Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We'll need to make sure you've downloaded the latest payroll update, tjeswald.

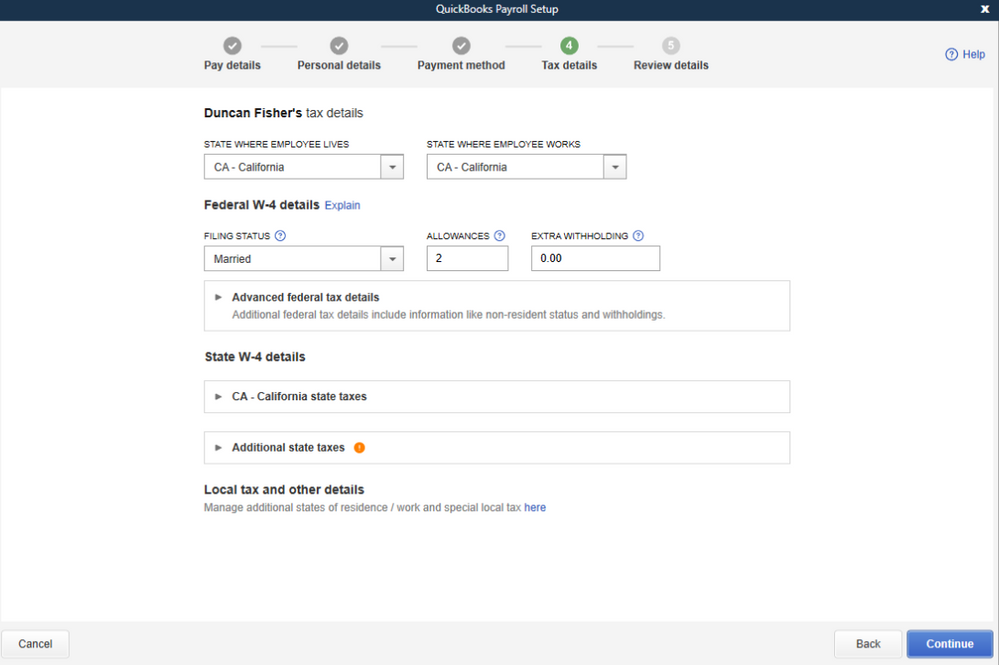

Then, let's enter the W-4 for 2020 information in QuickBooks Desktop. Let me show you how to do it:

You can also scan the W-4 form and attach it to the employee's profile. Simply click on the attachment icon and click on Scanner. Then, click on Done. By saving a copy of this form, you can have it stored in your company file.

We will gladly help you with any payroll questions. Please go ahead and post them here.

I guess I am confused. Where on the new form does it state number of allowances?

Good afternoon, @leannjack.

I'm here to help with information on the new W-4 form.

The “total number of allowances” section is now gone. Instead of calculating the number of allowances, which translates into a certain amount of tax withheld (the more allowances, the less money is withheld), the form features questions about your income and dependents. There is also a new optional “Step 4” section on the new form for other adjustments such as deductions for mortgages.

Thank you for reaching out to the Community, have a great day.

Thanks Josh! I figured out that I wasn't getting the drop down menu in my payroll updates. QB made it part of the maintenance update. So once I did that I could get the drop down menu.

Also, since I did the update I now can't have QB 2018 and QB 2019 open at the same time. I have had this problem since October with 2017 & 2018 and spent about 2 hours on the phone with tech support and they couldn't help. I have never heard back. Can you answer why this hasn't been fixed or what you suggest I do so that I can have more than 1 database open?

Good day, leannjack.

