Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowThe federal withholding taxes are not calculating for some of our employees. They are all using the 2020 W-4 form. I have entered the information off that correctly. Please do not suggest the following as none of that applies.

"These are the possible causes that may affect the tax calculation on your employees' paycheck:"

I looked at posts from a year ago and it does not look like a solution to this problem has been found. Can you please help? Thank you.

Hello, Elise.

Thanks for taking the time to scour our Community space for potential solutions. If you haven't encountered this yet, this solution will prove useful in resolving the federal tax calculation issues.

QuickBooks calculates the federal withholding taxes based on the following elements:

You'll want to check how your employees are set up and ensure their payroll tax settings are entered correctly. Here's how:

This article can also give you important pointers about the tax calculations in QuickBooks Desktop: How QuickBooks calculates payroll taxes.

More troubleshooting steps can be found here: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly.

Need to see your employees' year-to-date data and other payroll details? You can run a payroll liability report to get started. This article can provide more details about the report and how to run it: Run payroll liability balances report.

Do you have more questions about your employees? Ask away and I'll help you out. If you have questions about managing your company in QuickBooks, add them to your reply.

This is not a solution. I have checked and rechecked and everything is entered correctly as I said in my original post. After reading through countless posts it does seem like this is a QB glitch and I have seen no resolutions. When is this issue going to be resolved?

I can see the urgency of getting this resolved, @Elise-K.

Since you've done all the recommended troubleshooting steps but the issue persists, I recommend contacting our Technical Team. They have the tools to pull up your account to investigate the cause more closely and find another solution to fix the problem.

To reach them, here's how:

You can also check out this link for more information on how to contact them: Contact QuickBooks Desktop support. Ensure to review their support hours, so you'll know when agents are available.

Please let me know if you have other concerns. I'm just around to help. Have a great day.

I had the same problem and did the latest update, etc and it did not help. So I contacted QB support and got a call back. This tech very helpful and had me download the IRS calculator excel worksheet: https://www.irs.gov/businesses/small-businesses-self-employed/income-tax-withholding-assistant-for-e...

Using that sheet shows that it is the 2020 W4 Filing Status that is the issue. Putting in my employees gross wages for 2020 W4, federal withholding showed 0. When I change the W4 version to Before 2020, the withholding is $69. So Quickbooks is not the issue--it is this 2020 W4. I asked if I could change my employee to prior 2020 W4 and the answer is no. That field is greyed out once it is selected and you cannot change them to Prior 2020 once you set up a new employee for that. I am going to suggest to my employee she review her tax situation and if she wants to, we can set up a set amount to be deducted for federal tax withholding each pay period.

I just switched to quick books desktop and was having this problem. As it turns out I had my payroll schedule set to annual instead of biweekly. Not sure if that helps but another place to check!

Elise,

I am in this same desperate situation. Been on phone with QB support for hours, no resolution. Did you ever figure out what to do to get federal withholding to calculate correctly?

We are having the same issue. One of my employees owes over $800 due to QB not calculating this correctly. The issue is inside of QB and how they set up the 2020 W4 in their system. Has anyone found a correction or are we stuck with manually figuring it and using the "extra withholding" option (Step 4 C) on the W4?

Welcome to this thread, northcobooks.

First of all, you'll want to review this article about important pointers about the tax calculations in QuickBooks Desktop: How QuickBooks calculates payroll taxes.

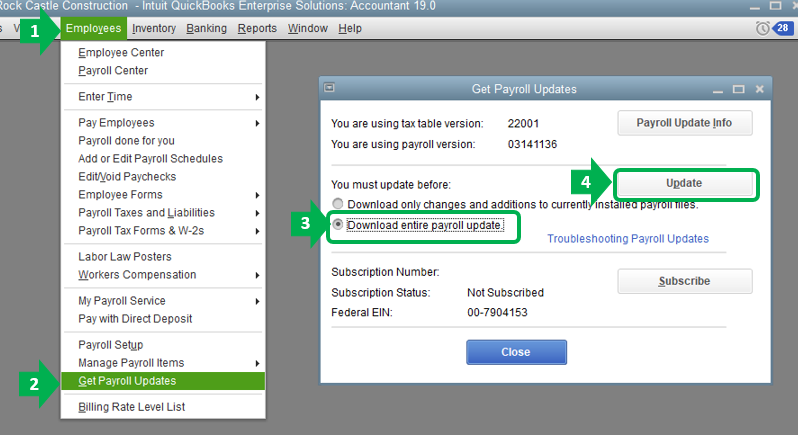

In case you haven't updated your payroll to the latest release, I recommend doing so. This is often used to fix payroll issues and downloads the most current tax rates and calculations in your account.

Here's how:

Here's an article that provides a list of common payroll errors and how to fix it: How to fix common Payroll errors in QuickBooks.

You may find the following articles helpful. It provides an overview in case payroll items/taxes are calculating incorrectly:

Let me know in the comment section if you have other payroll questions or concerns. I’ll get back to answer them for you. Have a good one.

NULL

Is this "solution" a joke? "Just run an update!" If the answer was that simple would this still be an issue for some people? My taxes weren't calculated correctly for an entire year, not just because of some recent update. Not to mention NO ONE else in the company was affected so it just being a simple update seems unlikely. (Oh and for fun we did one anyway and it didn't help. How strange!) Now I owe the IRS $800 because your terrible product screwed me. I fully admit that some of this is on me for not catching it until tax time but I feel like we should be able to trust QB to be correct considering how much we have to pay for it.

Your product is awful and your customer service is worse. Maybe I should talk to a lawyer about a potential lawsuit to try to recoup what I owe due to your mistake. I bet I could find some people on these message boards who would want to make it into a class action deal too. Should be fun for everyone involved.

