Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I recently started bookkeeping to help my friend's restaurant . Bank account is already connected to QBO. The sales amount will be deposited after marketing and processing fee are deducted. Should I do journal entry to add deducted amounts as expense?

Solved! Go to Solution.

Hi there, Leah1989.

QuickBooks can integrate with hundreds of apps. That said, yes, connecting QuickBooks to Grubhub app is the easier way to import your sales transactions between two software. Your sales and deposits will automatically post to QuickBooks and you can get one journal entry with fees in the appropriate accounts in QuickBooks. And, deposit entry will now match the deposit in your banking feed. With this, I suggest going to the App center inside QuickBooks. Then, look for the Grubhub app so you can start connecting this to QuickBooks.

Here's how:

Please refer to this article to see information on how QuickBooks calculates the correct tax rate on each sale: Learn how QuickBooks Online calculates sales tax.

Let me know if you have other questions about recording sales entries in QBO. I’ll be around ready to help you out. Keep safe.

Thanks for sharing the details with me, @Leah1989.

I’m here to help you and share some insights on how to record this in QuickBooks Online (QBO).

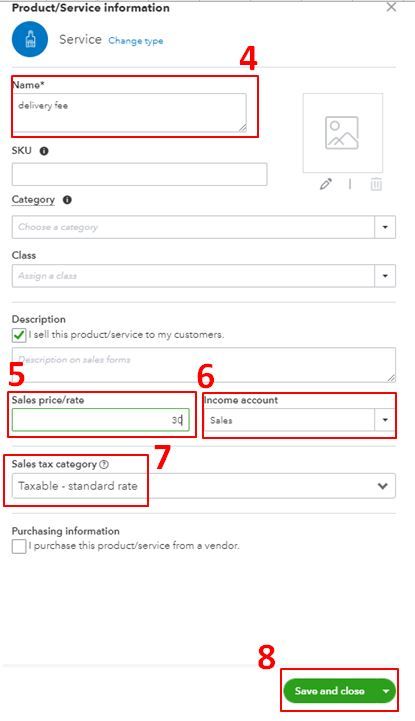

To easily track those delivery service sales, you’ll want to create a service item. No need to do a journal entry. Let me show you how:

You can also check this link for more details about how to add product and service items to QuickBooks Online.

Then add the delivery fee as another line item when creating an invoice to your customer. I’ve added an image for your visual reference.

Once your customer pays their invoice, you can refer to this article on how to record it in QBO: Record invoice payments in QuickBooks Online.

Also, if you wish to create a journal entry, I suggest reaching out to an accountant for guidance. They can effectively guide you on which account to use and ensure your accounts are accurate.

Furthermore, I’m adding this link that you can utilize in reconciling your accounts: Reconcile an account in QuickBooks Online. This link provides detailed steps and information on matching your accounts correctly.

Need to learn some tips on navigating around QBO? You can check out our QuickBooks Support page. Here, you can browse articles and topics for your reference.

Let me know if you have other questions about recording sales in QBO. I’ll be around ready to help you out. Keep safe.

Do I need to create an invoice to the Grubhub?

Creating service items are for when restaurants do their own delivery or catering services, no?

In my case, there is a statement issued by Grubhub. Online sales net amount is deposited after phone orders amount deducted. I want to add Grubhub Marketing and Grubhub processing fee as expenses. Also, sales tax amounts as A/P. And Phone orders amount to make the total sales amount shown correct. There is no invoice. I am still new to QBO, please advise. My accountants are not very helpful since they are not familiar with QBO but only QB desktops.

Thank you.

Hello there, @Leah1989.

You have two options in recording your Grubhub sales transactions in QuickBooks Online (QBO). You can create an invoice when payment is received later. Then, you can opt to add a sales receipt when payment is received immediately.

The service items are not just for restaurants that do their delivery or catering services. Their main purpose is for you to easily track how much you make and spend on each product or service. With this, you can have more detailed financial reports, and helps you complete transactions faster.

You can add the Grubhub marketing, processing fees, and phone orders as service items. Just make sure to indicate the appropriate account (i.e. expense or A/P) in the Income account field (Please see the screenshot below). Kindly refer to the steps provided by my colleague above to complete the process.

Once done, you can create a sales transaction and add the necessary service items to show the correct total amount. Then, you can complete the process by recording its payment (for invoice only). You can refer to this article for the detailed steps: Record invoice payments.

