Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have an employee has is being garnisheed for child support for 2 children. I have setup the payroll accounts to do the deductions from the paycheck, and created a vendor to cut the checks, but I want to know where to expense the amounts on the checks. For the time being I posted the amounts to Payroll expense, but I know that's not right. I considered creating an account called "Child Support" and posting the expense there, but where does the other side come from. My payroll deductions items are called Child Support and Child Support 2 but where do they appear in the chart of accounts? Payroll Liabilities? So do I just offset the Child Support expense and post the other side in Payroll Liabilities?

I apologize if my wording of this question is faulty, and displays my lack of accounting knowledge. I hope someone here will be able to help me.

Randy Clay

Solved! Go to Solution.

It's the Payroll Liabilities account, RClay.

It lets you track the deductions to be paid for Child Support. Though, you can create a Payroll Liability sub-account and name it Child Support.

To create a sub account:

The deducted amount from the employees' paycheck will be sent to the liability account and will be shown on your Chart of Accounts or Balance Sheet report.

Let me know if you have further concerns. I'll be here.

It's the Payroll Liabilities account, RClay.

It lets you track the deductions to be paid for Child Support. Though, you can create a Payroll Liability sub-account and name it Child Support.

To create a sub account:

The deducted amount from the employees' paycheck will be sent to the liability account and will be shown on your Chart of Accounts or Balance Sheet report.

Let me know if you have further concerns. I'll be here.

I have used "wage garnishment" as the name of my payroll deduction for child support from employee #1. And set up the proper way to pay, etc. Have accomplished the payments and deductions for several months with no problems.

I just received a notice from the same agency that I should deduct child support from employee #2.

I set that up with proper case # just like the I did for employee #1 named "wage garnishment 2".

Today's paychecks are created properly, but PR Liabilities totaled the 2 garnishments per employees and is going to the employee #1 case ID# only.

What should I do to overcome this error, besides filling in the proper payment per employee and the case id# manually?

Hi there, Bigdog54.

I'm here to make sure your items for garnishment are posted to the correct employee.

Let's make sure the number that identifies you to the agency and the liability account is correct. To confirm this, you can go to the Employee Settings of your second employee and make sure the Wage Garnishment #2 is on the Payroll Info tab.

Here's how:

As always, you can get in touch with our Care Support Team in case you require assistance from a live support. Here's how you can get in touch with them:

Let me know how it goes or if you have further questions about this or if you need help with something else, I'm always glad to help.

THANK YOU..I had set everything up correctly, but accepted the quick fill of wage garnishment on both paychecks...hence one total amount due.

After noting your "Wage garnishment #2", I realized I didn't look for that when creating his paycheck.

Thank you for your prompt reply.

Hello there, Bigdog54.

I'm glad I was able to help. You might want to visit this website to know more about QuickBooks Desktop for Mac: https://qblittlesquare.com/.

Please know that you're always welcome to visit us anytime you need help.

The garnishment (which I created last week) is showing the wrong wages earned dates. Is there a way to correct this in my pay liabilities window?

The state ordered garnishment was dated 2/4/19 and says he's liable for $xxx per month. I can use the amount specified for weekly paychecks. My payroll schedule is set at the Friday following a completed week. i.e.: paycheck dated 2/8/19 was for wage week of 1/28 to 2/3 which had child support deducted. However, the pay period for the first liability pmt to the agency is for this week's paycheck. What did I do wrong now????

I edited the garnishment names to identify each employee's specific garnishment. On the attached screenshot, you'll see the second garnishment is labeled wrong (showing Employee #1 name)...HELP

Good day, @Bigdog54,

Thanks for adding to the conversation. I can share some insights about the scheduled liabilities in QuickBooks.

You're on the right track with setting up the schedule. However, the period displayed on your scheduled liability taxes is based on the check date of your employees' payroll, and do not reflect their pay period.

This is following the IRS regulation for using constructive receipts to determine when a cash-basis taxpayer has received gross income. This doctrine helps them identify your payment schedule based on the amount of income and FICA taxes you reported during a specified look-back period.

You might find these articles helpful:

That should do it, @Bigdog54.

Please let me know if there's anything you need help. I'm always around to help you with QuickBooks. All the best!

One more question: I would like to change the due date of these garnishments. I remember setting a day of the week to pay it, but I don't know where to find that. So can I do that and how to do it?

Hi there, Bigdog54.

I'll be glad to walk you through setting up your garnishments payment schedule:

Here's a reference article for more details: Set up and Pay Scheduled or Custom (Unscheduled) Liabilities.

You can always get in touch with us here when you have questions in the future.

We do not currently use Quickbooks payroll. ADP pays the wage garnishments for our employees. They take the wage garnishment out of the employees check and pay him 1 check, then they pay another check for the wage garnishment to the state. I'm not exactly sure how to keep track of that since the check isn't going directly to the employee. Should I write the check out to the employee in Quickbooks (even though ADP does not) and then class it to wage garnishments? I want to be able to see what the employee was paid throughout the entire year and have it all classed to him, but also need to note the wage garnishments.

Does this make sense? Please help!!

Thank you!

It's nice to have you here, @lmeyers,

Thanks for joining the discussion. Allow me to chime in for a moment and share some insights on how to record your employee's payroll details in QuickBooks.

Since you're using a third-party payroll processor, you can enter the paycheck information in QuickBooks by writing the checks manually. You can record it the same way ADP creates them.

