Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, rftltidwell.

There's a default payroll expense account if you're using QuickBooks Online Payroll. If you're doing payroll outside of the program, you can create an expense account in your Chart of Accounts. Here's how:

Also, this article will guide which accounts to use for the employer portion of Social Security and Medicare when recording your journal entries: Record Payroll Transactions Manually.

Leave a reply below if you have other questions.

The linked article is showing as deleted. Is there somewhere else I can see to determine where to place the employer paid portion of the taxes?

Great to see you here, @rb9876,

Thanks for joining the conversation. I want to make sure you're able to enter your employer paid taxes.

I've checked and verified that the link provided by my colleague is fully working. If you'd like to record payroll liabilities paid by your company, you can follow the steps below:

However, if you have a different situation, I'd recommend checking this article for further instructions: https://quickbooks.intuit.com/community/Help-Articles/Record-payroll-transactions-manually/td-p/1856...

Please let me know how it goes, @rb9876. You got me here to help whenever you needed me. Have a great day!

Today I paid for full payroll services and I need help to get payroll out tonight.

I had previously purchased payroll enhanced and now all of the employee information isn't there. Can I merge them or can you take over and do it?

Hello Aefs1,

Thank you for posting here in the Community. I'm here to assist you with any questions you may have with your subscription in QuickBooks Online.

Right now, merging two different QuickBooks Online subscriptions are unavailable. You may need to record the year-to-date payroll data into the account you're currently using in the system.

For more insights on adding prior payroll, I'm adding the article I recommend on this:

Please know you can also move your lists from another QuickBooks Online using CSV or Excel file format. In case you need the steps, I'm also adding the link down below:

Move your lists to QuickBooks Online.

As always, the Community is here if you have any additional questions related to your subscriptions. Wishing you a safe and wonderful weekend.

Good morning!

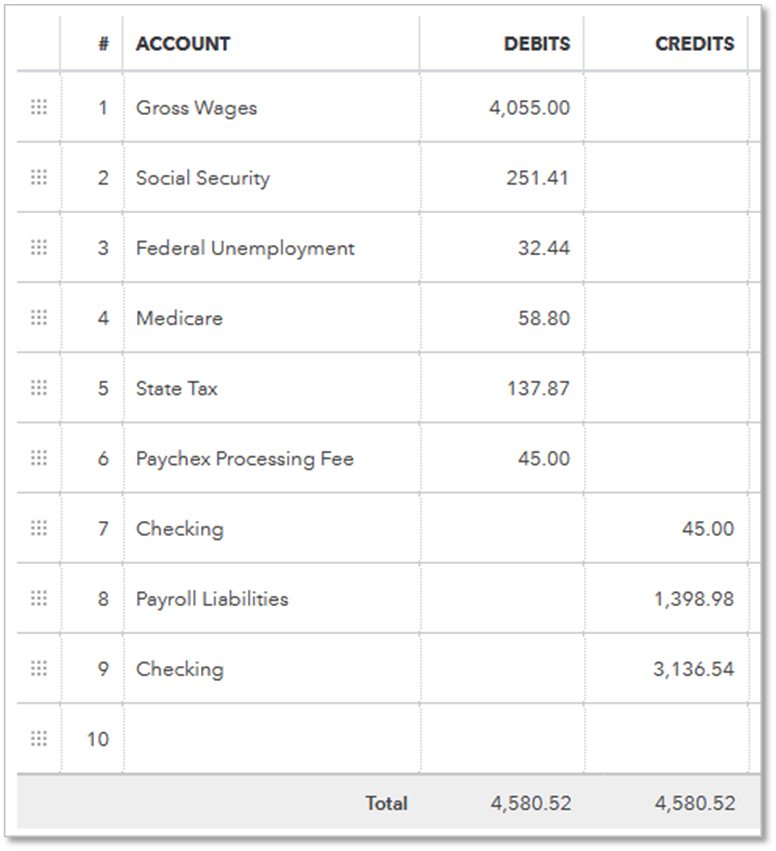

We also have our payroll processed by a third party vendor. The vendor does an ACH Debit from our checking account for the payroll processing fee, net payroll, and tax liabilities.

The vendor prepares the tax returns and pays the payroll tax liabilities. How would our process and journal entries differ from GarlynGay's?

I appreciate your assistance.

Kim

Hi, Kim.

Since the third party company is the one who processes everything, you can create a journal entry using an expense account. The steps of creating a journal entry for this type of situation is shown in scenario #1 in this article: https://quickbooks.intuit.com/community/Help-Articles/Record-payroll-transactions-manually/m-p/18563...

Please comment down below or post another question if you need anything else.

I'd like to answer your payroll questions, Kdhpmc2.

In your first question, the answer is yes. You'll have to create these accounts in the Chart of Accounts. Here's how:

Let's go to your second one. I suggest recording the payroll every week instead. This way, there wouldn't be any differences when reconciling the bank account.

If you have other questions, please reach out to us back again.

Hi, i have a question, so after you enter the payroll journal entry, is there a way to add the gross amounts for each particular job on this same journal entry, I have done it before but cant for the life of me remember how i did it, i do know however that it was done on the same journal entry. any help is greatly appreciated

Yes, you can @Kimmiekim.

When you select an employee or project under the Name column, as long as the transaction is linked to a project or employee, It will automatically include in the report.

I also recommend contacting an accountant. This way, you'll be guided accurately on how to record these works.

To help you understand more about how Journal Entry works, you can check this article for information: How to Use Journal Entries.

You can also check this link that can help guide you on how to record payroll transactions manually.

Also, check out our Employees and payroll taxes page to learn some tips on managing your Employees.

