Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I set up Sick Leave? The employee will earn 1 hour of sick leave for every 30 hours worked. Max time is 48 hours. No carry over. Please be specific. Thanks.

Hello @myingling13,

You can set up your employees' sick and leave hours directly from the Preferences menu. Let me show you how.

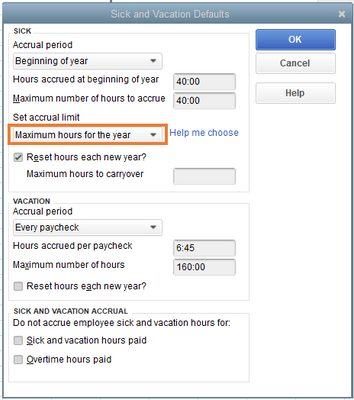

In addition, here's a screenshot and an article you can read to learn more about how you can set up your employees' sick leave: Sick Pay Maximums.

Lastly, I've also included this helpful article for the steps in creating a paycheck for your employees: Learn how to create paychecks to pay your employees.

If you have any other questions, please let me know in the comments below. I'll be here to help. Stay safe and well!

Changing this in Preference will update all current employees? Or will I have to go into each employee and make the changes? Please be specific. Thank you.

Your confusion ends here, @myingling13.

Allow me to fill you in on everything about changing the preferences for sick and vacation time accruals in QuickBooks Desktop (QBDT).

Changes to any company preferences for payroll, like sick accruals, would only apply to new employees. Therefore, the existing employees' preferences wouldn't be changed. You'll want to go through each employee and set their sick accruals individually. Here's how:

This setup is for 1 hour sick time accrued for every 30 hours worked. Please repeat the same process for the rest of the affected employees.

I'm adding this article for more details: Set up and track time off in payroll.

Just in case you are ready to create a paycheck for your employees, feel free to check out this article for the detailed steps and information: How do I create a paycheck for an employee?

Please know that I'm just a reply away if you need any further assistance setting up that sick leave. Wishing you and your business continued success.

Question on this. I did this exact set up.

What my situation is... the employees only get 48 hours for 2021. If they use sick pay... you don't get more in 2021 only 48 hours.

QB desktop is allowing once an employee uses sick pay, it will allow it to accumulate back to 48 again.

So essentially they would get over the MAX 48.

I could take out the amount to accumulate once they got to the 48 and that works. But for those still accumulating and using at the same time, it is giving them more.

I hope this makes sense and someone can help.

Thanks for joining this thread and sharing detailed information, AudreyCO.

Let me add a few clarifications about the employee's sick pay.

The sick pay item may have been incorrectly set up on your list. I'm adding a screenshot once the employee reached the maximum limit:

You'll want to review each payroll item used and keep track of the accruals shown on the paycheck. This way, we can correct the issue. Let me show you how:

You can also check the employee's profile to fix this. Here's how:

Also, I'm adding this article for additional reference: Set up and track time off in payroll.

Let me know if you have follow-up questions concerning payroll. I'll be right here to help you.

Hello,

Thank your for the explanation. As I review our payroll item it appears correct however our employees continue to have the sick time available after they use it because it is re accrued. Not sure what I'm looking for in regards to payroll item, can you clarify or post a screen shot of how the payroll item should be set up? Thank you.

I've got your back, @FRRS.

You've got one more step to stop sick leave from accumulating once your employee reaches the maximum accruals in a year.

Here's how:

Once done, your employee won't accrue more sick time until the new year starts. For more info, check out this article: Sick Pay Maximums.

I'm also adding this guide for more details: Set up and track time off in payroll.

I'd be happy to help out again if you need more help setting up your employees' time off. Wishing you continued success.

How do I do exactly this in QB Online? There is no "Edit" option... I would like the employees to ONLY accrue 40 hours per year. They currently begin accruing more as they use it, so it is a never ending supply of paid time off. I would like to change the policy and have it apply to all employees rather than going in and changing them each individually. Please help!

Hello, StaceyL1.

I can share the step to change the accrued time for your employee's time off in QuickBooks Online.

The ability to create a policy that applies to all employees is currently unavailable. You'll have to edit or change their policy individually. I'll show you how.

I've added this article for more detailed information: Set up and track time off in payroll.

In addition, check out this resource to learn how to add your salaried employee's sick and vacation pay hours: Enter sick pay or vacation pay hours for salaried employees.

Don't hesitate to reply to this post if you need further assistance setting up paid time off in QBO. We're always here to assist you.

Any chance you could explain to me how to do this for 1 hour of sick pay for every 52 hours worked with a maximum of 40 hours? And is there a way to set it retroactively a couple of weeks?

Can you do a formula like this for me? I'm stumped! Our state sick leave policy is 1 hour for every 52 hours worked with a maximum for 40 hours leave time. I can't figure out how to do this!

