Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSomeone created a loan in my company's QBO account by Crediting the Loan/liability and Debiting Opening Balance Equity. The Loan acct shows this as the first transaction and showed it as Reconciled. This is a loan we owe but money was never deposited into a bank account. The Loan acct will not let me enter an opening balance since it is already established. This is not part of the opening equity. How do I fix this to show opening equity zero and the loan beginning balance as $30,000?

I'll help you fix the beginning balance of your loan account in QuickBooks Online (QBO), @parksbarbie.

Before that, let me share some insights on how the Opening Balance Equity is used in the program. This account is the offsetting entry used when entering account balances into the Quickbooks accounting software. This account is needed when there are prior account balances that are initially being set up in Quickbooks.

Therefore, when dealing with another current liability account, such as any loan, a credit entry to the account will decrease its balance. This will also apply to any asset account when entering its opening beginning balance in the opposite way.

We can only zero out the Opening Balance Equity if all accounts doesn't have any beginning balance when they were created.

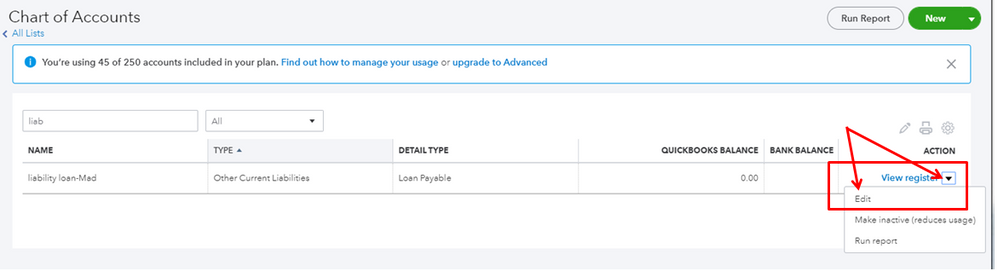

However, we can correct the opening balance in the Loan/Liability account by deleting the journal entry that affects it. Just follow these steps:

Once done, you can now go back to this account and manually enter its opening balance. Here's how:

In addition, I've included an article on what to do if you've been tracking transactions in QuickBooks for a while but didn't enter any opening balance on your accounts: What to do if you didn't enter an opening balance in QuickBooks Online.

If you have any other questions please let me know. I'm always glad to help any way I can.

I deleted the journal entry and when I go back to the liability/loan account in the chart of accts and hit edit there is NO OPTION for an opening balance? How do I enter that now?

Barbie

Allow me to walk you through the steps, @parksbarbie.

Once the journal entry is deleted in the system, it will automatically zero out the balance in the register.

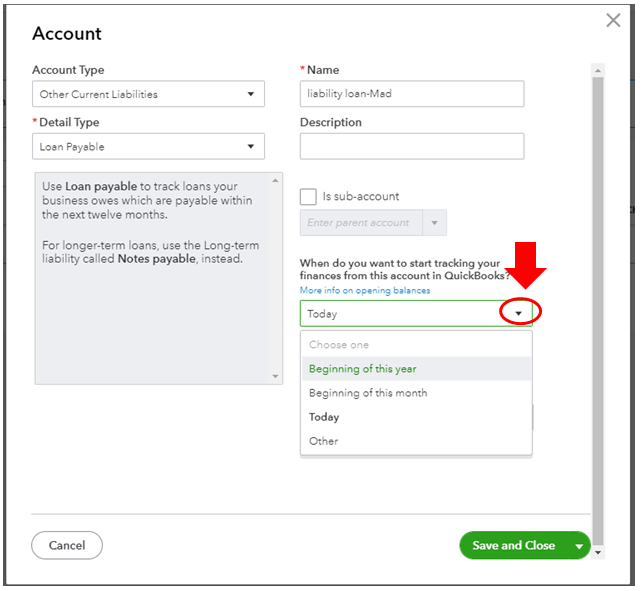

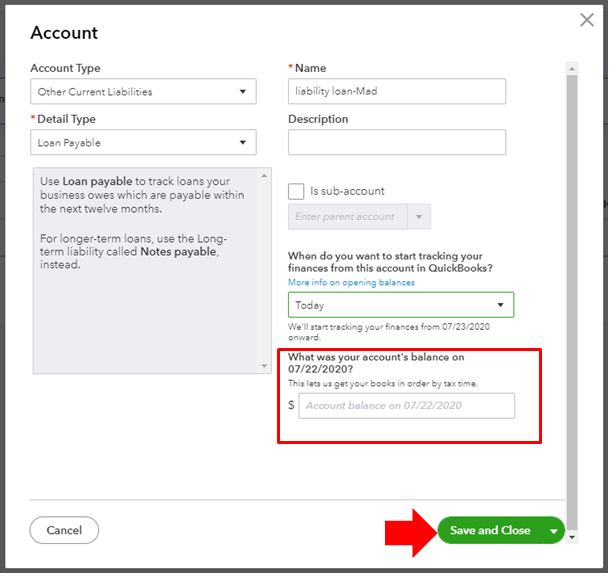

You'll have to choose a period when you want to start tracking your finances, so it will give you an option to enter the opening balance. Here are the steps:

You can check this article for more information: Enter opening balances for accounts in QuickBooks Online.

