Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowThanks for joining this thread, @Bookkeepingisfun.

Due to the IRS tax law and regulations, Form W-4 Employees Withholding Certificate was revised in order to more accurately calculate withholding.

Since this issue affects your Payroll experience in QuickBooks, I recommend reaching our Payroll Specialists in QuickBooks Desktop. There they have tools to check if the tax withholdings are calculating correctly.

You can also review this estimator from the IRS to check further in matching withholding calculation with QuickBooks: Use the Tax Withholding Estimator.

Additionally, you can check this article for more details about the revised law from the IRS: What's changing with the Federal W-4?.

Please feel free to leave a message to this post if you have more questions. We're always here to assist you. Stay safe and healthy!

I have been following this thread and have the same issue. I can check withholdings against the IRS tables and it shows tax due, but not in QB. Something is not done right in the system and needs to be fixed, after all ,we are paying for the service, to be correct.

And please no generic answers ...we need this fixed quick, PLEASE.

We'd really want to sort this out for you, bubu59.

As previously shared in the earlier replies, there are a couple of reasons why there's a zero amount for federal withholding. Most of the times, it's caused by:

A good indicator of why income tax was not withheld from the employee's paycheck is to review their gross pay and tax status.

For example, if they are married, paid twice a month, and their gross for one paycheck is $300, most likely they’re not meeting the taxable wage base to have income tax withheld from their paycheck.

An employee’s preference should only be set to Do Not Withhold if they explicitly claim exemption from withholding on their Federal Form W-4 or any applicable state form.

Please review the employee profile to make sure that the withholding is calculated correctly. If the setup is already correct, please give us a call. Our Payroll Support Team will take a closer look at the paycheck and the employee setup as well to sort this out for you.

Follow the same steps that are shared above on how to reach out to our Payroll Support Team.

As always, visit us again in the Community if you need anything else.

These are the same employees we have had for years and just all of a sudden it stopped calculating withholdings correctly. It has been $30 per pay check for one employee and up to $50 per pay check for another employee. From my understanding, the tax tables have not changed and I have had to manually change the amount of withholding to make sure the appropriate amount is withheld so the employee does not have to pay taxes at the end of the year.

We want this checked and fixed as much as you do, MMotors.

You can check the reasons and fixes provided by my colleagues at the top. Although, if you've checked the employee's profile and payroll settings already, I'd suggest reaching out to our payroll support. They have more tools to further investigate your issue. You can follow Jovychris_A steps on how to get in touch with us.

Once it's all good, the taxes should be calculating correctly.

You can visit us anytime if you have other payroll concerns. Feel free to drop by.

I am having the same problem with 1 out of 3 employees. It is a problem with QB and not all these users. I use QB online.

Thanks for joining this thread, wwalsh.

I have information regarding the Federal withholding not calculating on paychecks. In QuickBooks Online (QBO) taxes are calculated based on the following factors:

You can check out these articles for more information:

I'd also recommend reaching out to our Payroll Support Team via chat or call to check your account. Before doing so, please check our support hours: Here. Then follow these steps:

. Please feel free to leave a comment if you have any additional questions or other concerns. Take care and stay safe.

Hi, the payroll support team doesn’t help, they say it’s correct if it isn’t withholding taxes at all but that makes no sense. At the very least it should be 10%, no?? It seems to be calculating on a per-paycheck basis instead of a Gross basis, but filling out the 2020 W4 has only effectively made it so only 1% of FIT is being withheld per paycheck. It’s not a setup issue! The only questions you’re asked on the W4 are filing status, if no defendants and only one job that’s literally it.

Thanks for joining this conversation, @SFM_Admin.

QuickBooks is always following the IRS Publication (Circular E) when it comes to withholding federal and state income taxes.

If a paycheck shows $0.00 or no income tax withheld, it may be caused by any of the following:

To check if an employee was set to Do Not Withhold, please refer to this article: 0.00 or no income tax withheld from paycheck.

I also recommend checking out the IRS Publication (Circular E), Employer’s Tax Guide, and proceed to page 21 for more information about Withholding From Employees' Wages.

Please leave a comment below if you have any other questions or concerns. I'll be more than happy to help. Have a good one!

Having the same issue!!!

Hello, @Cdenn.

The withholding of federal and state income taxes is based on the IRS Publication (Circular E). To ensure that the correct options upon entering the W-4 are selected. Let's check the Federal Filing Status/State Filing Status of the employee.

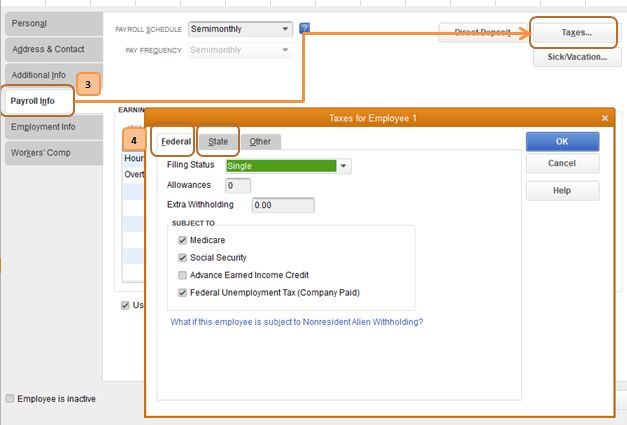

Please refer to these steps:

If the information is accurate but still getting the wrong calculation, I suggest reaching out to our QuickBooks Care team. This way, they can further investigate what causes the odd behavior of the software and generate steps to fix it for you.

