thank you! I worked perfectly!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here