Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI believe I may have found a reason for the discrepancy that is going to occur when you file your first MA PFML quarterly report for Q4 2019 period via the Mass Tax Connect website. QuickBooks is incorrectly calculating the MA Paid Medical Leave payroll item at only 0.62%. Mass Tax Connect is calculating the MA Paid Medical Leave at exactly 0.61875%. QuickBooks is also incorrectly calculating the MA Paid Family Leave payroll item at only 0.13%. Mass Tax Connect is calculating the MA Paid Family Leave at exactly 0.13125%. In other words, QuickBooks is incorrectly calculating at only two (2) decimal places and Mass Tax Connect is calculating at a full five (5) decimal places. And you can easily check this discrepancy by using the Calculator Mass Tax Connect provides on their website. I just ran our first payroll of the New Year last night for our small business and, as a result, I had to manually enter payroll adjustments for both payroll items on the Preview Paycheck window for each of our five employees. Intuit please correct this issue ASAP with a proper update that incorporates a full five (5) decimal places for each payroll item.

Hello @jcorbin,

I want to let you know that your voice matters and I'm taking notes of your feedback and submitting it directly to our engineers.

As of the moment, QuickBooks payroll calculates your taxes base on the two (2) decimal places of the tax rates based on what is implemented by Massachusetts.

In the meantime, you may want to consider manually doing what you've started as a way around. This will absolutely help other users, like you, who are also in need to create an adjustment manually

In case you need some reference, I've got you this article for more insights about your payroll tax: Massachusetts Paid Family Leave.

I've also included the following articles below for future updates about our product:

Let me know in the comment section down below if you have any other questions. I'm always around happy to help.

Thank you for your feedback and your prompt attention to this matter. As a result of the incorrect calculation last quarter, it appears I will also have to complete a Payroll Liability Adjustment, for the period ending 12/31/19, against each of the affected Payroll Items for each of our five employees. I have completed these in the past for employer-paid payroll items in order to account for the occasional discrepancy, but is it safe to do so for employee-paid payroll items? Also note the state of Massachusetts is requiring additional reporting in Box 14: Other on each our of employee's 2019 W-2 forms as "MAPFML". We will need this amount to exactly match what is owed and paid to the state of MA in our forthcoming Q4 2019 MAPFML report. If we complete Payroll Liability Adjustments to correct what should have been calculated for Q4 2019 for each of our employees, is this going to cause further issues? Or do we simply manually enter this amount in Box 14: Other on the W-2 to match what we will actually owe and pay to the state of MA for each employee?

So for example, we had an employee last quarter who earned $7,250 in Gross Pay according to our Q4 Payroll Summary Report. QuickBooks is currently showing MA - Paid Family Leave Emp. at $9.43 and MA - Paid Medical Leave Emp. at $17.99. When we go to run the Paid Family and Medical Leave Contribution Calculator, which the state Q4 report is going to exactly mimic (see attached PDF example), the State of MA is instead showing:

Family Leave: $9.52 = $7,250.00 X 0.13125% and

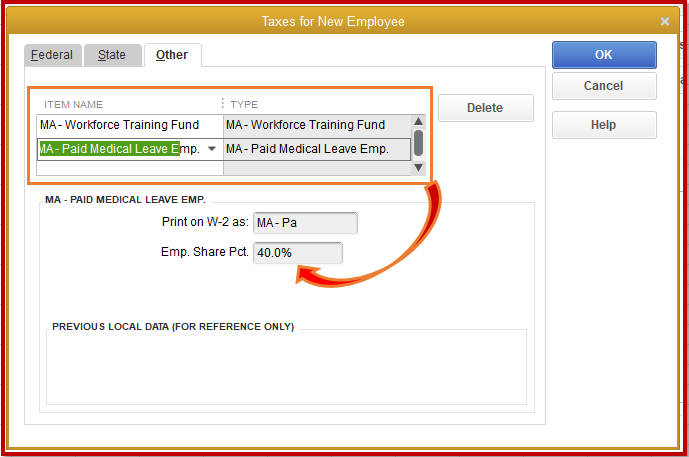

Medical Leave: $17.94 = $7,250.00 X 0.61875% X 40%.

Note as a small employer, we are not required to contribute anything; our employees are supposed to be paying 100%. As you can see, this is leaving a discrepancy of $9.52 - $9.43 = $0.09 for MA - Paid Family Leave Emp. and $17.94 - $17.99 = -$0.05 for MA - Paid Medical Leave Emp. So please provide detailed instructions on how we should be accounting for this discrepancy in QuickBooks via presumed Payroll Liability Adjustments for each employee to end Q4 2019. And then please explain how we should be reporting this on the W-2.

