Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm using Premier Nonprofit 2020, Desktop. I'm trying to set up a local payroll tax, user-defined. I have followed the QB instructions, but the tax won't calculate. I've talked with two customer service reps for two hours and they were not able to solve the issue either. Has anyone else had a similar problem? My friend with the 2019 version is not having a problem.

Let's get your local payroll tax working again, @BalletChristina.

I've checked our records and haven't found similar issues about a local payroll tax malfunction.

Let me go over and dig deeper into what's causing this. First, there are several reasons why payroll taxes aren't calculating. Among these are:

To start, let's ensure to update QBDT and the payroll tax table to the latest release. This way, you'll have the latest features, fixes or patches.

You can also use this article for other solutions: Why payroll taxes won't calculate?

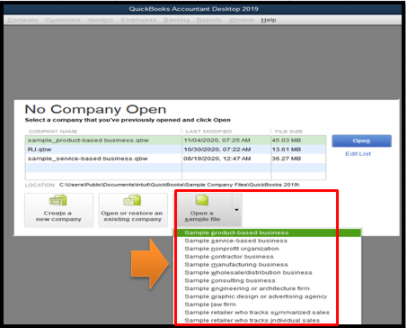

If you get the same result, you can open a sample file. This way, you can test if there's data damage on the original company.

Here's how:

If you're able to see the correct details, then the original file might be damaged. In this case, I'd recommend running the QuickBooks Verify and Rebuild tool. This can help identify and repair data damage.

Here's how to Verify your data (original company file):

If it detects an issue, you can Rebuild your file. Please head to this link for the detailed instructions: Verify and Rebuild data in QBDT.

After that, you can now start submitting your taxes to file them on time.

You can always lean on me if you have more payroll tax concerns or any QuickBooks-related. I'm here to help you.

Thank you for all the information. However, after doing all this and speaking with three customer service reps, the fourth figured out rather quickly what the problem was. I had entered the tax rate as a decimal (.044) instead of a percentage (.44%). That fixed it. Sigh.

Hey there, BalletChristina.

Thanks for following up here and letting us know about what happened in your QuickBooks Desktop account regarding the payroll tax.

It's great to hear the agent was able to identify the problem with how the rate had been entered. I'm sure other users who read your post will appreciate the reminder to enter the tax rate as a percentage.

My colleague, ReyJohn_D, provided some excellent help articles above, but please don't hesitate to reach back out if you have any other questions. Myself and the rest of the Community are always here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here