Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt’s nice to see you in the Community, a1bookkeepingsvc.

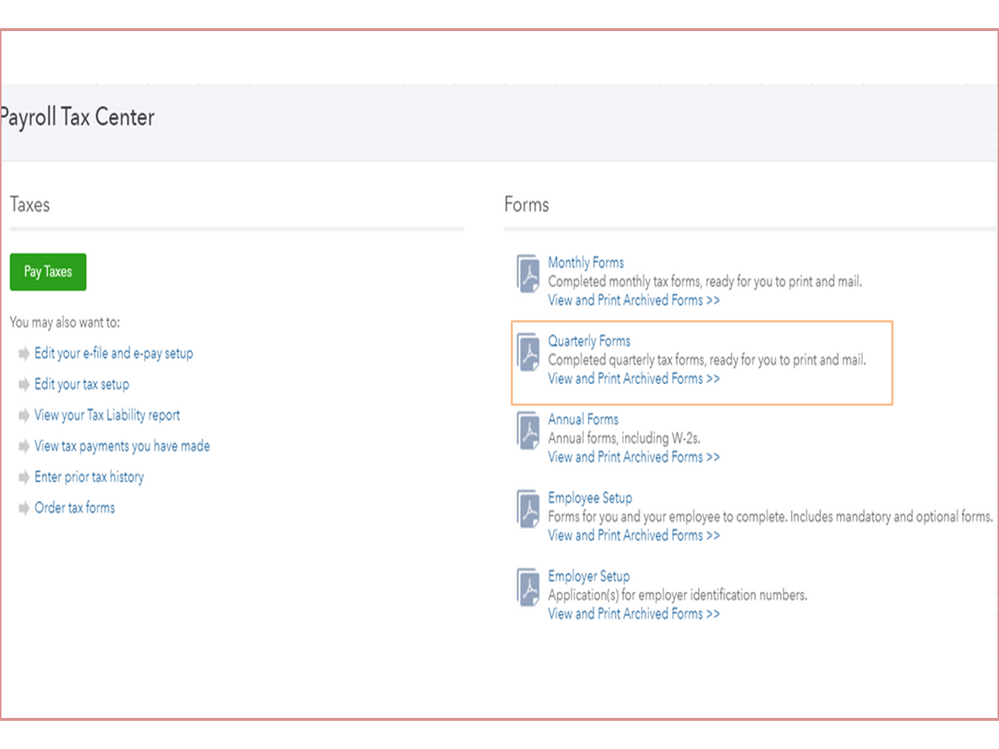

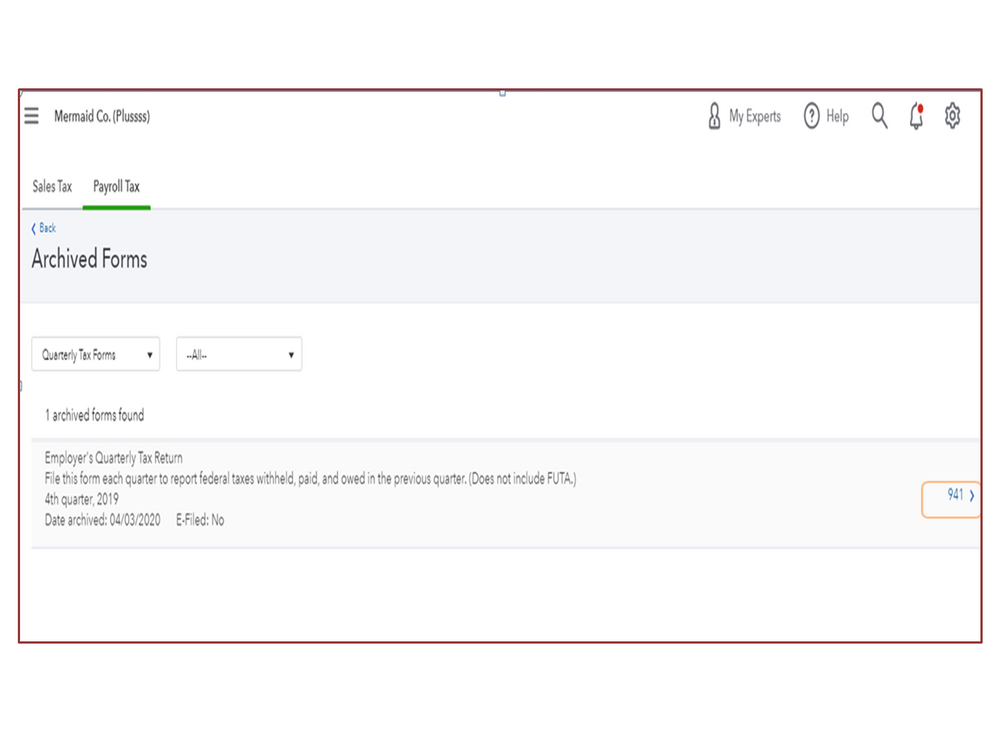

We'll have to go to the Payroll Center to find the 941 report. It only takes a couple of minutes to get there.

