Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm hoping someone can help me with this. So some of you may know, I work at a restaurant. And in any retail or restaurant business you get paid in either credit/debit cards or cash. So when I enter my journal entry for the sales of the day into quickbooks, I enter those payments into the undeposited funds account until I see the owner or the cc's deposited into the bank. Now what if that cash payment was used to pay an expense but not all of the cash deposit? How would I enter just a partial deposited and keep the rest in the undeposited account?

You've come to the right place, Angel11-72.

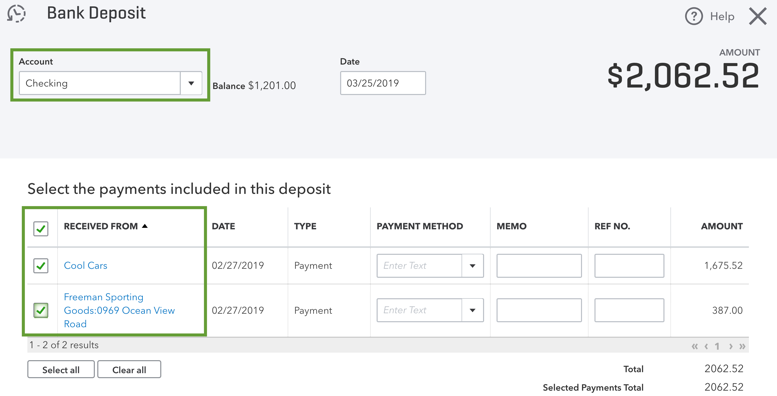

You can create a bank deposit of the partial amount you've received. You can combine all the payments you received so far.

All payments you put into Undeposited Funds account automatically appear in the Bank Deposit window.

Learn more and get detailed steps for how to combine payments and make a bank deposit.

Stay in touch with me if you need anything else.

Maybe you missed understood me. So say I have 2 deposits for $200.00 each sitting in the undeposited funds account, but I only need to deposit $300.00. How do I put the extra $100.00 back into undeposited funds?

Hello there, @Angel11-72.

Thank you for the additional information you've provided. Allow me to clarify some insights when depositing partial payment.

We deposit the $300 or partial amount to remove the Undeposited Funds (UF) and post in the bank. Then, the remaining $100 payment will remain in the UF suggested by my colleague @MaryLurleenM.

To ensure that we're able to provide you the exact solution, it would be great if you can add some information on how you record the payment in the Undeposited Funds.

I've added this article that can guide you more about Undeposited Funds in QuickBooks Onlline.

Just click the Reply button to add your comment. I'm here to help you out. Have a pleasant day.

I enter all my info into a journal entry for each day the restaurant has sales. And I enter the cash, credit card income from Square and from Uber into the same account UF account, but I separate it into 3 different entries in that one journal entry. (Meaning 1499-UF - CASH, 1499 - UF - CC'S FROM SQUARE & 1499- UF INCOME RECEIVED FROM UBER.) I hope that made sense. Then when I want to deposit the money, I hit new, choose banking deposit and go from there. Is there another way that I can deposit only the partial amount I need, so I can leave the rest in undeposited funds that I don't know about?

Thank you very much.

-Angela

And because it's a restaurant, we don't use invoices.

Hello there,

you still did not understand or solve the question. I have same problem so I understand the previous colleague very well.

The problem is; we receive payments into the UNDEPOSITED FUNDS Account. Now while making a bank deposit all the payments you received into the UNDEPOSITED FUNDS Account do appear on screen for you to select which payments you want to deposit. Now these lines CANNOT BE SLIPTTED! Here is where the problem is. What if I have received $500 in one line but I only want to deposit $300 only and the remained amount to stay in Undeposited funds Account?

i hope you will understand now.

Thanks for joining this conversation, @Radegunda.

In QuickBooks Online (QBO), the option to split the amounts in the Undeposited Funds (UF) account when depositing it to your bank is currently unavailable. The UF account is designed to put all your payments so you can combine them into a single record.

I can see how this option would be helpful for you, and I'll take note of this. Our Product Engineers are always looking for ideas to consider on how to improve QBO.

In the meantime, I recommend visiting our Blog site. This is where we share recent happenings and future developments, such as updates to newly added features. Here's the link: https://quickbooks.intuit.com/blog/.