Additionally, if you're unsure of what account to use for the employee's wage garnishment, it is best to contact an accountant for further assistance. They can provide the best legal and accounting advice for your business and can add in-depth information on recording your payroll manually.

I've also attached here a related article if you want to set up manual payroll for Quickbooks Desktop: Set up payroll without a subscription.

That should help you get on the right track. If you ever need further assistance about payroll processing in QuickBooks Online, please feel free to mention me anytime. Have a great and productive day!

Does each state need it's own sub-account in child support?

Good afternoon, @JTowCo.

Thanks for joining this thread.

Yes, you're correct, each state should have it's own account or sub-account to keep payments to each of the agencies separately. This way, you can go back and reference them at any time, and they'll all be organized within their own account.

Having each state in a sub-account isn't a requirement, but it's best for tracking and organization when running reports.

For more information about the available reports in QuickBooks Desktop, you can refer to this article: Understand Reports.

Feel free to reach back out if you have any more questions. Have a safe and productive rest of your week!

I have a different problem. My state requires that I make the child support payment at the end of the payroll period. I pay on a biweekly schedule, but under Payroll Set up, Schedule payments that option does not exist. How do I set the payment up for a biweekly obligation. I do not want a weekly payment routine.

Hi there, chairman25.

I can help set up your scheduled payments for child support payment to biweekly.

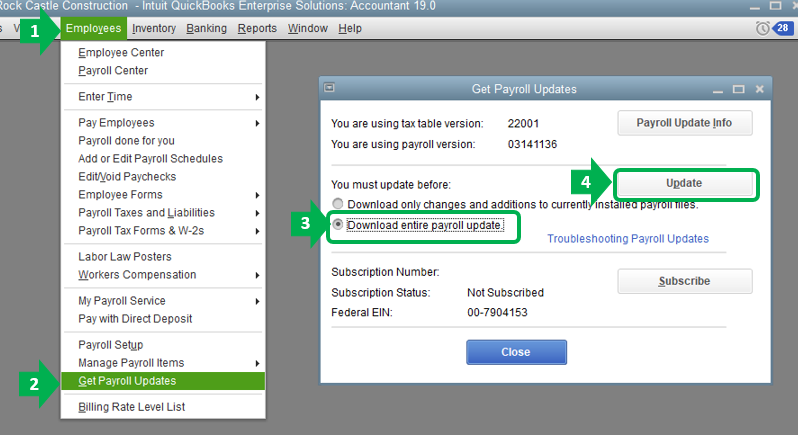

Since you're don't seeing the biweekly option under Payroll Setup, let's manually update your payroll to the latest release to get the most recent tax updates in the software. Kindly follow the steps below:

Learn more about this whole process through this article: Updating your payroll to the latest release.

Once done, try setting up the schedule again by following the steps below:

For more details and information about setting up child support payroll items and their schedule, here's an article you can read for reference:

Be sure to get back to me if you have follow-up questions about setting up payroll items. I'm always happy to help. Have a good day!

This is not my question, my question is do I make two checks for child support. One for the employee and one for the garnishment of child support.

Hi @Virgie0730, I'll share details about your employee garnishment,

You don't need to make another check for child support. Creating a payroll for an employee in QuickBooks will automatically deduct the amount of garnishment for child support in every employee's paycheck.

Use this link to read and learn more about your payroll item: Set up a Payroll Garnishment Item in QuickBooks Desktop Payroll.

I'm adding this reference for tips and guides to utilize in preparation for the coming year-end: Complete Certain Tasks in QuickBooks Desktop Payroll to Prepare for the New Fiscal or Calendar Year.

Don't hesitate to post a comment below if you have other questions about payroll items and transactions in QuickBooks. I'm always around, ready to help. Take care and stay safe!

Ok I went online to register for child support, but if not I need to send a check to the child support division.

So would there not be two checks, one for employee and one for the child support division.

Thanks for getting back to us, Virgie.

In QuickBooks, payroll deductions, like Child Support, are automatically calculated on the paychecks.

QuickBooks doesn't automatically send payments to the Child Support division. You need to write a check and manually send it to them.

In addition to this, you only need to write one check for the payment. No need to create another check for the employee.

You can refer to this article to learn how to make the garnishment payment: Set up and pay scheduled or custom (unscheduled) liabilities. It provides instructions to keep track of your payroll liabilities.

Get back to me if you need more information about creating a check for the garnishment. I'm always right here to help you.

Is there a way to add a Payment Frequency of bi-weekly? Our payroll is biweekly and I need to pay my child support bi-weekly as well. I only see weekly, monthly, etc.

Hey there, ktray.

Thanks for joining this thread. I'd be glad to lend a hand with setting up bi-weekly payment frequency.

So I'm able to give you the correct steps, which payroll service are you currently using - QuickBooks Online Payroll or Desktop Payroll?

Let me know and I'll get back to you directly!

Thanks for letting me know, ktray.

I did some searching and as it shows in your screenshot, there isn't currently an option to set up a bi-weekly pay schedule. I can see how having this option would be helpful so I recommend submitting this as a suggestion to the Product Development Team.

This can be done directly through your account by:

1. Clicking the Help tab in the menu bar at the top of the page.

2. Select Send feedback online.

3. Choose Product Suggestion.

Additionally, the following linked article provides the details to pay your non-tax liabilities in QuickBooks Desktop Payroll.

Please feel free to reach back out if you have any other questions. I'll be here to help in any way that I can.

Thank you for the response...I will submit a suggestion as you described for a bi-weekly option to match payroll.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here