Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

Thanks for getting back in touch, @jfakenney.

I’m happy to further assist you with moving transactions back to the For Review tab. You can undo an added bank transaction. If you want to get rid of an added transaction entirely and start from scratch, you can Undo it.

Let me guide you how:

To batch action those transactions, you’ll put a Check Mark in the box beside each transaction and then click on Batch Actions and choose to Modify Selected.

Here’s a helpful article about moving and reviewing bank transactions:

Hit the reply if you have other questions.

Good afternoon, @jfakenney.

Nice to have you here in the Community. I'm happy to provide insight into banking rules for you.

QuickBooks Online offers banking rules to categorize transactions in the Banking tab accurately. These rules apply to unaccepted transactions (transactions on the For Review tab of the Banking screen) ONLY. Meaning the categorizing only applies to transactions that are currently coming in from your bank that need to be accepted. This article on Using Banking Rules outlines how the rules work.

Should you need any further information, please do not hesitate to contact me. Wishing you continued success now and in the future.

Thank you! Is there a way to move those transactions back to For Review so the rules will apply?

Bascially I've got hundreds and hundreds of transactions I have to go in and change the account for manually if I can't use the rule. Is there any way to batch update a list of transactions, etc or do they all have to be updated one at a time?

Thanks for getting back in touch, @jfakenney.

I’m happy to further assist you with moving transactions back to the For Review tab. You can undo an added bank transaction. If you want to get rid of an added transaction entirely and start from scratch, you can Undo it.

Let me guide you how:

To batch action those transactions, you’ll put a Check Mark in the box beside each transaction and then click on Batch Actions and choose to Modify Selected.

Here’s a helpful article about moving and reviewing bank transactions:

Hit the reply if you have other questions.

Thank you SO MUCH! You saved me more than a full day of work, no exaggeration!

That worked perfectly. I tried with 5 transactions and the only thing that happened was that I had to re-reconcile my bank account, which took no time at all! It was already balanced so easy peasy!

Thanks again, life saver! - Jennifer

Once you undo, does the rule apply?

Hello there, Doug E Fresh.

Yes. The rule will still be applied after undoing some transactions. It helps accounts to be balanced and accurate. Let me also share with you a few reasons why sometimes we unreconcile transactions.

Here are the possible reasons for doing it:

In case you still have a problem with your reconciliation, or you may have adjusted a past reconciliation. It's best to consult your accountant to help and guide you further with this. I've attached some articles below wherein we can get additional information about reconciling accounts.

Comment below if you have more something to ask about reconciliation in QuickBooks Online. We are all right here to help. Take care!

I have the same issue. But where is the "Reviewed" tab mentioned in step 3? I am on the banking page with the desired account selected but there is no "reviewed" tab to select. I've clicked on everything.

Hello there, @David A P.

The QuickBooks Developers does product enhancements when there are new features or things that need to be changed. The Reviewed tab was included in the recent update and was changed to Categorized.

This is how it looks like now:

I've added this article to help you with the process of unmatching the bank transactions: Unmatch downloaded bank transactions or move them to another account.

You may also read through this article when you're ready to assess your business financials: Learn the reconcile workflow in QuickBooks. this contains tips and a complete process of reconciliation.

You're always welcome to come back if you need further assistance. I'm here ready to back you up.

It sounds like I can apply a rule retroactively, but do I have to then reconcile again?

Hi @almostthere!

You can apply the bank rule to past transactions. Let me assist you.

The bank rule is designed for the uncategorized or unaccepted transactions on the For Review tab. In order to apply it to the past entries, you'll need to undo or unmatch them so they'll be moved back to the For Review tab.

When you undo them, it can affect your accounts especially if they are reconciled. And yes, you'll need to reconcile them again once you add them back to your books.

If the purpose why you want the bank rule to apply to these transactions is to move them to a different account, I suggest you reach out to your accountant. They have an option to reclassify or move multiple transactions at once.

Lastly, you can check the reconciliation workflow through this article: Learn the reconcile workflow in QuickBooks. This will show you not only how to reconcile, but also how to fix reconciliation issues.

I'll be glad to assist you if you need more help with banking. Take care!

How do I rereconcile them? I thought I would just go back to the beginning of the year and walk through each month, but it does not let me do that. Can I change to "R" in the registry?

