Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hello!

I'm about to start trying to reconcile my Quickbooks to my bank's checking account. There are 13 entries in Quickbooks that are categorized as "undeposited funds," but the deposits are already in the bank (I think they're all credit card payments for memberships to our organization, via Authorize.net).

Does the fact that they're listed as "undeposited funds" in QB mean that QB hasn't factored them into its deposits? Should I tell QB somehow that these funds have been deposited, and if so, how?

I'm trying to get things balanced. Thank you!

Solved! Go to Solution.

Labels:

Best answer May 27, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

"HOW" Is create a deposit INSIDE QBO. It is your responsibility to Record In the software what you do in real life. Undeposited Funds is the default temporary holding place for money in. Now look at your bank statement and recreate the deposits that were made in real life.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Glad to have you here, SueTy.

In QuickBooks, payments will show in the Undeposited Funds account if you will not deposit them to your bank register. We can start creating a bank deposit to clear your undeposited funds and match the transaction amounts on both your bank statement and in QuickBooks. Let me guide you how:

- Go to the + New button.

- Select Bank Deposit.

- From the Account drop-down▼menu, choose the account you want to deposit the money into.

- Select the box for each payment you want to combine. Make sure the deposit total and selected payments match your deposit slip.

- Select Save and close or Save and new.

You can use this article for more details: Record and make Bank Deposits in QuickBooks Online

Once done, you can start reconciling your account.

If you have any other concerns, please don't hesitate to post them here.

23 Comments 23

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

"HOW" Is create a deposit INSIDE QBO. It is your responsibility to Record In the software what you do in real life. Undeposited Funds is the default temporary holding place for money in. Now look at your bank statement and recreate the deposits that were made in real life.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Glad to have you here, SueTy.

In QuickBooks, payments will show in the Undeposited Funds account if you will not deposit them to your bank register. We can start creating a bank deposit to clear your undeposited funds and match the transaction amounts on both your bank statement and in QuickBooks. Let me guide you how:

- Go to the + New button.

- Select Bank Deposit.

- From the Account drop-down▼menu, choose the account you want to deposit the money into.

- Select the box for each payment you want to combine. Make sure the deposit total and selected payments match your deposit slip.

- Select Save and close or Save and new.

You can use this article for more details: Record and make Bank Deposits in QuickBooks Online

Once done, you can start reconciling your account.

If you have any other concerns, please don't hesitate to post them here.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Thank you so much -- this is so helpful! It turns out that, when they came into QB from Wells Fargo (via Authorize.net, because they're credit card payments), even though the payments just said "bankcard deposit," because each was for the exact amount and day, I'd matched them.

So, they were already counted as deposited: When I tried to do as you said, to deposit them, I got a message in QB that they were already linked to a deposit, and I figure that this is why: I'd already matched the payments to a member.

Does this make sense? Again: thank you so much! -- I'm betting that there were a couple I didn't match yet, and in any case it helps for the future, for sure!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hi, SueTy.

I'm happy to hear we were able to help get you back to business. That's what the Community is here for. You're correct, any payments that have already been matched and recorded as deposits can't be done a second time.

If you ever have a question, you can reach out to us anytime. Have an awesome Friday!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I am having the same issue with deposited credit card payments. How did you move it from undeposited funds?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I can help you move those payments from your undeposited funds account, @FlexMgt.

You can move it from the Undeposited Funds account by making a bank deposit. All payments in the Undeposited Funds account automatically appear in the Bank Deposit window.

Here's how:

- Go to the + New button and select Bank Deposit.

- From the Account ▼ dropdown, choose the account you want to put the money into.

- Select the checkbox for each credit card payment.

- Click on Save and close or Save and new once you're done.

For more information, please visit the What’s the Undeposited Funds account? article. It provides details about how it works, like grouping payments together.

You can refer to the following article on how to combine transactions in QuickBooks with a bank deposit: Record and make bank deposits in QuickBooks Online.

I'm just a post-away if you still need more help with your credit card payments and or anything else by leaving a reply below. Take care and have a wonderful day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

What if the transactions have already been reconciled? I still have money in the undeposited funds account because my bank account is automatically linked and I have been matching, and assuming that when I do a bank deposit is automatically created in QBO. I'm not sure how to fix this now. Do I always have to create a bank deposit if my bank account is linked? I'm still new to all of this and don't quite understand. I have about $900 in undeposited but it should have automatically made deposits for some of them because it would be more than that if not. Thanks I'm advance!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hello, ekelly08.

