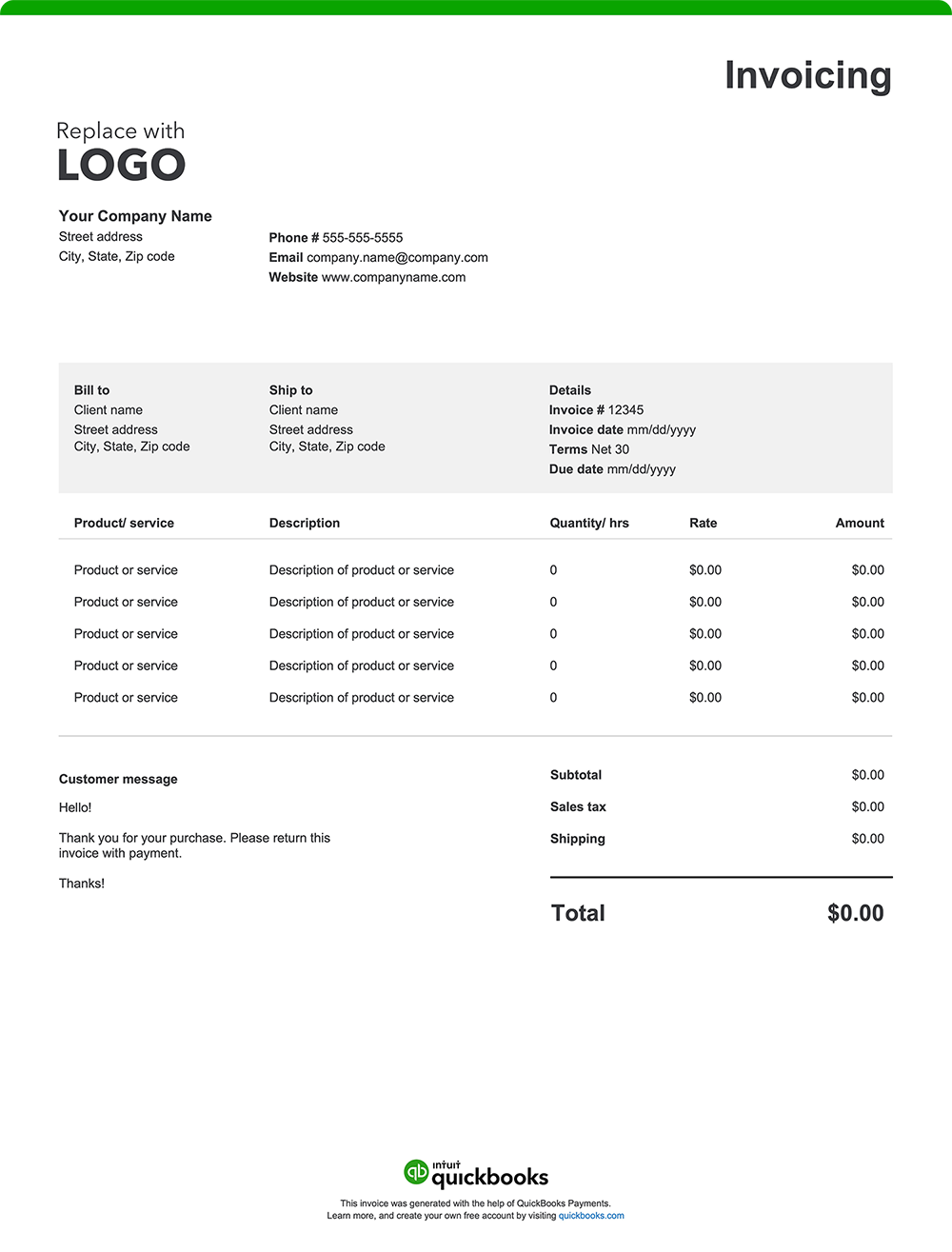

9. Specific payment terms and instructions

Straightforward payment terms are essential for maintaining your cash flow. Here’s a breakdown of what to include in this section:

Payment timeframe: Specify when payment is due. “Due upon receipt” or terms like Net 7–15 days are common for short-term engagements. For larger consulting projects or legal retainers, you might schedule payments around project milestones or phases (e.g., “50% upfront, 50% at project completion”).

Accepted payment methods: List all payment types you accept, such as direct bank transfer, check, credit card, or secure online payments.

Deposit or progress payments: If you require a retainer or deposit before work begins or bill in stages for lengthy projects, explain these terms clearly. “A deposit of $1,000 is required before commencement of legal services,” or “Progress payment due after each deliverable is submitted.”

Payment details: Provide all necessary instructions based on the method chosen—include your mailing address for checks, an account number for transfers, or a direct link to your payment portal.

Late payment penalties: State the penalty if payment is overdue, such as “A 1.5% monthly finance charge applies after 30 days past due” or “$50 late fee for missed installment.”

Early payment discounts: If you offer incentives for prompt payment, note the specifics. For example, “A 2% discount applies if payment is received within 10 days.