Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowThat worked for me - thank you

If you updated and the NEC eligible accounts are greyed out and say "Box 15: State tax withheld", here is how I resolved that issue.

Go thru the Print 1099's process again and select to Print 1009-MISC instead of 1099-NEC.

On the screen where you map accounts to boxes, set all accounts that should be 1099-NEC to "omit". These are the account that were greyed out previously. Save.

Now go back and print the 1099-NEC. It would let me change those accounts now.

Hope this helps.

I followed all these steps, and nothing, no change. So I did it again, and now when I click 1099-NEC it will only show me -MISC forms!!! So I do it again, I do it two more times with full computer reboots and now nothing paths to the NEC form! What the heck is going on here!?! This is insane! I wish I never did this 'update'

I'm running QuickBooks Pro 2021

Thanks for following this thread, @Jacquelyn924.

I understand the need to have this option updated on your end. I'd suggest you run the verify rebuild tool to fix potential data damage.

Here's how:

To Verify Data:

To Rebuild Data:

If you get the same result, I recommend contacting our phone agent to conduct a screen-sharing session with you to take a closer look at your issue.

For future reference, check out our year-end resources to learn more about completing necessary tasks in QuickBooks.

Let me know if you have additional questions. We're always around to help in any way we can.

I did everything you said and My Critical update says install pending. ?

I did all that, why does my Critical fixes say install pending

Let's make sure that your critical update will be successful, @Trulyunhappy. This way, you can print the three pages 1099-NEC forms as soon as possible.

I appreciate the efforts you've made so far to deal with this issue. Successfully updating the critical update will help you display and print the 1099-NEC with three pages in QuickBooks Desktop.

The full release will be re-downloaded. Please note that the update process will depend on the size of the download and your connection speed. With this, ensure that you've stable internet to update your company files easily and speedily.

I recommend waiting a few hours to finish the upgrade. If it has been too long, I'd suggest stopping the update, then close and re-open QuickBooks.

After that, update your company file again. The QuickBooks Desktop Information window will appear advising you of a software update. Just restart your computer to kick-off installation. Afterward, you'll print and file the three pages 1099 forms.

Additionally, if you need 1099's complete instructions, visit this article: Instructions for Forms 1099-MISC and 1099-NEC (2020).

Check out these articles below to know how to check the status forms and other frequently asked questions about 1099:

If there are any questions about viewing the 1099-NEC form, let me know by clicking the Reply button below. I'm always here to help. Keep safe, Trulyunhappy.

GENIUS!! I'm so glad you found this fix! It worked for me...at least for the NEC forms. I still need to do MISC as well so hopefully QuickBooks will behave. Not sure if the program likes it though. It shut down a few times in the process.

Thank you so much! You definitely get a Gold Star today! :D

Thank you, seems to have worked. :)

I can now print 3 up. Thank you! Next problem, QB Accountant 2022 crashes every time I try to align the document. Called customer support and told that there is nothing they can do. The alignment is bad enough that I cannot send them out. I have over 250 forms to do for my clients.

GENIUS!! I'm so glad you found this fix! It worked for me...at least for the NEC forms. I still need to do MISC as well so hopefully QuickBooks will behave. Not sure if the program likes it though. It shut down a few times in the process.

Thank you so much! You definitely get a Gold Star today! :D

Can Quick Books 2018 be updated to print 1099s 3 to a page? I have the updates all done but still no luck

I am having an issue that the IRS thresholds for NEC is zero, did something change?

I uninstalled Quickbooks 2022, rebooted my computer, re-installed, and did the updates. I can now print 3 per page. It also got rid of the "Critical Update is waiting to be installed" warning that has been coming up for 2 months now. Kind of a pain but it worked

Hi there, Lynda M and NancyC.

Thank you for visiting the QuickBooks Community. I'll be sharing details on how printing a 1099 form works with the new updates. Then, ensure you'll be able to use and accommodate three forms on a page. Also, to make sure you can file 1099 NEC without any problem.

Preprinted copies or three up 1099-NEC forms are available in QuickBooks Desktop and are compatible with QuickBooks 2020 or later versions, including the Mac version. However, 1099 for three per page isn't possible in QuickBooks 2018. You can get more information about QuickBooks Pre-Printed 1099 Kits by clicking on this link: QuickBooks Pre-Printed 1099 Kits.

