Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI appreciate you joining this forum, kamran5.

To assist you better, could you tell me the problem you're encountering? If you're experiencing the same issue as other users in the forum, such as a printing error that occurs when printing your form, here are the steps you need to follow:

But before you start make sure:

Step 1: Print from another program

Step 2: Test the printer setup

Step 3: Test your company file and QuickBooks Installation

Step 4: Run the Print and PDF tool from the QuickBooks Tool Hub

To know more about the detailed steps you can check this article: Fix printing issues in QuickBooks Desktop.

However, if you'd like to report an issue, I recommend contacting our Desktop Payroll support team. Our representatives are well-equipped with the tools and expertise needed to investigate further if necessary.

Here's how:

1. Sign in to your QuickBooks company file.

2. Navigate to Help, then select QuickBooks Desktop Help/Contact Us.

3. Click Contact Us.

4. Give a brief description of your issue, then select Continue.

5. Sign in to your Intuit account select Continue and then Continue with my account.

6. Select Chat with us or Have us call you.

Furthermore, QuickBooks Desktop offers resources on tax forms, withholdings, and other payroll-related topics, including understanding payroll tax wage bases and accessing state agency websites for payroll in QBDT.

I'm still ready to back you up if you need more help with payroll. If you meant something else, I'll keep the thread open so you can comment.

I am having the same issue while trying to process NH state UI return.

Thanks for bringing this to our attention, JGinNH. Let me help you process your NH state UI return.

If you are encountering the same issue printing the NH state UI return that other users have reported in this discussion, let's go through some steps to identify and resolve this.

Before you proceed, make sure to:

After that, you can follow the steps provided by my colleague above to fix printing issues in QuickBooks Desktop.

Moreover, if the issue persists after following the steps, it is best to contact our customer support team. They have the necessary tools and expertise to conduct further investigations if required. Here's how:

1. Open QuickBooks.

2. Navigate to Help, then select QuickBooks Desktop Help/Contact Us.

3. Click Contact Us.

4. Give a brief description of your issue, then select Continue.

5. Sign in to your Intuit account select Continue and then Continue with my account.

6. Select Chat with us or Have us call you.

Furthermore, I've added this article as your future reference in case you want to check your past tax payments and forms: View your previously filed tax forms and payments.

Keep us posted if you have other concerns or questions about printing your tax forms in QuickBooks Desktop. The whole Community is here to help.

I was able to generate my Q4 TN UI return successfully this time although I was never able to generate the Q3 return and had to do it manually.

Has this error been fixed yet? I am now having the same error for our 4Q filing in New Hampshire. We also use Enterprise.

I also can't run the NH report for 4Q. We use Enterprise. I reinstalled the most recent version of QB and that did not solve the issue.

I genuinely appreciate the time and effort troubleshooting when printing your state form and running the report. Let me provide your next step on what to do in resolving this.

Other than the recommendations provided above, let's also update the latest tax table by following the steps below:

After doing the update and you're still unable to print, I suggest reaching out to our Customer Support team to further investigate. Here's how:

1. Open QuickBooks.

2. Navigate to Help, then select QuickBooks Desktop Help/Contact Us.

3. Click Contact Us.

4. Provide a brief description of your issue, then select Continue.

5. Sign in to your Intuit account select Continue and then Continue with my account.

6. Choose either Chat with us or Have us call you.

For more detailed information about getting the newest tax table, you can refer to this article: Get the latest tax table update in QuickBooks Desktop Payroll.

Additionally, you can create, access, and modify memorized reports to save your preferred settings. This way, it will help you run the report smoothly.

Let us know if you have further questions about managing your QBDT Payroll. We'll be right here to help you anytime.

Hi Ariel,

Thank you for the suggestions. I already contacted customer support through the Contact Us function yesterday and spent over an hour with them and they still could not fix it. At this time, it appears there is still no fix.

I'm in NH and I just got this error when trying to complete my state unemployment quarterly. I was able to do the federal 941. And now I can't do W2's. Same error. Was there a fix ever found?

I'm in NH and I just got this error when trying to complete my state unemployment quarterly. I was able to do the federal 941. And now I can't do W2's. Same error. Help

Me too in NH! They told me it was our state hadn't submitted the updated form. To wait a couple days. Then I tried doing W2's and that wouldn't work either! Same message.

I appreciate checking in with the state regarding the updates for the unemployment quarterly W2 forms, @tonya74. Let's work through some troubleshooting steps together to help resolve the printing error.

To begin, please ensure you have the latest updates for QuickBooks Desktop (QBDT). QuickBooks periodically releases improvements that often include fixes for tax form issues.

Have you already tried using the QuickBooks Tool Hub to resolve the error? The Tool Hub can assist you in completing your state unemployment quarterly W2s and helps fix common errors. For the best experience, it's recommended to use the Tool Hub on Windows 10, 64-bit.

Here’s how to get started:

You can also check out this article for more information: Fix Common Problems and Errors With the QuickBooks Desktop Tool Hub.

If the issue persists, I recommend contacting our QBDT Support team for further assistance in isolating the problem. Our representatives have the tools and expertise to thoroughly investigate this error and can create a support ticket if necessary. For detailed information about their availability, please visit this article: Customer Care Support.

Additionally, we offer resources on tax forms, withholdings, and other payroll-related topics, including how to file a corrected Federal Form 941 and 940 and access state agency websites for payroll in QBDT.

Feel free to update me on your progress, @tonya74, or if you have any further questions about printing payroll forms, tax filings, or any other payroll-related tasks in QBDT. I'm here to help, along with the Community team, whenever you need support.

I had reinstall QB Desktop latest version, but didn't update the payroll update manually and it's all working good

I was able to print W2's. Not able to access state of NH UC quarterly still though.

