Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi Bookkeepingisfun,

QuickBooks Desktop follows the IRS guidelines for the W-4 2020. You'll want to check on the articles provided by my colleague Ashley H for more details.

You can click on this link: https://quickbooks.intuit.com/learn-support/en-us/employees-and-payroll/re-2020-w-4/01/463288/highli...

I'd also recommend reaching out to our Customer Care Team for further assistance by following the steps below:

Please feel free to me know if you have any additional questions or other concerns. Take care and stay safe.

I have completed all Payroll updates but this change has not populated to my QB program. I still see the original W4 withholding options (prior to the 2020 change) and there is not an option to choose "2020 and later". How do I fix this issue?

There's one thing that you'll have to do to successfully see the option, ambert.

Updating to a new launch usually takes a slight change to the database. It is necessary for you to update QuickBooks Desktop application in a timely manner for the application to work properly.

Once done, check if you already have the withholding and 2020 and later options.

For future reference, you can check this article for more information on what you need before setting up payroll: Getting Started With Payroll.

If there's anything else that you want me to help, please let me know so I can get back.

Ashley, is it possible to change an employees W-4 from 2020 and Later to 2019 and before? Thanks in advance!

Thank you for joining the thread, @sdseagles.

Allow me to share additional insights about the W-4 form.

The IRS revised some forms to be more accurate in calculating withholdings due to some tax law changes. QuickBooks stays in compliance with the IRS mandate, thus, once the 2020 and later option is available, you may not be able to change the form to Later to 2019.

Employees who have submitted Form W-4 in any year before 2020 are not required to submit a new form simply because of the redesigned form. You can continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

To learn more about the form, feel free to check out these articles:

To stay complaisant with the state payroll tax regulations, you can also review our Payroll Tax Compliance Links.

If you have any other questions about payroll or forms, please let me know by adding a comment below. I want to make sure everything is taken care of for you. Cheers!

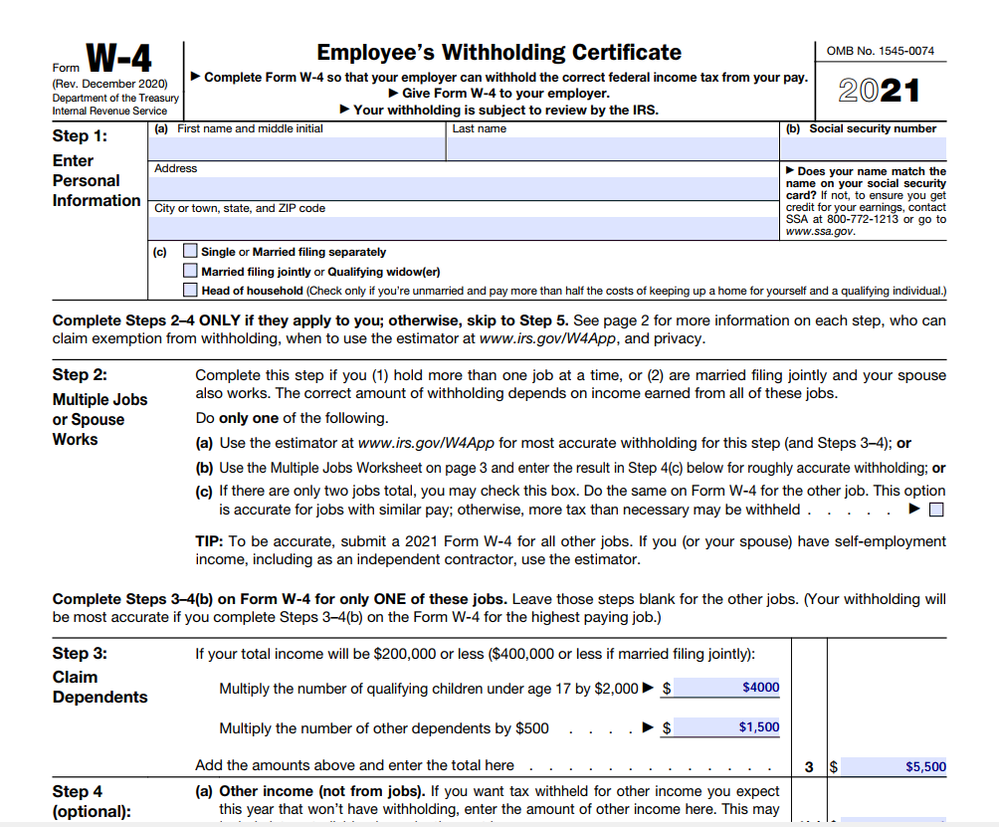

Hello I am just realizing we have the dependents for our employees incorrect? We put for dependents the number 1.00 or 2.00 instead of the 2000.00 or 4000.00 amount. This was for all of 2020. I am not sure what to do. We have not submitted W2s yet. What should I do?

