Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet me share some information about the new sales tax feature in QuickBooks Online (QBO), giudidetorres.

May I know what problems you encountered with the new sales tax system? QBO tracks your state’s tax laws to accurately calculate sales tax and returns using the Automated Sales Tax feature. Also, it will automatically calculate the total tax rate for each sale based on the following:

For more details about sales tax calculation, check out this article: Learn how QuickBooks Online calculates sales tax.

If you're referring to the Location of Sale box turns blank and reverts sales tax rate upon saving invoice using the automated sales tax settings, then we have an ongoing issue about this one. Our engineers are still working on the permanent fix.

In the meantime, just manually override the tax rate on the invoice.

Once done, please reach out to our Customer Support Team. They'll pull up your account in a secure environment and add you to the list of affected users.

Just request a callback from our support agent. This way, you won't have to wait on the line. Here's how:

I've got a link here where you can find articles about managing sales tax in your account: https://quickbooks.intuit.com/learn-support/en-us/taxes/pay-sales-taxes/08?product=QuickBooks%20Onli....

Keep me posted if you need a hand with running sales tax reports or any QBO related. Wishing you and your business continued success in all that you do. Take care always.

Yes - moving to the new automated taxes has completely broken my billing. I have no desire to manually edit every single invoice and that's the path they are telling me I have to take.

This one "upgrade" has basically broken my account and put me in a situation where if they don't fix it soon I'll have to look for some other accounting package that doesn't force me to remember and edit their broken tax calculator. All I need is to add the local tax but for some reason they've decided to make it a manual process I have to do every single time I make an invoice.

Not only that, it breaks the recurring transactions if you edit them and also changes older invoices as well. This is a horrible move on Intuit's part and I hope they fix it soon.

I appreciate you for sending feedback to us @robert54.

I can see that my colleagues already shared information about the new sales tax feature. Also, the product request to switch back to the old sales tax interface is already relayed to our software engineers.

In the meantime, you can check this article link for reference: Create and set up local taxes. This link provides steps to set up local tax for employees.

QBO also has reports you can pull up to view your sales tax information.

To keep you updated you can visit the Intuit blog for QBO latest product updates.

You can always come back here if you need anything else. Stay inside and keep safe.

The article you mention is for paying income tax, not sales tax. We don't have a state income tax in Texas and that's not at all what the problem is.

The problem is - automating the sales tax calculations means you have to actually have every taxing jurisdiction available to either pick or manually enter.

Giving us Texas without giving us the local taxing leaves 2% unaccounted for and when we go to pay our taxes the state isn't going to care that Quickbooks didn't put that information in.

We get to lose 2% of our profit because your system arbitrarily removes the 2% allocated for local taxes even if we edit an old (previously correct) invoice.

Your business decision to force customers to use this broken system is financially impacting every single Texan that uses QuickBooks Online. Relying on them to manually fix your problem on every single invoice is not practical and adds to the potential for clerical error thereby making your service of less value.

This is not what we want you to experience, @robert54.

The Automated Sales tax feature in QuickBooks Online (QBO) will calculate taxes base on your customer or company address. Since you've verified that the system didn't calculate the correct rate, I recommend contacting our Support Team.

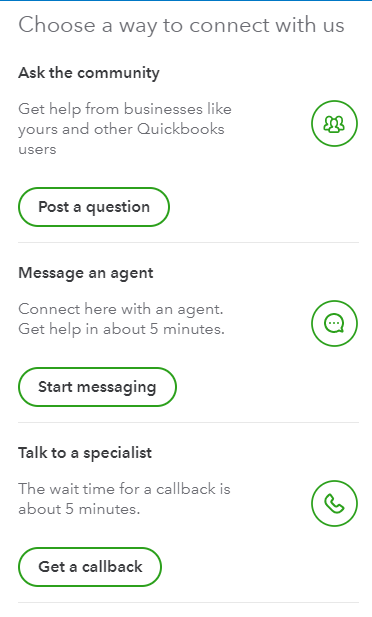

From there, they can securely check your account and investigate this matter. Here's how to contact them in your QBO account:

In the meantime, you'll want to manually add the right amount by clicking the Override this amount link.

You might also want to check our Income and expenses page to learn some tips and best practices in managing your income.

