Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI ran Q1 2023 (941) reports in April.

I updated in to Quickbooks Desktop 2023 in May

I cannot run Q2 2023 (941) reports in July

This is the beginning of the message I get:

Warning

Have you downloaded the latest payroll tax forms?

You are about to create a tax form for the 2023 tax year, but the from currently installed in QuickBooks Desktop is for the 2022 Tax year.....

Welcome to the Community! We understand that experiencing runtime errors may affect your payroll activities in QuickBooks Desktop. The Community is always here to help you rectify your issue, LB200.

The payroll tax tables give the most recent, accurate rates and computations for federal and supported state taxes, as well as payroll tax forms. Please ensure you have the latest payroll update in your QuickBooks Desktop (QBDT). The latest Payroll Update is 22312, which was released on June 15, 2023.

You can get the newest tax table in QuickBooks Payroll to stay compliant with paycheck calculations by going to the Employees menu, then selecting Get Payroll Updates.

Moving forward, you might see some errors when you update the payroll tax table. Visit this link for guidance on how to troubleshoot them.

Moreover, paying your federal taxes and filing the relevant payroll forms on time is essential throughout the year. You'll want to pay and file your 941 taxes and forms electronically with QBDT.

Please come back if you have any other payroll-related queries, LB200. You can always reach out to us any time by clicking the Reply button below or posting to our forum again. Enjoy a successful year with QuickBooks!

A lot of people are getting this error message even after doing every update out there, including resetting the updates. I believe it is a known issue with Quickbooks and I am not sure why Quickbooks keeps responding with the boilerplate "how to update payroll in Quickbooks" without really understanding the question and looking at other posts that people have posted. There is a lot of frustrated preparers.

I personally have been getting this error message on all versions of QBDT but when the form prints it shows 2023 so I have just been ignoring it so I can meet my deadline. I do not use the efile feature in Quickbooks so I do not know if there are issues with that.

It's nice to hear that you are having the same as I have seen. I also am ignoring it and filing the 941 form as I have in the past. I just wish Intuit Quick books 2023 IT(backend) would just fix these errors so we would not have to mess around wondering if everything is working right. I feel all Quick Books wants is everyone to go with the online version which is so messed up!!

Totally agree with you.

So, I ran updates MANY times but there seemed to be an issue with actually installing the update. Message as follows:

Warning: QuickBooks could not update the component because one or more of the files are in use. Please close all application that are currently running on your computer, restart Quickbooks, and try again.

If you continue to get this message, restart your computer and try again. For information about which files QuickBooks is trying to use, open an review the qbwin.log.

Also a message that read: [PS077] QuicBooks is having trouble installing your payroll update. Note the message number at the beginning of this message, and click Help for troubleshooting tips to resolve this problem.

I closed absolutely everything and restarted QuickBooks MULTIPLE times, this did not solve the problem. Finally, I restarted the computer which then seemed to solve the problem after all...at least for now!

Usually updates and upgrades are very easy and seamless. This one was a little stressful with pending deadlines, end of the month and end of the quarter...

I have the same issues but still using QB 21. Have tried updating multiple times with no change. Finally decided to just try e-filing the forms today and hope they go through without issue. I also noticed that they do have the right year in the top corner so not sure what is causing the error exactly, but agree that QB support should look into this further since the issue is something other than users not installing the latest update.

Update - I still get the error in 2021 and 2022 versions. But not in 2023.

Hmmm... wonder if this is an attempt to force us to upgrade....

I had the same thought

Hello, everyone. We understand that having a seamless experience is crucial for our users, and we appreciate your patience as we work on getting updates on your payroll tax activities.

As shared by my colleague above, updating your payroll tax tables will help us ensure you've got the recent updates for federal and state taxes, rates, computations, and payroll tax forms. Thus, to enable us to rectify this issue, you'll want to consider updating your QuickBooks Desktop to its latest release. Doing so will allow your desktop program to automatically download and installs the latest features and updates. You can also perform fixes to your tax tables if you've encountered errors when updating them.