Let me provide you a few information so you can correct your employees' allowances, Angeluh4211.

Allowances that were tied to a personal exemption amount are no longer allowed by law. You'll have to make sure to calculate the dollar amount in your W-4 form to correct your employees' allowances. Here are a few links you can check out with more information on the 2020 W-4:

In addition, new employees who are required to fill out the new 2020 Form W-4 but fail to submit one must be set-up with the following entries:

For your reference, you'll want to read this article for payroll updates: Latest Payroll News and Updates.

Reach out to us if you need further assistance with your payroll. I'll be here to help.

Please explain this like I am 5 years old. Here is the Federal form W-4 2021 filled out correctly by an employee. What number do I enter into the line "Claim Dependents"??

Not 1 single answer from anyone in this entire thread has answered this question. Not any user, not any single QB help desk person. This is very important and fundamental to keeping my business open. I need to be able to properly withhold Federal taxes correctly.

NO!!! THIS IS NOT CORRECT. THIS IS NOT THE ANSWER TO THE SPECIFIC QUESTION!!

Maria,

In your answer you said:

"You'll have to make sure to calculate the dollar amount in your W-4 form to correct your employees' allowances. "

Please explain where in this window from QB Premier Desktop 2019 do I enter that dollar amount from box #3 in the 2021 W-4 form?

Hi there, @kjkleins.

I'm here to shed some light.

With the new W-4, you'll have to calculate the total dollar amount and enter it for the Claim Dependents box. You should know the exact amount to be filled in that field for we're unable to share specific amount to be entered.

Here are some articles you can reference with more details on the 2020-2021 W-4:

If you have any questions or concerns, feel free to let me know. I'm here to help anytime. Take care!

Related problem with W4 here. My employee wants to remove the $2,000 dependent claim on his W4 because his paychecks are showing zero federal tax withheld. When I go into his profile in Quickbooks online to edit his W4, I delete the $2,000 amount from line 3. I click "Done" to save the edits. Then I go back into his W4 to check that it was saved, and the $2,000 is still there. It won't go away. I have tried several times now, and it is very frustrating. Can Quickbooks please explain why I can't edit the dependent claim on the W4?

Let's perform some troubleshooting steps to get the correct data on your W-4 form, pizzabookkeeper.

I appreciate you for performing some solutions to get this sorted out. There are times when a browser's cache data becomes full of frequently accessed websites or damaged. This causes odd behavior when running your W-4 form. To better isolate this one, let's try signing in to QuickBooks Onlne (QBO) using a private or incognito window. This mode doesn't use the existing cache data and helps us confirm browser-related issues. Here's how:

Once logged in, go back and try to check the amount on Line 3 again to double-check. For more guidance, feel free to check out this article: What’s changing with the Federal W-4?. If it works, go back to your regular browser and clear the cache to delete those temporarily stored files and browsing history. The overtime collection of data can create corruption, however, removing this should fix the issue. You can also use other supported, up-to-date browsers to roll out the possibility of a browser-related issue.

The new changes state that employers will calculate the withholding based on the information from the employee's W-4. The IRS revised some forms to be more accurate in calculating withholdings due to some tax law changes. To learn more about the form, feel free to check out these articles:

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Feel free to reply to this post and I'll get back to you. Take care always.

Hi RCV, thanks for replying to my question.

Using a new private browser did not work. However, I was able to figure it out and fix the problem. Here's how:

1. Cleared entire browser history and all Intuit cookies. This was probably unnecessary, since the private browser hadn't helped, but I wanted to be sure I tried everything.

2. In the employee's W4, I had previously been selecting the $2,000.00 in the dependents box, hitting "delete" on my keyboard, then clicking the green "Done" button to save the changes. This time, I deleted the $2,000.00 and then typed "$0.00" in the box for line 3 dependents, then clicked the green "Done" button. And then when I went back into the W4, the changes had been saved. The $2,000.00 was gone.

Hope this helps other people.

im at my wits end, I checked the 2020 and later for w-4 on my payroll tax page and now NO federal withholdings are being withheld on the checks. how do i correct this i have been on the phone with quickbooks for two days trying to resolve this and am extremely frustrated because nothing has been resolved so far. now i have to go to support and will probably have to pay for a service that is a glitch to begin with. Change the tab for w-4 back so i can change it to 2019 and before.

When I enter the $ amount claimed on employees new W-4 then quickbooks does not withhold any federal tax. Isn't this going to cause a problem at the end of the year when they have to pay their taxes?

I'm here to share some information on how QuickBooks calculates your payroll taxes, @jsimmonstexturewood.

Federal and State Income Tax (FIT and SIT) calculations are based on the following:

Also, make sure that your QuickBooks software and payroll tax table is updated to the latest version.