You're always welcome to post here anytime you need help. I'm always around to back you. Have a beautiful day and always stay healthy.

I've already gone through two sessions with support and my case number is [removed] - all they have told me is to wait for a backend developer to reach out to me.

Hello there, robert54.

I understand the hassle that this caused you. I know that this is not the kind of experience you expect us to deliver. I’d love to help to get this sorted out so you could get back to business.

However, since this issue has already been escalated, I recommend waiting for the backend developer to reach you.

Moreover, I don’t want to leave you empty-handed, you'll want to visit our Community Help Articles hub in case you need some related articles in managing your account.

Drop me a comment below if there's anything I can help you. It's always my pleasure to assist. Have a great day ahead.

Hello,

I'm also having issues with the Sales Tax feature. It just gives me a blank page when I click on the Taxes tab. I've tried logging in to different browsers and as using incognito and still does the same. I've contacted QB support and they said they would send me an email once it was resolved and I haven't received any emails from them since, and this was 3 weeks ago. If the automated sales tax feature cannot be fixed, how do I reverse back to the manual sales tax process?

I appreciate you for trying the basic troubleshooting to resolve the sales tax issues, @8031_dp20. I understand we need to get this fixed. At the moment, the investigation is still In Progress status.

Also, switching back to manual sales tax isn't available in QuickBooks Online. While we're waiting for the resolution, you can use the custom rates to manually calculate taxes on invoices or receipts.

Here's how:

Check out this link to know more about how to use custom tax rates on your next invoice or sales receipts.

Let me know if you have more questions. We're always delighted to assist.

Explore this AST Filing & Reporting app to integrate with your QBO. You may find something useful.

https:// taxjar.grsm.io/mytax

Hi --

I run a seasonal landscaping business. We collect downpayments at the beginning of the season and apply them to work as we do it. Most of my clients "hit" their downpayment amount in the month of June.

I record the downpayments on sale invoices, item DOWNPAYMENT, listed as OTHER CHARGE. The item ties to the liability account. When the client's bill is bigger than the initial downpayment, I subtract the amount of the downpayment, leaving the amount due.

My sales tax report this month is picking up all those negative downpayments as non-tax sales (but as revenue, not a liability), meaning that my non-tax sales are negative and making the Taxable Sales amount larger than the Total Sales Amount.. That doesn't make sense and is sure to raise a red flag in the State Sales Tax Audit Department! I looked back at June 2019 and this didn't happen. I switched to QB Desktop Mac 2020 over the winter. Is this a new feature?

Should I be handling the downpayments differently? I've been using QB Mac for 20 years and have never had this issue. I inherited the system, but it's never been this odd.

Thanks in advance for any help you can give.

I am having the same issue. I need to collect and remit a 1% county tax that requires a separate return and payment. QBO does not have my county as a tax authority, and will only let me direct the money towards my state agency. This means I will need to keep track of every invoice by hand and do journal entries to shift tax liabilities into a custom category each month. One mistake and I am out thousands of dollars in fines. It's not a matter of if, its when.

I have spoken with two tech supports who were very friendly, but did not have any solution to this problem. The case has been open for 5 weeks.

Please give the option for Manual Sales Tax to my account, and ideally all accounts.

If this isn't solved soon, I will need to find software that lets me track my taxes, which is really a core requirement for accounting software.

The implementation is TERRIBLE.

1) Simply does not work for California. I know were' a small state, but I think it should work here. First, most small businesses make monthly deposits but file quarterly, QBO cannot be configured to do calculate sales taxes this way.

2) The due dates are often, if not always, incorrect.

3) California has special deposit period. May 1- June 15 sales tax is due June 30. No support.

4) Please give us the option to roll back to the prior implementation until QBO takes time to fix this.

"If you're referring to the Location of Sale box turns blank and reverts sales tax rate upon saving invoice using the automated sales tax settings, then we have an ongoing issue about this one. Our engineers are still working on the permanent fix."

Has this issue been fixed? We are now having this issue and cannot process payments as sales tax has been removed AFTER we sent the invoices which includes the sales tax.

Hey there, mdixon55.

