Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'd be happy to walk you through the steps, mygatorcleaning.

Regardless of the current employee status, you can generate their W-2 as long as they have paychecks recorded during the year. Before doing so, make sure the following information is correct:

Then, follow these steps to get the form:

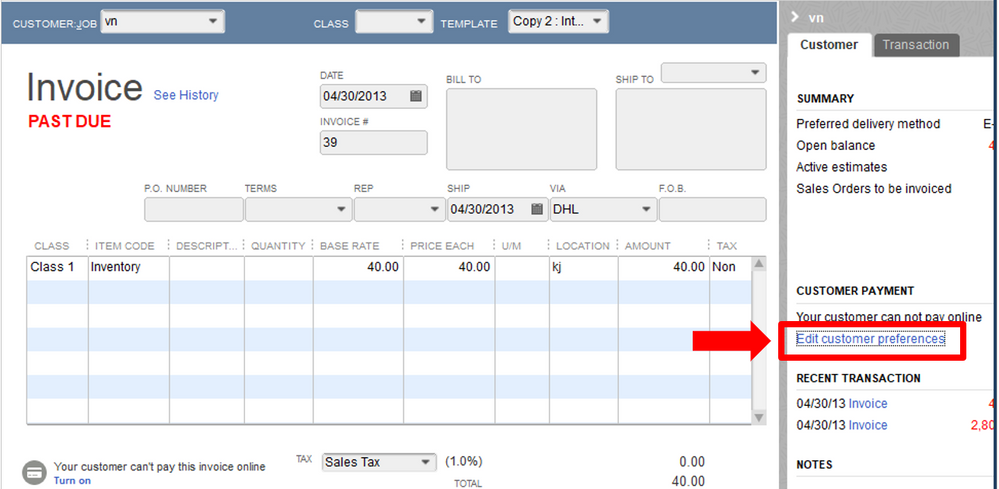

Please see these sample screenshots for a visual reference:

You can check out these articles for more details:

For more information about year-end guides, you can open this article: Year-end checklist for QuickBooks Online Payroll.

Please keep me posted if you have other questions with QuickBooks Online Payroll. I'm always around to answer them. Have a great day!

I changed the address for a terminated employee. She is now living in Georgia. After I changed her address, reports for Georgia popped up in my To Do List. She worked totally in California.

How do I get rid of these reports?

Thanks for joining the thread, Connie2249.

If your employee lives in California while he/she is still working, then, the employee address should be under California. Thus, it shouldn't be changed to Georgia.

You may check out this article for more information: Edit or change employee info in payroll.

Additionally, employee who works at a work location in a state outside your primary work-location state, your employee is subject to work-based taxes (such as state unemployment insurance) in that other work-location state, regardless of where your employee lives. To know more about the multistate employment payroll situations, you refer to this article for further guidance: About multistate employment payroll situations.

Please let me know if you have any other concerns and I'll be here to keep helping. Have a wonderful day.

How can I do this in the desktop version of QuickBooks and NOT the online version?

Hey there, amyt71.

I'd be glad to help you with generating a W-2 for a terminated employee in QuickBooks Desktop. Here's how:

In case you need help with changing your employee's information, you can check out the following articles. These will provide you with steps in modifying as well as purchasing their W-2s:

Set up employees and payroll taxes in a new state.

I'll be right here if there's anything else you need. You can always count on me. Have a nice day!

Just to clarify your response...if I have an employee who terminates then moves to another state, I'm not supposed to update their address? QBO does not give the option to have a physical AND mailing address. If I do not update their address to the new state, how would they get their W2? When I change the address for a previous employee, it creates Payroll tax report notifications for that new state. Is there no other way around this other than printing the W2 with their old address and putting in an envelope with the new, out of state, address?

Thank you for turning to the Community about your W-2 concern, BhamPro.

Having accurate payroll records is essential for every business, particularly your employees' information. This is essential to stay compliant with tax form filings, especially when mailing out W2s.

It is important that we have the correct mailing address for your employees to send their W-2s. We'll be mailing the payroll forms to their home addresses (from January 16 to January 31) for those who have chosen to receive a physical copy.

Changing an employee's address in payroll to a different state may trigger payroll tax notifications for that state. That said, I recommend contacting our Payroll Support Team for further assistance. They have tools to update the worker's address to the right one. Let me show you the steps to obtain the support details.

Here's how:

For detailed information on the support hours for your payroll service, click here: Contact Payroll Support. Then, click the link for QuickBooks Online Payroll.

In addition, your employees can opt out of a mailed copy of their W-2 through QuickBooks Workforce. This option may not be available to all, as it depends on the specific payroll service utilized by your employer.

Moreover, I've got some resources that cover topics such as year-end filing preparation, W-2 processing, and filing amended returns:

If you have any additional questions about updating your employee's records or address and processing W-2s, just let me know @BhamPro. I'll get back as soon as I can and make sure everything is taken care of. Have a good one.

Hello I'm no longer working for my company anymore and he said he put the W2 on QuickBooks how would I go by getting mine

I can see the urgency of the matter, Hotcoco. If you're no longer working for your previous employer and you haven't received your W2, let me help you on how to get them in QuickBooks Online.

Contacting your former employer directly is often the best first step in obtaining your W2. They should be able to provide you with the necessary information or assistance to obtain your W2, even if you're no longer working for them.

Furthermore, you should contact the IRS and explain your situation. They can help facilitate the process of obtaining the necessary tax documents from your previous employer.

Moreover, I've got some resources that wrap topics such as year-end filing preparation, W-2 processing, and filing amended returns:

If you have any further inquiries regarding updating employee records, address changes, or W-2 processing, feel free to reach out to me at @Hotcoco. I'll respond promptly and ensure that everything is handled efficiently. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here