Here’s how:

The following guide provides more insights into this process: Archive old forms.

Additionally, this article covers all the details on how to see the status of the forms and payments processed in QBO: Check e-filing or e-payment status.

Stay in touch if you still need help with QuickBooks. I’ll pop right back in to assist further.

Greetings, a1bookkeepingsvc.

Were you able to perform the steps I shared on how to pull up the tax form? Please know helping you out finding your 941 report is my priority.

Reach out to me directly through this thread if you have additional questions. As always, I’m only a few clicks away for help. Have a great day ahead.

What do you mean "left panel" where "taxes' is. I am using the accountant's version and there is NO taxes on left panel. So unbelievably frustrating I just need to print prior period payroll tax returns filed through Quickbooks and it's nowhere to be found. help

When you say this:

I am using the accountant's 2020 version and there is no left panel taxes selection? I just need to print copies of prior period payroll tax returns and W2s that were filed using Quickbooks and I am getting completely frustrated as I CANNOT easily do this. Please help.

I'll be there to help you at every stage, @Source Consulting.

I'm here to help you see the Taxes tab in your QuickBooks Accountant 2020. Thus, you can print your prior period payroll tax returns and W2s swiftly.

If you're using QuickBooks Online Accountant (QBOA), you can see the Taxes button on the QB Accountant logo under Your Books. Let me show you how to accomplish this:

If the issue persists, I'd recommend doing some basic troubleshooting steps to fix the problem. To begin, log in to your QBOA account through incognito. This way, we can check if it's browser-related issues. Then re-follow the steps outlined above.

Here are the keyboard shortcuts:

If that works, please return to your regular browser and clear the cache to clean the slate.

However, if you're using QuickBooks Desktop Accountant 2020, here's how you can print the forms.

For more details, click this link: Print, save, and email copies of filed tax forms using Adobe Reader .

Also, to learn more about QBOA features, special tools, client's rep for taxes, check out these articles:

Furthermore, visit our Taxes Help Articles. This page contains steps on how to manage your tax preparation, reports, forms, and more.

Please know that you can always ask about any topics or other processes within QuickBooks. I welcome the opportunity to respond immediately. Stay safe and fit.

Thanks for the reply. Sorry I guess I did not mention I am using the desktop version. Please provide steps for this program.

Thanks for coming back and providing us details on the QuickBooks version, Source Consulting.

To print the forms in QuickBooks Desktop Accountant 2020, just follow the steps below:

To learn more about this one, see the View and print payroll tax forms article. If you have filed your 2020 W2's and Automatically create an archive when I e-file or print checkbox is selected, it will create an archived PDF format on your computer. Let's manually pull up your W2 form. I'll show you how.

Alternatively, you can download the W2 form from the IRS website and manually fill it out. You can pull up a tax worksheet from QuickBooks for the details. Here's how:

Let me share the Print W-2 and W-3 forms article for more details about this one. I've included the Resolve printing issues article to help you fix common printing issues. Here you can find the solution in resolving trouble when printing in QuickBooks Desktop.

Feel free to visit our Process payroll page for more insights about managing your payroll in QuickBooks.

I want to make sure everything is taken care of for you, please let me know how it goes or if you have any other issues or concerns. Just leave a comment below and I'll get back to you. Take care always.

Ok. Did I had already tried what you said in my frustration. There is nothing showing up under saved filings and under Efilings there are only copies of state efiling confirmations that I can print. There is NO federal filing information and NO copies of the payroll tax returns or W2's which is what I need to print to finish this clients work. What am I doing wrong? This should not take 2 days to locate these or have to ask the client to print and scan them to me individually. I am completely frustrated and disappointed that I just paid to upgrade to the 2020 version and it is making my life more complicated. I have zero issues getting copies of any prior filed tax form, payroll journal or W2 with Paychex. I log in, go to reports, there they are. Why is this not the same with QB's?

Maybe I should be prefacing that I did not process the payroll or file the payroll tax forms in Quickbooks myself. I received a QB backup from a client who did the payroll processing in QB's.

Is this why none of the suggestions I've received have worked. Bottom line I do not see any saved tax forms in QB's or have a "PDF tax forms" folder or any folder with PDF located under the users/public/public documents/intuit folder nor where I restored and keep the client's Quickbooks company file?