Additionally, services for older versions of QuickBooks Desktop are discontinued. You can no longer use the 2018 version to utilize payroll services like paying taxes are unavailable. To know more about it, I recommend checking out this link: QuickBooks Desktop service discontinuation policy and upgrade information.

I suggest updating your QuickBooks 2018 to the latest version. This is to keep your software up-to-date so you'll be able to file taxes without any issues. All you need to do is check what operating system, hardware, software, and other requirements to run the latest version. You can refer to each article below to know what your computer needs.

On the other hand, there are no changes in thresholds for NEC. You're required by U.S. tax law to file a Form 1099-NEC for anyone that you paid $600 or more in the previous year. To ensure you'll be able to file a 1099-NEC without any issues, you'll have to review and make sure that your chart of accounts is properly mapped for both the 1099-MISC and 1099-NEC forms. Then, click the Show IRS 1099 filling thresholds to refresh the updated details so it will not show as zero.

You may refer to this article to view other related information about 1099 so you'll be updated with this form: Get answers to your 1099 questions.

You can always count on us if you have other concerns or inquiries about 1099-NEC. I'm always here to make sure that everything is taken care of.

There is an error within QB - whenever I attempt to print Forms 1099 MISC or NEC, the program freezes.

Using QB 2021 DTPro!

Have all updates!

When will this be fixed - this is an emergency! These are deadline driven!

Intuit needed to be on this in September! I can't even view a sample of my 1099 information without the program freezing.

How can this happen? I'm guessing Intuit wants to sell and create another program!

We have all updated programs in order to print correct forms and now you are not providing the product as advertised!

This is a deadline driven document - I've seen several instructions to update, and restart but apparently you are just occupying our time with ridiculous instructions as they do not work!

Hi there, AdminStaff55.

Thank you for coming back to the QuickBooks Community. This isn't the kind of experience that I'd like you to have while using the QuickBooks software and I know how printing and viewing 1099 is important. With this, I'll ensure to provide some troubleshooting solutions to ensure you'll be able to achieve your goal with the tax form.

To start with, I suggest downloading and installing the QuickBooks Tool Hub. This helps fix common errors and you'll need to close QuickBooks to use the tool hub. You'll have to use Tool Hub on Windows 10, 64-bit for the best experience.

Here's how:

If you're unable to find the icon, do a search in Windows for QuickBooks Tool Hub and select the program. Once done, run the QuickBooks PDF & Print Repair Tool in the Tool Hub. Please follow the steps below.

If the issue persists, I reccomend opening this article to see the additional steps to fix the issue and start the following Solution 2: Troubleshoot PDF and Print problems with QuickBooks Desktop.

You may refer to this article to view other related information about 1099 so you'll be updated with this form and how it works in QuickBooks: Get answers to your 1099 questions.

You can always count on us if you have other concerns or inquiries about 1099-NEC. I'm always here to make sure that everything is taken care of.

Thanks for the reply. I am using QB Desktop Accountant 2020. I did the update and can print 3 1099 NEC per page. What was weird was QB wanted me to change my thresholds as it didn't match the IRS but when I looked at what QB said was the IRS NEC threshold it said 0, instead of $600. Did it not update completely? Any suggestions?

Thanks for updating us on this, NancyC. We're glad you can now print 3 1099 NEC per page. I'm here to make sure the IRS NEC threshold gets fixed.

Since it still shows zero after performing an update, I'd suggest contacting our QuickBooks Support Team. They're equipped with tools to determine its cause and resolve the issue.

To reach out to them, I'd suggest following these steps:

Additionally, I've included these articles that'll help you in preparing and filing your federal 1099s with QuickBooks Desktop. These articles will guide you in ensuring everything is accurate:

Please let me know if you have other concerns about managing 1099-NEC, NancyC. I'm just around to help you out. Take care always.

When will there be a fix for the online version?

Thanks for making a follow-up, Tschlickman.

I'm here to share some updates regarding the issue about printing 3 pages of 1099 NEC in QuickBooks

If you are on the latest releases with appropriate ULIPs applied, you are now able to print 3 to a page for 1099 NEC. If you're not, you'll want to download updates then close and open QuickBooks so you can install them.

