Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow to set up form 941 for efile

Solved! Go to Solution.

Good day, @dg11,

I'm here for some clarifications about the 94X form.

The 94X stated in this thread refers to 941, 940, and 940 forms. QuickBooks generates these forms for you so you can file them to the IRS.

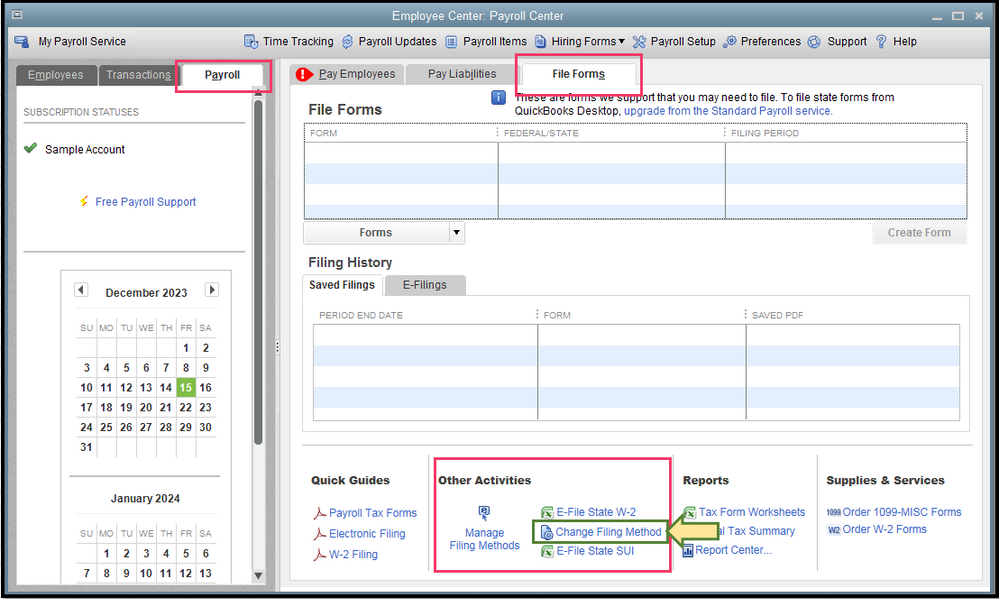

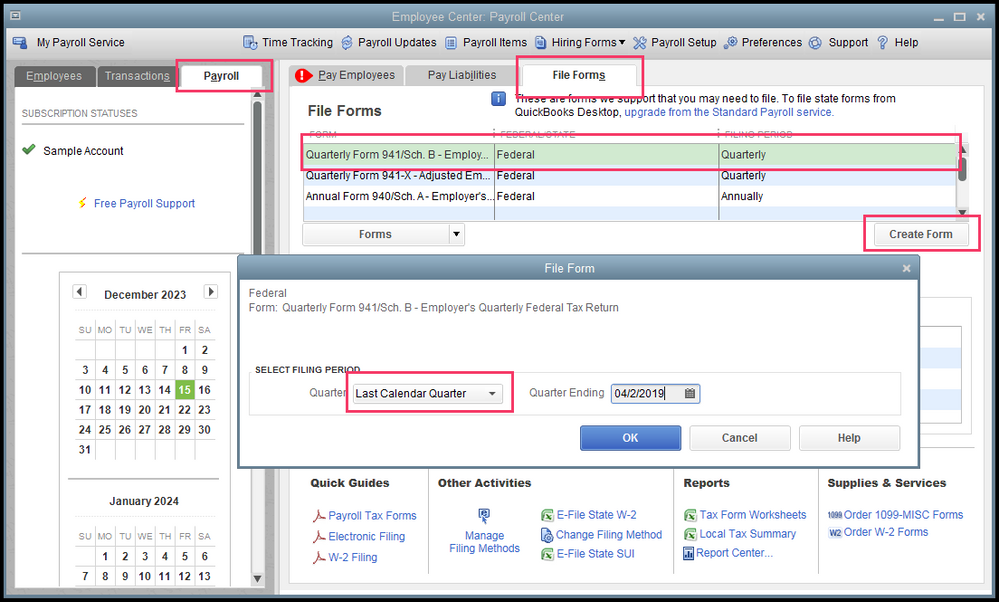

Let me guide you through on how to set up 941 for e-filing:

Once done, here's how to e-file the form:

To learn more about e-filing in QuickBooks Desktop, check out to this link: E-file 940, 941, and 944 tax forms.

