Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowThanks for posting a question here in the Community, @angie-barker.

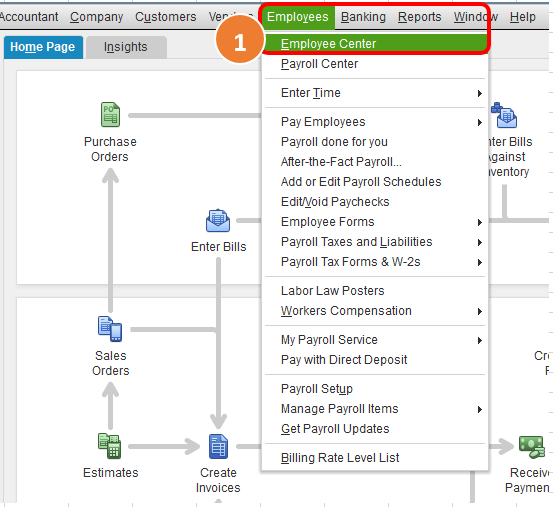

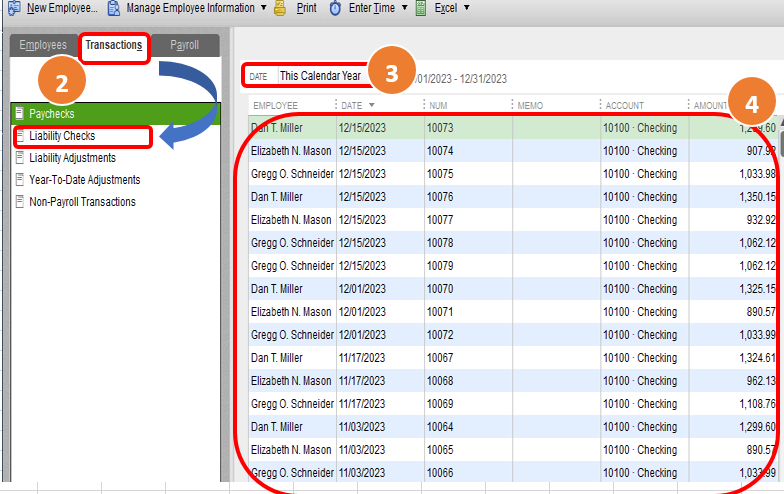

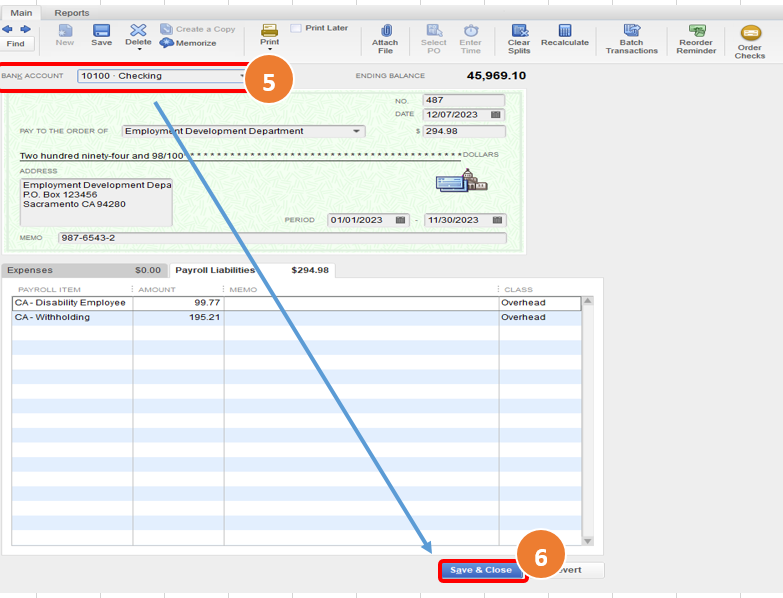

You'll have to go to the Employees Center to edit the account for the direct deposit amount. This way, you can put it in the correct bank account. I'll guide you on how to do it:

Also, you can consider checking out these articles to learn more about direct deposits in QuickBooks Desktop. This way, you'll have better ways on how to manage your direct deposits:

Here is an awesome help article that you may read in case you have other QuickBooks concerns, such as tracking income and expenses, setting up inventory and projects, running reports, manage reconciliation and online banking, etc. This way, you can effectively and efficiently run your business.

Feel free to leave a comment below if you need any help. I'd be more than happy to help. Have a splendid day and take care always!

That did not help at all. I am not sure I am explaining this good enough so I will try again.

I pay the payroll and it drafts from Bank A. So that is fine, taxes are also paid from Bank A and there is no issue there. The problem is once QuickBooks creates the Direct Deposit Liability, instead of showing up in Bank A, it shows up in Bank B. How do I get QuickBooks make that liability show up in Bank A like it should?

Hello there, @angie-barker.

You can create a direct deposit offset item in QuickBooks Desktop. This process will prevent you from overpaying your employees.

Here's how:

For more information about creating a direct deposit offset in QuickBooks Desktop, you can visit this article: Create a direct deposit offset item.

Do your other payroll-related questions in mind? Feel free to leave them below. I'll make sure to get back to you as soon as possible.

How does this work for Quickbooks online payroll?

Thanks so very much.

Hi Angie,

I believe you will need to change your preferences in the direct deposit 'Send/Receive Data' screen:

Go to EMPLOYEES, then SEND PAYROLL DATA. Click on the PREFERENCES button which takes you to account preferences for the direct deposit source account. Make sure the bank account box reflects the account that's actually sending checks to employees. This change should start reflecting the 'Direct Deposit Liability' checks in the correct bank register moving forward. I hope this helps.

Hi Angie,

I believe you will need to make a change to preferences in the direct deposit 'Send/Receive Data' screen.

Go to EMPLOYEES, then SEND PAYROLL DATA. Then click on the PREFERENCES button which takes you to account preferences. Make sure the account you're actually sending payroll from reflects in the Bank Account box. Correcting this source bank account should cause all future Direct Deposit Liability entries to post to the correct bank register. I hope this helps.

I am having the same problem. The funds come out of the correct bank but the payroll is recorded in a bank account that is closed and marked inactive in QB.

Finally! Thank you that worked!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here