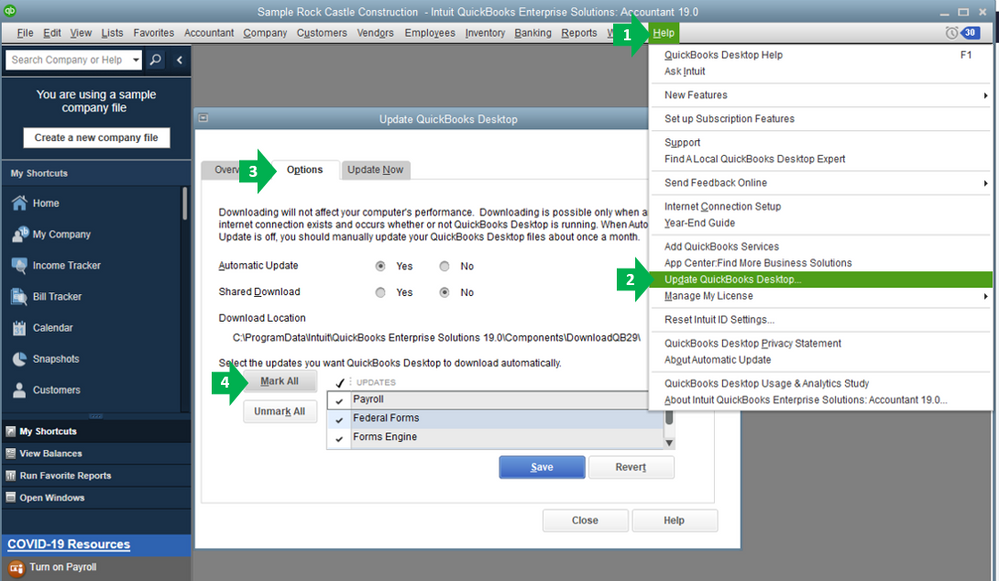

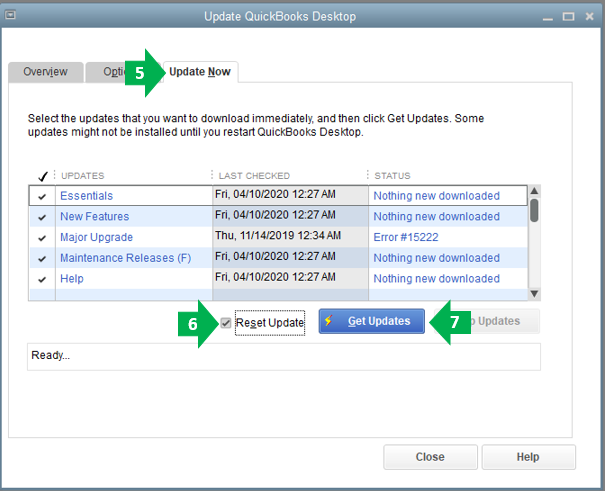

Here's how to manually update your software:

To give you more insight and a visual guide on how to update QuickBooks Desktop, please check out this article: Update QuickBooks Desktop to the latest release.

Once done you can try and process 1099 again.

I'm adding this IRS article for further details about 1099-NEC: Instructions for Forms 1099-MISC and 1099-NEC. It contains the complete set of instructions and the latest information about the form.

To learn more about what you need to do when filling the 1099-NEC, I suggest checking out this article: 1099-MISC and 1099-NEC Filing.

If you have additional questions about 1099 or any concerns, just leave me a comment below. I’ll be here to help you out.

Hi

I have QB desk top 2018 for the first part of this year. I need to print the 1099 NEC 3 per page.. My IT department and I have done all the updates and its still not working. We do not use QB for our payroll we use it for Vendors only. How do i go about getting this update for this version so I can print the 1099 forms

Hey there, @makers.

Thanks for taking the time to follow along with the thread.

When you start tracking contractors for 1099 payments, QuickBooks Desktop gives you the option to print the 1099-NEC without needing payroll services. To do so, use the steps below:

Since you're having issues getting the update to load, I recommend contacting our Support Team. This way, an agent can review your account in a secure environment and investigate what's causing the update not to send through. You can use the link I've included below to connect with an agent.

Please let me know if you have any additional questions or concerns. Take care!

This does not work. Nothing works. I spent almost three hours on the phone with tech support yesterday and they did not resolve the issue. I called back this morning and they told me there is nothing they can do at this time. QB will not correctly print the new forms and they do not know when it will be able to do so. Your clients are literally left with trash software that is not functional. This is a colossal failure. You should be embarrassed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here