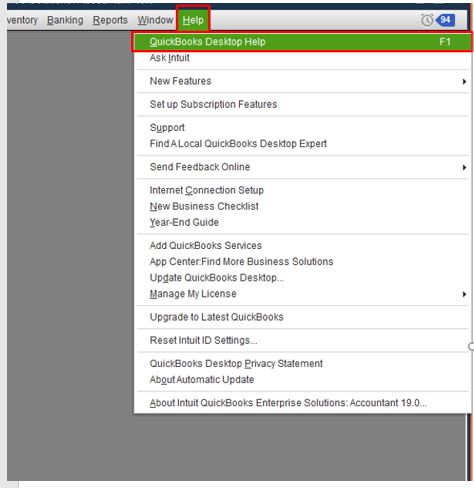

Running the QuickBooks Install Diagnostic tool is a good start when it comes to fixing program-related issues.

Here's how:

![]()

Once done, restart your computer and open your QuickBooks again. You can refer to this article to download the QuickBooks Tools Hub: Fix QuickBooks Desktop install errors.

In case you want to know some "How do I" steps in QuickBooks Desktop, you can always visit our Help Articles page for reference.

Let me know if you have other questions about this topic. I'll be here to provide further insights and help whenever you need one. Have a lovely week.

Thanks for providing us a screenshot. Let me provide a few information about claimed dependents, 494.

In the Claim Depends field, we need to enter the number of dependents you are subject to based on your W-4 information. There are two types of dependents, each subject to different rules:

For more details about Internal Revenue Services (IRS) rules for qualifying dependents, please check out this IRS article: https://www.irs.gov/publications/p501#en_US_2018_publink1000220868.

To learn more about claiming dependents, just refer to Whom May I Claim as a Dependent? article coming from your tax agency.

I've got a link here that contains articles about adding and managing your tax forms: https://quickbooks.intuit.com/learn-support/en-us/taxes/tax-forms/08?product=QuickBooks%20Desktop.

Fill me in if you need a hand with preparing and filing your payroll year-end forms or any QuickBooks related. I'm glad to help.

Can you provide a screen shoot, I am still confused.

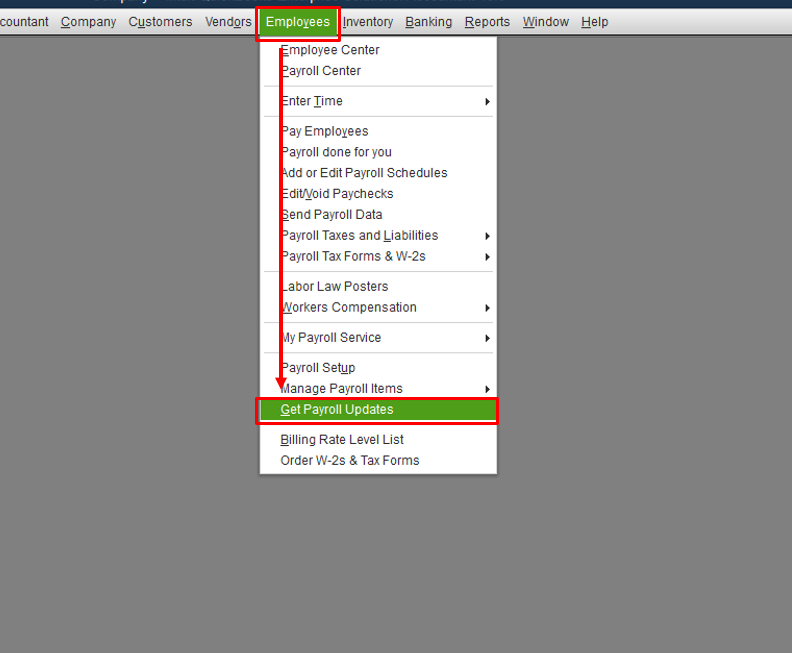

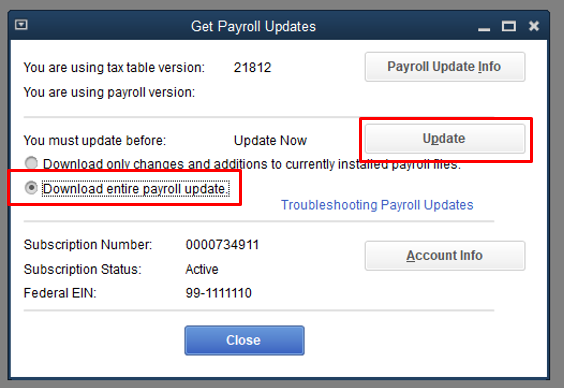

I got your back here, @Ringold. Let me walk through you on how to set up W4 for 2020. Though, we need to make sure we have updated payroll in QuickBooks Desktop.