I appreciate you getting back to us and providing detailed information about your concern, @jcorbin.

While we don't advise you to adjust the payroll liability of your employee-paid payroll items by yourself, our Payroll Support can do it for you. They'll perform some payroll corrections so your employees' taxes are calculated and tracked accurately. With this, it will also give you precise report for your W-2 forms.

Here's how to reach them:

Feel free to read this article for your reference: Contact the QuickBooks Desktop Customer Support Team.

You might also want to check out this article to know how to submit your state W-2 forms electronically: Massachusetts state W-2 e-file help.

Please know that you can always get back to this post if you have further questions. I'm always here to help. Have a good one.

I just got off the phone with a representative from the MA Department of Revenue this morning. Apparently, there was an "issue" with their reporting system that has been recently "fixed." They are also reporting the system should now correctly calculate to 2 decimal places instead of 5 decimal places as the Paid Family and Medical Leave Contribution Calculator is currently showing on the Mass.gov website. They directed me to use our MassTaxConnect website account to contact them directly, via messaging system, should any discrepancies arise between when we owe them and what we actually withheld for our five employees for MA Paid Family Leave and MA Paid Medical Leave when we go to file our first (Q4 2019) report . They also advised that if there is a discrepancy, to only report what we actually withheld for each employee in Box 14: MAPFML on their W-2s for 2019. This presumably means we will have to then reconcile any deviations internally (for example 5 cents or 10 cents for a given employee) to an Employer Payroll Expense account, as our company will have to pay any remaining balance owed. I hope this additional feedback helps others with similar questions.

I wanted to circle back to reveal my final findings over the last several days:

1. Yesterday, we filed our Paid Family and Medical Leave Return on MassTaxConnect for Q4 2019 and I can confirm the report is correctly calculating at two (2) decimal places. A representative from the MA Department of Revenue also confirmed, last week, the calculator received a recent update that "fixed" the previously incorrect calculations.

2. The QuickBooks Desktop Payroll version (we are currently using tax table version 22002) likewise appears to be correctly calculating at 2 decimal places.

3. Do NOT use the Paid Family and Medical Leave Contribution Calculator (see here: https://calculator.digital.mass.gov/pfml/contribution/) to verify your numbers at any point during or following a given quarter. As of this writing (1/12/20), this tool is incorrectly calculating at five (5) decimal places when it should be correctly calculating at two (2) decimal places. As this calculator is being provided by the Department of Family and Medical Leave, which covers themselves with the following disclaimer: "By using this calculator, I understand that the Department of Family and Medical Leave is not bound by estimates given", the same representative from the MA DOR could not provide any information regarding when it will be fixed. It would be great if the calculations revealed by this convenient online tool matched the actual MassTaxConnect return. We shall see.

4. To verify your numbers, I recommend using a simple Excel (or similar) spreadsheet, as shown in the following example:

| Employee | Wages This Quarter | Paid Family Leave % | Paid Family Leave Employee Contribution | Paid Medical Leave % | % of Medical from Employee | Paid Medical Leave Employee Contribution |

| John Doe | $7,250.00 | 0.13% | $9.43 | 0.62% | 40% | $17.98 |

(Note we have fewer than 25 employees and, therefore, pass 100% of the required contributions to them.) Using our "internal calculator," I was able to confirm the correct numbers for each of our five employees during the return. These Q4-ending numbers, verified in the spreadsheet, exactly matched what was displayed on our return.

5. If you experience discrepancies when filing your return (and we had a few amounting to a total of five cents), since the return does not, as of this writing, allow you to correct overpayments (for example), pay what you owe and then speak with your accountant about the proper way to handle small differences in QuickBooks (for example, Payroll Liability Adjustments recorded on 12/31/19). You may also be able to apply your payroll liability overpayment as a credit, if the situation applies, and you have the proper payroll tax expense accounts set up (see the article here: https://quickbooks.intuit.com/learn-support/en-us/journal-posting/apply-your-payroll-liability-overp...). In our case, we have individual payroll tax expense accounts set up for MA Paid Family Leave and MA Paid Medical Leave. Again, speak with a professional about the proper way to account for variances (and especially year-ending variances) for tax reporting purposes.

6. The MA DOR is requiring all employers to report all employee contributions, combined into one figure, and reported in Box 14 (Other) on Form W-2 for W-2 employees and Box 16 (state tax withheld) on Form 1099-MISC for applicable independent contractors. The contribution should read MAPFML. I have not filed our W-2's yet for 2019 and so I do not know if QuickBooks Desktop Payroll will be handling this entry automatically or require a manual entry. I will report back here to let everyone know.