I've got you covered! I'll be explaining what you'll need to do to clear out the amounts from the Undeposited Funds account (and how to ensure your reconciled ending balance is correct).

You're correct about the matching part. Matching a bank transaction with an undeposited funds record will automatically deposit it to the bank account.

You don't actually need to create a bank deposit every time (assuming that you've matched the correct transactions).

I take it that the remaining amounts in the Undeposited Funds account aren't matched or categorized yet. In this case, you'll still want to create a manual bank deposit to empty out the account. Here's how:

- Go to the + New button menu, then select Bank deposit.

- Select the bank account where you want to deposit the amounts.

- Set the Date to when the funds have been deposited to your live bank account.

- Check the deposits under Select the payments included in this deposit.

- Add important information such as memo, description and the like.

- Once done, click Save and close.

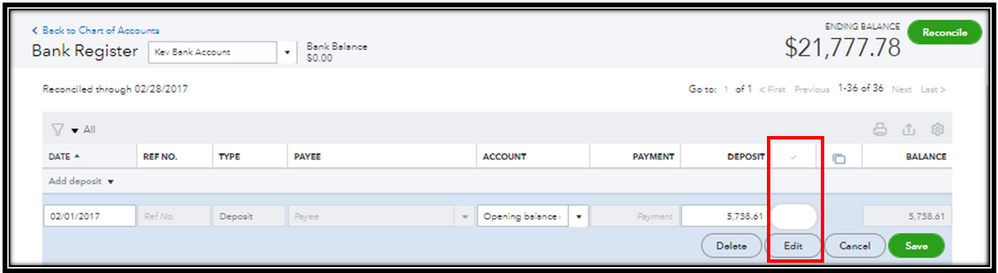

After making a deposit, manually reconcile those deposits in the bank register:

- Go to your Chart of Accounts.

- Find your bank account, then click the View register link.

- Locate and select the deposits.

- Click the "check mark" column until an "R" appears.

- Proceed with Save.

When you're about to reconcile the next statement period, you'll want to ensure the ending balance is correct. If you need help with it, you can check this article for a guide: Reconcile an account in QuickBooks Online.

However, I would still recommend consulting an accountant. They'll ensure your books are accurate before and after doing the corrections.

If you need to learn more about managing your bank transactions, feel free to use this article for reference: Categorize and match online bank transactions in QuickBooks Online.

After taking care of the Undeposited Funds corrections, do you also need to manage and pay your sales taxes? This article can guide you through the process: Sales tax in QuickBooks Online.

I'm more than happy to help you out again if you have more questions about managing your Undeposited Funds account. Would you like to learn more about other processes in QuickBooks? I'm with you in every step of the way.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I have a question about this response. In creating a manual bank deposit to clear out the undeposited funds account (for old 2020 deposits that have already been reconciled), will it show an increase in my bank account in quickbooks? This is what I'm trying to prevent. All the deposits that are showing in undeposited funds in 2020 have all been "matched" or reconciled with the correct account. How do I prevent the bank account from looking like it has way too much $$$

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Thanks for posting this concern in the QuickBooks Community, @chyrchel74,

Allow me to join the thread and share some steps to help you further with the Undeposited Funds (U/F) corrections. Yes, when you deposit the correction to the operating account, it will increase the register's balance.

To avoid affecting your account balances, you can use a clearing account to transfer the amounts. Here's how to add a dummy account:

- Select the Gear icon, then select Chart of Accounts.

- Press New.

- Under Account Type column, select Bank. Under Detail Type column, select Cash on hand.

- Add a name called Dummy Bank.

- Once done, save the information.

When you're ready to make an account inactive:

- Go to Settings ⚙ and select Chart of accounts.

- Find the account you want to delete.

- Select the Action ▼ dropdown and select Make inactive.

If you have further questions or concerns about this Undeposited Funds topic, please let me know in the comment below. I'll be right here to guide you further with the corrections. All the best!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I am having a problem where my Undeposited Funds account is showing previously reconciled and deposited funds from years back- funds that have been deposited into my checking account via QB but are still showing up in the Undeposited Funds Account. Because of this, they do not show in the New>Bank Deposits section, thereby misreporting my Undeposited Funds Asset Account. How do I get these to go away? I have tried to delete the payment for these invoices and then mark them paid again and deposit, but they remain in undeposited funds.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

It's my pleasure to help you today, BAUSA.

