Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDoes the Workers Comp feature in QB allow the employer to input and track employees hours/codes who work on multiple jobs in multiple states in a given week? Trying to decide if we want to purchase the Enhanced Payroll version. Thanks.

Yes, you can manage and track your Workers' Compensation manually as long as you have a payroll service subscription, @JE4255.

QuickBooks has a few tools to help you with your audit. It allows you to pull information quicker and more organized.

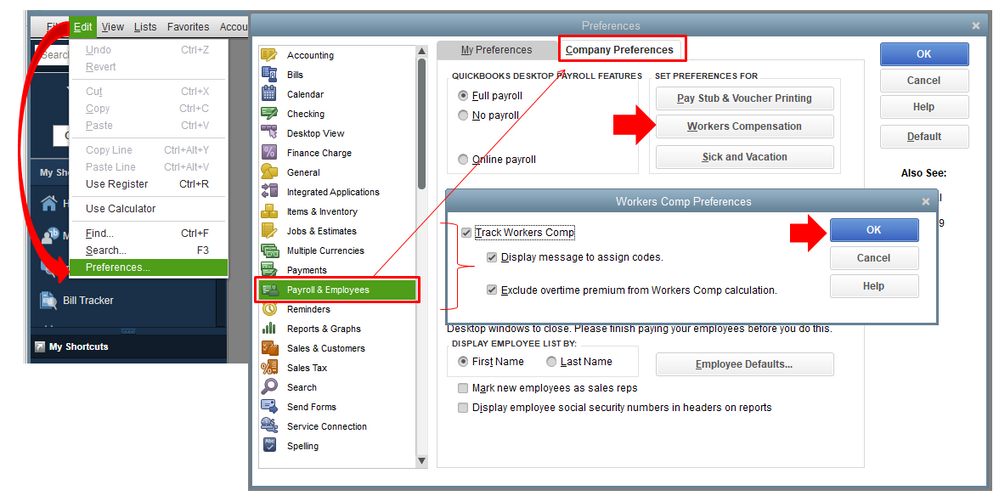

You’ll want to set up worker’s compensation before paying your employees to avoid incomplete and incorrect reporting. You can start by turning on the feature in the program to track them. Let me breakdown the steps for you:

Once the feature is activated, you can directly set up Workers Comp for your employees and their class codes. QuickBooks assigns a code to the employee’s earning items automatically. So when you write a paycheck, it includes your employee’s Workers Compensation premiums for all earning items. However, if one of them is exempt, you'll need to assign an Exempt code.

Here’s an article that tackles Workers' Compensation in QuickBooks Desktop. It contains complete instructions to get started including assigning codes, adding an experience modification factor and paying the premiums.

In addition, here are the available reports for workers’ comp with their description and how you can run them in QBDT.

Should you have other questions about Workers Compensation in QuickBooks, please let me know. I’ll be happy to assist you further.

Hi Madelyn,

Thank you for your reply. I reviewed the info you forwarded but still have questions due to the complexity of our payroll. I researched info about setting up codes but have found nothing to demonstrate how to set up individual codes for multiple states. Maybe if I give a scenario you might be able to shed some more light on it. I have an employee, J. Doe, last week he worked 46 hrs. in GA, NC, SC (he rec'd 3 paychecks last week, one for each state, he receives W-2's for each state at the end of the year); John's duties are as follows last week:

GA paycheck- code 5478 - 3 hrs.

- code 5221 - 5 hrs.

NC paycheck - code 5478 - 4 hrs.

-code 5221 - 6.5 hrs.

-code 5445 - 2 hrs.

SC paycheck - code 5478 - 7 hrs.

-code 5445 - 3 hrs.

- code 5221 - 8 hrs.

-code 5474 - 7.5 hrs.

Does QB allow me to set up 4-6 codes per state (GA, NC, SC) so when I process paychecks it will apply the codes and hours to those particular states? Thanks again for your assistance.

I appreciate the complete details you've shared, @JE4255.

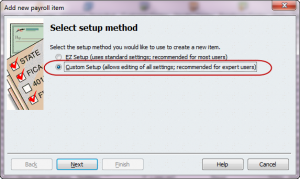

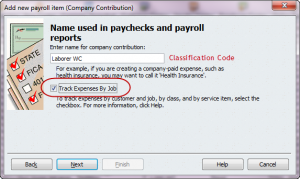

Yes, you can set up multiple workers' compensation codes in QuickBooks. Also, you can track Workers Compensation when it was a rate based on hours worked. I can guide you on how to do it.