I also recommend downloading the latest tax table update every time you pay your employees, or at least every 45 days. This is to ensure your payroll has accurate information.

Keep me posted if there's anything I can help you with filing your returns. I'm always here whenever you need help.

Welcome, @Vwindle and thank you for coming to the QuickBooks Community for assistance. I have some insight on filing your 941 to pass along.

When you submit your Form 940/941/944 (Form 94X) enrollment information, the following occurs:

For more information on filing your 941 and other tax forms, click here.

Please remember, I'm always here for any other questions or concerns.

@SterlingD wrote:Welcome, @Vwindle and thank you for coming to the QuickBooks Community for assistance. I have some insight on filing your 941 to pass along.

When you submit your Form 940/941/944 (Form 94X) enrollment information, the following occurs:

- You send the enrollment information electronically.

- The secure filing system forwards the information to the IRS agency.

- The filing system sends you an e-mail that indicates the IRS has received your e-file enrollment request.

- The IRS will verify that your EIN, legal name, and the officer or employee of the company's contact information match their records.

- If everything matches, the agency sends a unique 10-digit PIN through to your company legal address. You'll need your PIN every time you submit Form 94X. Store the PIN in a secure place.

NOTE: It can take up to 45 days to receive your 10-digit PIN in the mail from the IRS. If you have not received your 10-digit PIN after the 45-day timeframe has elapsed, you can check with the IRS at [removed].- Please be sure you sign and return the PIN acknowledgment to the agency in a timely manner. If they do not receive it, your PIN may be disabled.

- If your enrollment is not accepted by the agency, you will be notified via mail by the IRS and provided with information on how to correct the enrollment. You may re-enroll.

For more information on filing your 941 and other tax forms, click here.

Please remember, I'm always here for any other questions or concerns.

@Vwindle wrote:How to set up form 941 for efile Get 94X form

Good day, @dg11,

I'm here for some clarifications about the 94X form.

The 94X stated in this thread refers to 941, 940, and 940 forms. QuickBooks generates these forms for you so you can file them to the IRS.

Let me guide you through on how to set up 941 for e-filing:

Once done, here's how to e-file the form:

To learn more about e-filing in QuickBooks Desktop, check out to this link: E-file 940, 941, and 944 tax forms.

I also recommend downloading the latest tax table update every time you pay your employees, or at least every 45 days. This is to ensure your payroll has accurate information.

Keep me posted if there's anything I can help you with filing your returns. I'm always here whenever you need help.

Hello,

I applied for and received a PIN from the on-line electronic filing people. I failed to notice that I needed to confirm receipt of the PIN within 10 days, so according to the letter I received, my PIN has been dis-abled and I need to re-submit the application. I signed on to EFTPS and they say that the application should be made through the software, which is QuickBooks. I cannot find where, in QuickBooks, to re-apply for the PIN. When I did the initial application, there were clear instructions and a window for the application in QuickBooks but now I cannot find them anywhere.

Please help.

I applied for and received a PIN for online filing of 940 and 941 returns. I failed to notice that I needed to verify receipt of my PIN within 10 days of receiving it. According to the letter, my PIN has been disabled (It's been 2 months) and I need to re-apply. I signed on to the IRS website and it says that I should apply through my software, which is QuickBooks. When I originally applied, there was a window in QuickBooks that guided me through the application, but now I can't find it anywhere!

Please help!