Let's sort this out so we can find a solution to the reconciled deposits showing on your Undeposited Funds (UF).

This can be fixed depending on how these deposits were being deposited. Let's go over and open the original deposit to which the account should be deposited. From there you can add the payments and remove the manual line item to the sales/income acct.

Open the Deposit Detail report to find the deposit. Here's how:

- Go to Report.

- Enter Deposit Detail in the search field.

- Click it and find the deposit transaction from there. Click to open it.

Otherwise, create a giant deposit using the Bank Deposit feature. This will deposit all of the undeposited funds to the right account. Make sure to enter an equal but negative amount under the same account to zero out the total. For the funds not to increase to your checking account, please ensure to fill in the correct information on the Deposit page.

Here's how:

- Go to +New icon.

- Choose Bank Deposit.

- Fill in the necessary information.

- Use the correct account when creating the deposit under the Account column on the Add funds to this deposit section.

- Once done, click Save and close.

To learn more about deposits, you may check this article: How to Record Bank Deposits in QuickBooks Online.

Both methods can fix your issue with the reconciled deposits shown in the UF. However, I recommend you do this under the guidance of your accounting professional. This is to prevent you from messing with your books since these are old transactions.

You know where to find me if you have any other banking or deposit concerns, I'll be always here to help you. Have a great day ahead.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Can you clarify this part—

“This can be fixed depending on how these deposits were being deposited. Let's go over and open the original deposit to which the account should be deposited. From there you can add the payments and remove the manual line item to the sales/income acct.

Open the Deposit Detail report to find the deposit. Here's how:

- Go to Report.

- Enter Deposit Detail in the search field.

- Click it and find the deposit transaction from there. Click to open it.”

What do you mean by removing the line item? These are reconciled transactions. How would I replace them with a payment?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Thanks for getting back to us, BAUSA.

To clarify, the report shared by my colleague above is to help you trace the deposit. That way, you can see if there's a transaction that need to correct.

I'd suggest consulting an accountant to help and guide how to record this. Your accountant can provide more expert advice in dealing with this concern so your account stays accurate.

You're always welcome to post any questions you have other banking or deposit concerns. I'll be happy to help you some more. Have a good day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I have matched all of my transactions but my funds are still showing up as undeposited. Why is this? I was under the impression that once you matched funds they would change from Undeposited to deposited to whatever account they were put into. Is that not the case? From your response above that is what it sounds like but it apparently is not working.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Thank you for joining the thread, @kmh88.

I appreciate your effort in matching all your transactions just to fix your issue about your undeposited bank. I'll make sure to help you get through this.

Yes, matching all transactions is a big help in changing undeposited funds to deposited one. However, discrepancies happen when the transaction is duplicated, this might cause the issue of your undeposited funds not being deposited to your bank.

I recommend checking your bank register if there is the same transaction and amount. To fix this, you can delete the duplicated one.

Here's how:

- Go to the Accounting tab and then select Chart of accounts.

- In the Action column click View Register for the account with the duplicate transaction.

- Find the transaction you wish to delete, then select it to show more details.

- Select Delete.

- Repeat the steps for any other transactions you wish to remove.

Once done, it will then be placed in the For review section in your bank feed. If you want to remove it from your bank feed you can refer to this link: How to remove duplicate bank transactions in QuickBooks Online.

When everything is clear you can now deposit it into your bank or any desired account, you can click this link for reference: Record and make bank deposits in QuickBooks Online.

If you want to learn how to make sure that your account matches your bank and credit card statements, you can read through this article: Reconcile an account in QuickBooks Online.

For further questions about Undeposited funds, you can always reply to this post. I'll be willing to lend a hand. Take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hello, I am using QBD and encountering the same problem, and my accountant is the one asking why there are so many funds in that account. These amounts were already deposited into our bank, show up in the deposit report, and cleared during reconciliation...they even show the little checkmark beside them. So why are they still showing as "undeposited funds" if they have already been deposited in every way manageable?

ETA: I also closed our books for the 2022 year, yet when I look at a report for this fiscal year, that same amount is showing plus anything else I've entered for this year. Shouldn't it remain in the previous fiscal year if I have already closed out the books for that year?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I appreciate you for joining this thread, @sharieb.

Yes, you're correct. It shouldn't be showing as undeposited funds since it's deposited and reconciled.

Let's fix this together. First, check the Audit Trail. It might be that there are changes to your deposits. Here's how:

- Go to Reports.