Just a heads-up, allowances are no longer allowed base on the updates from the IRS. Here's an article you can read to learn more: What’s changing with the Federal W-4?.

See these articles to learn more ways to fix payroll taxes that are not calculating:

I'm always here if have other questions about managing your employees' payroll and taxes. Let me know in the Reply section below. Have a good one!

Even after getting payroll updates, I don't have the drop down under the Federal Tax to choose 2020 and later W-4. Quickbooks Desktop Pro 2018 (I know I have to update before May31st, but would like to get this employee's info entered now)

I can see the importance of entering your employee's W-4 information in QuickBooks Desktop (QBDT), @Mary96. That's why I'm here to guide you on the actions you need to take care of this issue.

I appreciate you for getting the latest payroll updates. However, I'd also recommend having your QBDT software updated. This way, you're able to utilize the latest features (i.e., updated Federal Tax info to choose 2020 and later W-4 option) and fixes. For the detailed steps, you can refer to this article: Update QuickBooks Desktop to the latest release.

After that, enter your employee's W-4 information by referring to this article: Employee's Federal W-4. It also includes topics about the major changes to the form and printing it, to name a few.

Also, I'm adding this article to answer the most frequently asked questions about 2020 Form W-4: FAQs on the 2020 Form W-4. It includes topics about new releases, downloading, and redesigning the sad form, to name a few.

Let me know how it goes in the comments below. If you have other Form W-4 concerns or inquiries about managing employees in QBDT, I'm just around to help. Take care always.

Thank you for the help with how to enter the W-4 Claim Dependents as a number or dollar amount on line 3 for input into QB.

I did go to the IRS Web Tax Withholding Estimator. It seems to have an issue determining if you are claiming a Minor vs. Other Dependent when it completes its calculation. It uses $500 for each Dependent over 16? In my case it should have been $2,000 for each dependent claimed because they were under 16. I could not see how to change that calculation. Any help with this would be great.

Just to everyone in general, especially all of the "Quickbooks Team Members" with your copy and paste info. I 100% know how the payroll taxes work, so does my CPA. What we don't know is how it works with your software because we aren't software engineers. What we do know is your software is calculating the federal taxes very incorrectly. VERY. I should not force my employees to "withhold an extra tax" because our, for lack of a better word, dummed down software does not know how to properly calculate your payroll taxes even though we are paying for assisted payroll (which you might as well drop the word assisted out of there and change it to something like "our robots process your payroll and deposits, etc. Sometimes we pay and file your taxes, sometimes we don't. It's really hit or miss, we are now known as the hit or miss sometimes assisted payroll platform". Please for the love of everything tell me they have figured this out and hopefully fired their entire software development team. Like every single one of them, except the underdog that no one listed to (there's always one) -- this person was probably right. How can you have 5,000 complaints about the same issue for well over a year AND with plenty of time to set it up, and have it not work AND THEN have the audacity to tell us to calculate it ourselves and contact our CPA's?! Mine just laughed because he knows our software is a joke Looking forward to the day we roll our data out of here.

Once again, 0 stars. Would no longer recommend to a friend.

What on earth happened to you guys? How many of you even work there? *Work* there....answering service isn't helpful either. That's for another topic though.

TO ANYONE WHO REPLIES:

Yes I followed your step by step guides on how to enter a W-4. Do not send me your copy and pasted handbook instructions and the exact same stuff I have already done.

PS: Thanks for overriding every 3rd party and taking ownership but *not telling us* .... that was fun not being able to work for a week.

Employee chose Head of Household on the new 2020 W4, however there is no Head of Household filing status in the State Tax drop down menu for MT. What should I enter?

Hi there, MTBIB.

I'll make sure that you can select that filing status.

The Head of Household filing status for the state of Montana is available in QuickBooks Desktop. To isolate this issue, you'll want to make sure that your product is up to date so you always our latest features and fixes.

After that, update the payroll tax table to get the most current rates and calculations for supported state and federal tax tables, payroll tax forms, and filing options. Here's how:

However, if the Head of Household filing status is still missing, I'd recommend running the Verify and Rebuild Data utilities. It could be that there's a data integrity issue in your company file preventing you from viewing this option.

In addition, here's a reference that you can browse to help ensure compliance with MT payroll tax regulations: Montana Payroll Tax Compliance.

I'll be right here to keep helping if you have any other concerns or further questions about payroll and taxes. Have a good one.

The irs changed their withholding liabilities in 2020 and it’s been released in the news several times that many family employees with child dependents making under $75000 per year would likely have little to no federal withholding since their tax liabilities are lower. This is not a mistake, they don’t owe federal taxes based on their income. They likely will not receive a refund as previous years in April, or it would be much less than before.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here