Thank you for joining the thread, @mmarton. I’ll help you with resending your request to get a PIN for e-filing in QuickBooks Desktop (QBDT).

It’s essential to pay your taxes and submit the relevant payroll documents on time. Thus, e-filing makes this more convenient for businesses, to make sure they stay compliant with the IRS.

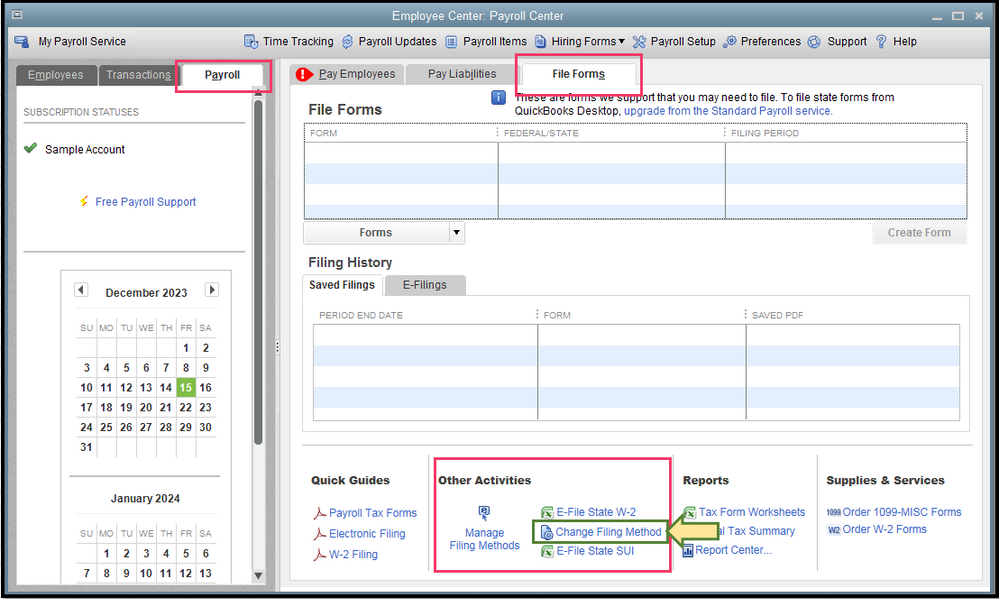

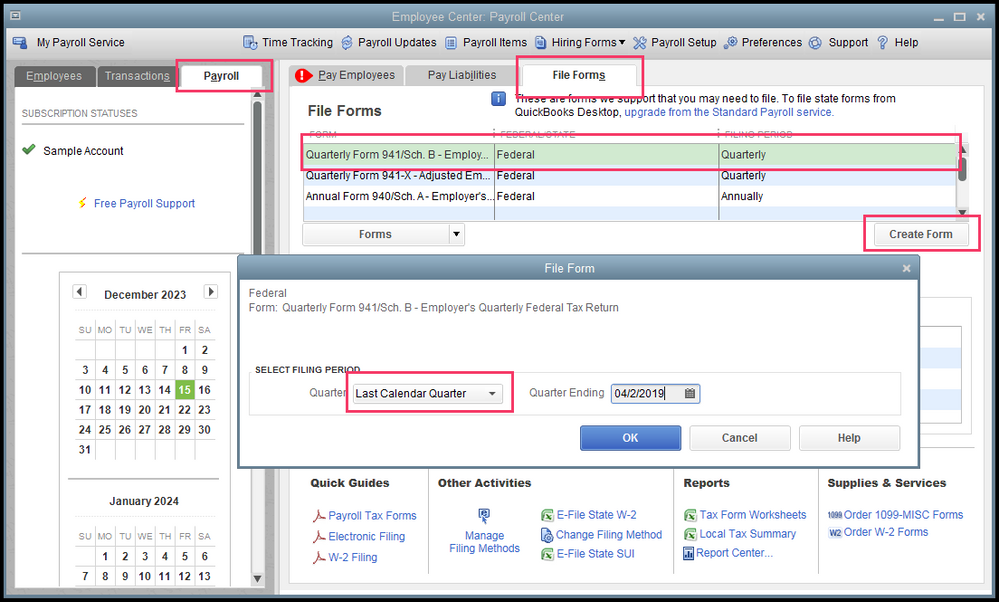

Here’s how you can set up your federal filing method:

Once you’re done with the steps provided above, kindly proceed with enrolling in the IRS e-file program. Detailed steps are outlined in the article under Enroll and set up e-file: Set up Federal e-file and e-pay in QuickBooks Desktop Payroll Enhanced.