However, if the error persists, I suggest contacting our Customer Care Team. They have the necessary tools to review your account, conduct further research, and may create an investigation ticket if need be.

Here's how to reach them:

Furthermore, I'm sharing this helpful resource that you may utilize when filing and paying your payroll forms and taxes electronically: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

I appreciate your understanding as we move toward a resolution. If anything comes up in the meantime, please get back to us in this thread. We're always available to provide additional assistance. Keep safe.

I have the latest payroll update 22312 in my 2023 QBs Desktop version and I am still receiving that error!

So I really hope you read this at least twice. You instructions are NOT helpful.

1-Payroll update to current 2023 as of Jun 2023. (Please don't ask if I have updated.)

2-I am still able to e-file/mail my 941 forms for 2023 but tired of the warning every time I open my 941 form!!

3-This is not the customer's doing anything wrong!! It's QB's desktop IT department that needs to fix this.

4-No I am not going to call tech support---my time is valuable and I wish QB's Intuit would treat me that way!

5-The Warning we are getting: "You are about to create a tax form for the 2023 tax year, but the form currently installed in QuickBooks Desktop is for the 2022 tax year."-There is more but just know that this warning is NOT correct and Intuit should fix this mess.

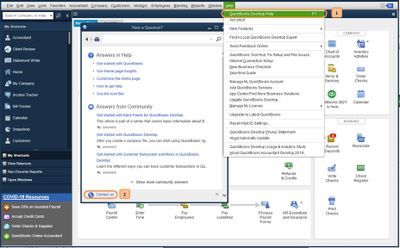

PLEASE review attachment. Please do NOT reply less you really know how to fix this for all of us.

Thanks-Kerry--Just help only

We understand this isn't an easy process for you, and we appreciate your efforts in trying to fix this, PPP report.

Currently, we received similar reports from other users affected by this issue. While I understand how precious your time is in managing your business, I recommend contacting our Payroll Support team directly. This allows them to provide you with the most up-to-date information and assist you further in navigating through this matter. Reminder: Please note the hours of operation for QuickBooks Desktop Payroll to ensure agents are available for assistance.

Here's how:

Moving forward, ensure that your payroll tax table is always up-to-date. This helps you to stay compliant with your payroll computations.

Here are a couple of guides you can check to learn more about Form 941:

We appreciate your patience and understanding while we're working on this for you. Just notify us if you need more help with generating payroll forms. We're always here to help.

I am getting this message in 2023 after updating multiple times. However, I have found that if I run the 941 for reporting agents it lets me run it.

You are correct! The Reporting Agent option works great! Thank you!

There has been issues with the Payroll/Employees areas of Quickbooks since late May/early June. This also includes trying to do reports relating to employees. There was an update a week or 2 ago that helped a little. But it was not fixed. The update this week seems to have made things worse again. I have been trying to enter payroll today for 2 hours! The program is extremely slow and seems to lock up...but if you wait long enough, it finally comes back. There are other posts about this in this community forum as well. Don't let QB fool you into thinking there is something wrong with your computer or database. It is a programming error on their end and we all will suffer until they fix it.

I too believe this is is a known issue with Quickbooks and am tired of the incompetent, boilerplate responses like "how to update payroll in Quickbooks". .

Response to: "I feel all Quick Books wants is everyone to go with the online version which is so messed up!!"

I live in Alaska and all of my clients also live in remote Alaska where Quickbooks online is not a viable option. Although internet access has improved in remote "bush" villages it is still not reliable.

Please fix the payroll forms update!!!!!!!!!!!!!!!

Hello all...frustrated customers like me and Quickbooks IT,

I spent 4 hours today...and QB charged me $599.99 to fix the payroll problem with forms being 2022 and I can't get the 2023 forms to complete payroll forms for 2023 (i.e., 940, W-2, W-3, etc.). They took control of my computer and did not resolve ANYTHING!!! I am soooo frustrated. QB has worked great for years and years and years...and payroll was seamless...for years and years and years. And this year, what a nightmare! Considering other options. But I sure want my $$$ back since they did nothing but waste my time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here