Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowWe recently received a letter from CDTFA that we are now required to file 2 prepayments prior to our quarterly sales tax return. The new automated feature does not allow me to make prepayments, it assumes that I am filing a return. Where do I post this prepayment on my balance sheet? Should I simply post to the sales tax liability associated with QBO automated sales tax feature? Will the system recognized that a prepayment has been made? Any help will be appreciated.

QBO support, if you are reading this post, please make an upgrade to have an option to make prepayments directly from the sales tax tab.

Thank you!

I can show you how to post the prepayment, FabianaT.

You'll have to create an adjustment.

Here's how:

I've attached a screenshot for your reference.

Let us know if you need more help. Have a good one!

This would work but I cannot "View Return" because is greyed, out "Accruing"...Since I file Quarterly, it will not let me file return until April and I need to make pre payments for Jan and Feb.

We can click the View return button when it's time to file the quarterly taxes, FabianaT.

Let's wait for the quarterly tax filing for us to be able to click the View return button and enter an adjustment for the prepayments. To do it, please refer to the steps which my colleague @Kristine Mae provided.

You can get back to me if you need more help. Have a good one!

Joyce,

This is not a feasible solution. The funds will clear my account on the date of payment...so the entry must be in QBO for purposes of cash flow and bank reconciliation. Your suggestion is that we wait until April to record payments made in Feb and March?

Any other suggestions?

Thank you,

Hey there again, FabianaT.

You can create a journal entry to record the prepayment. Though, this will not affect the sales tax center. It will only affect your bank.

Here's how:

As always, I suggest conferring with your accountant for the categorization of accounts.

We're here if you have other concerns. Have a good day!

Is Quickbooks updating software to address this issue. Sales Tax PrePayments are the standard in California and we need a way to post these payments real time and have them reflected on our returns.

Hello there, Vaslau.

For now, that's the only way for us to record a sales tax pre-payment using the new automated sales tax feature.

I will forward this concern to our management so they can pass this to our engineering team. They will review this and might add it to the future update.

In case you have other concerns, feel free to let us know.

Do you need to change filing to Monthly in order to make a monthly pre-payment. "Filing" is technically done on a quarterly basis, and therefore the view return button won't show up until after the end of the Quarter. I'll test and see if this works.

thank you for the idea, spent hours on the phone with QBO...

I tried changing my Sales Tax Setting to "Monthly" It will let me click on view, so I can record the payment into my checking account. Haven't moved forward with this yet, as I will need to delete / Void previous entries I made to my checking account to keep it in balance. Want to think about this a bit more first.

Hello there, @Jevans,

We stay compliant with the sate and the IRS's regulations when it comes to filing frequency and paying sales taxes.

You can change the filing frequency, however, you're unable to file it in the system since you're required to file quarterly.

I suggest pulling up the Sales Tax Liability report, then filter the date range by quarter. This is to view your return for the specific quarter and pay directly to the IRS.

Here's how:

To delete previous entries to your checking account, please follow the steps listed below:

To learn more about sales tax prepayment, feel free to read through this article: Prepaying US Sales Tax.

I've also added this article for your guidance on how record, adjust, and delete sales tax payments: Manage sales tax payments.

Should you need anything else with your sales tax, please let me know. I'd be glad to help you out.

So this issue still hasn't been fixed in over a year?

Sales Tax Prepayments still can not be entered for Quarterly filers in the Sales Tax module. It seem unreasonable to expect people to wait months to enter the Prepayments or enter a Journal Entry that would then need to be removed and re-entered in the Sales Tax Module. Prepayments are standard in California and we need a way to post these payments in real time and have them reflected without duplicating work.

Please bump this up the priority list for QBO to resolve ASAP.

Hello BookHappy,

As of now, there's no specific time as to when recording prepayment of sales tax will be ready. In the meantime, you can use a clearing account as a workaround where you can transfer the sales tax payment you made. This helps you move money from one account to another account. Here's how:

Once the filing is ready, you can then record payment to the sales tax using the clearing account. Also, you can visit our QuickBooks Blog website to know our latest features and product enhancement from time to time.

Comment below if there's anything else you need. Stays safe always.

i have tried to record a prepayment as noted in this thread, but it increases my sales tax due, not decrease.

i have made 2 prepayments. one of them shows up and one does not. please help!

Thanks for joining us here in the Community, @tisaocean.

I got your back in managing the sales prepayment that you've entered in QuickBooks Online.

You'll need to check the set up of the other payment that was not showing up. This way, you can make necessary corrections so it would be posted correctly.

If you can't find the transaction, you can search it from the Audit Log. From there, you can modify the transaction.

To do that:

Once done, you can create a sales tax adjustment to decrease your sales tax amount due.

To do that:

Here's a great resource that you can check on for more detailed steps: Manage Sales Tax Payment.

If you're using the Automated Sales Tax feature, here's how to make Sales tax adjustment:

You can check out this article for more detailed steps: Set up and use Automated Sales Tax.

You're always welcome to visit the Community again if you have any other questions with taxes. I'd be more than happy to help. Have a good one!

I was able to change the filing frequency to monthly to record the prepayment and then change it back to quarterly. This does not appear to have any impact on prior reports, etc.

This is how I handled it, not sure if the report will be correct.

go to Sales Tax Center -

Change the due date start to July (the beginning of the Quarter) and the due date end to September. Then California will be accessible. Click on view return, then select "Make Payment".

The dates seem to be key. Use July as the "Due Date Start" and Sep as the "Due Date End". You should then be able to access California report. Once there, I selected "Make Payment" and entered the prepayment. The liability account looks correct. I am hopeful the report will reflect accurately.