I'm also adding these articles for more information about managing and depositing payments in QBO:

Reach out to me in the comment section below if you have any other questions or concerns. I'm always here to help. Have a good one!

Oh my goodness what poor answers from Intuit. If there is no "feature" to accomplish the task then there must be a "procedure" to do it as this is something that must accounted for. Here's what I suggest, using the example of receiving $400 in cash but only wanting to deposit $300 in the bank. Record two cash payments on the same date, one for $300 and the other for $100. Log the $300 to the bank and the $100 to the Undeposited Funds account. This will allow you to reconcile your bank statements with QBO and show you kept $100 in undeposited cash.

I feel like we, as consumers, should get an account credit for all the work-arounds we have had to come up with for their failure to implement fixes for common problems.

Thank you for the suggestion.

Can anyone explain how to do the workaround for me? I'd like to select partial undeposited funds. I deposit $5k into our Bank Checking account monthly, and leave any excess in the lockbox as Undeposited Funds.

Thanks so much for any help.

Thanks for following this thread, andgre01.

I’ll help and guide you on how to record your sales in QuickBooks Online (QBO).

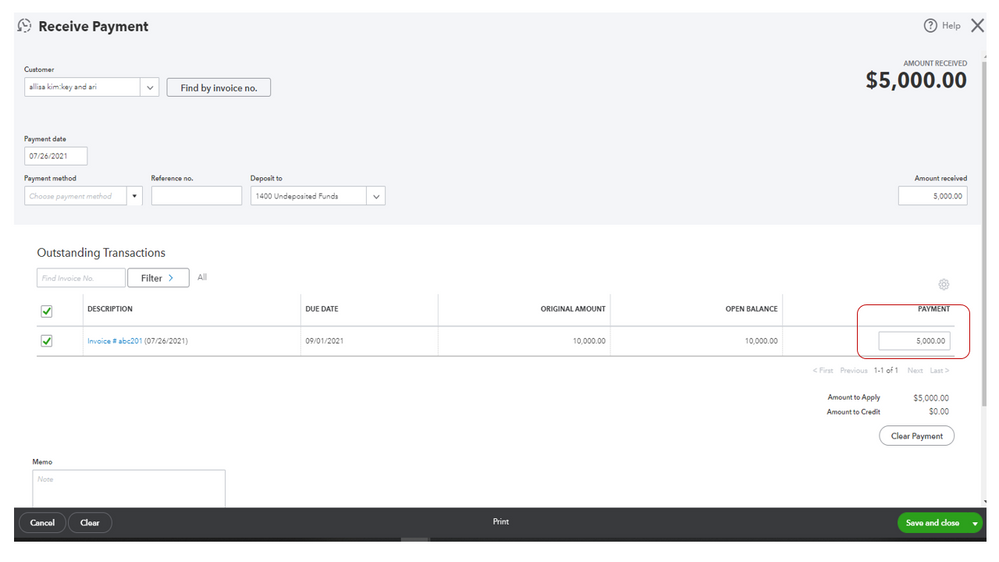

We’ll have to record the $5000.00 and the excess sales via sales receipt or invoice. Then hold them first in the Undeposited Funds before depositing the entries into their respective accounts.

Here’s how:

To record the payment:

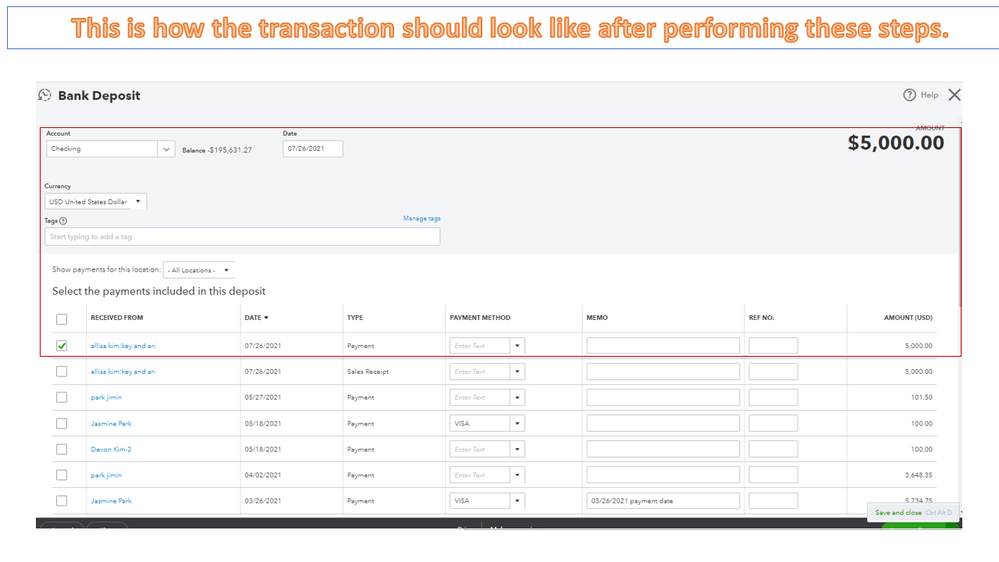

After performing these steps, deposit the payment and track it to your checking account. Let me share the steps on how to do this in your company.

Please know the excess amount is still recorded in the Undeposited Funds. Make a deposit when you’re ready to post it to the right bank or credit card account.

You can bookmark the following links in your browser for future reference. These articles outline the complete instructions on how to accept customer payments and hold them into Undeposited Funds. From there, you'll learn how to combine transactions in the online program.

Keep me posted in the comment box below if you need help managing your sales and other customer-related transactions. I’ll get back to assist further. Have a great day ahead.

I had to apply my payment in 3 separate payments to make the deposit work. I removed the large payment, and applied 3 separate payments in cash to the customer's account so I could deposit only the amount I needed. Not convenient, but the only way I was able to divide the money.

I am still looking for a solution to this issue. I have dozens of cash transactions imported from Square and placed into Payments to Deposit (Undeposited funds). Of those, I deposited $252 in cash to our business checking account and left the rest (many other transactions) for petty cash. The $252 does not align neatly with any selection of the cash transactions that I can find, so at least one of those small transactions (we sell coffee) was partially deposited. I've tried adding the smallest additional transaction to the match and then clicking Resolve and adding a transaction back into Payments to Deposit, but this then shows up as an expense.

So is there no easy way to get Quickbooks to account for a perfectly legal and common use case: depositing only a portion of a cash transaction?

Hi there, tjohnson15!

Allow me to help with a short answer on this.

You'll want to deposit all payments and put the undeposited portion in the Cash back section. Just select your cash back account (Petty cash) and enter the amount for it, like in the screenshot.

Please don't hesitate to go back to this thread if you need more help. Take care and have a great day!

Thanks, that looks promising, but I don't have a bank deposit screen. I have a transaction imported from my business checking. If I pick Find match I go to the match screen that doesn't offer a Cash Back section. Should I just delete the downloaded transaction and add a deposit manually?

Hi there, @tjohnson15. I'm here to make sure you can clear your deposits right away.

Have you tried using the filters available when finding a match? There are a few ways to find what you're looking for. You can select a specific transaction type and time period to narrow down the results. You can also use the Search field to locate transactions by amount, reference number, or memo.

Here's how:

If you're still unable to find a match, let's perform basic troubleshooting steps. Issues like this are usually the result of outdated or corrupt cache files in your web browser. We can clear them in just a few easy steps. Let's start by accessing your account through an incognito window to rule out the possibility of a webpage issue. You can refer to these shortcut keys to open an incognito window in all supported browsers:

If it's responsive, I recommend that you clear your browser's cache. By clearing them, you can remove that historical data and access QuickBooks with a clean slate. You can also switch to a different supported browser to see if it has something to do with your browser.

Otherwise, you can just delete the downloaded transaction and add a deposit manually. Here's how:

Once done, record the deposit manually. Here are some resources that will help you in managing your bank feeds:

Please swing by if you need more help with categorizing your transactions. I'm always happy to help. Have a good one.

I can find all the transactions that still need to match, but they don't exactly match the deposit, because I didn't deposit all of the funds. There is no way to select a set of transactions that match the deposited amount exactly. We run a pop-up coffee shop, so our transactions range from $1.08 to $30+, but most are small. The answer above to indicate cash back is the closest I've seen to solving the problem so far. I just don't have a cash back option in the match screen for the deposit. Perhaps there is a way to check Resolve difference and do the cash back there?