Hello there, Tonya.

Let me assist you on how to access the state of New Hampshire UC quarterly in your account. Before we begin, it's important to make sure that we're able to update our payroll tax table manually.

Here's how:

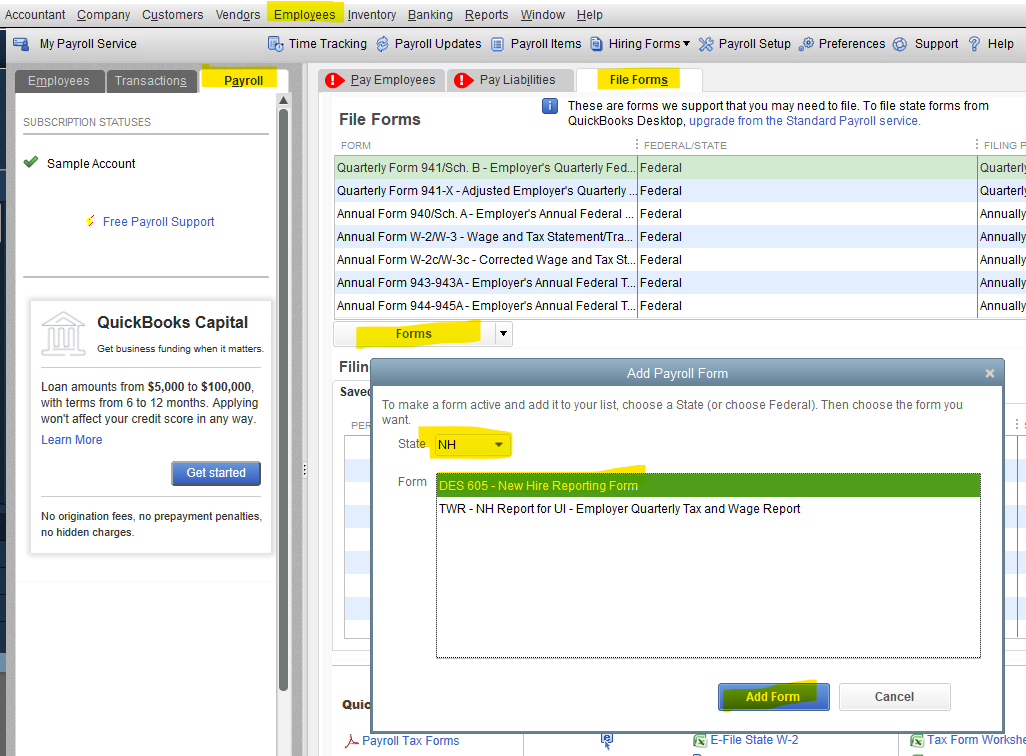

1. Select Employees on the upper tab of your screen.

2. Click Payroll Center and choose Forms drop-list below the table.

3. Choose your preferred State, which in this case will be NH (New Hampshire).

4. Click Add form.

From there, you'll be able to add your Employer's Quarterly tax and Wage Report.

Moreover, you can also check this article for more tips about viewing your payroll tax payments and forms in QBDT Payroll: Access payroll tax forms and tax payments.

Lastly, you can visit this article to help you wrap up this year’s payroll and prepare your tax form: Year-end checklist for QuickBooks Desktop Payroll.

Should you have any other concerns about getting an access to your quarterly forms in QuickBooks Desktop. Please don't hesitate to Reply again on this thread. Your satisfaction is of utmost importance to us. Keep safe.

I've tried that after updating, and it is still not working.

Is there any update on a fix for this issue?

I'm in New Hampshire and I am getting this error message when running the 4th Qtr NH Employer Quarterly Tax Report 2024. I did not have a problem with this report for the 3rd quarter 2024, why am I now? Please advise asap. Please explain how to gather the detail to complete the form. I followed Gigi59 instruction which is helpful, but how do I get the total number of covered workers who worked during or received pay for any part of the PR, number 7. on the NH Quarterly Tax Report?

I am having this same issue with this error code. I cannot run the New Hampshire Employment Secuirty 4th Quarter tax report.

This did not work. It says all state forms are active.

Well at least I'm not alone. I spent over an hour on the phone with quickbooks and they couldn't figure it out and then they said to wait a few days. I'm not assured by this suggestion. I have tried everything that people are posting and have looked up a lot of other things, so far nothing has worked.

you in NH?

Hi there, @BCgilfordNH.

The error message you’re encountering while running your 4th Quarter NH Employer Quarterly Tax Report likely stems from a missing or outdated payroll update in QuickBooks Desktop (QBDT). Rest assured, I'm here to guide you in getting the best help available.

First, let's ensure your QBDT software is updated to the latest release. Go to Help, Update QuickBooks Desktop, then restart after the update. If the issue persists, I recommend contacting our QuickBooks Desktop live support to have this case investigated. They have the right tools to pinpoint the root cause of this problem and apply a solution as soon as possible. Here's how to contact them through a browser:

To view the total number of covered workers for line 7, you can run the Payroll Summary report by going to the top menu, select Reports, Employees & Payroll, then Payroll Summary. Adjust the date accordingly to match your records.

Moreover, you can also consider checking out this article to access state agency for QuickBooks Payroll: Access state agency websites for payroll.

Please don't hesitate to leave a reply if you have further concerns about running tax reports in QuickBooks Desktop. We're always here to help.

When I tried again I got this error also,

Unknown printing error. There may be insufficient memory to print. Please close other applications and try again.

Can you advise what steps to take?

Me too I had the same messages, but I was able to process my W2's. I can't even get onto the state site to submit it that way. I have never had any issues, and I've been using QB for many years.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here