Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowINVENTORY

I have a PPE client. They bought stock at 2.00 but as mask wearing is down she wants to take a one time write down to $1.00. How do I do this in QBO?

Solved! Go to Solution.

Hi LizSnay,

Thank you for following up on this. I'll be happy to add more details.

QuickBooks follows the First In, First Out (FIFO) concept, so the realized cost of the sold item will always be based on the purchase cost. Therefore, if your client bought the item on 3/16/21 and sold them, you only need to edit the cost of the item in the purchase transaction on 3/16/21.

Changing the starting value of the item itself has no effect on previous transactions. The cost revaluation should be done on the purchase transaction (bill, check, expense)

Let us know if you have any other questions in mind. We're just right here to help you with your inventory.

I'd be happy to walk you through the steps on how to write down your inventory value, Liz.

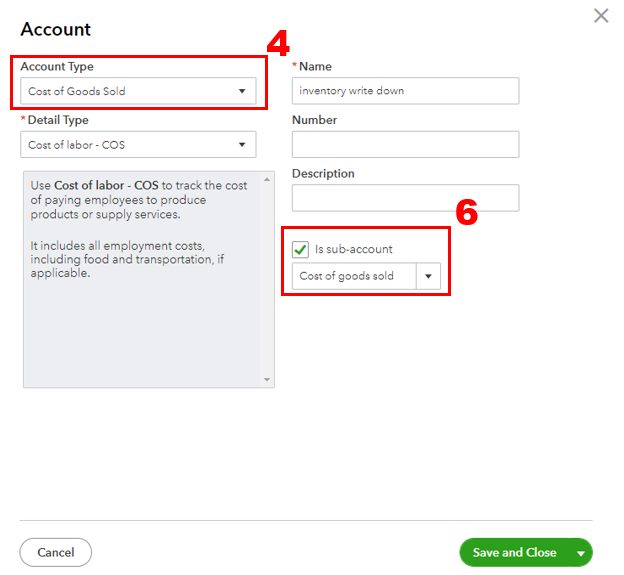

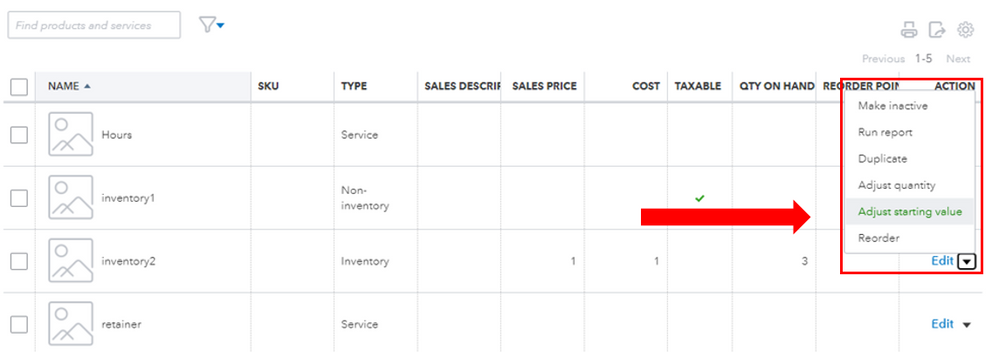

You can go to your Product and Service page and adjust the value of your inventory from there. To begin with, you'll need to create a sub-account of your Cost of Goods Sold (COGS) account and use it for the adjustment. I'll show you how.

You can also check this article for more details: Add an account to your chart of accounts in QuickBooks Online.

Once done, we can now adjust your inventory value. I'd propose working with your accountant for additional guidance. This way, we can ensure the accuracy of your accounts after making these changes. If you're not affiliated with one, you can visit our ProAdvisor page and look for one from there.

When ready, you can follow these steps:

Let me also add this link that you can read for guidance in case you need to adjust your inventory quantity: Adjust inventory quantity on hand in QuickBooks Online.

I'm just a post away if there's anything else you need assistance with adjusting your inventories. You can also add in your response if you have any other QBO concerns. I'll be more than happy to help you out anytime.

Will changing the starting value change all past cost of goods entries? I want to value to reduced on the stock on hand as of 3/15/21.

For example let's say that I want to change 387,360 Part1200s from a value of $874684.80 to $437342.40 as of March 16th without effecting 2020 or the financials from 1/1/21-3/15/21. Do your steps work?

I am the accountant so I'm prepared to make journal entries is needed but will I have to update all of 2020 when there were 1000s of sales of PPE?

Thank you,

Liz

I appreciate your clarification and prompt reply, Liz.

