Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowtaxes didn't print on one check and was not posted on tax liabilty how do I fix the problem and pay the month fed tax in QB payroll?

Hi there, Donald14!

The most common reason for non-calculating taxes is when an employee has a pending paycheck, and you try to create another one instead of going back to it. In this scenario, you only need to revert the paycheck. I will guide you through the steps.

There are also other reasons why taxes are not taken out. Check this out: QuickBooks Desktop calculates wages and/or payroll taxes incorrectly

Please don't hesitate to reach back out if you have other questions about your payroll. Take care and have a great weekend!

Thanks for the help what if the paycheck was cut and cashed already with no taxes taken out?

Let me share some ideas on how to fix a paycheck that was cut and cashed already with no taxes taken out, @Donald14.

Take note of the net checks distributed and create a duplicate check number for each and post each to Employee Advance. Then, add it as a payroll item if you do not have it already.

Here's how:

I've also added this link to help you edit a payroll item if ever you'll apply some changes.

Once done, void issued payroll checks then, install the update. After, run payroll for correct taxing again and go into each check detail before saving and enter deduction from net to the employee advance item. Each new payroll check will be zero, but taxes will be correct. Next period when you run payroll you will deduct the remaining advance amounts from each employee.

In addition, let me attach these articles to help you understand tax calculations in QuickBooks Desktop:

Please let me know how it goes. If you have any additional questions about the taxes calculation in QuickBooks, don't hesitate to leave a comment below. Have a good one.

I have a similar issue. The payroll check was cut, but not cashed. Can a correct the taxes not deducted and reissue the check? Can I void a payroll check through the register and the run an unscheduled payroll and issue just that check?

Yes, you can, Shari. I’m glad to help you manage this payroll check in QuickBooks.

Since the payroll check wasn’t cashed yet, you can void it in QuickBooks Desktop Payroll to update the paycheck amount to zero.

Here’s how:

You can read this article to learn more about fixing employees' paycheck: Delete or void employee paychecks.

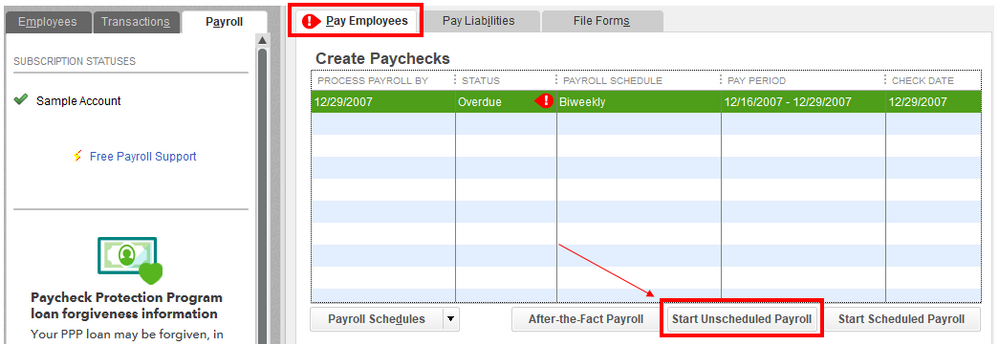

Once done, you can create an unscheduled payroll. You can follow the steps outlined below:

You might want to visit this reference that contains tips to keep your payroll, finances, and whole business organized and compliant: 10 expert tips on how to stay payroll compliant.

If you have any other payroll questions or concerns, please don’t hesitate to visit Community. We’re always here to help. Take care!

Can you be a little more specific wth yourexplanation of what to do to remedy this situation? what do you mean by create a duplicate check number for each and post each to Employee Advance?

Can you be a little more specific?? I ran payroll for one employee, March 31st, and neglected to run a payroll update. The payroll taxes were not deducted. The employee cashed the check. It's disturbing, because it's the end of the quarter. What do you mean by create a duplicate check number for the check and post each to Employee Advance? I'm so confused!

Hi there, @Liz 4084.

I can help you with the taxes that were not deducted from your employee's previous check in QuickBooks Desktop (QBDT).

In this, we can create a liability adjustment to correct and fix employees' year-to-date (YTD) or quarter-to-date (QTD) payroll information. First, let's find payroll discrepancies and start this by running a payroll checkup.

After that, run a payroll summary report for the month you need to make the adjustment. Then, please take note of the amount of every payroll item that needs adjustments.

Once done, let's start adjusting your payroll liabilities to fix this. To do so, you can check out this resource and refer directly to Step 2: Adjust your payroll liabilities: Adjust payroll liabilities in QuickBooks Desktop Payroll. Then, we can resolve the difference in the amounts with your employee.

Let me know if you have more questions about payroll deductions or any QuickBooks-related matters. The Community is 24/7 available to help you. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here