Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, MJDuncan.

Welcome aboard to the Intuit Community. Before changing the password in QuickBooks, make sure you’ve already changed the one on the EFTPS website.

This is to ensure that the new password matches for both portals. After updating, download the latest QuickBooks release and update the tax table.

This can help get the accurate rates and calculations for supported state and federal tax tables. Here’s how:

To input the new information:

For an overview of the process as well as the link to access the EFTPS website, see the following article: E-pay.

If you need further assistance while working in QuickBooks, reach out to me by posting a comment below. I’ll jump right back in to help. Have a good one.

Can I change my information without submitting a tax payment? I don't have one due at the moment but I want to change it for future payments.

Hi @CaityGaliano,

You'll need to have an e-payment so you can update your new EFTPS password. Once you're able to update your password, it'll be saved in the program for future payments.

Here are the links for our quick guide on managing your liability and electronic payments:

You can also visit our page for more topics and related articles for QuickBooks Desktop Payroll.

Please know that we're always here to lend a hand, so reach out to us anytime. Thanks for coming in and have a nice day ahead.

I've read the instruction on resetting password. I do not see a check box to clear "remember my internet password. Please help

How do you get the rejected payment back up in the pay taxes and liabilities box so you can re-schedule once you have changed your internet password with eftps?

Hello, Karen.

I hope you're doing well. Rescheduling an epayment is easy and I'm here to give a step-by-step process to help you out.

You'll want to void the rejected payment check in the Payment History Section. Here's how:

This will put the rejected payment back to the Pay Taxes & Liabilities section.

I'd also recommend checking the messages (and the corresponding solution) for the rejection before voiding to ensure your payments are submitted on time.

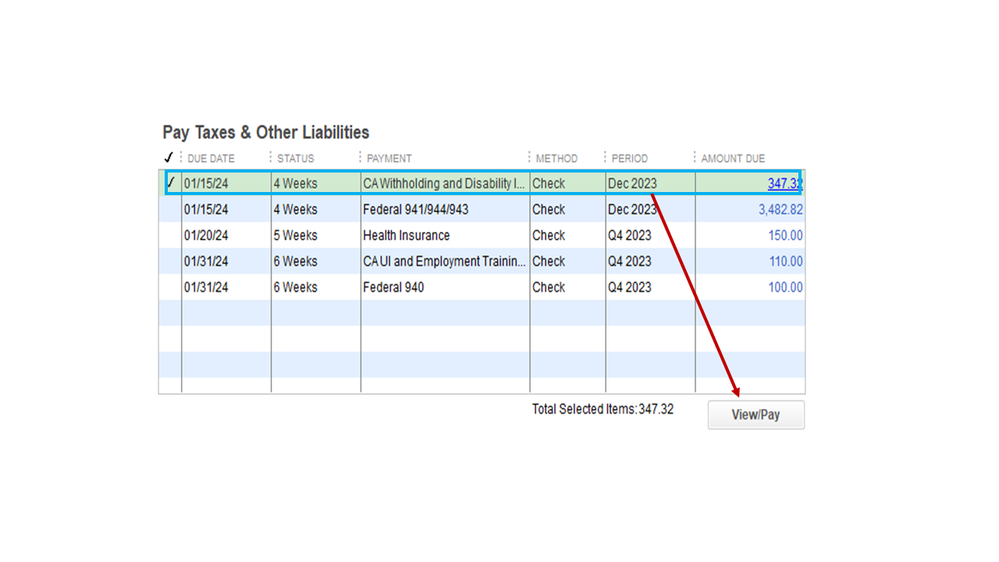

Next, e-pay your tax liabilities when you're ready (or after changing your EFTPS password).

Want to learn more about the process in changing your EFTPS password? Check out this article: Update your EFTPS Internet password.

Our articles also offer a bunch of guides regarding payroll and tax details, compliance and employee management. Give them a shot if you need help: QuickBooks Desktop Payroll general help articles page.

Happy to lend a hand again if you have any other concerns with your payroll service or QuickBooks Desktop in general. Tag my username (@jamespaul) in your replies and I'll be there for you.

One clarification of the solution presented here. To void the e-payment you have to go to the drop-down "Edit" on the menu bar. From there you can choose "void e-payment." I had to update my EFTPS password and it took a bit of hunting to find the "void" option.

