Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHey all! Work at a timeshare resort, issue checks to owners for rental revenue but deduct a rental management fee for the resort. How do I enter the payment/check to reflect the original amount to be 1099'd and the fee amount with the correct total to pay the owner while still reflecting that original amount when filing 1099's? Ex: $950 rental rev, $190 rental fee, total to owner $760. (Unsure what amount QB will pull when doing 1099 wizard/where it pulls from). I've run the summary report and it appears to be the check amount.

Apologies, I came in to this after someone else entered the "bills" and the vendor payments aren't consistent so I have no idea how the transaction should be entered in order to verify or fix them all to file the 1099's. I've been tasked to figure this out, any help would be appreciated. Quickbooks Pro desktop.

Thanks all!

Tracey G

Thanks for your time checking this 1099 concern with us, @Justra23,

I want to be clear on this so I can help you further. Are you reporting the $950 rental amount into the 1099 report or the $760 net for the owner? Also, is the rental fee some kind of property expense for the owner? I need this information to make sure I provide the right steps to record everything.

In the meantime, to record the income from tenants, you can either use the options below:

If the fee is paid to the owner, you can record separate checks for $190 and $760. This way both amounts will be included to the total paid to a vendor in the 1099 form. You can write a check by clicking the Banking menu at the top.

To learn more about property management, see this article: Record transactions for a property management company

I'll be waiting for your response on this as I want to make sure all expenses are mapped correctly to the 1099 form. Have a good one!

Thank you so much for your response, I replied the other day but it appears it did not post. The amount reported to the IRS needs to be the $950. The actual amount to owner, check amount, is the $760 as the owner incurs the 20% fee for us to rent the unit for them.

The person that just left did not enter every check the same - some appear as a bill and check, some just a check and some that reflect a bill and a check and some other "line item"....yup.

I need to have the 1099's reflect the original rental revenue amount before the 20% fee (that is the taxable amount, it's up to the owner to file their taxes and decide how to claims the fee or whatever) but the checks reflect the original amount and the fee totaling the correct amount to owner.

I am unsure how this transaction should be entered so thats the first thing I need - need to pay the owner/vendor the rental revenue but I need to deduct the 20% fee from that revenue (do I create a bill to them or a line item on the check?) and then I've got to go back and make all the transactions she entered the same.

Thank again so much for any help.

Tracey

Hi there, @Justra23.

You can Write a Check when you paid the payment on the spot. You can use a Bill to designate it and pay the rent later through Pay Bills by a bill payment check.

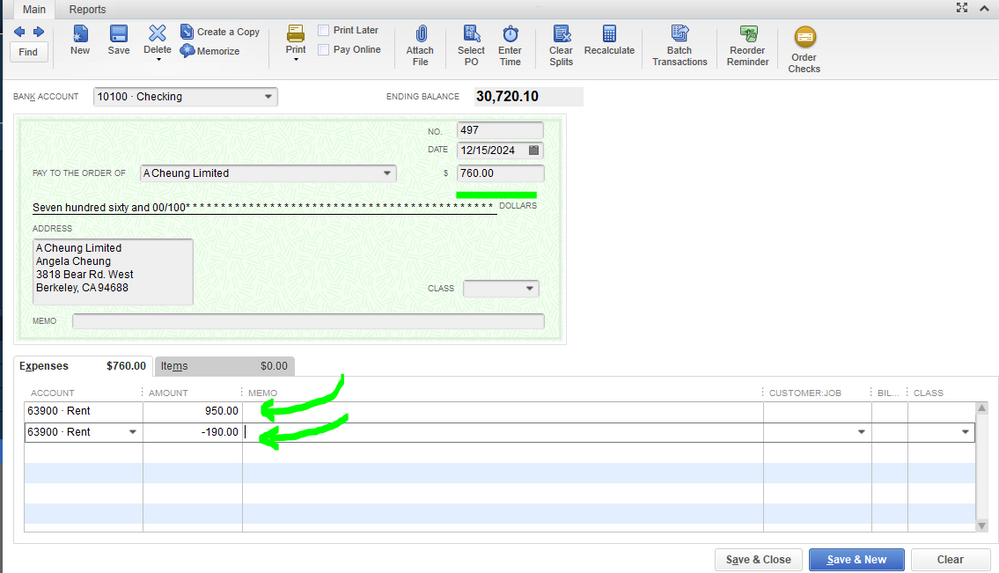

You're on the right track of recording your expenses to a vendor. You can follow the steps suggested by my colleague, Jen_D, recording a separate check to a vendor. Or you can follow my steps by putting the 20% fee on the line item as a negative amount.

Here's how:

That should help you correctly record your vendor's transaction and run the 1099 form.

If you have other questions in mind, feel free to tag me in your comment. We're always here to help. Take care, Tracey!

Thank you so much, I will try this next week!

Tracey

Thank you so much, I will try this next week!

Tracey

I am going to try this tomorrow and see how the other records were entered in comparison, is there a way to see how the 1099 is going to run, like where it puts the amount from? Previously it looked like it was pulling the check total on the 1099 detail report. If I run the 1099 wizard, just to see how it all works/looks etc. am I able to run it again (like if it's all wrong) or do you just get the one shot to run the wizard? I also hope o can delete the erroneous transactions she "cleared" and reenter them....eek

You're already on the right track in seeing how 1099 is going to run and where the amounts are put from in QuickBooks Desktop (QBDT), @Justra23.

The QBDT 1099 Wizard page will let you generate your 1099 forms (yearly) and show your vendor details, accounts, and included payments to name a few. Then, you can run it to see how it works since you're still able to generate the final forms after the year ends. I'd recommend checking out this article to learn more about 1099 boxes and how the system populates them: Understanding payment categories for the 1099-MISC and 1099-NEC.

There are two helpful 1099 reports you can pull up to check your vendor details (transactions and totals). Just make sure to set up the correct date range since they default to the Last Calendar Year option. You can learn more about this through this article: How to create 1099 summary or detail reports.

On the other hand, there are two possible scenarios that I can think of about deleting erroneous transactions in QBDT. It seems that you're referring to either filed 1099 forms or entered transactions of this year. When it's about the 1099 filed forms, you can refer to this article on how to correct forms after e-filing: How to correct or change 1099s in QuickBooks (QBDT section). While you'll have to select the vendor you want to delete and manually re-create one if necessary.

Additionally, here's an article that answers the most frequently asked questions about 1099 forms in QBDT: 1099 E-File, Setup, Troubleshooting, & FAQs. It also includes steps about viewing your filing history.

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about 1099 forms and reports in QBDT. I'm just around to help. Take care.

Thank you so much! Thank you everyone - it looks like I can create check, original amount as an expense "Rental Revenue" $950.00, additional line item as income as "Other Income" $190.00, check total becomes $760.00. When running 1099 wizard to confirm, I omit the "Other Income" selection, reports the correct amount of revenue to owner.

It appears the previous person entered "bills" and "bill payments" and now there are balances outstanding and the 1099 amount reports incorrectly - so at least can go back and delete her transactions, redo them and complete 2020 - what a blessing to have you guys!!

I cannot thank all of you enough - have an amazing Holiday Season!

Tracey G.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.