Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey QBO experts! I'm in a pickle and I sure hope someone can help. :)

We do not track individual credit card expenses in QBO, just enter a vendor bill for the parent credit card account and log the total for each expense category. May not be the most correct way, but it works for us...normally, that is. However, occasionally materials will be ordered on a PO and paid for by Credit Card. We've been entering the "paid" vendor bill in QBO to receive the items and close the PO, but I haven't figured out how to mark the invoices as "paid" in QBO. Any suggestions?

It’s great to see you in the Community, Teesa66.

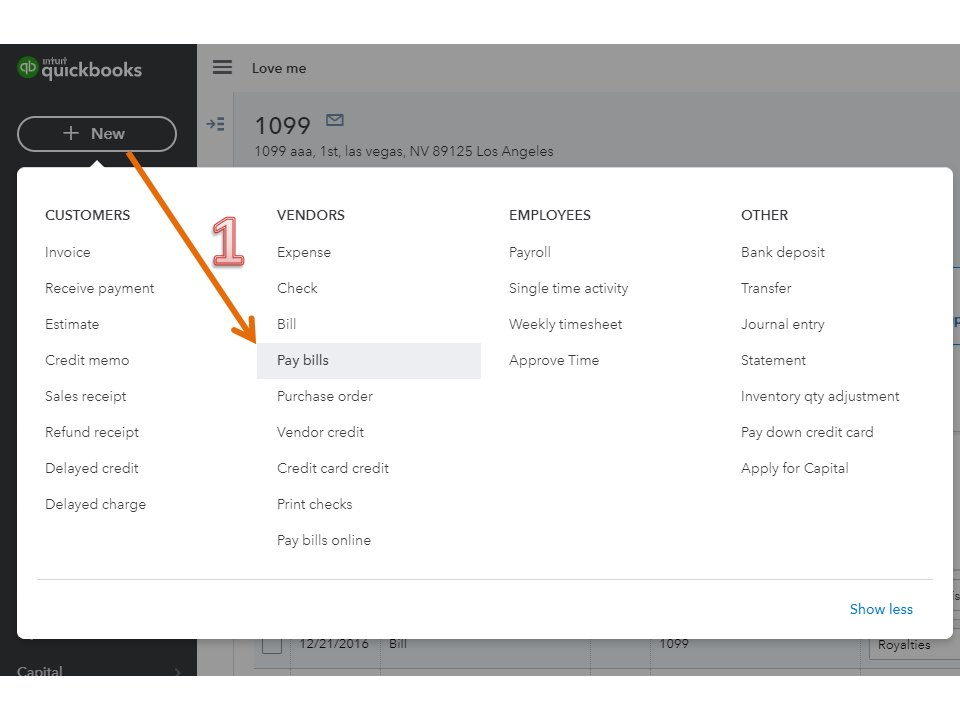

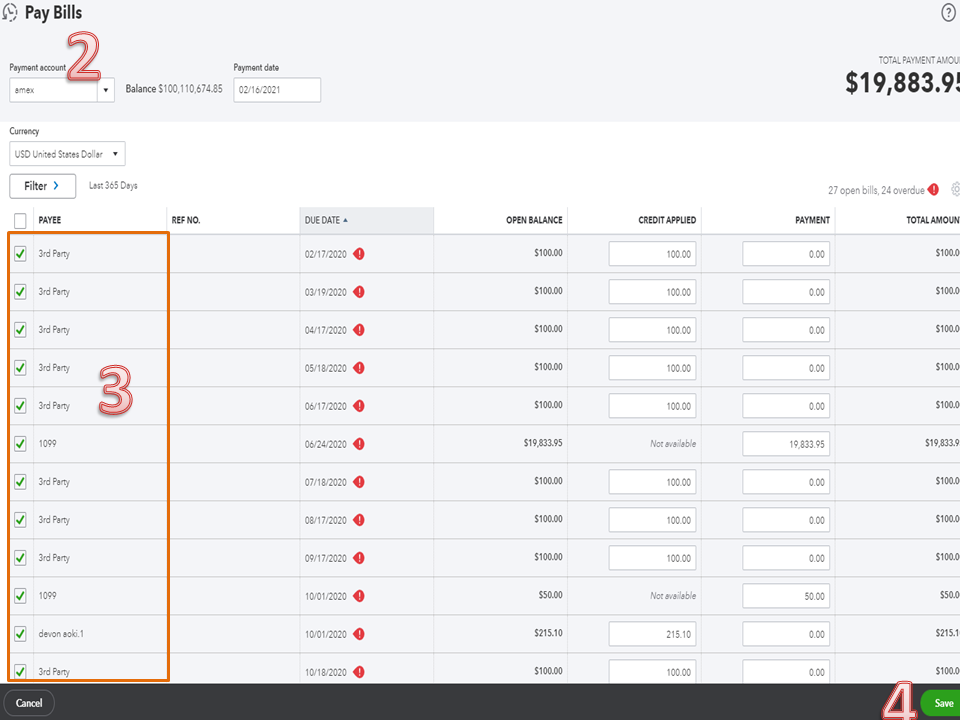

QuickBooks Online is a diary of your business that keeps track of what’s happening to the transactions. We’ll have to enter the payments via Pay Bills mark the bills as paid. I’ll help you on how to perform this task in your company.