Here's how:

For more details about the 2020 Form W-4, you can refer to this link: FAQs on the 2020 Form W-4

For additional guidance, you can check out these articles that will help:

Fill me in if you have any other questions about W-4 for 2020. I'll be around if you need any help. Have a great day!

A payroll update doesn't fix it. You have to do a maintenance update. Intuit was sneaky in putting in the maintenance update instead of the payroll update. Once you do the maintenance update, you can't have 2 QB years open. More corporate greed by Intuit!

This is exactly what mine looks like and I can’t find an answer either. Please update if you find an answer

Thanks for joining this conversation, @Sam70.

You're trying to input the new W-4 information for the employees, correct? If so, my colleague @GarlynGay shared the detailed steps above on how to do it in QuickBooks Desktop (QBDT).

However, if you're referring to something else, may I ask for some additional information (or a screenshot)? This will help me make sure that I can provide you with the best resolution for your concern.

You can click the Reply (green) button below to add some details.

I'll keep an eye on your response. Cheers!

Unfortunately you are not specific as to whether we are to enter the number of dependents or a dollar amount.

If # of dependents your explanation states that there are two types of dependents: qualifying child or an "other" dependent. How do we specify the number of each? Since there is only one field for claim dependents I have to guess it's a dollar amount.

If it is a dollar amount, then we need to be told by the employee what the dollar amount of the the credit is going to be for that year. This is where our employees get lost.

Quickbooks instructions are even more confusing because they lack clear instructions.

Please clarify.

I'm here to clarify this situation, BaderJDCPA.

The number of claim dependents is the total amount from the employee's W-4 form in Step 3. The screenshot below will highlight this.

Just make sure your employees will enter the correct amount. They'll have to calculate using the formula provided on the form.

Let me know if you have follow-up questions, and I'm always around to help you out.

So what I want to know is the data field a $ amount or a numeric figure representing the number of dependents? If numeric figure, how do we distinguish between qualifying child or other dependent?

Quote: "Just make sure your employees will enter the correct amount. They'll have to calculate using the formula provided on the form."

You can't be serious? I would LOVE for you to explain how I am responsible for the correctness of the total dollar figure my employee enters on their form when figuring their dependent credit.

RE: So what I want to know is the data field a $ amount or a numeric figure representing the number of dependents? If numeric figure, how do we distinguish between qualifying child or other dependent?

No, it's a large dollar amount.

For example if the employee had two children under age 17 and three children over age 17, they enter (2 * 2000) + (3 * 500) or $5,500 in box 3 of the form. While the detail will be on the form for you as the employer to see, I expect that all you'll enter on the employee record in QB is $5,500.

The Payroll Module still shows an allowance box and extra withholding box, whereas the W4 Form 2020 shows only a $_____. I would imagine that the update would have emulated what the form is reporting.

So, is there a different update in the works?

Thanks for joining the thread, @NB2020.

There are some new changes in regards to the W-4 Form. The latest Payroll Update was released on January 14, 2020. These updates provide the most current and accurate rates and calculations.

This article has detail information about the latest payroll news and updates:

This link is about what’s changing with-in the W-4 form:

Don’t hesitate to reach back out to me. I’ll be happy to help.