The investigation is still in progress, meaning that our engineers are still looking into the situation. With that being said I would recommend reaching out to our support team so you can be added to the it. When you're added you'll be included in the fix and updated with information as it becomes available. To reach our support team, follow these steps:

Open your QuickBooks Desktop to connect with us.

Chat with us online

Select your product and fill out the form to chat with an expert.

if you have any other questions, feel free to post down below at anytime. Thank you and have a nice afternoon.

The new system is horrible! We are a mobile company and I had everyone set up for their county. Now it is a mess, not to mention I have several corporate addresses that is NOT the county I need to tax. This created a mess!!

We want to help you with applying the correct sales tax amounts to every location you create a sale, @Repairs2day,

The Automated Sales Tax feature determines the rates based on the customer's billing and shipping address on the sales form.

If the calculation of taxes does not coincide with the actual rate because of additional local and county taxes, you can always create a custom rate for it. This option gives business owners the flexibility with their sales tax processing and helping them report the correct amount to the tax agency.

To do that, simply click the Select tax rate drop-down on the transaction and choose Add rate. See this:

I'll be adding a few related articles for you to be familiar with Automated Sales Tax:

Let me know if you have any other question about this topic. I'll be right here to help whenever you need it. Have a wonderful day!

I switched over to the new sales tax center last week and none of the past information is showing up. I can't see anything in "History". It states that all sales tax that is due for each month last year was zero and is also past due. This is incorrect because I have to pay sales tax every month to the state comptroller. I have sales tax due in two days and it says the amount due is "0". We should owe thousands in sales tax! Also, we are a mobile company and sales tax is set to each customer's address. We have tons of agencies set up in Quickbooks and none of them are showing up: City, County, SPD, Emergency, etc. I have spoken to so many QB staff over the phone and everyone tells me something different. None of them know what to do. Many of them just hang up after pretending to put me on hold so they can get help! UGH! So frustrating! After about 15 attempts today, I finally just called customer service myself instead of waiting for a call back through my QB account. She assured me that her boss (who is a "Coach") would call me back in about 2-2.5 hours because he was currently in a meeting. That was 5 hours ago and still no call back! I can't pay sales taxes. I can't send correct invoices. I CAN'T DO ANYTHING! SO WHY AM I PAYING AN EXTREME AMOUNT OF MONEY FOR ZERO SERVICE!!! NEXT STEP - CANCEL THIS SERVICE AND FIND ANOTHER COMPANY AND THEN FILE A COMPLAINT. Not sure who to file a complaint with. I can't reach anyone in Quickbooks so surely a company complaint will go nowhere as well. Maybe with the Better Business Bureau? Anyone else have this issue or file complaint with the BBB?

We are having the same issue. I've been chatting with a tech for 2 hours and we can't figure it out --- ugh!!! Please update if you figure out how to put downpayments in -- we own a landscaping business as well

We are having the same issue. I've been chatting with a tech for 2 hours and we can't figure it out --- ugh!!! Please update if you figure out how to put down payments in -- we own a landscaping business as well

Explore this AST Filing & Reporting app. You may find some references for your needs.

https:// taxjar.grsm.io/mytax

This new automated system is completely broken. It will not show my past returns. A prior payment was applied to the wrong quarter and now has screwed everything up and there is no way to correct it. I cannot pull up the past return to adjust. So it applied my third quarter payment to 4th quarter. So it is showing my 3rd quarter outstanding. It is the only return I can pull up.

I WANT MANUAL SALES TAX BACK. THIS IS HORRIBLE!!!

I HAVE WORKING IN QB SINCE 1990 AND HAVEN'T HAD A PROBLEM WITH SALES TAX AT ALL PRIOT TO THIS.....!!!!!!!!!!!!!!!!!!

I understand the hassle that this caused you, @mdhovde. Let me help to get this sorted out so you could get back to business.

The new sales tax system is irreversible once you switch from the old one. You can use custom rates on your transactions if you need to track special taxes manually.

I also suggest contacting our support team to check your account if you have the option to switch back to hybrid.

Here's how:

For future reference, learn how to file your sales tax return and record your tax payment.

You always have me if you still have other questions about sales tax. I've got you covered. Have a great and prosperous day ahead.

I'm still having this issue and support offered NO support! UGH!!!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here