I'm not even the type of person to complain about most things but when you make mistakes that affect my family's financial status, all bets are off.

Oh and I'd call for support but I don't feel like talking to multiple people today for three hours to get nothing accomplished. Also weird how it took me four times to post this message because it kept "failing authentication."

Maybe I should run another update?

Did anyone from Quickbooks contact you yet? I have some very angry employees calling me to say that when they went to file their taxes this week their accountants told them that not enough federal taxes were taken out even though they had 0 deductions on their W4's. They all have to pay instead of receiving refunds. I told them I set up everything properly in the system and that it is a Quickbooks glitch. Help!

I'm in the same boat. Did you receive any more information?

What did you tell your employee who owes the $800? I apologized to my employee who was expected a big refund and instead owed money but he is threatening to sue. I feel really badly but I feel it is quickbook's fault and not ours.

I have this issue with one of my clients. They have one employee and he had to pay $2400. for his 2021 taxes. Then I spent 2 hours on phone today with Intuit Accountant payroll and they didn't resolve crap! I got stupid suggestions and such which tells me that the customer service for the QBO payroll do not know anything about payroll or payroll taxes! I have been a bookkeeper for 30 years and never seen such a mess. FIX the issue Intuit!!! Already this year the same employee has grossed over $5000 and has only had $10.67 pulled for Fed Withholding tax!!

We have the same problem, and it is QuickBooks' error in how they calculate payroll taxes. One employee now owes another $2500 that should have been withheld from their paycheck.

The employee is paid bi-weekly, and sales commissions are paid twice a month on a separate check.

The way QB calculates the taxes is by looking at only the one check, and the stated frequency of pay. So each check's FIT withheld is based on 1/26th of the annual tax bracket for withholding. (I used to setup the brackets in our payroll system decades ago).

This seems fine unless the paychecks vary significantly. And in our case, there are extra checks for commission.

QBO even has a separate button selection for Commission only paychecks, so they do acknowledge that this practice exists. They just don't know how to do the math to calculate FIT correctly.

ALSO, trying to back into the FIT QB calculated, they may be ignoring overtime, too.

There is no solution from Intuit, until they decide to change the math formula to look at YTD Total Gross Wages for each paycheck.

Is there a good way to fix this issue? I have an employee who isn't having Federal Taxes taken out of his paycheck. I can't see where anything is entered differently for him than any of the other employees! If you are able a step-by-step for a non-accountant would be amazing!!

Thank you for joining in on the thread, Kiirsi.

I will definitely provide the steps so that you can easily follow them. But first, let’s check to find out why your employee’s paycheck doesn’t calculate Federal taxes.

Federal Taxes will not calculate if your employee’s pay is too low or has many dependents. Another reason is when you're creating another payroll even if he has a pending and unsaved paycheck. Try to increase the gross pay by entering a larger rate or worked hours. However, if the same thing happens, check if the employee has a pending paycheck and revert it so that the taxes will calculate.

If you like to see some references for QuickBooks Desktop Payroll, just visit the main support page, scroll down a bit, and click More topics.

Please feel free to share an update after following the steps above. We're just right here to continue to assist you if you have other concerns. Take care always!

I know this is a little old, but I have something of value to input. We've noticed that employees using the 2020 or later W-4 do not have federal taxes withheld until some threshhold is met. We've had a few employees that have a couple children and start in the last quarter of the year have zero federal taxes withheld their first years and have similar underpayment issues come tax time.

2 of my employees have only had $1 taken out for federal this year. They don't make a lot to begin with and this is totally messed up.

I think Quickbooks needs to make it possible to switch back to the older version of the W4 because this new one is NOT WORKING the way it should. It is screwing people over and it needs fixed.

I believe that QB Desktop calculates correctly.

The problem is specifically in QUICKBOOKS ONLINE PAYROLL!!

Since they have a bottomless chasm between QBD and QBO, the developers in QBO don't take advantage of the experience built up in desktop. I think a class-action suit might get their attention.

And for the people asking for the 2019 W-4 to be reinstated, that won't work either.

Part of the problem is a change in tax withholding several years ago. The Feds reduced withholding, and everyone was happy to get more money in their paycheck! Now they are unhappy that their refund is gone.

Something about having cake and eating it...

Are the QBO Support Team really this clueless?

Or just pretending?

Over the past couple of months, I have had a few employees question the low amount of FIT withheld from their paychecks. In response, I have double checked my entries into their employee records, and everything was entered correctly per their W-4 form, all of which were 2020 and later. This morning I was preparing my personal tax return and noticed that the FIT withheld is indeed significantly lower than it had been in previous years, although I opt for an additional $50 deducted with each payroll. I think the post which mentioned the Feds lowering taxes since the Pandemic and you can't "have your cake and eat it too" is accurate; however someone also posted that the download from the IRS website showed that insufficient taxes were being calculated within the QB product, so maybe it's a mixture of the two. I spoke with our staff this morning and mentioned to them that they may want to consider completing an updated W-4 to have additional Federal Tax withheld. I think that is the only solution at this moment for the 2022 year. Thank you to everyone in the 'Community' who has written about this issue. I have found all the posts to be informative. I do agree that too often QB seems to have somewhat 'canned' responses, though, and specific points being brought to their attention are simply glazed over and not addressed at all, to everyone's frustration.

Been dealing with same issue. One of my employee's brought it to my attention that his federal income tax not being withheld. Now QB wants me to go back and find the correct tax on the affected payroll and make a excel report to send to them so they can correct it and have 3 days to do it, awesome customer service (wrong).

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here