I agree. NOWHERE does it tell us how many State Exemptions to choose on the Federal form and I don't see a State form for my state. QuickBooks, you need to help us more than just filling out the form. Telling us to use the 2019 does NOT help for new 2020 employees. In addition, for the Federal form, if I am completing the form for a family of 4 is that 3 deduction or 4 deductions to include myself. I've fun the worksheet on the irs.gov site and it's worthless. If a relatively intelligent person is having difficulty figuring out what should be on this worksheet, how are people that don't do accounting going to know how to complete the form?

QuickBooks, we need better information.

Hi, Suezew.

Updating your payroll tax table is a good start when it comes to fixing payroll forms related issues in QuickBooks Desktop.

Here's how:

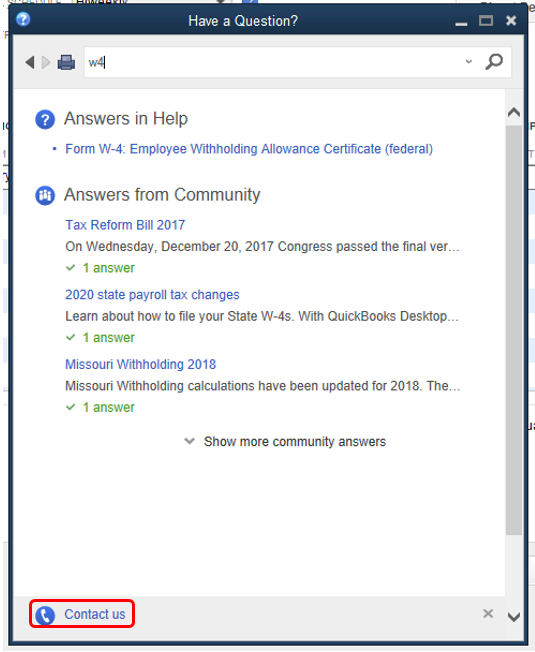

If you still can't access the form after the update, I'd suggest getting in touch with our QuickBooks Desktop Support. Unlike in this public forum, they have the tools required to perform any escalations in the system whenever necessary on your behalf.

To know more about payroll forms, here are some articles for future use:

States withholding allowance certificates: W-4 and/or W-5 forms.

Don't hesitate to drop me a reply below if you need further assistance or if you require more information about payroll forms. I'd be glad to help. Have a nice day.

I have an employee who has filled out a 2020 W-4. I have the new for an information to enter. QB desktop 2018 had no place to enter the $ amount only allowance from the previous form. How do you get the correct field to enter the data in QB and when you get the field will other employees with previous W-4 allowances be altered?

Thanks for joining on this thread, @TRAH2002.

Let’s make sure the newly added employee’s W-4 information is properly recorded in your company file.

To accomplish this task, download the latest release version for your QuickBooks and update the tax table version.

The previous enhances the functionality of the software as well as fixes known issues. Meanwhile, the latter provides the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file payment options.

To download the release:

Once done, let's go ahead and update the payroll tax table. Check out the following article on how to accomplish this task: Get the latest payroll tax table update.

Next, open the company file again and open the employee's profile. From there, go to the Taxes screen and choose the Federal tab.

Once you see the fields (Claim Dependents, Other Income, and Deductions), you can start entering the correct amount.

For your other concern, if your employees were hired before 2020, their allowances will not be altered.

Employers will continue to compute withholding based on the information from the employee’s most recently submitted Form W-4.

For an overview of the new updates to the Federal W-4, check out this article. The information applies to all payroll versions: What’s changing with the Federal W-4?

If you have any clarifications or questions, let me know by posting a comment below. I’ll be right here to answer them for you. Have a good one.

So in the new input screens in QB Desktop for the new 2020 W-4 inputs, do we enter a dollar amount in the Claim Dependents field? Or do we enter the number of dependents claimed?

Thanks for joining the thread, @sarahcpa.

To ensure you get the best possible answer, I recommend reaching out to your accountant. They'll be up to date on any new tax form information and can tell you what goes in the Claim Dependents field. You may find this article from the IRS helpful: FAQs on the 2020 form W-4.

Feel free to drop a line below if you have any other questions. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here