Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood morning, @accountspayable5.

I hope you're enjoying this lovely day so far.

Great news, changing your bank account for direct deposits is easy. Allow me to show you how to accomplish this. Below I've included the steps.

First, you'll want to add your new bank account in the chart of accounts.

To do this:

1. Open the Lists menu and choose Chart of Accounts.

2. On the Accounts drop-down menu at the bottom, click New.

3. You'll choose Bank for the account type and select Continue.

4. Fill in the required information on the next screen.

5. Hit Save & Close once you're finished.

Next, you'll update the bank info in Payroll now that your new bank account is ready to go.

Here's how:

1. Open the Account/Billing Information screen from the Employees menu at the top.

2. Sign in using your Intuit Account login.

3. After you've signed in, you'll go to the Payroll Info section. Under Direct Deposit Bank Account, click Edit.

4. Enter the payroll PIN then hit Continue.

5. Enter your new bank account details, and then click Update.

6. Wait for the confirmation. Then you'll select Close.

Now that we've updated the bank info, you'll want to update the account that direct deposit paychecks and fees will post to. Here's how to do this:

1. Open the Employees menu at the top. Choose Send Payroll Data.

2. On the Send/Receive Data window, hit Preferences.

3. Select the new bank account from the drop-down list in the Account Preferences.

4. Click OK to save the changes.

5. Hit Close on the Send/Receive Data window.

For more details, check out: Change your direct deposit bank account for QuickBooks Desktop Payroll.

That's all there is to it. Please don't hesitate to let me know if you have further questions or concerns. I'll be here every step of the way. You can always reach out to the Community or me anytime you find you need assistance. Take care and have a good one!

We are about to switch banks.

My questions is; can we maintain both Banks within our QuickBooks online? We would like to have both accounts active while we transition from one bank to the other to ensure all checks clear and direct payments are switched over. Is this possible? If so, please explain in detail.

(We do not perform payroll through QB, so not an issue.)

We are concerned about deposits, payments, direct deposits, ACH, etc.

Hello, @Paramount1.

As long as the bank won't disable the connection, that'll remain active in your account. Also, if you'll not going to inactivate the bank from the Chart of Accounts.

Here's how to change bank account information:

Check this article for more information: Change bank account information.

Let me know if there's anything else that I can help you with. I'm always here to assist. Have a great rest of the day!

This does not help me at all.

We do not subscribe to Payroll.

We want to have access to 2 different banks at the same time to ensure all pay outs clear before closing the old bank account.

Is this possible?

If so, please tell me how.

Hey there, @Paramount1.

Thanks for reaching back out to the Community. I can provide you with some insight into having two bank accounts connected in QuickBooks Online. If you mean connected through the Banking tab, then yes. You're able to have more than one bank account connected. All you need to do is add your financial institution's information. Here's how:

Once all the payout clears in the old account, you can disconnect the old account.

If you use our QuickBooks Payments (Merchant Services) feature, then check out this link to help you change the bank information within the Payments settings.

I'm only a post away if you have any more questions. Take care!

After disconnecting the bank account, what happens to the reconciled transactions from the previous bank account?

I am in a similar boat, I need to change my bank account to a corporate account and the bank has told me I will have to close the account I currently have (which has 2 years of reconciled statements in QBO) and open a new one. How do I make this transition smooth and keep the previous transactions in my register?

Thank you, Bryan

Hello there, BryanVP.

Welcome to the Community. I can provide insights about disconnecting a bank account and changing a new one.

When you unlink the bank feeds, transactions in your account will still show in the register including the reconciled entries. If you wish to hide the account in the register, inactivate it so you can still see historical transactions on the report. I’ll be your guide today on how to accomplish the following tasks.

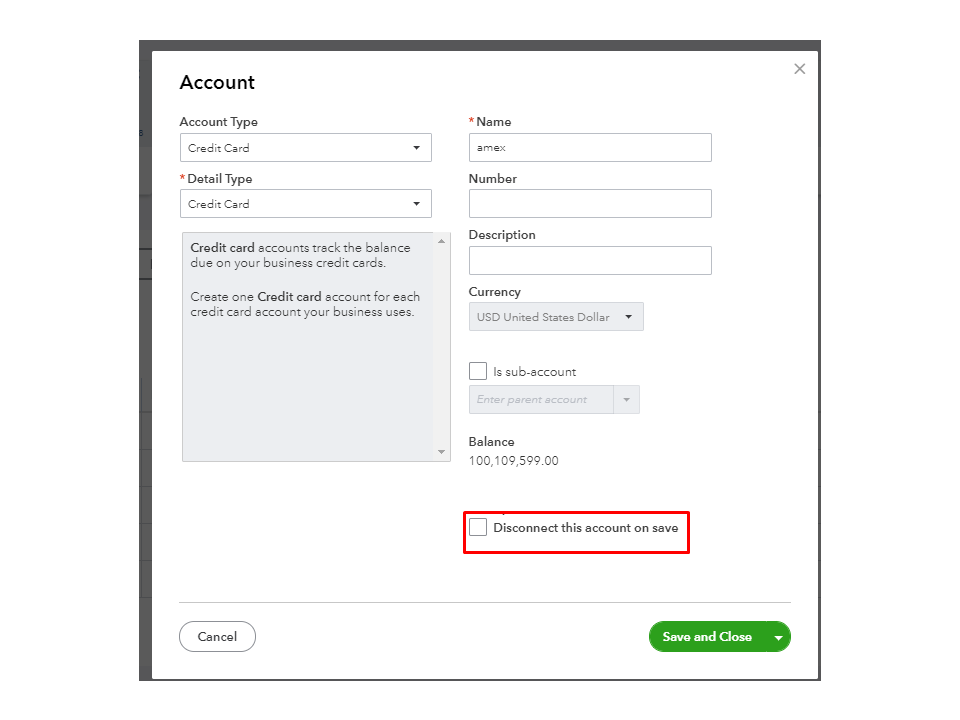

To unlink your online banking:

To hide the old account:

Let me share this article to learn more about unlinking or removing bank feeds: Disconnect or delete accounts connected to online banking.

To view historical data, all you have to do is click the Make active drop-down and then choose Run report.

When you’re ready to transition to the corporate account, here’s a link that covers all the steps on how to: Add an account to your chart of accounts in QuickBooks Online.

Also, the following guide will walk you through the process of linking the bank feeds in QBO: Connect bank and credit card accounts.

Keep me posted if you need further assistance performing any of these steps. I’ll be glad to lend a helping hand. Wishing your business continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here