Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Is anyone else having trouble with the 2021 W-2s? They are not reflecting the correct wages subject to Federal income tax.

Solved! Go to Solution.

@jle1 wrote:I'm not having an issue with the State wages. As you can see above, I said Federal taxable wages. I have it set up and calculating correctly and the report shows the correct amount to be reflected on the W-2. However, the W-2 does not.

What report are you referring to? In QuickBooks, there is only one excel-based report, the Tax forms In Excel's W-2, that is designed to duplicate the W-2 Box 1 calculation.

Box 1 does not report taxed federal wages the way other boxes report the taxed wages for their taxes. Instead, Box 1 is the sum of the amounts from the collection or payroll items that use tax tracking types that are included in Box 1. This means that you could set up addition items with tax tracking types included in Box 1 but force them to not be included in the Federal tax calculation and the money amounts will still show up in Box 1. There are actually a couple of tax tracking types that aren't taxed - correctly - but are still included.

To see the items that are included in your file, run the report mentioned. You'll be able to see each item for each employee and the amount that contributes to Box 1. You can even click on the total to see each paycheck amount behind the total.

To run the report, start at Employees | Payroll Tax Forms & W-2's | Tax Form Worksheets in Excel

Choose the W-2 option.

When the report is created, each Employee's Box 1 section will look something like this:

You'll see each payroll item's amount total for the year and can click on the amounts to see the detail behind them.

Thanks for visiting the Intuit Community, @jle1.

QuickBooks populates the total stage wages, tips, etc., in Box 16 that are subject to state income taxes and paid to the employee during the reporting year. Some deductions like 401(k), pre-tax medical, fringe benefits, etc., are not taxable to state income tax, however, they can affect this box.

For more details about this one, please refer to the Taxability of pay types article on how they affect this box.

The tax tracking types on your deductions/additions can affect the reported earnings if they are incorrect. With that said, let's review the deductions and check the tax type to correct this.

Here’s how:

1. Click List on the top menu.

2. Choose Payroll Item List.

3. Open the deduction you’re working on.

4. Right-click your mouse and select Edit Payroll Item.

5. Click on Next twice.

6. On the Tax tracking type window, check if you’re using the correct type.

7. If it’s incorrect, select the appropriate classification that matches your plan type

8. Click on Next.

9. Review the tax setup, then click on Next until you reach the Finish button.

If you’re unsure which tax tracking type to use for each deduction item, please reach out with your accountant for recommendations.

Then, to verify if you have the correct state withholding earnings, just follow the steps below:

1. Run a Payroll Summary report for the entire calendar year.

2. Double-click the amount for the state withholding in question. The amount here is equal to the total of the wage base column.

The following links provide an overview on how to fix incorrect tax forms and steps to process them.

Stay in touch if you need further assistance while working in QuickBooks. Please know I’m ready to help and make sure you’re taken care of. Have a good one.

I'm not having an issue with the State wages. As you can see above, I said Federal taxable wages. I have it set up and calculating correctly and the report shows the correct amount to be reflected on the W-2. However, the W-2 does not.

Let’s get this resolved so wages reflect accurately on your W-2 form, @jle1.

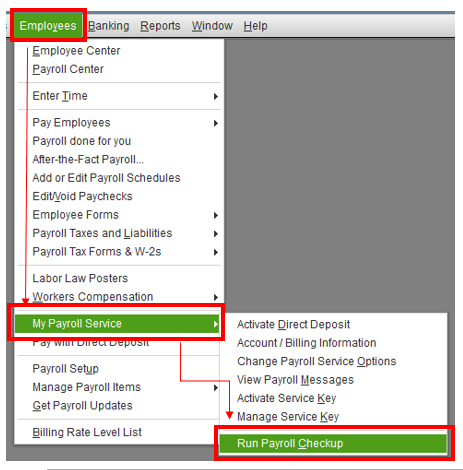

Since your payroll report shows the correct amount, you can run the QuickBooks Desktop Payroll Checkup. It's a diagnostic tool that helps eliminate payroll-related errors like missing information, data mismatch, or discrepancies.

Before that, make sure to create a backup of your company file. Then, you can follow the steps below.