Let's make sure you'll be able to correct your transactions on the previous months, almostthere.

If you have reconciled a transaction by mistake, you can unreconcile them one at a time. You'll want to undo it manually by following the steps below:

You can also check out this article for the detailed steps and if in case you encounter reconciliation errors: Undo Or Remove Transactions From Reconciliations In QuickBooks Online.

You can also invite an accountant to review your accounting and undo the reconciliation. Go through this article for your guide: Invite An Accountant To Review Your Accounting In QuickBooks Online.

Let me know if there's anything else you need about reconciliation. Don't forget, I'll be right here if you need help.

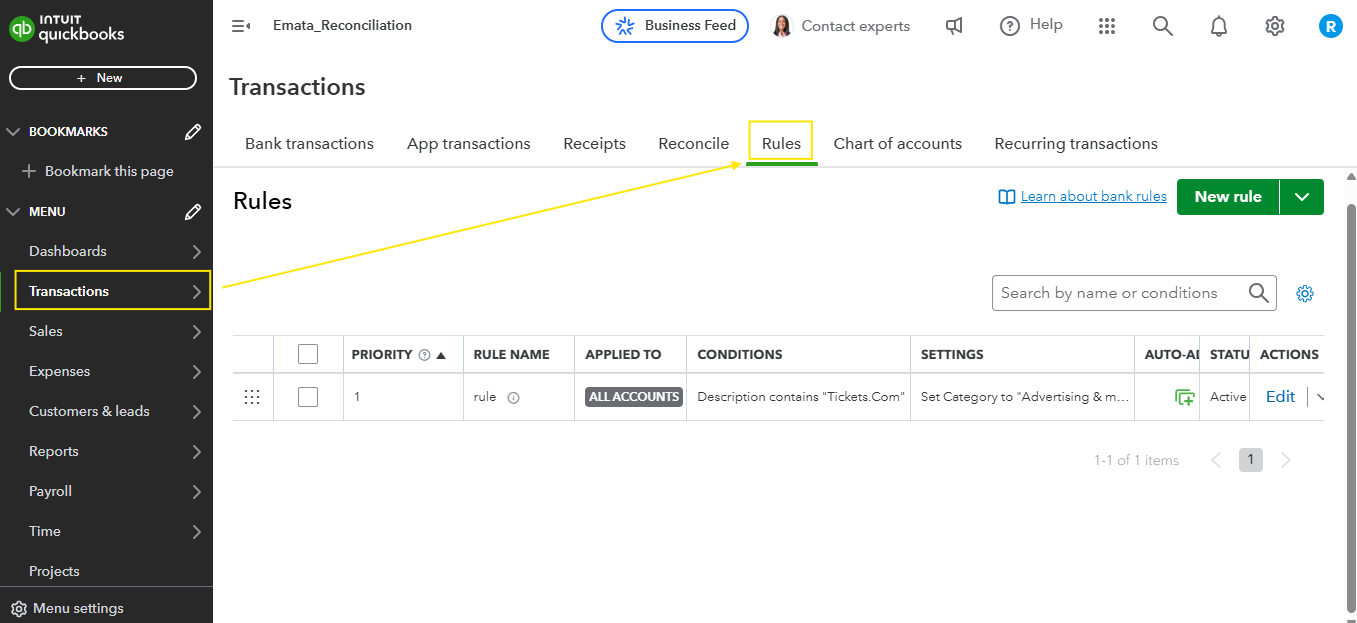

How can I review the rules I have already created in QBO?

Hi, @DebHC. Welcome to the Community!

Allow me to guide you through the process of reviewing the rules you've already created. Here's how:

For more details about bank rules, you can refer to this article: Set up bank rules to categorize online banking transactions in QuickBooks Online.

Additionally, you can check out this helpful article: Categorize online bank transactions in QuickBooks Online. It provides step-by-step guidance on how to categorize your bank transactions effectively.

Looking to spend less time managing and organizing your books? Consider QuickBooks Live Expert Assisted! They can help you keep your records accurate, clean, and up to date.

Feel free to hit the Reply button if you need further assistance with Banking Rules in QuickBooks Online. We're always here to help whenever you need us.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here