This resource also gives you a better way on how to organize Chart of Accounts (COA) moving forward: Understand the chart of accounts in QuickBooks. I’m sure you’ll find it helpful.

Let me know if there’s anything else I can help you with. I’m just right in the corner, take care.

Hi there, @parksbarbie.

I'm glad to share with you the other way to edit the opening balance of your liability account in QuickBooks Online (QBO).

Here's how:

For more information, please refer to this article: Edit an incorrect opening balance.

Also, if in case you want to break down your expenses, income, and other transactions to make your accounts organized. You may visit this link for the detailed steps: Create subaccounts in your chart of accounts in QuickBooks Online.

Keep me posted if you have any other QuickBooks concerns. I'll be here to help. Have a great day ahead.

If the company has to transfer all opening balances from other accounting software to QB, how are we to do it? Thanks!

We make things easier for you, Pearson Crystal.

For now, you can only import your bank data, customers and vendor lists, chart of accounts, and product and service information. You can use a CSV file (Comma Separated Values), Google Sheets, or an XLS/XLSX file to import this information to QuickBooks Online. You'll want to manually enter all the opening balances from other software.

In addition, once you connect your bank and credit card accounts, QuickBooks automatically downloads your historical transactions. For more information, please check this article for your reference: Enter an opening balance for an account in QuickBooks Online.

Also, QuickBooks Online has different kinds of reports that you can use to show the status of your business. Please visit this article so you'll be guided: Run Reports in QuickBooks Online.

Please touch base with us if you any concerns about transferring your data to QBO. Remember, we're here to make things run smoothly for your business.

What about this scenario: not quite sure how to enter it.

Expense of equipment: 5,770.00 paid on my personal credit card

Partner sends money from her personal LOC to pay it off…

we owe her personal Line of Credit 5770.00.

I’m in a query here… where this is a loan to the company but is her personal LOC holding the debt?

I have the same situation with @parksbarbie. Now, if I do what you are suggesting, the opening balance in COA will change again.

Hi christyannesia!

I understand this is a fairly long thread, but there's a simpler and easier way to make corrections to an account’s opening balance. I’m happy to share this with you.

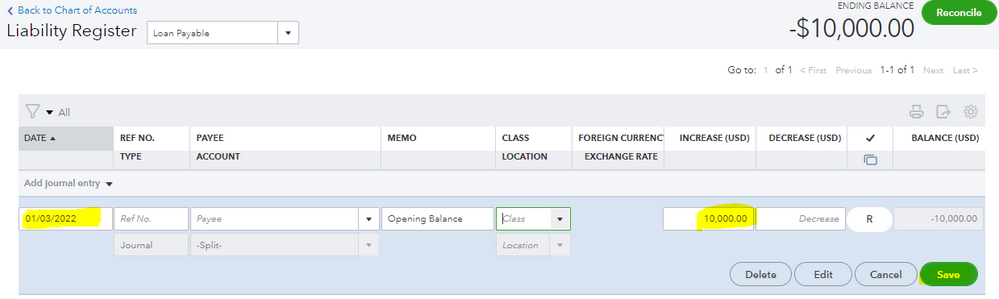

When you create a liability account and enter an opening balance, that amount will be recorded as a journal entry with Reconciled (R) status. That entry will show you a credit to the liability account and a debit to the Opening Balance Equity.

I’ll give you two If’s that will guide you through handling an opening balance.

If you want to correct the amount or date, and or delete an opening balance, just do so from the register.

If you didn’t enter an opening balance and realize you need one after the account is created, just record it as a journal entry. Well, you already know the entries - a credit to the liability account and a debit to the Opening Balance Equity account.

I'm sharing these articles for your additional reference:

If you have other concerns about correcting your transactions or anything in QuickBooks, just comment below. Take care always!

We have a loan that i set up in quickbooks as a long term liability. We never received any money but we owe for the business we purchased. The old owner is financing. It shows up as a debit for the person we are paying and a credit to opening balance equity. Is this correct?

Hi there, @Conniepresley. Allow me to chime in and share some details about your concern with your transactions in QuickBooks Online.

Yes, I’d agree that the amount shows up as a debit for the person you’re paying and show credit to the opening balance equity. Still, I recommend reaching out to your accountant for assistance with this matter.

Additionally, I'll share with you this article if you want to know more about the chart of accounts in QBO.

When everything is all set, you'll want to check out these articles for guidance. These can guide you further on how to categorize your transactions and reconcile your account flawlessly:

I’m always ready to assist you if you have any other questions or concerns about managing your bank transactions. Tag me in your reply and I’ll sprint back into action. Have a good one and keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here