I have set a new EFTPS password and need to change it in quickbooks. I dont have any payments that need to be made in the pay liabilities section. But i have rejected payments that I need to go back and pay. Please help me reset my password in quickbooks and re-send payments. Thank you!

This doesn't help because I dont have any payments in the pay liability section.

Let me step in and assist you in resetting your EFTPS password in QuickBooks, @Mygirls3.

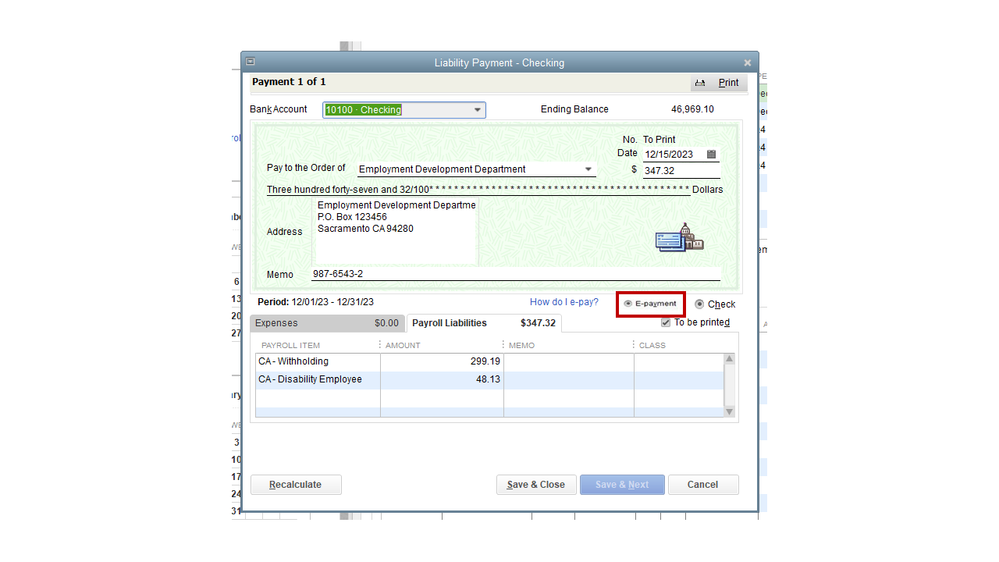

When you use E-Pay in your QuickBooks Desktop, you'll have to update your QuickBooks Desktop password to match your new EFTPS Internet password the next time you make an E-Payment.

Before changing your EFTPS Internet password, make sure to update your QuickBooks to the latest version and download the latest tax table updates. Keeping your QuickBooks updated keeps your software up-to-date, so always have the latest features and fixes.

Here's how:

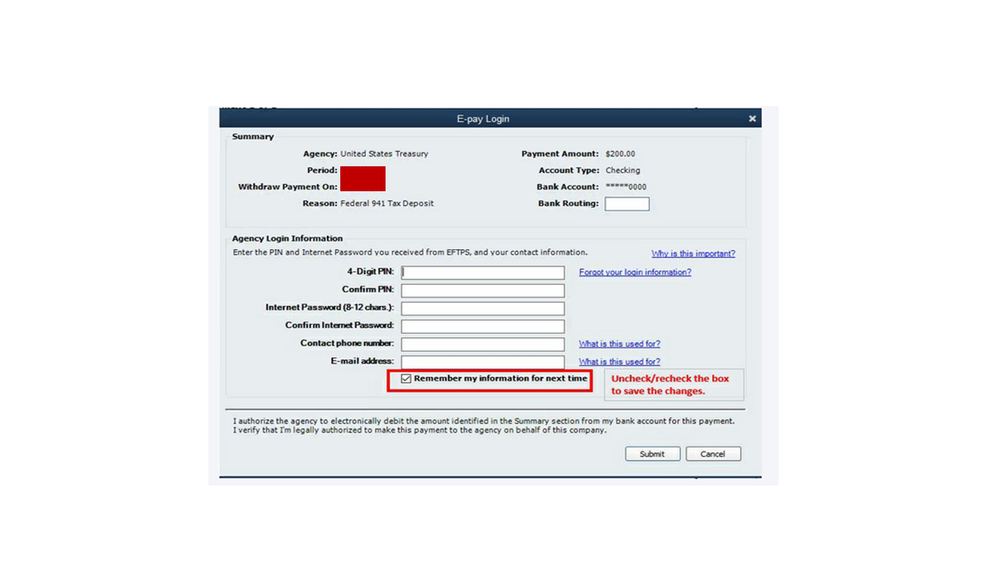

Re-enter your 4-Digit PIN and EFTPS Internet password the next time you make an e-payment. Then, click the box next to Remember My Information for the next time.