I've got your back to help clarify the cash back option in the match screen, @tjohnson15.

I can see the relevance of this feature to you and your business. Currently, this is unavailable on the match screen. What we can do is to enter an adjustment to resolve the difference in a match.

Here's how:

I'm leaving you this recommended article. This will provide you with more information on how to manage your bank transactions in QuickBooks Online as well as on what are the options you can choose to allocate them: How to set and use banking rules for downloaded transactions.

Don't hesitate to comment down if you have other questions about your banking transactions in QuickBooks. I'll be happy to help you. Stay safe!

After I check Resolve difference. I don't have any options for Add new expense or Add new deposit:

Thank you for pointing that out, tjohnson15.

I agree that there's no option for Add new expense or Add new deposit in this section. However, you can add the details in the Add receiving transactions section. Just make sure to select the vendor or customer from the Payee section, add the correct account from the Category field, and enter the difference in the Amount box.

QuickBooks will then create transactions like Expense or Deposit based on the info you've added. You can find the transactions by going to the Categorized page, and selecting the one you added.

Here's a sample screenshot for reference:

To learn more about categorizing or matching your transactions in QuickBooks Online, please check out this article: Categorize and match online bank transactions in QuickBooks Online.

When you're ready to reconcile your bank account, the instructions are included here.

Please don't hesitate to reach out to us again if you have any additional questions or concerns. The Community has your back. Hope your week is off to a great start! Take care.

I don't know how to go from your "Before" to you "After"; however, whenever I add a transaction to Find Match (either to increase or decrease the selected match amount), I get either an extra sale transaction showing up on my business bank account, or an extra expense on the account. Since working with the downloaded transaction is getting more and more convoluted, I excluded it and then clicked New->Bank Deposit, checked all of the recent transactions until the amount was just over the $252 deposited, then filled in cash back to the Cash account in the amount of the overage. This adds a single entry to the bank account register that matches the date and amount of the deposit. It also transfers the correct amount of "cash back" to the Cash account.

So it looks like what is needed here is for the Find Match screen on downloaded deposits to include a cash back at the bottom, instead of just Add Transaction.

Thanks for getting back to us, tjohnson15.

If your transactions are in the For Review tab, they can be matched to the transactions you have created manually in QuickBooks. You can use the Find Match bubble to allow QuickBooks to search for transactions that you created to match the ones for your bank account.

The program will also make suggestions based on the records it found. That's why you see a green highlighted box that says Record found. Keep in mind these aren't always accurate, so you'll want to double-check the match it found before clicking Add.

Here's how:

To learn more about reviewing downloaded bank and credit card transactions in QBO, visit this article: Categorize and match online bank transactions in QuickBooks Online.

I'll be around if you need further assistance matching your transactions. I'm more than happy to work with you again. Keep safe!

I am having the same issue as several other people above.

I am in a mostly cash business that I use Square for to track all my sales including cash and credit cards. When my link squared account updates to my Quickbooks online, it will match up all the credit card deposits with my Business checking account after review. I will then add all my Cash / Check transactions to Undeposited Funds in which I will build up my cash and make bigger deposits at one time. These will not add up to the exact amounts that I deposit since we keep some Cash on hand.

My question is, can I transfer all the Undeposited Amounts into my Cash account and then reconcile my banking deposits by transferring the Cash Bank deposit amounts from Cash to my business Checking which would then show whatever amount that I didn't deposit in my Business checking as Cash ?

Thank you for following up on this thread, @buckeye44837. I’m here to help address your inquiries about moving your undeposited amounts and reconciliation.

I appreciate you giving the complete details of your concern. Yes, you can transfer the transactions from your Undeposited accounts into your Cash account. You can then transfer them to your business checking account.

Here’s how:

I also recommend seeking expert advice from an accountant. This way, we'll be able to ensure the correct accounts are affected.

You’ll want to read through these articles to learn more about how bank deposits work with the Undeposited Funds account in QuickBooks:

You can check out this guide to match your bank statement with the entries you’ve made in QuickBooks: Reconcile an account in QuickBooks Online.

Don’t hesitate to leave a comment if you need further assistance with the process. If you also have any other bank deposit concerns, I’m always ready to lend a helping hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here