I am ASTOUNDED that Quickbooks has not resolved this yet. How can you consider yourself a professional accounting program without this capacity? I think I'm going to need to change software and find something else. I echo Bookhappy above:

So this issue still hasn't been fixed in over a year?

Sales Tax Prepayments still can not be entered for Quarterly filers in the Sales Tax module. It seem unreasonable to expect people to wait months to enter the Prepayments or enter a Journal Entry that would then need to be removed and re-entered in the Sales Tax Module. Prepayments are standard in California and we need a way to post these payments in real time and have them reflected without duplicating work.

Please bump this up the priority list for QBO to resolve ASAP.

And it is now Feb 2023 - QBO has not resolved this issue!

We thought they had not fixed this. They still probably haven't, but for some unexplained reason the journal entry we posted this month to indicate sales tax prepayment for January actually worked and showed up as a payment in the Sales Tax Module. No idea why it worked now and not before.

Try a journal entry crediting your bank account and debiting the Sales Tax Payable account.

I appreciate you for joining the thread. I'll gladly share a possible reason as to why you can't get around this and enter Sales Tax Prepayments inside your QuickBooks Online (QBO).

You can't enter the prepayment in QBO because the program uses the schedule you entered in your sales tax setting. A workaround for this is to add an adjustment. I can input the steps below to get you started. Here's how:

I'd also recommend reaching out to your accountant if you're unsure of the steps that I've mentioned. This way, they can provide you other ways to enter your prepayments.

Feel free to visit this article for more information about the process: Create or delete a sales tax adjustment in QuickBooks Online.

Additionally, see this page to learn more about adding details to your reports in QBO: Customize reports in QuickBooks Online.

Thanks for dropping by today. In case you have any additional QuickBooks-related concerns, feel free to post here again. Take care, and have a nice day!

I have the same issue. Read my post here: https://quickbooks.intuit.com/learn-support/en-us/taxes/how-to-record-estimated-pre-paid-sales-tax-i...

I submitted feedback and so should you. Here was mine:

The state of CA is requiring us to make monthly "estimated" sales tax payments, but our filing requirements continue to be quarterly.

QBO with auto taxes turned on does not allow for proper recording of sales tax prepayments. The suggested work-around to record such a payment is to add an adjustment. However, when adding a "pre-payment" adjustment, the only accounts types allowed are expenses. For some reason, this actually increases the tax liability. When adding a "prior pre-payment adjustment" one is able to choose between an expense account and an income account. You are able to then record the payment as "income" and then from the bank feed, categorize your payment to the same income account to zero it back out.

Ideally, one should be able to add a sales tax payment on an open period. Somewhat less ideally, one should at least be allowed to choose a bank account from the "pre-payment adjustment" which should result in a decreased liability on the sales tax account and a "sales tax adjustment" transaction which can be matched from the bank account.

Attention QuickBooks! This is not an isolated problem. Here is a list of some others with the same issue:

2. https://quickbooks.intuit.com/learn-support/en-us/taxes/applying-sales-tax-prepayments/00/1051455

3. https://quickbooks.intuit.com/learn-support/en-us/taxes/sales-tax-prepayments/00/1082439

4. https://quickbooks.intuit.com/learn-support/en-us/taxes/sales-tax-prepayments/00/1269319

6. https://quickbooks.intuit.com/learn-support/en-us/taxes/sales-tax-record-payment/00/880413

Please Quick Books, we need a solution to this problem.

I can share what I know about the features and options you can use in QuickBooks Online (QBO), LSGMB.

As of now, the ability to record the Sales Tax payment into the Automated Sales Tax feature is unavailable in QBO. As a workaround, we can create an adjustment. You can follow the steps provided by my colleague KurtKyle_M on how to do it.

I can see how the functionality would be beneficial to your business. I'd recommend sending a feature request directly to our Product Development team. This helps us improve your experience and the features of the program.

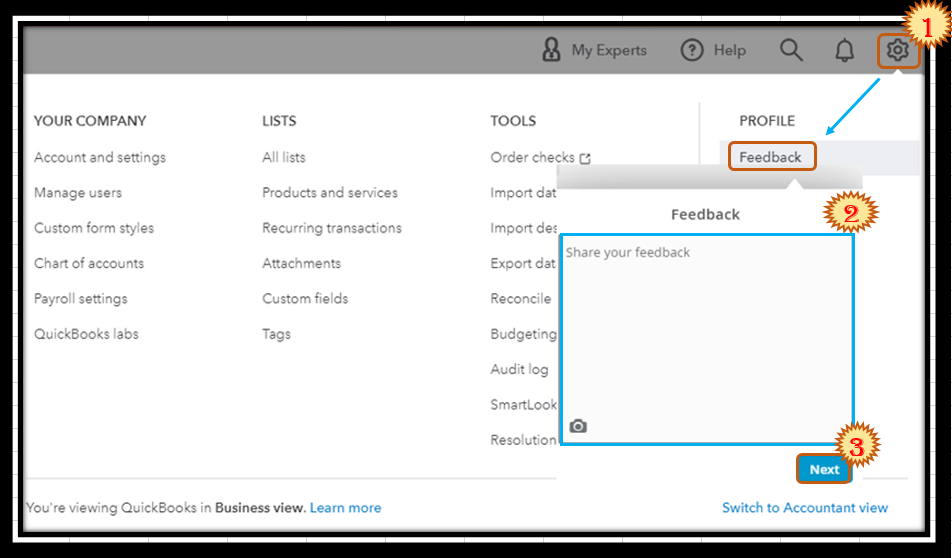

Here's how:

I've also added this article to learn more about how to record, adjust, and delete sales tax payments: Manage sales tax payments.

Reach out to me if you have additional questions about recording pre-payments in QBO. I'll be more than willing to help. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here