In addition, to stay compliant with paycheck calculations, learn how to get the most recent payroll tax table in QuickBooks Desktop Payroll: Get the latest payroll tax table update.

Let me know if there’s anything else that I can do to help you with taxes. The Community always has your back. Have a great day!

Im having problems with e filing my 941 with QB online, it dont have the option for me to file electronically, only manually. Im stumped.

How do you attach a statement which was required on the 941 and then e-file through QBDT?

Hi

Your screen shots on QB is pretty good...but how does one get a 10 digit Pin from the IRS...Can QB apply or does an individual employer have to apply and if an individual employer has to apply :is there a link?

Hi

Your screen shots are good and very educative. But when one goes through the process, it asks for a ten digit pin....where does one get that? is there a link in thr IRS.gov, that one apply for and get the pin especially when filing 941 or 940 etc ?

[PII removed]

I appreciate you following up with us while trying to go through the process provided, @TexasCovers. Allow me to join the thread and share insights about the 10-digit PIN while activating e-filing services in QuickBooks Desktop (QBDT).

Yes, you have to input your 10-digit IRS Efile pin when you opt to file your forms electronically. Usually, it's given by the IRS after enrolling in our E-file service. If you haven't enrolled in the IRS e-file program yet, you can follow these steps:

Your enrollment will show Accepted when the agency receives your enrollment, and you’ll get a 10-digit e-file PIN by mail. If the application is rejected, you can resend your request.

However, if didn’t get a 10-digit e-file pin, contact IRS for further help. You may dial the number provided in this link under the Lost 10-digit E-file PIN/Rejected Enrollment section: Set up state e-file and e-pay in QuickBooks Desktop Payroll Enhanced. The same materials will give you detailed information about setting up for e-file and e-pay in QBDT Payroll.

After that, you're now ready to file your taxes electronically. If you decide to do it manually, see the resources from this article as your reference: Pay and file payroll taxes and forms manually in QuickBooks Desktop Payroll.

Please let me know if you have other questions while acquiring the 10-digit PIN while managing your taxes in QuickBooks. I'm always here to help. Have a good one!

I am already enrolled in EFTPS. How do I file 941 quarterly report once I have logged in?

Let me guide you in the right direction on how to file your 941 forms, HPH-12.

In QuickBooks Desktop (QBDT), you'll have to set up the filing method to E-file and enroll in the IRS e-file program to submit your payroll tax forms electronically. I'm here to ensure the process is a breeze for you.

Here's how:

After setting up the filing method, enroll your company in the e-file program. Here's how:

Once you have the 10-digit IRS Efile pin, you can send your payroll forms electronically in QBDT. For detailed instructions, head directly to Step 3 in this article: E-file and e-pay federal forms and taxes in QuickBooks Desktop Payroll Enhanced.

When you sign up for the EFTPS service, you'll have to wait 7 to 10 business days to get your PIN and enrollment number via mail. Enter the data into your EFTPS account as soon as you receive the 4-digit EFTPS PIN.

Here's how:

Next, configure your tax payments to e-pay. For the step-by-step process, proceed directly to Step 2 in this guide: Set up Federal e-file and e-pay in QuickBooks Desktop Payroll Enhanced.

I've included some links below that will guide you on how to handle the following payroll activities:

If you need further information on how to accomplish a specific task, feel free to browse the following link: Payroll Hub.

