Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am an accountant / CPA / ProAdvisor and can find nothing on your website or in the community the answer to this question. It is not a W-4 form question, it is a "how do I enter this to QB" question.

I'm here to shed a light on that, sarahcpa.

I've read all your previous posts. In the new W-4 form, we'll have to enter the dollar amount in the Claim Dependent field. You can follow the steps below in entering the information:

I've also listed the different entries that need to be set up for the new employees who are required to fill out the new 2020 Form W-4 but fail to submit:

I encourage you to read this article to stay current with the latest updates of the Federal W-4: What’s changing with the Federal W-4?

I'll be right here to help you further sarahcpa. Don't think twice tag me in your comment below if you have further questions about the new W-4 form.

@Joshua R To further clarify, now that the number of allowances has been replaced with a certain amount (under Claim Dependents), does this also translate into the more the amount, less money is withheld?

I'm here to clear things out for you, Iris3.

Yes, that means the more amount you enter, the less money is withheld. As what my colleague Joshua R have mentioned, instead of calculating the number of allowances that translates into a certain amount of tax withheld, the new form prompts you to enter a dollar amount in the Claim Dependent field.

You can follow the steps that I've listed above in entering the information in the new W-4 form. I've also listed the different entries that need to be set up for the new employees who are required to fill out the new form.

I encourage you to visit this article to learn more about how the new W-4 form works in QuickBooks: What’s changing with the Federal W-4?

Do you have any other questions in mind? Please leave a comment below and I'll make sure to get back to you.

Thank you for joining the thread, @sfvaughan.

The Internal Revenue System (IRS) requires employers to withhold federal, social security and medicare taxes from the employees' wages. If paychecks don't calculate federal income taxes, the employees' filing status, wage base, exemptions or allowances may be the reason.

You can use the official IRS Employer's Tax Guide to find out how much should be deducted from the employees' paychecks based on their filing status, pay period, and any other deductions. This allows you to possibly determine the cause for a lack of deduction.

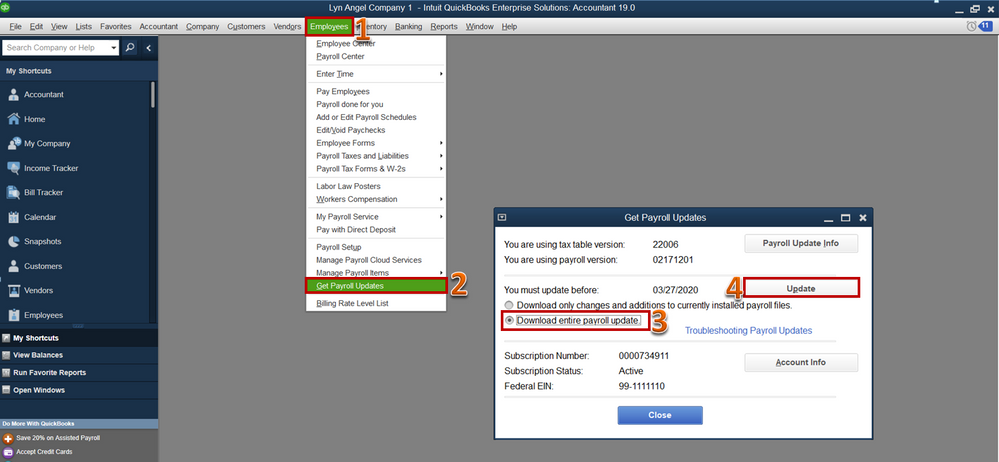

Also, I encourage updating your payroll tax table version to the latest release to ensure payroll taxes are calculated correctly.

Here's how:

For additional reference about this action, read these articles:

I'm also adding this article for additional reference about paycheck calculation in QuickBooks Desktop: Payroll items on paycheck are not calculating or are calculating incorrectly.

Get back to me if you have any other questions. I'm a few clicks away to help. Have a good day!

I have auto updates turned on. Latest release was downloaded today and I do not have the new 2020 W 4 drop down needed for a new employee onboarding.

@Timp1 Thanks for joining this thread. This issue was answered previously: Updating your payroll tax table is a good start when it comes to fixing payroll forms related issues in QuickBooks Desktop.