- Select Accountant & Taxes.

- Pick Audit Trail.

You can modify the Date Entered/Last Modified to the one you want to check. If there are no changes, then let's perform the verify and rebuild to find if there's an issue with your company file.

The Community is here to help you resolve your issue. Just click the reply button below, and we'll be here extending a hand. Have a good day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

I have transactions that have been deposited to the bank account and reconciled. The transactions are still in the undeposited funds account even though the deposit has been matched a reconciled. The undeposited funds account shows these transactions as reconciled. How do I remove them from the undeposited funds account?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hi there, alina11.

I'd be glad to share additional information about clearing up your undeposited funds account in QuickBooks Online (QBO).

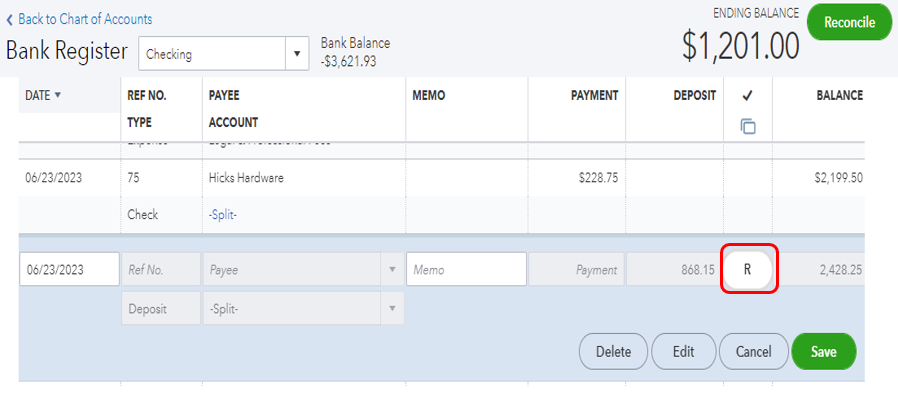

It seems like you haven't linked the transactions to match the deposit in QBO. You can undo the transactions in your register and match them to avoid any duplicates.

You can manually undo the reconciliation by going to the account register. Simply select the box with the “R” and keep clicking it until the box is blank. Refer to this article for more details about this process: Undo or remove transactions from reconciliations in QuickBooks Online.

After that, we can go back to the Banking page and Undo the added transactions. From there, we can use the Find Match tool or Suggested Matches to see options that might match.

Once done, let's change back the cleared status in the bank register to R.

Additionally, you can check out these references as your guide to view various guidelines that will guide you in reconciling your online transactions:

- Fix issues the first time you reconcile an account in QuickBooks Online

- Learn the reconcile workflow in QuickBooks

Let me know if you have additional concerns with reconciling your account. I'm always here to assist you. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hi, we have QBO linked with our FE Software. We are only enter the payments but not payables.

So we can run AR reports but not AP, our balance sheet shows only the Acc Receivable $ and Undeposited $ QBO.

We would like to link our banck account to QBO to keep better track of the business... what will be the best way to do it

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Undeposited funds -- already deposited to bank account, but QB doesn't "get" this

Hi there, BOLKO-GOING.

Thank you for joining the thread, let me go ahead and share some information about connecting your bank.

Yes, we can connect your bank directly to your QuickBooks Online. Once connected, QuickBooks Online will download all your bank transactions, including expenses (charges and payments) and income (deposits).

Here's How you can connect your bank:

- Go to select Transactions, then select Bank transactions.

- If this is the first bank account you’ve set up, select Connect account. Or select Link account if you already created one.

- Search for your bank. You can connect most banks, even small credit unions.

- Sign into your bank by entering your banking username and password. Then select Continue.

- Follow the on-screen steps to connect. Your bank may require additional security checks. It may take a few minutes to connect.

- Select any accounts you want to connect like, your savings, checking, or credit card. Then choose the matching account type from your chart of accounts in QuickBooks.

- Select how far back you want to download transactions. Some banks let you download the last 90 days of transactions. Others can go back as far as 24 months.

- Select Connect.

You can check this article for more information on connecting your bank:

Connect bank and credit card accounts to QuickBooks Online.

Moreover, let me share some articles that can assist you when your bank is connected to QuickBooks:

- Categorize and match online bank transactions in QuickBooks Online.

- Manage imported transactions in QuickBooks.

If you still have questions, you can reply on the thread or post a new one. Have a lovely day and take care.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...