Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello, the 1099 option is not showing under the vendors tab and not showing under the reports tab. When i go to each vendor, the check mark for 1099 is grey and not active. Pls help. Thanks

Solved! Go to Solution.

Thanks for following up with the Community about this, Emy1881. I appreciate your picture, that helps me better understand what you're experiencing.

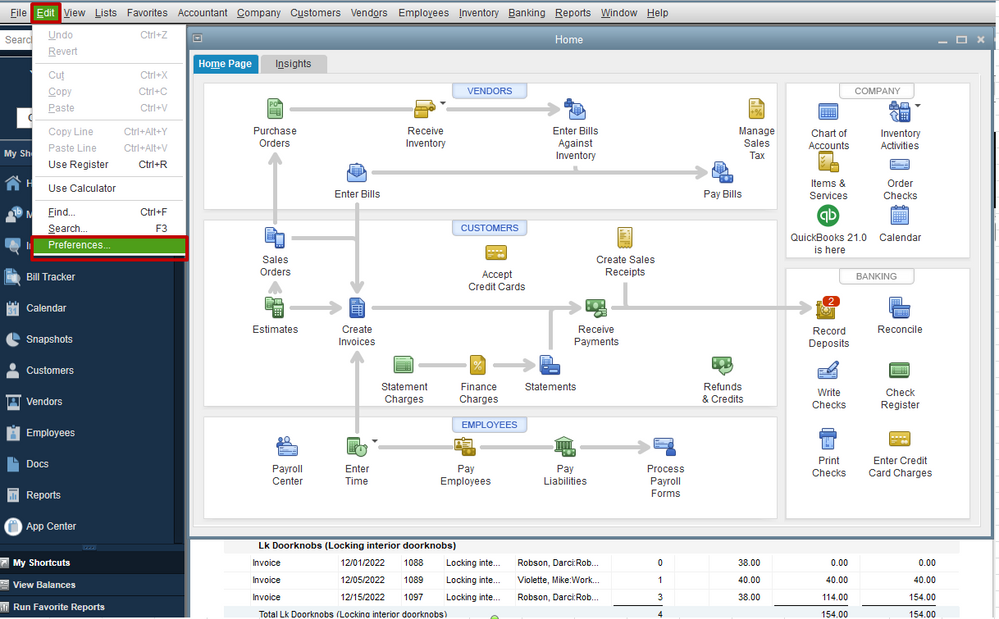

After reviewing the screenshot you've provided and taking a look in QuickBooks myself, it looks to me that you should definitely have the Tax: 1099 option available. However, it may be somewhat hidden when you first access your preferences.

I've included an animated image showing where you'll be able to find what you're looking for:

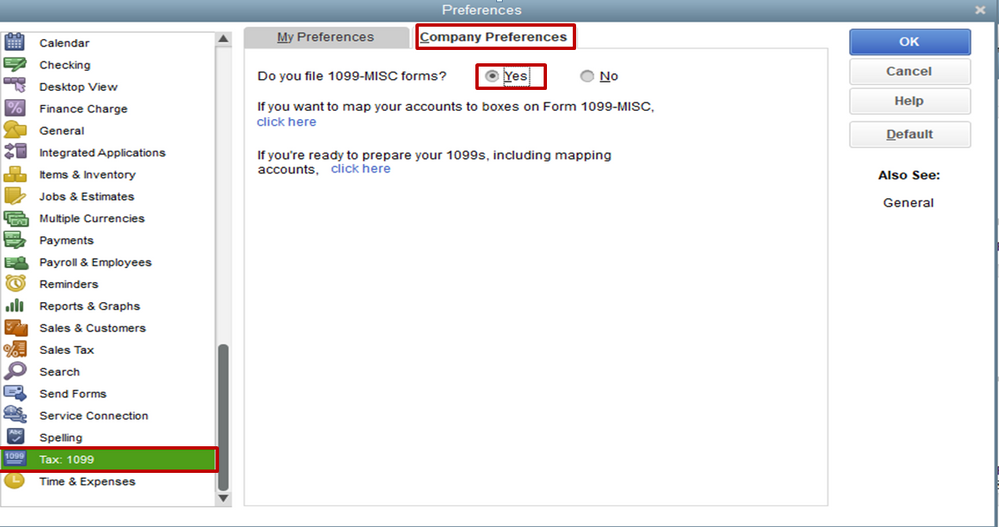

As Rubielyn_J mentioned, once you've set your Do you file 1099-MISC forms? setting to Yes, you'll be able to tick the Vendor eligible for 1099 checkbox when editing a vendor's Tax Settings.

Many useful resources about working with QuickBooks can be found in our help article archives.

I'll be here to assist if there's any additional questions. Have a lovely day!

I'm here to make sure you can access the 1099 option, @Emy1881.

To enable the checkbox for the 1099 form, let's ensure that we've selected Yes from the "Do you file 1099-MISC forms?" question in your company preferences. Let me show you how:

Once done, you can go to the Reports tab and Vendor Center and then click the 1099 checkbox for the appropriate vendor.

I've added a reference that will guide you in preparing and filing 1099s with QuickBooks Desktop.

Feel at ease to let me know if you have further inquiries about how 1099s work in QuickBooks. I'd be glad to help you as soon as I can. Keep safe.

Thank you so much.I will try this today and let you know.

Thanks for following up with the Community about this, Emy1881. I appreciate your picture, that helps me better understand what you're experiencing.

After reviewing the screenshot you've provided and taking a look in QuickBooks myself, it looks to me that you should definitely have the Tax: 1099 option available. However, it may be somewhat hidden when you first access your preferences.

I've included an animated image showing where you'll be able to find what you're looking for:

As Rubielyn_J mentioned, once you've set your Do you file 1099-MISC forms? setting to Yes, you'll be able to tick the Vendor eligible for 1099 checkbox when editing a vendor's Tax Settings.

Many useful resources about working with QuickBooks can be found in our help article archives.

I'll be here to assist if there's any additional questions. Have a lovely day!

Thank you so much. I will try your suggestion in a few minutes and let you know if it worked. Thanks again

EXCELLENT!!! it worked!!! THANK YOU SO MUCH!!!!.

Now, when I am going to print the forms, it says: "Base on your 1099 setup, no 1099 vendors have sufficient payments for this period to received your 1099 MISC form".

But all the vendors received more than $10,000 in 2020. Could you please help me with this too?

Thank you so much!!

Thanks for the keeping us updated, @Emy1881. I'm glad to know that the solutions provided by my colleagues above worked for you.

When processing 1099, there are payments excluded. This includes those payments made to 1099 vendors via credit card, debit card, or third party system, such as PayPal, are excluded from the 1099-MISC and 1099-NEC calculations. This is because the financial institution reports these payments, so you don't have to.

To determine what payments are excluded, here's what you can do:

For more information about this, see this article: What payments are excluded from a 1099-NEC and 1099-MISC?.

Here's also a helpful resource you can read in case you'd encounter issues when preparing 1099: 1099 E-File: QuickBooks Desktop setup, troubleshooting, & FAQs.

Keep me posted with the result. I want to make sure you're taken care of. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here