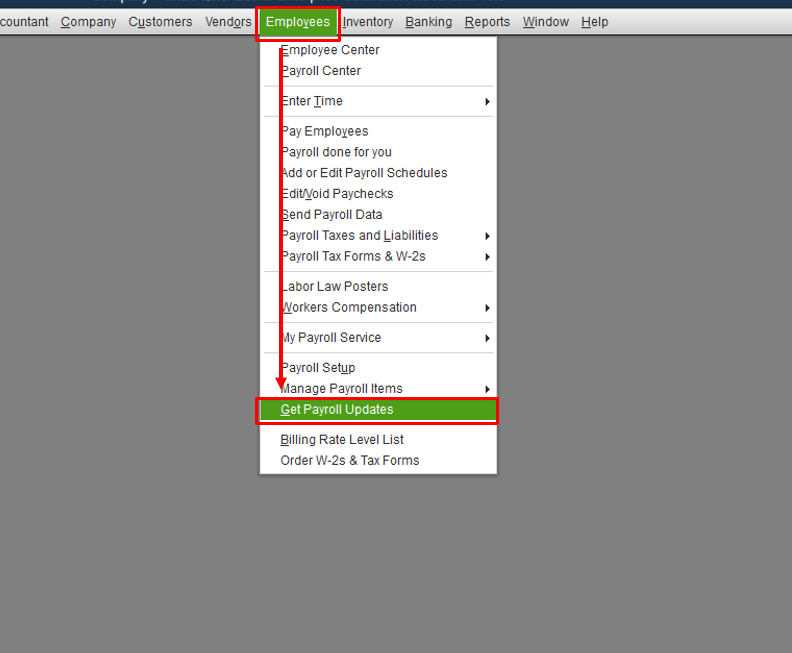

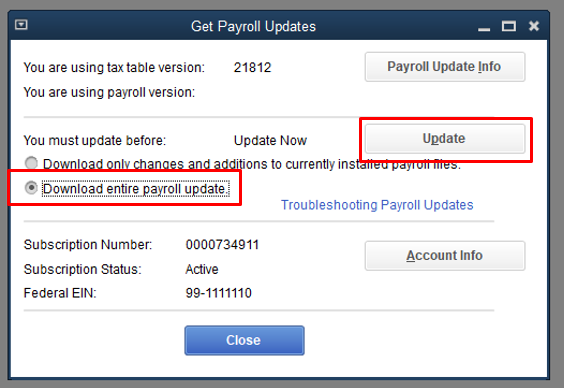

Here's how:

If you still can't access the form after the update, I'd suggest getting in touch with our QuickBooks Desktop Support. Unlike in this public forum, they have the tools required to perform any escalations in the system whenever necessary on your behalf.

To know more about payroll forms, here are some articles for future use:

States withholding allowance certificates: W-4 and/or W-5 forms.

Please come back to us if you need additional help.

Thank you, KlentB!

I have a question. On QB other income, what number is the one I have to enter- The amount the employee put on the Step 2(b) #1 or the number the employee put on the Step 2(b) #4?

Happy to help out, @Dianeska.

Step 4(a) on Form W-4 is not calculated based on other boxes. This field is for other income the employee receives (not from jobs). I've included the description for this field from the official Form W-4 below.

You can find the official FAQ page for Form W-4 here: About Form W-4, Employee's Withholding Certificate

Just shoot me a reply if you run into any other questions. I'm here to ensure your continued success. Have a great rest of your week!

I have an employee that wants an additional $125 in taxes withheld and he listed it in line 4c. Will the amount listed in 4(c) be calculated with the Federal Taxes or do you have to add it to the deductions section in line 5 of the pay setup?

Welcome to the thread, @lahawk81.

If you have an extra withholding that you want to withheld each pay period, you can enter it in line 4(c). This includes any amounts from the Multiple Jobs Worksheet if this applies to you.

For guidance on how to enter employee's W-4, you can check this article: What’s changing with the Federal W-4?.

You can also visit this IRS website to know more about the 2020 Form W-4: https://www.irs.gov/newsroom/faqs-on-the-2020-form-w-4.

If you have any other questions, let me know by commenting below. Have a great day!

Thank you, I was looking for a separate line on the paystub which identified the Extra Withholding. It must be included in the total Federal Withholding, correct?

Hello again, @lahawk81. Yes, you're correct.

If you're using QuickBooks Desktop Payroll, you can add an extra withholding on an employee's paycheck. Here's how:

The extra withholding amount will add to the existing Federal Withholding item. You can run the Payroll Detail Review report to check the amounts per employee.

