Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI added additional withholding to an employee's payroll of 10.00 each week. How do I tell if it is doing it? I am thinking not as I can look back at previous stubs from the year before and it looks the same. Is it supposed to list it in the employee summary when I look at a check?

Hello there, brentsandsons.

Thank you for posting in the Community. I'm here to help provide additional clarification about the Federal Withholding calculation in QuickBooks.

Can you share with me how you add the additional federal withholding on a paycheck? Did you create a separate item or just adding amount into an existing Federal Withholding? Any additional information will ensure a timely solution.

In case you need the steps on how to add extra withholding on an employee's paycheck, you can follow these steps:

The extra withholding amount will add to the existing Federal Withholding item. You can run the Payroll Detail Review report to check the amounts per employee.

Here's how:

I'm adding this article for more information about how to add extra withholding:

Change employee payroll information.

Please know I'm always available here to help you with any of your QuickBooks needs. Just let me know by posting a response.

You want to use a Paycheck Calculator from the web, or Pub 15, to see what the Tax Table tells you would have been withheld for the employee based on their W4. Then, your QB paycheck should be about $10 higher. That's what you are asking.

Hello, I did it in the extra withholding field

Hello, I used a calculator like you suggested to check it. It came out the same. I was just wanting to make sure it was doing it correctly. Thank you for your suggestion.

Glad to hear again from you, @brentsandsons.

I’m delighted to hear you’re able to accurately and successfully add an extra withholding to your employee’s paycheck. With the right tools, any business owner can make payroll processing faster and easier, which your review perfectly illustrates.

Our Community articles have tips on how to set up all the program’s features and services, so be sure to check them out in your spare time: Help articles for QuickBooks Desktop Payroll.

Feel free to leave a post or comment below if you have other questions about managing your employee’s payroll. I’m always here to help.

HELP!

It appears you actually work for Quickbooks and I need help.

I have invested 4+ hours into trying to find the place to enter the additional tax withholding in Quickbooks Online Payroll for internet on a Mac. Where does one find this in my version?

Is there a way to contact an employee who provides customer service help? These community forums are nice, but professional help from someone who actually works for the company would save so much time.

How do I enter the additional federal withholding?

Hi there, @edasas.

I appreciate you joining this conversation.

The steps that were provided above is for QuickBooks Desktop (QBDT). To enter an additional tax withholding in Quickbooks Online Payroll (QBOP), here's how:

1. Go to the Workers menu at the left pane, then Employees.

2. Select the employee's name, then click the Pencil icon beside Pay on the Employee Details section.

3. Choose the Pencil icon again under the question What are (employee's name) withholdings?

4. Enter the additional tax withholding amount on the 5. Additional amount, if any, you want withheld from each paycheck field.

5. Hit Done.

For additional information, please refer to this article: Form W4 overview.

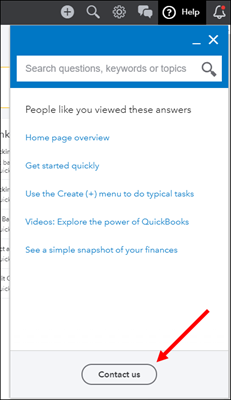

On the other hand, if you still wish to speak with our Phone Support team, here's how to reach them:

1. Click the Help (question mark) icon at the upper right.

2. Select Contact Us at the bottom to connect with a live agent.

That should get you pointed in the right direction. Please let me know how the call goes or if you need anything else by leaving a comment. I'll be happy to help. Take care and have a good one.

Thanks for the help!

I have hit the help button many times. Never had an agent open my chat. Not in the 5 minutes posted nor the next hour.

A link to this community instead of a help button would be better!

Thanks again!

Thanks for getting back to me, edasas.

I'm happy to know that I was able to help you enter an additional tax withholding in QuickBooks Online Payroll (QBOP).

You can always check out the article I've shared above for future reference.

For tips and other resources, I recommend visiting our website for further guidance: Self-help articles.

Please let me know if you have any other issues or concerns, and I'll get back to you as soon as possible. Have a great rest of the day!

Please help added additional withholding to my employees payroll set up and not only did it not take extra it took less??!!

