Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

This is a user community, call intuit for anything dealing with your account, no one here can access it

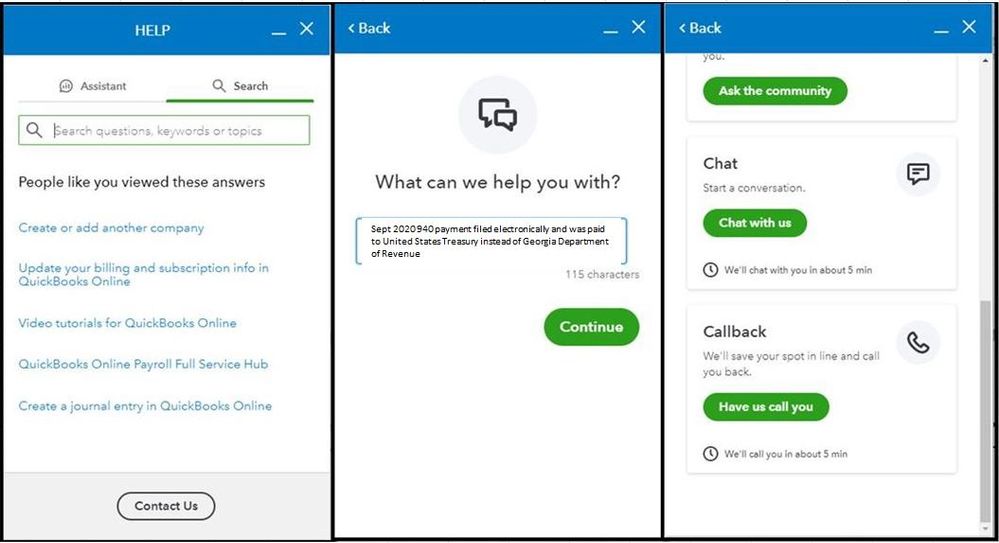

I can help you connect with a live representative here in QuickBooks, @dlrautorebuilder.

You can get in touch with them by following these steps below:

You can also share your concerns with us. We're also well equipped to provide you a solution.

Also, if you're looking for helpful articles, you can find it on the QuickBooks Q&A page. This contains hundreds of QuickBooks related-topics. Simply type your concern in the description box.

Please reach out if there's anything else I can do to help.

Let's see I can get them to call me back asap. I've lost an hour of my time to be redirected to the same automated phone system. This Quickbooks payment method freaking ,,!,, sucks. Takes 6 days to get your money.

NO ONE WILL SPEAK WITH US YOU GUYS HAVE PARALYZED OUR BUSINESS. CUSTOMER SUPPORT PUTS ME ON HOLD FOR HOURS AND WONT GET ON THE PHONE. WHAT KIND OF COMPANY IS THIS IS ANYONE ACCOUNTABLE? WILL SOMEONE PLEASE CALL ME [removed] MY NAME IS BRIAN.

Hi there, @brianchurilla.

I'll help you get in touch with our support team. You can get a callback from one of our agents by following the steps below:

You can also receive assistance here in the Community, so please let me know if there's anything else I can do to help. Take care, and enjoy your weekend!

How to obtain my 1099 from 2019

Hey there, AileenGalindo.

Thanks for dropping by the Community, I'm happy to help. Follow these steps below and you'll be able to print out your 1099 from 2019.

Here's an article that you may find useful if you have more questions on printing the forms: Print and mail 1099s in QuickBooks Online.

If there's anything else I can help with, feel free to post here anytime. Thank you and have a nice evening.

I’m trying to start a new company. I did start the process but unable to list services, fee amount and sales tax .

Thank You

Nice to see you in this thread, @Missy2020.

I'm here to lend a hand in setting up your new company.

When setting up a service item, you'll need first to turn on the sales tax feature so you can select sales tax.

To turn on, here's how:

When finished, add a service item again. You'll now able to choose sales tax.

For more details about the process above, check out below links:

Keep me posted if there's anything else you need and I'll get back to you. Have a great day ahead.

I have a problem with our Sept 2020 940 payment filed electronically. The payment was paid to United States Treasury instead of Georgia Department of Revenue.