After that, I'd recommend pulling up a sales report (i.e. Sales by Product/Service Detail). This is to effectively monitor your sales, income, and make sure each transaction is recorded accurately. Just go to the Sales and customers section from the Reports menu's Standard tab.

Additionally, you can personalize your sales forms to add the information that matters most to your business. This way, you can create attractive and professional-looking invoices, estimates, and sales receipts. You can learn more about this by checking out this article: Customize sales forms in QuickBooks Online.

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about managing sales transactions in QBO. I'm just around to help. Take care.

Hello, thank you for your assist.

I tried to see if that works but not quite well. It is because the sales and sales tax amount don't match on the Grubhub statement. It is very confusing and I am not sure what is the taxable amount on their statement.

I just noticed that I can connect QB and Grubhub app in QBO. Is that the easier way?

Hi there, Leah1989.

QuickBooks can integrate with hundreds of apps. That said, yes, connecting QuickBooks to Grubhub app is the easier way to import your sales transactions between two software. Your sales and deposits will automatically post to QuickBooks and you can get one journal entry with fees in the appropriate accounts in QuickBooks. And, deposit entry will now match the deposit in your banking feed. With this, I suggest going to the App center inside QuickBooks. Then, look for the Grubhub app so you can start connecting this to QuickBooks.

Here's how:

Please refer to this article to see information on how QuickBooks calculates the correct tax rate on each sale: Learn how QuickBooks Online calculates sales tax.

Let me know if you have other questions about recording sales entries in QBO. I’ll be around ready to help you out. Keep safe.

Thank you for your reply.

There is a bug getting the data from Grubhub and it's not working at all.

I am trying to bookkeep manually with above invoicing method but the sales and sales tax amount don't match with the numbers on the statement. What number on the statement do I need?

This restaurant is also using UberEats, Doordash and Toast. Is there apps for them as well?

Leah,

Did you ever figure this out? I am having the same issue. I want to just do a JE for Grubhub's deductions but can't seem to figure it out. Thanks

Sara

Thanks for joining us here today, @Sara08.

I'll share some insights about Grubhub and QuickBooks integration. Once you've mapped your chart of accounts with Grubhub. your sales and deposits will automatically post to QuickBooks the following day. You'll then get one journal entry with fees in the mapped accounts.

That said, you'll want to check your chart of accounts and look for the Grubhub journal entry. Here's what it looks like.

You can then match the deposit entry in your bank feed. For more information about the process, check out this guide: Record your total daily sales in QuickBooks Online.

I'm attaching these links in case you need help matching and reconciling your account.

Feel free to reply to this thread anytime if you have other questions or concerns with Grubhub Sales. I'll be around for you. Take care and have a lovely day ahead.

Hello ShiellaGraceA,

Is this cabability for Grubhub still available? I do not see this app in the Apps center in QBO. Or is there another app that can be used to import data from Grubhub, DoorDash and Uber Eats?

Hello ShiellaGraceA,

Is this cabability for Grubhub still available? I do not see this app in the Apps center in QBO. Or is there another app that can be used to import data from Grubhub, DoorDash and Uber Eats?

Yes, there is, @NiknicW.

I can guide you in finding alternative applications that can help you integrate your data.

Here in QuickBooks Community, we're unable to provide a specific app. There are several third-party applications integrated with QuickBooks Online (QBO). Thus, I can guide you on how to find one that suits your business needs.

I'll show you how:

You can also check the QuickBooks Apps Store for free apps built by QuickBooks that can also help you with your business. You can choose whatever works for you.

Feel free to get in touch with me here for any additional questions about QBO applications. The Community always has your back.

Thank you for your email, @Carneil_C,

I did look in both of those locations, and unfortunately, I do not see any apps for restaurant delivery services. I am familiar and use a POS system that syncs with QBO through an app, but it is the 3rd party delivery services that do not seem to have any apps that sync their data with QBO.

Hello, Niknic.

QuickBooks relies on the apps available on the Find Apps page. If you haven't found a suitable app but are already using a third-party application linked with QBO, ask your POS system support for help to see if they allow you to import sales from delivery services like GrubHub.

Furthermore, to effectively manage your sales and monitor financial data, you can use this article for guidance: Run reports in QuickBooks Online.

Our community is an open space for you, drop a reply if you have further questions about third-party apps. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here