As always, in case you want to learn some "How do I" steps in QuickBooks Online. You can always visit our Help articles page for reference.

If you have any other concerns, please don't hesitate to leave a comment below. I'll be around to help.

Thanks for your response. Would it be ok to debit the gross amounts for each job instead of putting the gross in as a lump sum on the journal entry?

Good to see you here in the Community, @Kimmiekim.

I want to make sure you'll get the best help possible.

That's right, you can do it by debit the gross amounts for each project and you can do putting the gross in as a lump sum in recording on journal entry.

For more complex payroll transactions, I recommend contacting an accountant. This way, you'll be guided for recording your payroll transactions.

Based on this article Recording payroll transactions manually, you may use expense or liability account when creating a Journal Entry ( for payroll transactions).

Please take time to read the article above. It'll help you record the payroll transactions correctly.

I'd be glad to help if you have other questions about recording payroll transactions.

Hello,

I also use third party payroll and they handle the tax payment. After every paycheck, the payroll company pull out the amount for the wage and taxes from my bank account. They also provide the general posting report so I can import into quickbooks. However, after the data is imported, it does not reconcile with my bank balance because the tax amount still sit in quickbooks as liability. What should I do to clear off this amount? I understand that I need to enter the taxes under expense account instead of liability? I am very lost right now. I attached the journal entry so you can take a look. Please help!

Hi lily_ttran,

Thanks for the screenshot and providing more details on this. You'll need to pay the tax outside the system so you can record it as a prior tax history inside the program. Let me guide you how.

Once done, you can match and reconcile the transactions in QuickBooks.

Please check this article for more information about recording tax payments: Recording Prior Tax Payments.

I have included this link in case you have other questions about payroll. Payroll And Workers.

Keep in touch if you need anything else. I'll be here to help.

Hi Maria,

Thank you for responding to me. I'm sorry I didn't mention that I use Quickbooks desktop so can I still do the tax payment using your guide? I can't find the Taxes tab in Quickbooks desktop though. Can you please show me how? Besides, I don't know if this information is important but October 2019 is my first payroll. I am new to this so I am still figuring out how to do this correctly. Please let me know if you need me to clarify more. I appreciate your help. Thank you.

I appreciate the additional details, Lily.

I can help you on the reconciliation side. However, to account your imported tax payments, it would be best if you can consult your accountant. They are the best people who can give you advice on the accounting side of the transactions. Of course, they have to reflect in your bank account, so you can reconcile. Let us know if they have instructions you find challenging to do in QuickBooks.

Once your payments are already posted in your bank account, you can start with your reconciliation.

With our payroll, the accounting side is done automatically. I’m not saying you that you have to use it. I’m just letting you know that the posting of transactions, which we’re not allowed to give advice, is done in the background.

Lastly, aside from posting here or contacting our support, we have in-product articles that you can use as reference while exploring QuickBooks. Just press F1 to launch the Help window and search for the topic you like.

Let me know if you have other questions with your payroll entries. We'll be happy to lend you a hand.

Hi JessT,

Yes I wish I used your payroll, it would have been less of a headache now but it wasn't my decision to make. What if I have to enter the payroll manually, can you give me advice on how to do that? I have October payroll and November payroll, but my payroll provider only provided the IIF file for November payroll hence I have to input the October payroll data manually into Quickbooks. Please let me know. Thank you.

Hello there, @lily_ttran.

You can record the payroll for October manually to make your records accurate. The data you enter ensures correct year-to-date totals on the paychecks you write for the rest of the year.

To do these:

Here's are links that outline the entire procedure and provides some screenshots. I recommend checking these out:

You've got me here to provide further assistance if there's anything else you need. Just notify me by leaving a reply below. Have a lovely day!

I have an issue with employer paying half healthcare ins for employees , that I can't seem to recall the journal entry to make for it.

A third party does payroll and they include the co paid ins in gross wages, but what is the journal entry for the insurance payble for co portion if its included in gross already?

employee 1/2 ins portion is deducted from wages.

When health ins is paid (both ER and EE portions) what is the journal entry ?

Appreciate it.

Mike D.

I need to know how I can record full details for Employees first in the "Quickbooks online plus" then how I can record the Cash advance or deduct or any details need to add each one

Thanks for joining the thread, @9130351862285956. Let me make it up to you by addressing each of your concerns regarding setting up your employees in QuickBooks Online Plus.

Follow these steps to add your employees:

For more details on how your employees can add their info, refer to this article: Add a new employee to your payroll.

Once you're done setting up your employee, you can now set up a cash advance repayment deduction.

Also, you can check out this article for the detailed steps on how you can add/edit a deduction for your employees.

Once everything is set up, you can now proceed to run payroll for your employees: Process or run payroll.

I'll be here if you need further assistance with the process. Feel free to let me know in the comment section. Take care and have a great day!

kindly check the picture attached to clarify, I would like to know if this version QuickBooks Online Plus serves the registration of salaries fully of advance payments and discounts and Account end of service, etc.

thanks

Thanks for reaching back out, @9130351862285956.

For me to provide the best resolution, what do you mean by this statement "...serves the registration of salaries fully of advance payments and discounts and Account end of service, etc.?" Any additional information is appreciated.

If you need more resources, video tutorials, and tips to manage your company, feel free to visit our Support page. Just select QuickBooks Online in the Select a product section.

Don’t hesitate to tap the Reply button below for assistance. I’ll be here to help. Have a great day and always take care!

I meant the payroll option can't see in list as I mentioned in the previous post by attached photos, so I want to use the software for Payroll but not showing.

how can i do that .

thanks

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here