I've also added an article to help you learn more about E-Pay tax liability payments.

If you have additional questions, please feel free to get back to this thread. We're available 24/7 to help you. Stay safe always.

AS OTHERS HAVE NOTED ... THERE IS Remember My Information for next Time BOX. This is a BIG DEAL that can cause fees and penalties. Please get these instructions corrected ASAP. We pay a ton of $$ for this service and no one can seem to give correct instructions for what should be a SIMPLE fix.

As others have noted: THERE IS NO Remember My Information for next Time CHECK BOX TO CLEAR.

Please update these instructions w/ a correct process. This should be simple. I'm paying a lot of $ for this service and this simple problem is about to cause us fees and penalties because someone is not READING the question.

Again: There is no check box that says: Remember My Information for next Time

It's not on my screen and IT'S NOT ON THE SCREEN CAPTURES IN THIS POST.

Please get this updated ASAP.

As others have noted: THERE IS NO CHECK BOX THAT SAYS: Remember My Information for next Time.

It's not showing on my screen and IT'S NOT SHOWING IN THE SCREEN CAPTURES. What's the deal???

Please update the instructions with the correct information. ASAP!!!

Updating QuickBooks Desktop to the latest release will give you visibility of the option, jyjaco.

As mentioned by @Rubielyn_J, first you'll have to update QuickBooks so it would identify and catch the latest features of the software. Second, you can now go ahead and proceed to update your new password when making an e-payment once done with the update. I've attached a screenshot so you'll be guided visually:

However, if you're still unable to see the option, I recommend contacting our support team to investigate further. They have the tools to pull up your account in a secure environment.

In addition, you'll receive an email after submitting your e-payment or e-filing to let you know if your e-payment or e-filing was accepted or rejected. You can also check your e-file status to know if e-filing is successful.

Please let me know if you have any other concerns about EFTPS password. Remember, the Community is always here 24/7 to help you.

My confusion is - do I need to go in and get a new EFTPS password and number? Or do I just go into Quickbooks and put everything in again? My tax payment was rejected so I'm not sure how to change the EFTPS info and resubmit.

Your confusion ends here, @NaeNae.

You don't need to get a new EFTPS password to resubmit your tax payment. Instead, you can simply void the rejected e-payment and submit it again.

Before we start, let’s update your QuickBooks Accountant Desktop to the latest release and download the latest tax table update. Keeping your QuickBooks updated prevents unexpected issues within the program.

Once done, follow these steps in voiding the rejected e-payment:

I'm adding this article to learn how to manage an e-payment that has been rejected by the agency: Handle payroll e-file and e-pay rejections.

You might also want to monitor the status of your e-payment. This is to ensure that your payment is received by the agency in a timely manner.

Please know that I'm just a reply away if you need any further assistance resubmitting your tax payments. It's nice working with you, @NaeNae.

I've gone through the steps and when I re-enter my password in Quickbooks I keep getting payment rejected. I can go online to EFTPS and use my same credentials and all is good. Just not in quickbooks??

Any ideas?

Appreciate the update, @JerryUSA.

I'll share a few reasons why an online tax payment may be rejected while processing it in QuickBooks Desktop Payroll.

To begin with, here is the list of the common reasons why tax payment processed online is rejected:

Now to make sure your tax payment goes through, use the following suggestions in this article for the steps: Handle Payroll E-file and E-pay Rejections in QuickBooks Desktop Payroll.

However, if you can confirm your account information is correct based on the resolution above, I recommend contacting our Customer Care Support. I want to include that reaching out to our team online is best during business hours from 6 AM-6 PM PT Monday-Friday. Use this article to learn more: Contact QuickBooks Desktop Payroll Support.