Welcome to the Community, @WTC. Thanks for joining the thread.

I'm happy to help you out with your withholding issues. To ensure we get you back to business in no time, I recommend reaching out to our QuickBooks Online Support Team. It's super easy and only takes a moment. Check it out:

That's it! Please touch base with us here if there's anything else you need, I'm determined to ensure your success. Thank you for bringing us your questions!

I have done all the things listed in order to set up an employee to have an additional $10 taken out each pay check but when I "run payroll" it doesn't work, it doesn't take out the extra $10. I can go back into the employees profit and look and see that the $10 amount has in fact been saved, but as I said, it isn't working as it should

Hello there, Sommersetangela.

All federal taxes you entered in the employee's W-4 will post on the Employee Taxes section under the Federal Income Tax (FIT) field. If you want to see how it works and is calculated, you can edit the Extra withholding amount to $11 for example. Then, save it and create a dummy paycheck to see the difference in the employee's FIT withholding.

If it's not being added still, the issue can be browser-related. There are times that the browser is full of stored cache files, thus causing websites, like QuickBooks Online not to perform well.

You can try logging into your QBO account using a private browser. To use a private browser, here's how:

Then, create a paycheck to see if the extra withholding is being calculated. If this works, it means that you need to clear your browser's cache so the system can start fresh. If you get the same result while using a private browser, I recommend switching to a different browser.

Feel free to use this article on what’s changing with the Federal W-4?.

Keep me posted on how this works. I'll be around to help. Take care!

Can you do a percentage? My employee would like 10% additional held from each paycheck but I am unsure how to make that happen.

I am delighted to have you here, @Dore.

You can add the additional 10% held in your employee's deduction. Just enter the 10% in the Company contribution column. Let me guide you how:

Once done, the additional 10% held will show in the Employee details. When it's time to run payroll the additional 10% held will show on the paychecks for that specific employee.

For more details on how to process paychecks in QuickBooks, see this article: Create paychecks in online payroll. It also contains links on how to print paychecks and payroll taxes.

I've also included an article that will help you track your company's payroll and employee expenses: Run payroll reports.

I'm just a post away if you have other questions or concerns. I'm always here to lend a hand. Thanks for posting and I wish you have a lovely day ahead, @Dore.

I have an employee who wishes to have an additional $50 federal withholding biweekly using the 2020 or later W-4. I put it in under extra withholding in the payroll taxes and it's not being withheld. He makes 1015.38/pay period, claims single, has no extra contributions. When I run payroll his federal w/h tax is 104.00, but when I use the payroll calculator from my accountant it comes up that it should be 143.86. How can I fix this?

Thanks for joining the thread, @WellsBookkeeper.

I want to make sure this is taken care of, and I'd like to route you to the best support group available to get this addressed right away.

The process requires collecting personal information which I’m unable to perform in a public space like the Community. For security reasons, I recommend contacting our Payroll Support Team. They can perform a screen-sharing session with you, trace where the problem is coming from and provide a fix.

To reach them:

Here's an article for more details: Contact QuickBooks Desktop support.

You can also read through these articles for more detailed information:

For future reference, you can bookmark these guides. They provide an overview of why payroll items/taxes are calculating incorrectly.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Can this be done in QBD? (Using percentage instead of amount?)

Can this (using percentage rather than dollar amount) be done in Desktop?

Hey there, @cpagal11.

Thanks for jumping in on this thread.

When reviewing my test account and the guide listed below, you can only enter a dollar amount with QuickBooks Desktop. I'll make sure to past your feedback along to our Product Developers so they can consider adding this in the near future.

Set up and manage company contributions

If you have any other questions, don't hesitate to ask. I'm only a comment away. Take care!

I have entered an extra $ 75.00 federal withholding, but this amount is not deducted. Please help

I entered extra$75.00 federal withholding but this extra amount not been deducted, please help

Hello there, gabe4evergreen. It’s possible that the extra $75.00 federal withholding was not deducted because the employee might be marked as tax exempt, or there could be other payroll setup issues.

To resolve this:

Feel free to reply below if you have further questions or need clarification.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here