When you create paychecks, the workers’ comp calculations are automatically added to the Company Summary section of each paycheck. QuickBooks will multiply gross wages by the workers’ comp rate to accrue and job cost workers’ comp expense for this paycheck. There are two different methods of how QuickBooks calculate Workers Comp.

Here's how to set it up:

You can follow the same steps in adding all the workers' comp classification you're using.

Get back to us here if you have other questions about setting up workers' compensation in QuickBooks. I'm always here to help.

Hi,

Ever since the last update i cannot access the workers comp tracking feature. I have a payroll sub too.

Can you help me?

Thanks,

I'm here to help, @John F3.

Let's perform some troubleshooting steps so you can access your worker's comp tracking feature. To start, let's run the verify rebuild tool to resolve any data issues within your company file. Let me guide you with the process:

Once done, access your Workers Comp tracking feature again. For your reference, please see this article: Manual Workers' Compensation in QuickBooks Desktop.

Let's also make sure that you have the latest payroll tax table so you have the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and payment options.

However, if the issue persists I recommend reaching out to our Payroll support team. This way, they can check your account and verify the root cause of the issue. Here's how;

Also, QuickBooks makes it easy to get the Workers Comp info you need through reports. For the detailed guide, please see this article: Workers’ Compensation report.

Feel free to get back here if you need further assistance in accessing the Workers Comp feature in QuickBooks. I'm always here to help you. Have a good one.

Hi is there any way I can set a payroll cap on employees for workers comp? Here in Nevada we have a cap of $36,000.00. I can not seem to find where to set a cap so it does not continue to calculate workers comp after the 36k.

Hi there, MCantoran.

I'll be glad to share some information about what I know about setting up your payroll.

At this time, there's no option to set a cap or limit for worker's compensation. You can read through this article to learn about the workers’ compensation report in QuickBooks Desktop.

When you create a paycheck in the future, please make sure not to add the worker's compensation code. This way, QuickBooks won't calculate it."

For additional details, you may visit this link: Manual Workers' Compensation in QuickBooks Desktop.

Don't hesitate to update me as to how things go. I'll always be here. Have a good day!

Hello - is there a way to set up workers comp codes by payroll item? I can see how to set them up per employee, but my employees each work on multiple payroll items that would be associated with separate WC codes. Thanks - Jodie

Hello there, @jbenson44.

In QuickBooks Desktop (QBDT), you can assign a Workers Comp code to your employees. As for your concern, the option to set up workers comp codes by payroll item is currently unavailable. And if your employee needs an additional Workers Compensation code, you can edit and add the code manually to the paycheck.

For more details about setting up Worker's Compensation in QBDT, see this article: Manual Workers' Compensation in QuickBooks Desktop.

Here are also some articles which you may find helpful about workers compensation:

Feel free to leave a comment below if you have follow-up questions about tracking workers comp. I’m always here to help. Have a great day.

My question here is that which liability account the company contribution should be. To me, since it is company contribution on Workers Comp, it shouldn't link to any liability account?

HOW do I or can we pay Workers Comp & Safety Insurance thru QBO payroll? HOW do we set it up to pay or do I still need to go to WSI (Workforce Safety & Insurance) site and manually pay our monthly pymts?

Let me respond to that question right away, @DeeDeeI. Hopefully, you're having a wonderful day today.

Allow me to jump in and share some details about paying worker's compensation in QuickBooks Desktop (QBDT) Payroll. This way, you can pay the monthly payment without a moment's delay.

You'll need to visit the Workforce Safety & Insurance site to settle your monthly payments since QBDT Payroll account is for recording purposes only. Before proceeding, ensure that you've followed the process below to ensure you are paying the correct amount:

Once confirmed, you may now pay the exact amount on the Workforce Safety & Insurance site as soon as you're ready to avoid any penalties.

In addition, check out these articles below on how to handle premiums worker's compensation and state agency information:

Do you have other questions about worker's compensation or employee paychecks? Add them in the comment section below, and we'll answer that in no time. Keep safe, DeeDeeI.

There is another screen titled: Default rate and limit. I cannot get the NEXT button to populate for selection. And I am not sure how to enter this so it works correctly. My work comp rate is $12.93 per $100. How would I enter this on this screen?

I know a way how to enter the work comp rate in QuickBooks Desktop, sarahstoke.