Keep me posted if you have other QuickBooks concerns or additional questions about filing and paying taxes. I'd be delighted to respond to them.

So if you haven't established your pin with IRS and you need to file a 941 in a timely manner do you attempt to send efile for quarter ending as well file your usual paper form?

So if you haven't established your pin with IRS and you need to file a 941 in a timely manner do you attempt to send efile for quarter ending as well file your usual paper form?

I can guide you through the process of filing your tax forms to the IRS, Bo Starnes. Let's get started and make your tax filing experience seamless and efficient.

Yes, if you haven't established your PIN with the IRS and need to file Form 941 (Employer's Quarterly Federal Tax Return) on time, you can file a paper Form 941 manually. Also, complete the form using the necessary information and mail it to the appropriate IRS address. Ensure that you include any required payment with your paper filing.

I've added these resources about how to estimate your quarterly taxes:

We understand the importance of accurate and timely tax filings, and we're confident that your submission meets all the requirements. If you have any further questions or need assistance with any other accounting tasks, please don't hesitate to reach out. Thank you for choosing QuickBooks Desktop, and we look forward to helping you with your financial needs in the future.

I need to have Quckbooks file the 94x form online or tell me how to do it. I have two clients that doesn't have the electronic 10 digit pen

I know how to file 941's and 940's but I need to get the 94x, 10 digit pen the employment signature pin

Greetings! We are grateful that you stopped by our Community forum, Penny. We are happy to help you with how your clients will obtain the 10-digit electronic pin.

To have the 10-digit pin, please ensure that your clients' was able to properly set up the filing method to E-file and enroll in the IRS e-file program to submit your payroll tax forms electronically in QuickBooks Desktop Payroll.

However, since the IRS provides the pin, I recommend reaching out to them for a PIN reset if they are considered lost: 1.800.555.4477. This way, you can talk with a representative and ask for E-file 10-digit PIN.

Moving forward, get the most updated payroll tax table to avoid disturbances while processing your E-file/E-pay in QuickBooks.

Moreover, visit this article to learn how to file payroll forms manually with the IRS and state agencies: Pay and file payroll taxes and forms manually in QuickBooks Desktop Pay.

If you have any more queries or worries regarding your payroll forms or other QuickBooks-related issues, please get in touch again. We are always willing to assist. Have a fantastic day, Penny!

What do I have to do with the IRS as a tax preparer to electronically file 941s and 940s for my clients.

Hi there. Thanks for joining the thread. I'd be glad to share some info about e-filing payroll taxes as a tax preparer.

If you e-file payroll tax on behalf of your clients in QuickBooks, you'll have to register with the IRS to become an Authorized e-file Provider.

Once you have successfully established yourself as a Reporting Agent and gained authorization for e-filing returns, you'll be able to prepare and submit Forms 941, 944, or 940 payroll tax forms directly from QuickBooks for your clients.

Here’s how you e-file your client’s federal tax returns with QuickBooks. You can also e-file their state tax forms in QuickBooks.

For additional reference, you can check out this article: E-file payroll tax forms for your clients.

If you have further questions or other QuickBooks concerns, please don't hesitate to reply in the comments below. We'll be around whenever you need help. Keep safe!

I have downloaded the most recent payroll updates and yet I continue to receive a message saying my 941 cannot be submitted until I download the most recent update. I continue to redownload the updates, but the form still will not be submitted. What am I to do?

I appreciate you downloading the most recent payroll updates to fix your 941 submission issues, cfdeloach.

Since you're still unable to submit your 941 forms, even after all the troubleshooting steps you've performed, I encourage you to contact our Payroll Care team. They can further investigate your submission issue and guide you with a fix in no time. Here's how:

After filing your Form 941, check its status to ensure the agency has accepted them. You may want to check out this article on how to do the process in QBDT Payroll: Check the status of your payroll tax payments or filings sent through QuickBooks Payroll.

Let me know if there's anything else you need in filing payroll tax forms. I'm always ready to help. Take care, and I wish you continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here