Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSo if payments were made by credit card we do not report that vendor on 1099's at all? Thank you.

Hi there, Munis.

Thanks for dropping by the Community today. If you're looking for a little guidance on 1099 forms then look no further, because I'm your guy! With 1099-MISC and 1099-NEC payments to 1099 vendors made via credit card, debit card, or third party system, such as PayPal, are excluded. This is because the financial institution reports these payments, so you don't have to. You can find this information as well as other great information in the following article about what payments are excluded from a 1099-NEC and 1099-MISC?

I'm also including a helpful article for you to check out, it highlights common issues people run into in 1099 filing and troubleshooting steps to take.

If you have any other questions, comments or concerns, feel free to post here anytime. Thanks again and I hope you have a nice Monday afternoon.

Good Morning Nick,

Thank you for the detailed explanation of the topic.

It's great to see you were able to receive the info you needed regarding 1099 forms, Munis!

If you ever need additional assistance, I recommend checking out these QuickBooks Video Tutorials. You can also view the QuickBooks Blog for details about product updates.

Of course, you're always welcome to post your questions here in this space. I'm just a comment or post away if you need me.

There are several answers here that properly walk you through the correct checks. This January 2021 answer is for those who already know how to and have done and redone the checks. I use all QB versions; this year I had this problem with QB Mac. When doing 1099's for one of my clients. the vendor not showing up was...ME! Here's the quirk and the fix: I write my business name, organized ever after, with all lower case letters (because, that's the end of the story, in case you wanted to know). Turns out, QB didn't like the lower case lead "o" in the VENDOR NAME box-- it was okay in the Company Name box. Until I changed it, QB listed my company at the bottom of the 1099 "Review Vendors" page, and did not include it on the "Confirm Entries" page. Once I capitalized the "o," the 1099 populated fine. Hope that helps someone.

I did exactly as it showed and only one of my contractors is showing when I get ready to print 1099NEC. I have compared all of them and I find no difference. Obviously something is different. Help

I paid all by check and they are over $600. Must be the mapping. I have contractor account and a sub account underneath each one. All of them were done the same , but only 1 appears when its time to print the 1099. And I run the 1096 and only that contractor appears.

I click on the video you gave me and it says Error. no video appears.

@Lexiesmemere wrote:Do you mean that no vendors show up?

There can be a couple of reasons for this. Only vendors you paid via cash or check should be reported, and only if the payments total $600 or more. (It's up to you whether to report anything below that). If you entered, e.g., a check for payment but used DBT or Paypal as the check number, it will be ignored. Also, you should check the mapping to your accounts. If the account you used when you entered the bill or paid the vendor is not mapped correctly no payments will show. Check out the video below for more detailed info on troubleshooting these issues.

You can also check out the following articles for more help.

Check out Prepare and file 1099s wit QuickBooks Desktop.

Thanks for following the thread, @GRR K.

We appreciate the time you've taken to try all the steps listed above. I understand how frustrating it can be when your vendors don't show to print for the 1099s.

However, since the steps aren't working for you, I recommend contacting our technical support team. Our technical support team has the tools available to review your account in a secure environment and investigate why your vendor's aren't showing for you. I've included the steps below to contact support.

Please let me know if you have any questions or concerns. You can always reach out to the Community or me any time you need a helping hand. Take care!

No vendors show up for me also. Last year it was easy. The Prepare 1099 link at the top of Vendors doesn't work.

Let's resolve the error you've encountered when trying to create and file 1099s, @Cherokee99.

You can run the Verify and rebuild tools. Once done, update QuickBooks Desktop to the latest release to get the latest features and fixes.

The Verify Data will identify any data issues within your company file. Then, the Rebuild tool will self-resolve it.

Verify data:

If it will detect an error, proceed and Rebuild your data:

To manually update:

You can now restart your computer for the changes to take effect. For detailed guidance, see these articles:

From here, try to create and file 1099s with QuickBooks Desktop. In case you'd encounter any errors, you can check this fix missing contractors or wrong amounts on 1099s to resolve it.

I'm always here if you need further help in preparing your 1099s. Take care and have a great rest of the day!

Thank you for this but it did not help me. I have mapped my accounts, I have checked the threshold and ran my report to confirm the GL accounts and amounts. But when I run the 1099 half of the vendors are not showing up. These are vendors that showed up last year and are set up the same.

I am using Quickbooks online.

Any suggestions?

I'm here to ensure your vendors will show on your 1099, vbillings.

A vendor appears on the list if it meets the following criteria in QuickBooks Online:

To verify the settings, I suggest following these steps:

For other troubleshooting steps to resolve 1099 issues, I suggest checking this article: Troubleshoot Common 1099 Problems.