If you can't enter an amount in the Default rate and limit section, we'll need to manually enter the rate by setting up a code for your employees. From there, you can enter the rate shown below:

Here's how:

QuickBooks automatically assigns that code to the employee's earning items if you assigned a job classification code to your employee. When writing a paycheck, it adds to their Workers' Compensation premiums for each earnings item. Let me show you how:

On the other hand, Workers' Compensation insurance companies usually change the rates they charge for each code yearly. If you get the new rates from your insurance company, enter them in QuickBooks. Just follow the steps and details in this article:

'

QuickBooks makes it easy to get the Workers Comp info you need through reports. You can check out this article for more details: Workers’ Compensation report.

Feel free to get back here if you need further assistance in accessing the Workers Comp feature in QuickBooks. I'm always here to help you. Take care always.

That does not work. When I select workers comp in the employees menu, the only selection is to set up new workers comp payment service which is a form to receive a quote for the service.

I want to stop this from happening to you, @John F3. I'll share some workarounds.

I want to ensure you can manually track the worker's compensation in QuickBooks without delay.

The Manually Track Existing Workers’ Comp Policy option is available in all QuickBooks Desktop (QBDT) Payroll. Just ensure that your Worker's Compensation feature is enabled.

Once confirmed and the issue persists, I recommend that you update your QBDT (R5) and payroll tax table (22211) if you have not already done so. Thus, your software has latest has the latest functionality and patches.

Do the following to update the QBDT:

For more details, see this link: Update QuickBooks Desktop to the latest release.

To get the latest payroll tax table, here's how:

For more guidance, click this article: Get the latest payroll tax table update.

If the problem continues, I'd suggest running the verify and rebuild tools. You can follow the steps provided by Divina_N above.

If you want to automatically pay Workers' Compensation premiums every time you run payroll, utilize the Pay As You Go service. For more knowledge, click this link: Understand workers’ compensation insurance.

If you have any other payroll concerns, don't delay in letting me know. I can help you come up with the best solution. Keep safe.

I admire you for going through the steps shared by my colleague, John F3. It's my priority to ensure this gets resolved.

Since the option to track the worker's compensation is still unavailable, I'd recommend contacting our QuickBooks Payroll Team. They're equipped with tools to check the cause. It'll also allow them to submit a ticket to our engineering team to alert them about the issue if necessary.

Here's how:

To ensure that you'll be assisted on time, please see our support hours.

Additionally, I've added these resources that'll help you learn more about managing the Worker's Compensation tracking feature in QuickBooks Desktop. This way, you can make sure everything is set up accurately:

Please keep us posted on how it goes. The Community is always here to help. Take care!

This does not make it billable on a customer invoice...

Not sure what that has to do with my question, but thanks for the reply anyway.

We want to make sure we can provide the answers you're looking for, John F3.

I'd recommend sharing more details of your concern about the Workers' Compensation feature. Doing so helps us provide an accurate solution to resolve this.

I hope you can respond to me on this thread so we can work on your concern together. Please know I'm ready to assist further. Keep safe always!

I currently do this worker's compensation tracking in desktop like you've explained. I would like to switch to QB's online? Is there a way to do this in the online version? The only workers' comp class I can find is on the employee level. I would need to do it manually when I input their time as we can have employees that have 3 different codes on one paycheck. We have two yearly audits that require this information therefore essential that we have the ability to do this.

The Workers Compensation functionality can also be found in QuickBooks Online, yluf.

When your policy is in effect, your payroll information is employed to determine your precise premium whenever you generate paychecks.

This is also a pay-as-you-go service with AP Intego. With this, the exact premium cost of your workers’ comp policy is calculated based on your actual payroll data. That amount is automatically withdrawn from your bank account and sent directly to your insurance provider. Unlike traditional workers’ comp policies, there’s no large premium due up front, and you avoid late fees, saving you time and money.

This allows you to send your workers' compensation premiums to participating insurance carriers for workers' compensation every time you process payroll. Let me share these steps with you:

Let me share these articles for additional details about this feature:

If you have an existing policy other than AP Intego, I would recommend reaching out to your carrier to check if it can be integrated with Intuit. If it is, please contact our Payroll Support Team so they can start with the integration process. Here's an article to get their contact details: Contact Payroll Support.

Since you are planning to move to QBO from Desktop, I'd like to share these articles as well for additional information about the migration:

Please don't hesitate to inquire further within this thread or create new posts in the Community if you require additional assistance while transitioning to a new platform. We are always available to ensure a seamless migration process.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here