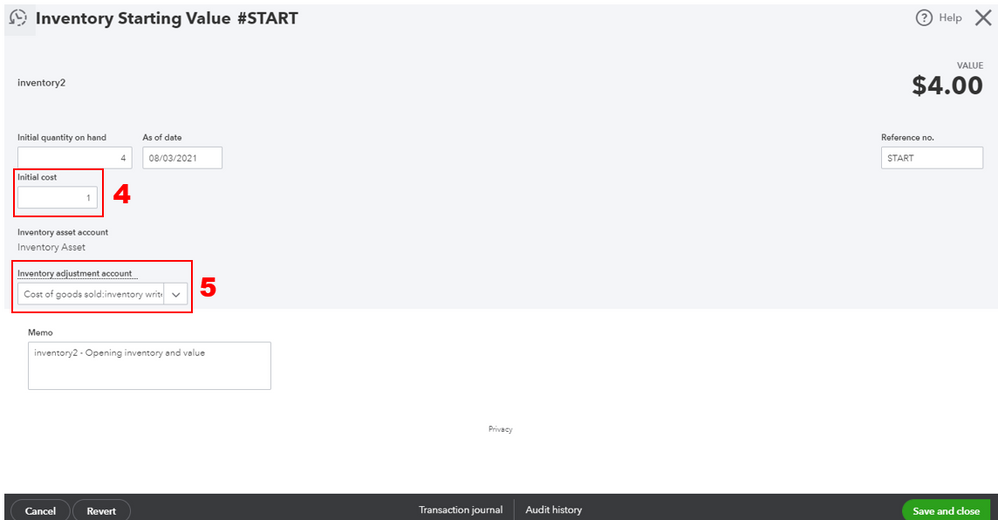

I'd be delighted to clear things up for you. You'll just have to ensure there are no transactions created on the date (3/15/21) you've selected for the adjustment. This way, it won't affect any of your past entries.

You can adjust the date of the adjustment in the As of date field. Moving forward, only inventory items on hand will be affected by the changes.

To learn some tips in seamlessly running your inventories in QuickBooks Online (QBO), check out these articles for reference. These can guide you through the process of restocking, edit inventory adjustment, and check the status of your inventory:

You're always welcome to tag me in your reply whenever you have other questions about handling your inventories. I'll be more than happy to work with you again. Stay safe!

Your instructions snagged at using a date after transactions. I've attached before & after reports of my attempt to follow your instructions. Without impacting vendor invoices which I already marked down I wonder if on 3/16/21 I could post somehow:

1200H -387250 units -$874684.80

+387250 +$.00

1400H -25980 units -$74302.80

+25980 +$.00

Liz

Hi LizSnay,

Thank you for following up on this. I'll be happy to add more details.

QuickBooks follows the First In, First Out (FIFO) concept, so the realized cost of the sold item will always be based on the purchase cost. Therefore, if your client bought the item on 3/16/21 and sold them, you only need to edit the cost of the item in the purchase transaction on 3/16/21.

Changing the starting value of the item itself has no effect on previous transactions. The cost revaluation should be done on the purchase transaction (bill, check, expense)

Let us know if you have any other questions in mind. We're just right here to help you with your inventory.

I still have to finish my final financial statement review this evening but I think I figured it out. I used all your steps and changed my start cost on these 2 items to $0, then I used Inventory Adjustment to change stock levels to 0 as of 3/15 and then set up a bogus vendor and received the same quantity of stock, but at $0 per unit, on 3/16. Inventory Valuation Report is correct, stock can be sold and tracked and I can generate Consignment Inventory Bills on a monthly or quarterly basis.

Thank you for your help.

Liz

Hello, I have a similar inventory write down. When I am in the product and trying to write down the initial cost, I get an error "Select a date that's before any transaction that used this item." There are sales that occurred prior to 7/8/22 that I do not want to adjust. Only inventory that was purhcased after 7/8/22 was impacted by price market drop needs to be adjusted down. How can I do this ?

Thanks for joining in on this discussion, Accel.

I'll be happy to help you modify the starting date of your inventory so you can successfully write down an item's initial cost in QuickBooks Online (QBO).

As my colleague indicated, QBO observes the First In, First Out method. As the name suggests, QBO will always consider the first units purchased (First In) to be the first units sold (First Out). That said, altering the item's initial cost has no impact on earlier transactions.

Please follow these steps to get rid of the error message:

Moreover, you'll encounter negative inventory if you unintentionally oversell products. Don't worry. I'll share an article that offers a thorough procedure to resolve the issue: Fix negative inventory issues in QuickBooks Online.

Please know I'm just a couple of clicks away if you need further help to manage your inventory in QBO. I'd be more than glad to assist you. Stay safe, and have a nice day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here