After performing these steps, the bill's status will show as paid. Check out the following guide for more information on the process: How to pay a bill with a credit or debit card.

Additionally, this article contains resources that will guide you on how to handle your expenses, pay bills, and write checks: Vendor transactions.

If there’s anything else I can help you with, click the Reply button and post a comment. I’ll be around to assist further. Wishing your business continued success.

@Rasa-LilaM Thank you for the reply. However, we do not track the credit card transactions in QBO so the credit card is not an option under the Payment Account.

Hi Teesa.

Thank you for the follow-up question. At this time, you can use a clearing/dummy account when paying your bill in QuickBooks Online. I'm here to guide you with the process.

First, create a clearing account from the Chart of Accounts.

Once done, select the account when paying your bill/s.

After that, you can either record an expense transaction for your credit card or transfer an amount to the clearing account through a journal entry. For the best option, you may seek help from a professional accountant. An accountant can assist you with tracking your transactions accordingly and choosing the correct accounts.

For more tips about managing your customer and vendor transactions in QuickBooks, you can also check out the topics from our help articles.

Please let me know how else I can help with paying your vendor bills. I'm more than happy to help. Have a good one!

@Angelyn_T Good morning! Thank you for the reply (screenshots). However, I'm still not sure how I close out the vendor bill that was paid by the credit card. At this point, the only thing I've been able to come up with is to zero out the vendor bill, putting the actual cost in the line item description, and then marking the bill as Paid...

Hi Teesa66, I'm curious if you were able to figure out any other way to do this? I have the same issue and have searched and searched without finding a solution.

Hello. has anyone found a better way to do this? I just spent and hour and a half on the phone with QB and they had me create a dummy account, but it just duplicates my expenses (one under dummy and one on CC) since I still have to enter my expenses to pay the correct amount on my credit card?

QB doesn't seem to have any understanding of how to get rid of the duplication and mark the invoice paid - correctly?

I'm losing my mind with some of the things that QB tells me to do!

Welcome to the Community, @sixtythreenova. Let me walk you through recording the vendor bill payment using a credit card.

You'll need to create a bill in the vendor's name, then use the Pay Bills option to record the credit card payment. You'll be able to link it to the vendor's account and keep track of your expenses this way.

QuickBooks Online makes it simple to link a credit card payment to a vendor (QBO). For now, if you haven't already, you need to create a bill.

Here's how:

After downloading the Credit Card Payment, you can match it with the payment or the bill you created. Never mind your dummy account. You can use the expense account you are tracking.

With the invoice, I'm adding this article as your reference in processing a credit card payment: Process a credit card payment in QuickBooks Online.

For your future reference, here is an article to help you categorize and match transactions in QBO: Categorize and match online bank transactions in QuickBooks Online.

Let me know if you have other concerns about paying a bill. I'm just around to help.

@Ethel_A Sounds like this works only if you have your credit card account linked in QBO, which I don't.

This is great, but I don't have the credit card attached to my QBO... won't work for me. Any other suggestions?

I'm unable to connect my credit cards for various reasons, too many, too complicated and doesn't work for our business model. I seem to keep finding glitches in QBO that no one seems to be able to answer.

Thanks for getting back to us, @Teesa66. I'm here to further guide you as to how you can mark a vendor bill as paid using a credit card not linked in QuickBooks Online (QBO). This way, you can manage your expenses and vendor transactions accordingly.

You're not necessarily connecting your credit card account (i.e., online banking) to QBO. You're doing the process only for recording purposes in QuickBooks to keep track of your vendor transaction.

With this, you can enter the payments through the Pay bills option to mark the vendor bill as paid. You need to make sure you're associating it to the appropriate account (i.e., cc account) on your chart of accounts. Follow the steps provided by my colleague Rasa-LilaM above or check out this article for the complete details: How to pay a bill with a credit card.