On the other hand, if you're using QuickBooks Online Payroll, here's how you can add a deduction:

For more information about the process I've provided above, you can check below articles:

If you need anything else concerning payroll, you can always get back to me. I am more than happy to help. Take care.

But I need to know if Line 4c, when an amount is added here on the W4, is included in the total Federal Tax amount deducted or if I need to add it somewhere else to make sure it is taken out of his paycheck. In other words, I have added the $125 on the W4 Line c, but it does not show up anywhere on his paystub. Is it included in the federal tax total that is deducted from his gross wages or do I need to add the deduction to have it removed in Section 5 of the pay setup similar to having retirement withholding?

Thanks for the response back, @lahawk81.

I recommend reaching out to your accountant for advice on how this information needs to be entered.

You should enter any Extra Withholding on Line 4c on the W-4. If this doesn't work for you, then you can follow my colleague's @MirriamM steps on how to make the deductions on your paychecks. If the issue persists, try updating your Payroll, then update the W-4 again and view the Employee's Pay.

Let me know how this goes for you. I'll be here if you need further assistance.

Thanks!

I am running QB Premier Edition 2019 and have recently processed all necessary updates. Unfortunately, I am not seeing anything different in regards to tax setup when I attempt to setup a new employee. It's still asking for the number of allowances versus the $ for "Claim Dependents" on the 2020 W-4 form. What am I missing?

I'm here to ensure you'll get the right support in entering the 2020 Form W-4 information for your new employee, @mbutler.

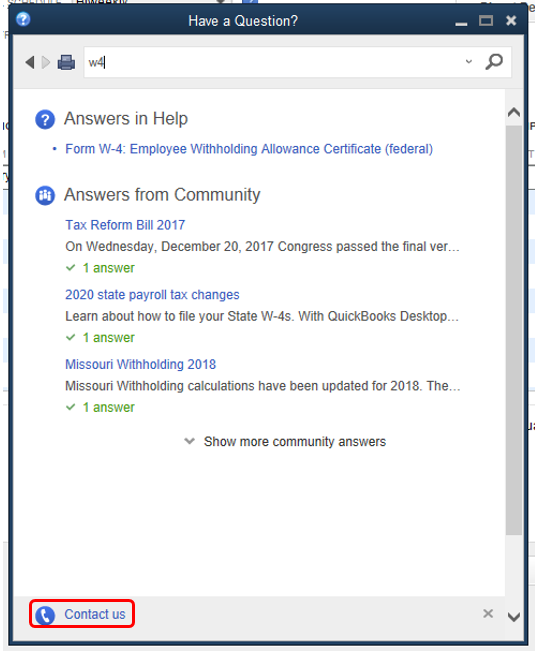

You're on the right track in downloading all the necessary updates, so there's no information you're missing. I'd suggest contacting our Customer Care Team since the system is still asking for the number of allowances instead of the $ amount in the Claim Dependents field. They can securely access your account and determine the root cause of this issue. They can also help you fix this so you'll be able to enter the employee's 2020 Form W-4 information. Please check out our support hours before getting in touch with them. Here's how.

For detailed instructions, see this article: Contact Support Team.

Once fixed, I recommend visiting this website: IRS Guide. This link provides you answers about the general, employee, employer FAQs on the 2020 Form W-4.

I'm just a post away if there's anything else you need. Have a great rest of your day, @mbutler.

Did you find an answer to this problem? I am also having this issue. I entered the dollar amount of $4000 for 2 dependents and it is not withholding any federal. All updates are current. It seems several are asking this question but not getting a helpful answer.

Did you find the answer for this problem? I am having the same problem...I entered the $4000 for having 2 dependents and no federal is withheld....I am certain this is incorrect.

I am having the same problem. Did you get an answer?

Hi I am having the same issue. No taxes are being withheld. Did you find a solution?

Thanks for joining this thread, @Roxfer83.

For the best assistance, I recommend reaching out to our Desktop Support. This is because they have the tools to get on a screen share with you and look further into this behavior. Rest assured, they can help you look into the Employee's Profile, as well as reviewing your Payroll to make sure everything is set up properly. Here's how to get in touch:

You'll hear from an agent shortly. Please let me know how the conversation goes.

I'll be here if you have any other questions or concerns. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here