Again, I hope this additional information helps others navigate the potentially problematic calculating and reporting process for the new MA Paid Family and Medical Leave.

I ran a payroll in December (first one since October 1) and it didn't deduct ANYTHING for PFML. I have two employees, so employees should be bearing 100%. Further, If I run a payroll detail report, it shows the Medical Leave component of PFML but not the Family Leave component.

I suspect that I have done something wrong in the setup, but I can't for the life of my figure out what - and the documentation/help has been unhelpful...

Thank you for joining this thread, jwkeene.

Let's download the latest payroll tax table to help isolate this issue. These updates provide the most current rates and tax calculations.

Here's how:

Please refer to the Latest payroll news and updates link to see the complete details of the earlier release.

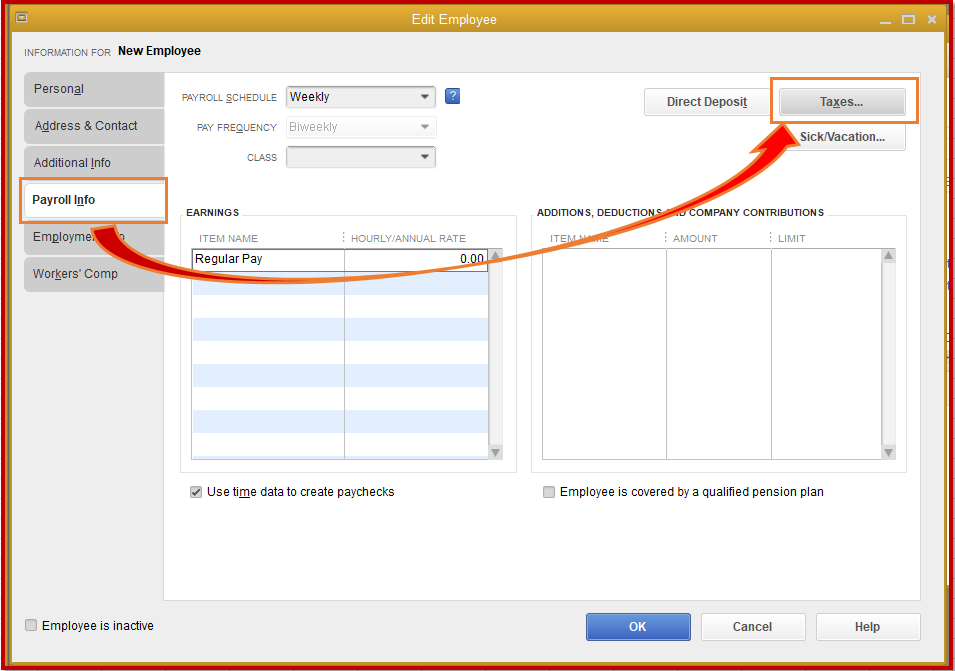

After that, let's check the share of the premium you've set up in the system. The new deduction must be finalized in QuickBooks for each employee before you issue the first paycheck in October 2019.

The following items below should be entered in the system:

Here's how to set them up:

If still not calculating, I recommend contacting our QuickBooks Desktop Payroll Team. They can do screen-sharing and review the set up of the MA Paid Family Leave program in a secure environment.

To get in touch with them:

Let me know how the call goes or if there's anything else you need. I'm always around to help you out.

Does QuickBooks Desktop create a file that can be uploaded to the MassTaxConnect?

Welcome aboard to the Community, @MichaelCPA.

When making payments and filing taxes outside QuickBooks, I recommend checking with your state agency about the supported file formats and information required. If there's any data you need, you can try exporting the Payroll Summary report to Excel.

Here's how:

I’m attaching the Massachusetts Payroll Tax Compliance article for more insights about e-file and pay within the program. Aside from that, it contains some insights about your state payroll tax regulations.

If there’s anything else I can help you with, click the Reply button and post a comment. I’ll be right here ready to help you. Have a good one.

Well... I need help.. ugh.. I have entered all information correctly for 6 employees..everybody’s pfml “family leave employer contribution” is shown as a deduction in the preview check window (company is paying 50%), EXCEPT FOR ONE Check... I don’t understand what is going on. I have tried changing the order, but all employees deductions are listed the same. But It won’t show the company contribution on only one check. It does on all the others. And the math is right on them. (Other than the incorrect amount for the employee contribution on the wrong check) . This is so confusing. Please help!!!:( I’ll make cookies!

Thanks for posting in the Community, @KTroupe.