I do not what to do at this point. And now I have wasted 2 days trying to get copies of the forms I need to finish this clients work and will be embarrassed to have to waste my client's time scanning copies of these. I do not have this problem getting copies of filed forms from my clients that use Paychex.

I know how you feel and this isn't the kind of experience we want you to have, Source Consulting.

I can share information on how you can obtain a copy of W2 information.

Yes, that's the reason why you're unable to see it. QuickBooks stored the form in a secure folder in the same location as the company file. The form files are saved in your client hard drive that isn't accessible to you.

Alternatively, you'll have the option to create and print a tax form coming from the accountant's or backup copy. This way, you'll have a copy of your own without requesting it from your clients. I'll show you how.

For more detailed information, you can check out this article: Print W-2 and W-3 forms.

I've got this helpful resource to help you manage your client payroll and employee report: Customize payroll and employee reports.

Let me know if you have further questions about the tax forms. I'll always be here to help you.

Thank you for your reply. This did not work either. Plus I need copies of the 941/DE9's for each quarter of 2020, not just the W3/W2. I am getting more aggravated with each time I have to keep asking for help to do what should be a SIMPLE THING. Like I've said I do not have this problem with any other payroll service any of my clients use. I just need a copy of a filed tax form. Why aren't copies of the forms my client paid your software to file not available for me to view? Can someone please just call me and fix this? Or can you give me a number to call?

What happens when I go to employees/process forms I get an error message pop up that says I need to install an update. I did the update already. still keep getting it.

I tried selecting "my payroll service" to see if that helps. I login and I get a list of names not even related to my firm (see attached). Is this related to my problem?

PLEASE HELP ME. This is bordering ridiculous.

This may not be an easy process for you, Source Consulting.

But let me help you check why you're unable to print payroll from the client's company file. Since you're using QuickBooks Desktop for Accountants, you need to check with the client if they've included the file where payroll forms are stored.

Also, the client should send you the Accountant's Copy, not a regular backup file. All monthly, quarterly, and annual tax forms available in a regular QuickBooks Desktop company file (.qbw) are also available in the Accountant's Copy.

Please refer to this link to learn about the file: Use the Accountant's Copy. It provides instructions on how to access the working file on the Accountants' version of your QuickBooks.

About the list of names, they're may be from the backup file. You can ask your client if they're associated with their company file.

Once everything is set up, you can follow the steps provided in this thread on how to print payroll forms .

If you want us to walk you through the process of screen-sharing, you can contact our Live Support Team. They can help open the Accountant's copy and view payroll forms for you.

Here's how to contact them:

Let me know if there's anything else you need about finding payroll forms. I'll be right here to help you.

Nothing has worked.

A. I have no QB PDF tax forms or any folder of this kind on my computer. I cannot ask the client for it or another backup as their CPA retired. They sent me a regular backup and that’s all I have. I do not use accountants backups because of limitations. If the same files should be available in QBW files as accountants copy why should this be an issue?

B. I keep getting update error messages to update the payroll file which I’ve already done several times now.

C. The only thing I have access to is state Efile confirmations in the payroll center no copies of filed tax forms past or present. I cannot even create a new tax form as none are available to select. I have tried to manually add one or reactivate one and get the update error.

D. When I click “my payroll service” and login using my credentials a list of names pops up that I do not recognize.

E. I get an error that the payroll subscription expired in 2021. Does that mean you block access to all the work the client paid for in 2020 and prior years? Is that why I cant print any of the prior period filed payroll tax returns?

F. I do not run any of my clients payroll through Quickbooks so my firm does not have an active payroll subscription. Does this mean I will not be able to view payroll tax forms on clients that use QB payroll? If this why I am having so many issues? I do not recall this being an issue in the past with clients that used QB for payroll. I recall having them send me a backup and I could seamlessly pick up payroll processing from whomever was doing it before. Is this no longer possible with newer versions of QB?

I appreciate all the replies but its looking like I need to speak with tech support as none of the suggestions have resolved my issue. I have not had to call tech support for the desktop version in over 20 years. Please route me to the correct place to resolve this particular issue.

As a side note. I apologize for being upset about this but I have never been more frustrated and wasted more time trying to simply print copies of payroll tax returns that were filed using Quickbooks and I use a variety of other payroll services with NO issue doing this simple task. None of them store these reports in some random file folder that can only be accessed by one person or don’t transfer when one does a QBW backup and restore. They are there, within the program that created them and accessible by anyone who logs in. I secretly hope my frustrating messages will get routed to your developers to fix this. This is not acceptable for accountant level software.

There is something completely wrong with my software. I never had this many problems in 20 plus years using Quickbooks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here