To learn how to prepare and file your Federal 1099s with QuickBooks Online, please refer to this article: Create and File 1099s.

Additionally, I've included our Year End guide for reference. This article contains information that'll help you complete year-end tasks and end the year smoothly.

We'll be right here if you need further assistance in managing your 1099.

I am having the same issue but with QBO.

Nice to have you join this thread, @Anonymous.

I'm here to help and get you back running your business. I want to ensure I’ll be able to provide you with the right resolution. Were you able to follow the suggested steps shared by my colleague CharleneMae_F above? If not, I recommend to check the mapping of your vendor’s 1099.

If you have, and the issue persists, I recommend contacting our Support team. This way, they can securely check your account and further look into this issue. They’ll be able to share with you additional steps to fix this.

Here’s how to reach out to them:

You can also check this link for more details: QuickBooks Online Support. Ensure to review their support hours to know when agents are available.

I’ve also added this article that you can read in case you want to learn how to check your filing status in QuickBooks: Check e-filing or e-payment status.

If you have any other concerns or follow-up questions, you’re always welcome to tag me in your reply. I’m just a few clicks away from you. Have a great day and keep safe.

Fun times! I was attempting to work on my 1099's, but 2 weeks ago I upgraded from Enterprise version 19 to version 21. Apparently during that upgrade it removed almost ALL of the 1099 check boxes from my vendors. So now I have to run reports and evaluate transactions to identify eligible vendors. I use this QB tool every year. Last year I had about 53 vendors that I created 1099's for. I expected the same this year. But as it turns out, now I only have 10 vendors who have check marks in the 1099 field. When I called Customer Support, they said something about it being a known issue and that it would have to be fixed manually by me. LOVELY!

Thanks for being detailed about your concern, WillieMcCoy.

I appreciate for letting us know of the steps you’ve performed to show the vendors' names on the 1099 form. Let’s perform another one to rectify the issue.