Here's how:

To learn more about the new changes of the federal W-4 as well how to enter and print them, please see this link: What’s changing with the Federal W-4?

Should you need anything else, don't hesitate to comment below. I'm always around to help. Stay safe and take care always.

Iam having the same issue. Was just on phone with QuickBooks 1hr 1/2 and they weren’t able to fix anything. Even though on back end they’ll Calculating my taxes at 0% she said it’s because my employees are not working 80 hours a week I told her that just doesn’t make sense Who works 80 hours in one week. Also the employees that are on the old W for taxes are getting taken out so it has something to do with the new 2020 tax form that they have entered on their end

This is not user error on our side.

this is a Issue on the backside of QuickBooks payroll and it should be looked into very deeply and quickly to correct

Nobody was able to help him they said double the withholdings No withholdings are taking out zero that would still be zero Thanks but no thanks for the help

Nope

Yvette - I to am having the same issues. I just now realized that since March no federal taxes have been withheld from employee paychecks. I have gone over all of the information in all of these posts and everything looks to be correct. Please help!

I see others are having the same issue and wanted to report it has never been resolved. The employees that were having the wrong federal withholding taken out of there check I manually went in and increased the additional withholding. If this had not been done, our employees would all be paying additional federal taxes at the end of the year because not enough was deducted from their check.

I am having the same issues. I have an employee who would like to file married filing jointly and the past 3 checks I haven't had any federal withholding coming out. How do I fix this so quickbooks calculates the federal withholding? All employees before 2020 are calculating federal withholding.

Hello there, Central Lutheran.

Just like the previous responses of my colleagues, QBO will calculate the federal withholding taxes as long as the employee meets the taxable wage base and is set up correct. You can use this link for reference: 0.00 or no income tax withheld from paycheck.

If the same thing happens, I'd recommend reporting this to our Payroll Support Team. They can pull up your account and further review your data.

Or

We'll be right here if you need anything else.

I was having a similar problem. Quickbooks was not taking out ANY payroll taxes on random employees. What is going on with this??

I'm here to make sure we get this sorted out, @marual72.

Do you know if these employees are meeting the wage bases set by the IRS? You can click on this link to learn the wage base limit: Topic No. 751 Social Security and Medicare Withholding Rates.

It is also possible that their W-4 status has been set to 'Do Not Withhold' by mistake. Here's how to check if an employee was set to Do Not Withhold:

To give you more troubleshooting steps on how to fix payroll setup when taxes aren't calculating, check out these articles:

Please let me know if you need further assistance. I'll be around to help. Have a good one.

I have also done the same checking, and still it isn't working correctly.

Hey there, @M5Drilling.

Thanks for following the thread.

Since you've followed the steps provided by my colleague above, I recommend contacting our payroll support team. They have the tools available to review your account in a secure environment and will investigate the issue's strange behavior. I've included the steps below to contact support.

1. From the Help menu, choose QuickBooks Desktop Help.

2. Enter your concerns, then hit Contact Us.

3. Pick the way you wish to contact support (Chat, Callback, Etc.).

Please let me know if you have further questions or concerns. I'll be here every step of the way. You can reach out to the Community at any time. Take care!

Hello , I am an electrical contractor and just set up a new employee. No federal tax was withheld. I tried deleting the check , re- entering the employee’s W4 info , double checking the tax exempt status and all other info. I created another check and still same problem- federal withholding was zero. The only difference with this employee to my others was the dependents , this person has 3 kids and a spouse which put the dependents at $6,500. I went into the W4 and changed the dependents to zero to see what would happen when I ran payroll for this employee. I created the check and Federal tax was withheld. It seems to be the dependents affecting my situation. I am not a tax expert that is why I rely on QuickBooks to take care of these deductions. So it’s one of two things:

1) It’s possibly correct that nothing is being withheld because of this person’s dependents- maybe the withholding kicks in after a certain amount????? Don’t know not a tax guy. Don’t have time to research it. Trying to run a business.

2)It’s a glitch in QuickBooks and needs to be addressed ASAP.

Not sure which it is but this just happened to me yesterday 9/14/2020. Was going to contact support but started searching the forums first. I may just leave the dependents at zero if the employee approves so that they don’t get hammered in taxes later- until this gets resolved.

I appreciate you for performing the initial steps to help resolve this, @Nevarc76.

It's good to hear that the program is calculating your new employee's federal tax after changing their dependents to zero.

We always want to make sure we're compliant with the federal rules and regulations. Per the IRS, taxpayers can no longer claim personal or dependency exemptions. Yes, it's possibly correct based on your first question above. For more information, go to Page 2 through this link: Publication 15 (Circular E), Employer's Tax Guide. Then, locate the "Redesigned Form W-4 for 2020" section.

I'd still suggest consulting your accountant or tax advisor for further guidance about your employee's withholding.

For your second concern, we want to ensure that the product is deducting payroll taxes accurately. Thus, you can check out our guide to learn more about how QuickBooks calculates them.

Also, I recommend visiting this website: Federal W-4. It contains more details about the new changes to the form and how to enter and print it for your employees.

In case you need to manage your payroll and keep track of employee expenses, run and customize reports in the program. Just go to Reports from the top menu and select Employees and Payroll.

Feel free to drop a comment below if you need anything else. The Community and I will be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here