Since we don't advise you to adjust the payroll items by yourself, I suggest contacting our payroll support. They'll perform some payroll corrections so your employees MA PFML are calculated and tracked accurately. With this, it will also give you a precise report for your PFML.

Here's how to reach them:

You can read this article for your reference: Contact the QuickBooks Desktop Customer Support Team.

You might also want to check out this article to know how to submit your state W-2 forms electronically: Massachusetts Paid Family Leave.

Please feel free to leave a message through this post for further questions. I'm always here to help. Take care!

I just uploaded a file to the Mass Connect site. There is one problem I came across. MA Connect calculates the tax on the total wages for the quarter and rounds that number, however in QB the tax is calculated weekly and rounded weekly. This causes a slight difference in the total tax due for each employee. Therefore, what MA Connect is reporting for each employee is now different than what is on the employees W-2 and what was actually taken out of their pay. Hopefully, QB will provide an update for 2020 to make sure the total tax by the end of the year rounds based on the employee's total wages for the year and adjusts the last deduction for PFML correctly.

For those employers who are passing any % share/portion of the MAPFML tax to their employees (we have fewer than 25 workers and so pass 100% of the burden), I am reporting back the good news that QuickBooks is correctly auto-filling the MAPFML information in Box 14: Other on the W-2s, which we have just processed for 2019. Run a year-ending Payroll Summary report, then use a simple calculator to check the math, as the line items for both the default labeled "MA - Paid Family Leave Emp." and "MA - Paid Medical Leave Emp." are summed to produce the final figure that displays on each W-2. For example, if a line item for "MA - Paid Family Leave Emp." = 17.39 and the next line item for "MA - Paid Medical Leave Emp." = 33.20, your W-2 Box 14 auto-filled entry should display MAPFML 50.59. Please note we are using the latest payroll update: 22004.

Well that was less than helpful. But thanks

Does anyone know how to change the rate in QB. With fewer than 25 employees the rate is supposed to be .378%, but mine is still withholding the entire .75%.

I know how to update it, NEF72.

You are correct. Your combined rate is .378% since you have less than 25 employees. You can follow these steps:

Here's an article as your guide about Massachusetts Paid Family Leave. This will explain everything you need to know about this tax.

I'll be right here if you have more questions. Have a great day!

The rates suggested to be adjusted in the answer apply to the % of the overall amount due to MA DOR from the Employee and the Company in the 4 separate settings. The problem is with 25 or fewer employees (with the Company paying 100% of the contributions and Employee 0%) the MA Paid Medical leave overall rate should be .248%. This was confirmed by a MA Tax connect phone representative. I expected to be able to change the rate from .62% in the payroll items the same way one may annually adjusts the state Unemployment insurance tax rate. Unfortunately the 0.62% value for MA paid Medical leave is not adjustable in the payroll items / payroll setup sections, Can this be fixed? Is there a different way intended to enter the proper value applicable for companies with <25 Employees?

Thanks for your input AlexV. Unfortunately this does not change the rate, only the portion that is paid by the employer vs employee. What I am trying to do is change the total rate from .75% to .378%. The Family Leave portion is correct at .13%, however the Medical Leave portion should be .248%, not .62% that QB has it set at. For now, I am just manually correcting each pay check, which is extremely time consuming.

Thanks for reaching back out to the Community, @NEF72.

If you're running into trouble when doing the steps my colleague provided, then I recommend contacting our Support Team. They have additional tools that are available to look further into your account and determine the best solution for your unique business.

Here's how:

1. Open QuickBooks

2. Go to Help.

3. Choose QuickBooks Desktop Help.

4. Select Contact Us.

5. Type in your question, then press Continue.

6. There will be a few support options you can choose from.

Remember, I'm only a click away if you have any other questions. Have a great day!

Ah, light dawns on marblehead. I finally understand. For those who don't, I'll explain it as I understand it. For employers with <25 employees, the total share between the company and the employee should only add to 40%, not 100% for the Paid Medical Leave portion of the tax. So follow AlexV's instructions above.

I don't even get those options on the Other tab. I did the update and I am on Quickbooks Pro 2020 desktop version. How come I don't have these?

I want to make sure that you can see those taxes, ChameleonIT.

We can manually add it through the Add new payroll item window to view the taxes in the Others tab. Let me show you how:

Once done, you can now view those taxes when you create a paycheck to your employees.

To learn more about about this new Paid Family Leave program, you can visit these articles:

If you additional questions about how MA PFML program works in QuickBooks, please hit the Reply button then add a comment. I'll be right here to keep helping.

Thank you - I have that sorted now. But I have a SEP and it seems to be calculating the amounts prior to the SEP being taken out. How do I get it to calculate the paycheck total - SEP?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here