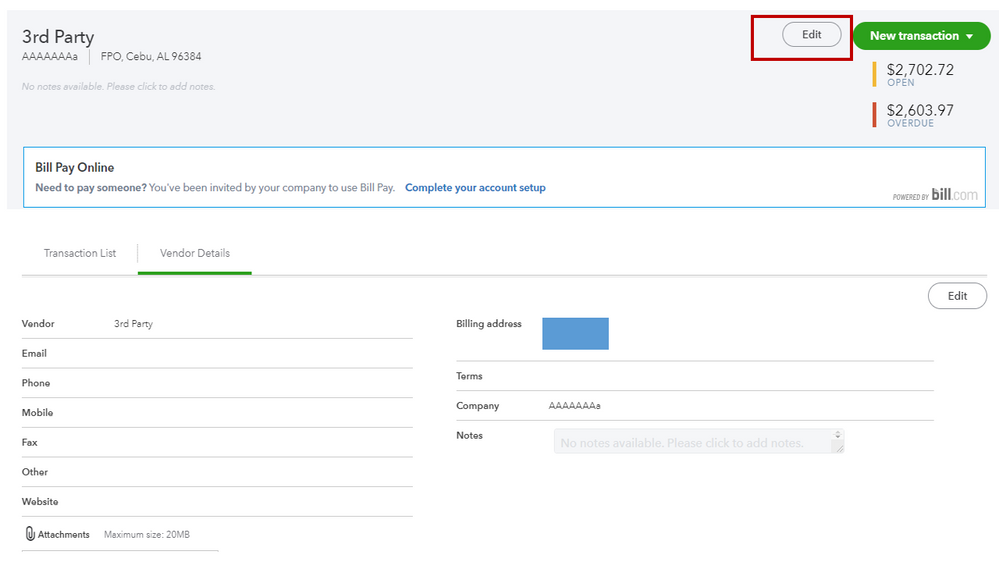

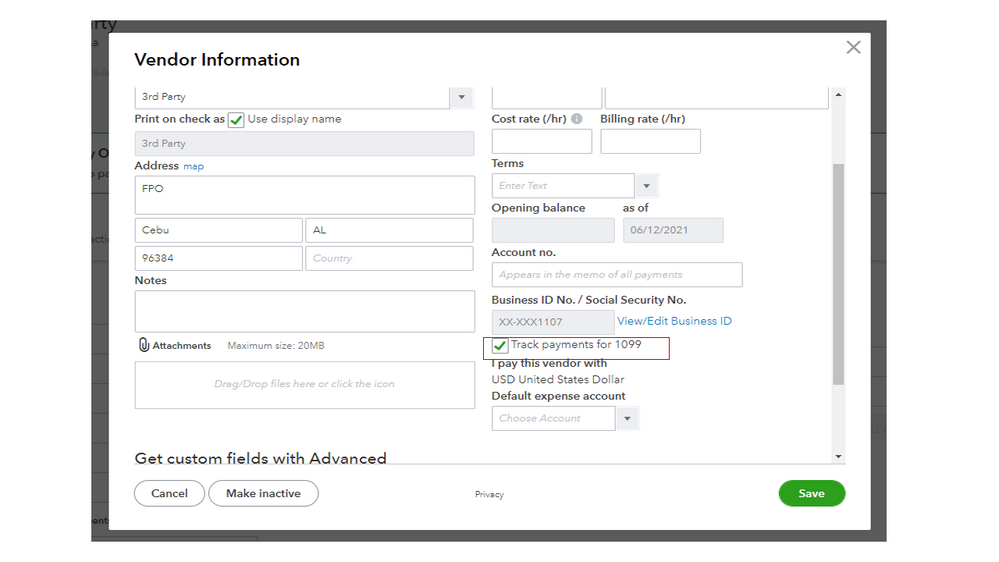

If your vendors are missing from the list, it could be they're not active or marked as eligible for 1099. We’ll have to open each supplier’s name and make sure the Track payments for 1099 box is selected. I’ll help and guide you on how to do this in QBO.

If your suppliers are deleted, make sure to activate them before processing the 1099 form. This way, the names will show on the form. For detailed instructions, check out this article and then go to the Restore a customer or vendor section: How to edit, delete, and restore list elements.

Please know the information displayed on 1099 is from 2020. If you’re unable to record expenses and map them correctly, the data will not show on the form.

However, if the contractors are active and set to track 1099, I recommend following the solution shared by @CharleneMaeF to resolve the issue.

For additional resources, here’s an article that contains solutions on how to resolve the following situation: Fix missing contractors or wrong amounts on 1099s.

Don’t hesitate to leave a comment below if you have other concerns or questions. I’ll get back to answer them for you. Have a good one.

How did you fix this? I use a sub account but it does not show up under 1099 Transaction Detail Report

Hello there, @Cheryl_Milne. I'm here to further help you see your sub-accounts when running the 1099 transaction detail report.

Let's ensure that you've mapped the payments to the correct expense accounts when preparing the 1099 form. If these are sub-accounts, those specific sub-accounts must be selected instead of the parent account. For more information on preparing your 1099 form in QuickBooks Online (QBO), feel free to open this article: Create and file 1099s using QuickBooks Online.

However, if verified that all payments are mapped to the correct accounts and you can't still see them, I suggest reaching out to our Customer Care team to further investigate the root cause of the issue. They can pull up your account in a secure place and you can also request a screen-sharing session so they can check your setup and guide you with the steps you'll need to take.

I've also added this helpful link to give you additional information about the 1099 forms: Get answers to your 1099 questions.

You'll want to personalize and filter only the data you need when generating a report, feel free to customize them in QBO. For the detailed instructions, check out this article: Customize reports in QuickBooks Online.

If you have any other concerns in accessing the 1099 transaction detail report in QBO, don't hesitate to post again here in the Community. I'd be happy to assist you further. Keep safe.

I am having the same problem. Looks like the vendors with less than $5000 are not showing up.

Should be set to $600

I am still having this issue.

Some vendors show up. Others do not.

I checked everything, included with your vendor support on the phone and sharing screens.

The only thing I see is that vendors with less than $5000 aren't showing up. Those with greater are.

Can someone check with the technical team to make sure that the threshold is not set incorrectly in the software?

Hi there, @Our IdeaWorks - Ivy. Thanks for taking the time to reach out to the Community for support.

I can see you have posted the same concern twice in the QBO Community. My colleague already shared their response on the other thread. You may refer to this link to review the solution to your concern.

You can also check this handy article for more details on how to create and file 1099s using QuickBooks Online.

Keep me posted if you still have questions or concerns regarding 1099. I'll be around for you. Have a great day!

I have quickbooks mac. How do I find this categorizing section? I have 2 subcontractors that will not show up on my 1099NEC. They are checked as 1099 vendors, and listed as subcontractors. But their transactions show up as uncategorized rather than non employee compensation. How do I change that?

Hello, anomalymk.

Let's double-check the setup of your 1099 to ensure it's categorized and mapped correctly in QuickBooks Desktops Mac. To to update your account, Go to the Vendors page, then choose 1099s, Please click this link for more guidance: Modify your 1099-MISC and 1099-NEC filing.

I'm adding these articles for further details about the 1099-NEC FAQs and various updates in QBDT.

Let me know if you still have questions or concerns with 1099s. I'm always here to assists you. Have a great day ahead. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here