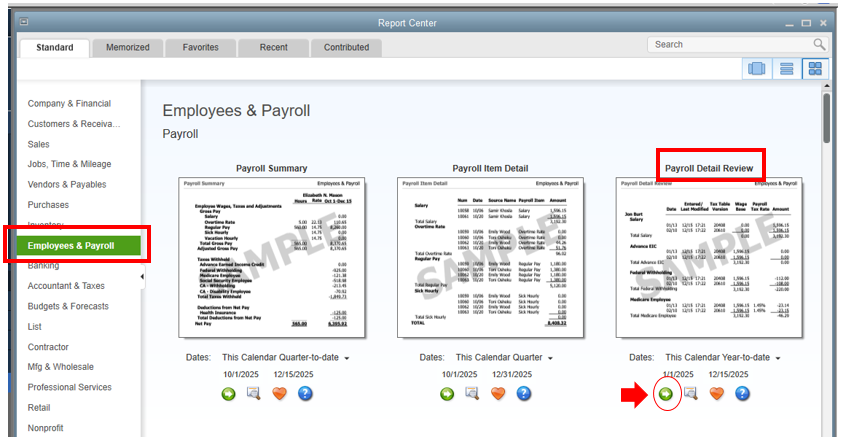

If you find any calculation errors in your payroll data, you can run the Payroll Detail Review report. And please check where the exact discrepancy lies. Here's how:

You can visit this article to learn how to correct wage and tax amounts using the tool: Run Payroll Checkup.

Here’s an illuminating guide about managing W-2 forms in QuickBooks: Get answers to your W-2 questions. It contains steps to file, print, and fix incorrect W-2.

Don't hold back to drop a comment below if you need further assistance with your W-2 form. It's my pleasure to help. Take care!

The issue is that the W-2s do not reflect the numbers on the report of wages by tax tracking type. The report is correct. The W-2s and 941 are not. Can you tell me how to get in contact with a programming person who can fix the issue?

Thanks for getting back to us and performing the steps shared on this thread, @jle1.

Allow me to chime in and share additional details on how to resolve the W2s that are not reflecting the correct wages. Before contacting a programming person, I'd recommend downloading the latest tax table in QuickBooks Desktop. That way, you always have the latest features and fixes since it should be posted correctly if you choose the correct tax tracking type.

Here's how:

For your guide, check out these articles:

If the issue persists after downloading the updates, I'd suggest contacting our Payroll Support Team. They can check the forms for you and provide other troubleshooting steps to get resolved.

Here's how to contact them:

1. Go to the Help menu once you open QuickBooks.

2. Click QuickBooks Desktop Help or press F1 on your keyboard.

3. Select the Contact us button.

4. Enter a short description of your concern in the Tell us more about your question box.

5. Hit Search. Select Start a message.

Please take note our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

To give you more details on how the system populates the W2 form's data and how to file them, please see these links:

Know that you’re always welcome to post a reply in this thread if you have any other concerns about payroll forms in QuickBooks. I’ll be around to listen and back you up. Have a good one and keep safe, @jle1.

@jle1 wrote:I'm not having an issue with the State wages. As you can see above, I said Federal taxable wages. I have it set up and calculating correctly and the report shows the correct amount to be reflected on the W-2. However, the W-2 does not.

What report are you referring to? In QuickBooks, there is only one excel-based report, the Tax forms In Excel's W-2, that is designed to duplicate the W-2 Box 1 calculation.

Box 1 does not report taxed federal wages the way other boxes report the taxed wages for their taxes. Instead, Box 1 is the sum of the amounts from the collection or payroll items that use tax tracking types that are included in Box 1. This means that you could set up addition items with tax tracking types included in Box 1 but force them to not be included in the Federal tax calculation and the money amounts will still show up in Box 1. There are actually a couple of tax tracking types that aren't taxed - correctly - but are still included.

To see the items that are included in your file, run the report mentioned. You'll be able to see each item for each employee and the amount that contributes to Box 1. You can even click on the total to see each paycheck amount behind the total.

To run the report, start at Employees | Payroll Tax Forms & W-2's | Tax Form Worksheets in Excel

Choose the W-2 option.

When the report is created, each Employee's Box 1 section will look something like this:

You'll see each payroll item's amount total for the year and can click on the amounts to see the detail behind them.

@jle1 wrote:The issue is that the W-2s do not reflect the numbers on the report of wages by tax tracking type. The report is correct. The W-2s and 941 are not. Can you tell me how to get in contact with a programming person who can fix the issue?

That's correct. The W-2 will not show you the sum of the wages by tax tracking type. I'll show the sum of the amounts for the tax tracking types that are included in box 1, regardless of whether or not the amounts were taxed. See my prior answer.

There is no one to contact because there is nothing to reprogram.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here