You may also read this reference with the topics to use while working with your payroll account and expenses: A Series of Articles that Covers Payroll Activity in QuickBooks.

I've got you covered if you have other questions about payroll taxes and payments. Let me know by leaving a comment using the Reply option below. Take care always!

We need to change my bosses EFTPS pin # & password in QBs. The person who used to do this no longer works here. Please help.

I can help you with that, Lincolfab.

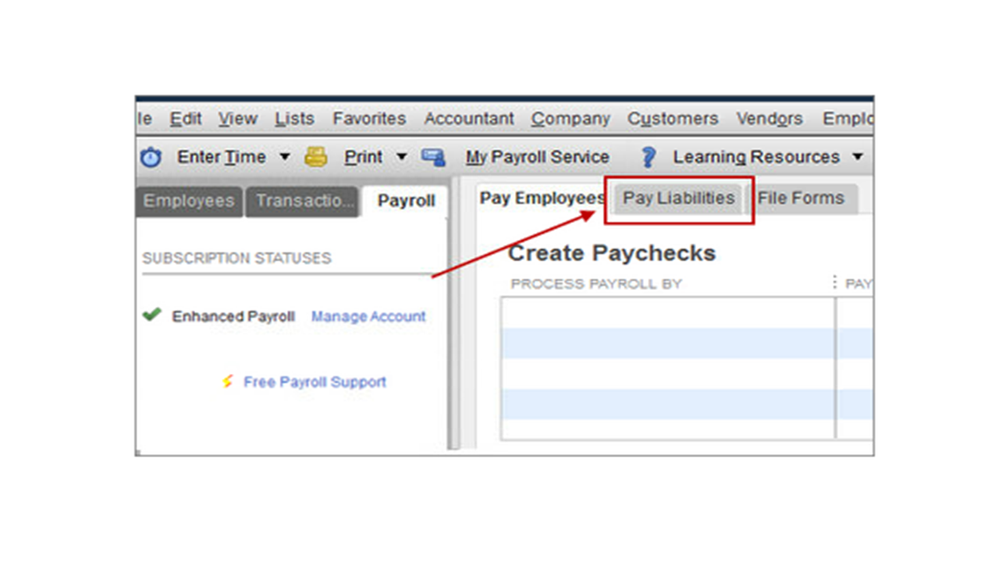

If you need to update your EFTPS Internet password, you'll have to update your QuickBooks Desktop and payroll tax table to the latest release. This is to ensure that you always have our latest security patches. Once done, follow these these steps to change your password when making an e-payment:

To update the pin for processing direct deposit. you can read this article to be guided in doing it: Change PIN for processing direct deposit payroll. For more tips and resources in managing your payroll transactions in QBDT, you can check out some topics from this link: Process payroll.

I'm just a post away if you need further assistance in accomplishing your other payroll tasks. Have a good one.

The problem I'm having is it automatically logs me into epayments so I do not get the option to clear info for next time. How do I change it then?

I appreciate you for joining the thread, @LatellaG. Let's work this out so you can proceed to change your 4-digit pin in your E-pay in QuickBooks Desktop (QBDT).

Before anything else, let's ensure that your QBDT application is updated. This way, we can eliminate the possibility of encountering any difficulties updating information within your company file in QuickBooks Desktop. I'll gladly input the steps below so you can proceed. To begin, here's how:

For more information, you can visit this article: Update QuickBooks Desktop to the latest release.

Once you've made sure that your application is up to date, you'll also want to do this to your tax table. This way, you'll get the current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and payment options. See this page for further guidelines: Get the latest payroll tax table update.

If the issue still persists, I'd recommend getting your application fixed by using the QuickBooks Tools Hub. Feel free to visit this article to learn more about how to use it: Fix common problems and errors with the QuickBooks Desktop Tool Hub.

Additionally, I've also included this article to help you manage rejected tax form or tax payment: Handle payroll e-file and e-pay rejections.

In case you need to view the status of your e-payment, you can visit this page: Check e-file or e-pay status.

It's been a pleasure to have you in the Community today, @LatellaG. Know that I'm determined to help you get this sorted out as soon as possible. Also, if you have any additional QuickBooks-related concerns, don't hesitate to click the Reply button below. I'll make sure to get back to you. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here