How do I set up Sick Time? The employee will earn 1 hour per 30 hours worked up to 24 hours. Sick Pay can be carried over to the next year. Please be specific. Thank you!

I'm glad to help set up a sick time pay for your employee, JSorty.

QuickBooks will accrue an hour per 30 hours worked as long as the setups are correct. Make sure that the format is set to Minutes since you'll be following the Every hour on paycheck option.

Here's how:

Once done, go to the employee's profile and set up sick leave accruals. Here's how to do it.

After setting up sick leave accruals, you can start paying your employees by creating a paycheck.

Stay in touch with me if there's anything else you need about setting up sick pay. I'll be around to answer your questions.

When I put your ".025," number in it's not calculating 1 hour of vacation for 30 hours worked. I tested it. If you put .03333 in, then it does work, and that number makes sense. The law for NM is 1 hour accrued for every 30 hours worked starting July 1, 2022. Am I missing something?

Evey time I get sick the boss resets the sick pay time

I have this employee that has the same settings as all other employees but has not accrued any more sick time in 2023. He was accrueing fine since he started May 2022 but stopped in January. I don't know why? I've tried to fix it and nothing works. Thanks

Thank you for connecting to the QuickBooks Community, yhtax876. Could you verify if you had that checkmark "Reset hours each new year"? on or off every year? If you haven't, you could remove the check.

I will be awaiting your response to assist you further! See you soon!

Hi, thanks. I have the "reset hours every year".

I did notice something now...

the last payroll for 2022, had a check date of Jan2023. If the employee used sick time during that paycheck (esentially using the sick time available before the end of the year), then QB did not accrue sick time in January.

For example:

employee had 8 avail sick hours towards the end of 2022. Employee used the time last week of december but payroll check went into January 2023. The 8hrs sick time taken is as if the employee took them in advance. Make sense? very confusing. Now the employee has not accrued any sick until those hours are "recovered" ??

Hello there, @yhtax876. I'll share some insights about your query on why your QuickBooks Desktop (QBDT) didn't accrue for this year.

Please be aware that this has something to do with how you set up the sick leave inside your company. You've mentioned that you recently ticked off the checkmark for Reset hours every year. Since this is the case, know that you'll only need to create the paycheck, and then QuickBooks will start accruing points to that specific employee again.

For more information, please see this helpful article: Set up and track time off in payroll.

To add up, I recommend checking this page to learn more about the accrual limits in QBDT: Understand sick pay accrual limits in QuickBooks Desktop Payroll.

Also, if you have time to spare, you can visit this page if you want your employees to see their pay stubs: Invite your employees to QuickBooks Workforce to see pay stubs and W-2s if you use QuickBooks Deskto....

In case you need further assistance with this, @yhtax876. Feel free to post here again in the Community space. Rest assured, we've got you covered. We'll help you out again. Thanks for choosing QuickBooks. Stay safe, and have a nice day!

Based on California's new sick pay law I want an employee to be able to accrue a maximum of 40 hours of sick leave per year, but allow a maximum accrual of 80 hours of unused sick time to carry over each year.

Is there a way to set that up in quickbooks?

Hello there, NMM3.

I'm here to help you set up a sick leave for your employees.

We can create a sick time-off policy to accrue a maximum of 40 hours per year. Let me guide you through the steps.

Here's how:

As for the accrual of 80 hours to be carried over, we can use the Paid time off field. Then, select 80 hours/year (accrued at start of year).

Moreover, I've added this article as your guide in paying employees: Create and run payroll.

I'm always around whenever you have concerns about setting up employee's time off.

I am trying to set up IL PTO on my desktop QB. this answer was very helpful, but I need to know what numbers to put in the box for 1 hour earned for every 40 hours worked.

Marsha

I recognize effective procedures for managing Paid Time Off (PTO) within the system, Marsha18. Allow me to provide some information regarding your inquiry.

QuickBooks doesn't include a feature to automatically recognize when an employee has worked 40 hours and should earn 1 hour of PTO. Nevertheless, you can manually track the hours and add the PTO accordingly. You can also generate a report to review the records.

Moreover, you may want to explore integrating a third-party app with QuickBooks to enhance your PTO management. You can find available apps through this link: https://quickbooks.intuit.com/app/apps/home/.

Here's an article for instructions on monitoring employee time off, vacation, and sick pay: Set up and track time off in payroll.

Feel free to consult this resource to learn about the maximum accrual limits: Understand sick pay accrual limits in QuickBooks Desktop Payroll.

If you have further questions about handling your employees' PTO calculations, return to the Community space again. I have the information and resources to assist you with any payroll-related issues. Have a good one.

I have not been using the sick pay information in Quick Books however it has been calculating balances regarding sick pay accruals. Effective 1.1.24, I would like to begin using Quick Books to calculate sick pay accruals. I've entered everything correctly, I think, however, there are sick pay accrual balances (negative balances) on all the current employees from the previous year. How do I change adjust the beginning accruals to zero?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here