Let me route you to the right support, @RT2413.

To help you fix your 940 payment, I highly recommend reaching out to our Payroll support team. They use specific tools to pull up your account and help you fix the 940 forms. Follow along below to connect with them:

For your reference, please visit this article: "Where to File your Taxes" for Form 940.

Also, QuickBooks Online offers several payroll reports that you can pull up to access your business and employee information. To get started, see our Payroll reports page.

Feel free to post here again if you need further assistance in managing your 940 forms in QuickBooks. I'm always here to help. Have a good one.

I need to find out out why payroll taxes are not being deducted from any of our employees. I've tried using the Help screen. But when I click on any option, it just takes me out of help.

I'd be glad to help with your payroll concerns, @nsc94.

Taxes deducted from your employee's paycheck are calculated based on their payroll setup. We can review its details to ensure they

Let's review the details to make sure they're taken out of your employee's paychecks. Here's how:

If all of the details are correct yet the taxes aren't deducted, I'd recommend performing some basic troubleshooting steps.

Too much cache accumulated in your current browser might be the cause of the issue. Let's clear this out by following these steps.

First, open your account in a private window. This doesn't save your web searches and login credentials. Here's how:

If taxes are now being deducted, go back to your regular browser and clear its cache. You can also use another supported browser to access your account. This might be a temporary issue with QuickBooks and the current browser that you use.

If the issue persists, contact our phone or chat support teams. They can take a closer look at this to determine why the federal taxes are not calculating for the rest of the employees.

I'd also like to share these articles for additional guidance and future reference when running payroll in QBO:

You can always reply to me or post questions in the Community if you need help again. We're always here to guide and assist you.

I need to speak with payroll concerning on of last payroll direct deposit to employee

Can someone call me? [personal information removed]

[personal information removed]

Hello there, asteam.

Can you share more details on your payroll worries about direct deposit for your employees? Without contacting our Payroll Team, I'll do my best to assist you. This also helps me provide the appropriate information to fix your problem.

If you'd like to speak with them directly, you can follow the step outlined above by my colleague ReymondO and make sure to select Get a callback to receive a call from our support staff.

You can also look at this article for further information on how to fix the direct deposit issues: Fix direct deposit issues.

Furthermore, feel free to review this resource to find out when to delete or void a direct deposit paycheck: Delete or void employee paychecks.

If you have any other questions concerning a direct deposit, please let me know. I’m more than happy to help you out. Keep safe and have a great day!

so what is the best way to connect with a rep.?

Hope you're doing good, Nitro2020.

The best way to connect with a representative is by utilizing the Help icon within your QuickBooks Online account.

You can contact us over the phone for assistance during available hours.

Support Hours

Here's how to contact them:

Also, I'd like to offer help on whatever issues you have. What help do you need regarding QuickBooks Online? I'd appreciate it if you could provide more details about the problem. That way, I can give the right information to fix it.

To learn more about QuickBooks Online such as bank activities, reports, account management, and many more, check out this link: QuickBooks Online Help Articles.

Know that you can always post your concerns here. I'll be around whenever you need assistance, Nitro2020.

Any specific concerns?

I have tried all of the suggestions I have received from the community for the past two days.. The message I receive is that I will call you back in 5 minutes. No call has come, The message at the bottom has OK , I have noy clicked this. Am I to click the OK button? The issues I have will require access to my computer.

Thank you for joining the thread, @lenw1. Let me point you in the right direction for support with QuickBooks Online (QBO).

You can follow these steps to reach out to our Technical Support team. They can pull up your account and assist you in real-time.

Here’s how:

For further details about the support hours, you can check out this link.

If the message pops up, you can click the OK button if necessary to get a call back.

Let me know if you need further assistance with your QBO account. The Community always has your back. Have a great day!

Any specific issue?

I am trying to go into Payroll and change my Employer Tax Rate???

Hi there, @Qtrmidget.

I'd love to help you achieve your goal, but would you mind sharing more details about your concern with changing the employer tax rate and its item type? It can help us get on the same page and provide accurate resolution.

I'll wait for your reply, or if you have any other questions, please let us know. We're always here to help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here