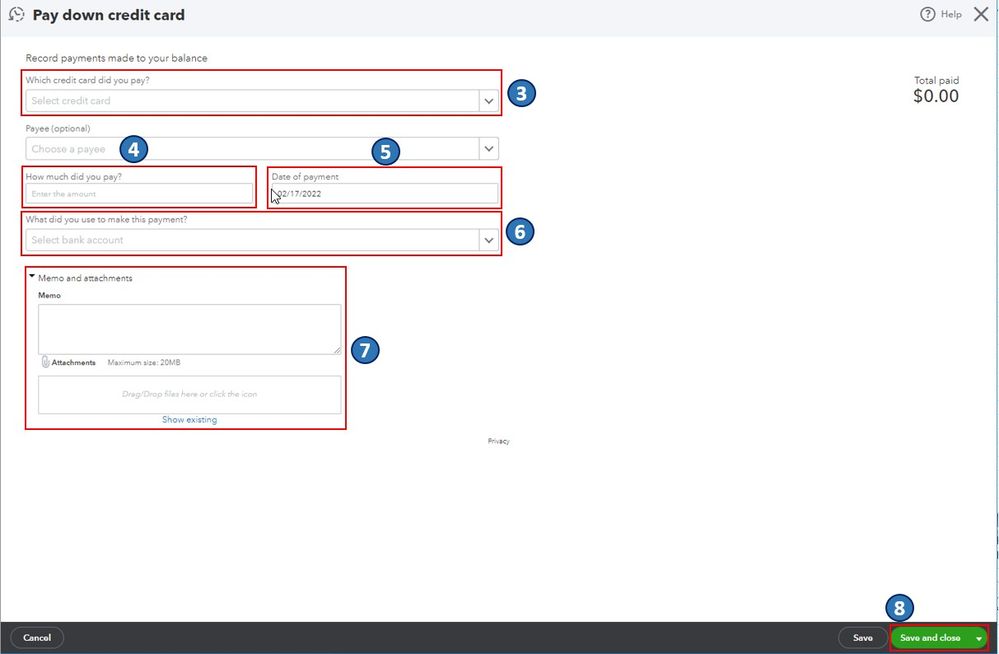

Once you're done paying your bills using a credit card, you'll have to pay it down. To do this, here's how:

You can also write a check as an alternative method to record credit card payments in QBO. If you wish to know more about this, you can refer to this article: Record your payments to credit cards.

Also, to further guide you in managing your bills, expenses, and vendor accounts in QBO, I'd recommend checking out this article: Expenses and Vendors Help Articles. It as well includes topics about paying expenses and bills, vendor credits, and inventories, to name a few.

Let me know in the comments below if you have other vendor concerns and questions about managing expense transactions in QBO. I'll gladly help. Take care, and I wish you continued success, @Teesa66.

Hi sixtythreenova,

I appreciate the additional details. However, I want to ask for more information, so I can guide you with recording your transactions.

When you say the credit card that is tracked in QBO, does this mean it's not a business card? It's not in your Chart of Accounts? The reason I asked is that there is a different way to track expenses paid by a CC that doesn't belong to the business.

For example, when you pay a business expense using a personal credit card, the payment will serve as additional capital/equity and is reimbursable to the card owner.

On the other hand, if the card is a business account, but you don't want to track it, there should be some sort of a clearing account where the money flows to pay the bills because you created bills (mentioned as invoice) for those business expenses.

I may be overthinking the scenario, so I would appreciate any additional details.

@Rea_M Thank you for the additional clarification. Maybe this will work for my process, but I'm afraid it would create duplicate expenses. Like @sixtythreenova, I don't track our business credit cards in QBO for various reasons, the biggest being the sheer number of transactions involved. When I receive one of the credit card statements, I code each charge then create a vendor bill for the credit card company on which I enter the total for each account code as a category line item on the bill. I then write a check to the credit card vendor and mail the payment.

If I were to follow the process you outlined, wouldn't I be entering the bill payment for the individual transaction twice - once during the credit card paydown you detailed and once when I generate the actual check payment for the credit card statement? Wouldn't I have to decrease the category total entered on my credit card vendor bill for each credit card paydown if I follow the method you've suggested?

Keep in mind, I am only entering vendor bills for those credit card transactions for which a PO was created, not for every credit card transaction. (If I were entering bills for every transaction, I'd just go on & link the credit card in QBO.) My ultimate goal is to close the PO while showing the items as received and linking the PO to the paid vendor bill.

Hello. You aren't overthinking at all... you're on the right track. So the credit card is not in my chart of accounts. Its a company card, but tracked outside of QBO because it's primary use is not purchasing parts. There is no reimbursement to the card holder either. The card is paid as a vendor bill but not imported to chart of accounts where the charges "pull into" for reconciliation. Most of the information given as well as my conversation yesterday with a QBO agent is double tracking my expenses so its not a viable solution. @Teesa66 is also having the same problem.

In order to get my parts into my inventory, I must make an invoice for the items received. However, I am having to add them with the credit card as my vendor since I cannot seem to mark the actual vendor bill as being paid with an untracked credit card payment. Again, adding a clearing house double tracks my expenses throwing everything off. I have even tried paying it with the credit card as a vendor and changing it to the real vendor and that doesn't work. In addition to being an accounting problem, I have to prepare tax forms at the end of the year and these become non trackable under the credit card in order to keep the accounting in order. @Teesa66 is also looking for an answer to this problem. thank you

Thanks for the additional information, @Teesa66. I'll share some insights about your concern along with the steps on how to resolve this.

What you're going to do is to create a purchase order and then link it to the bill. Once you've already done that, you can now proceed to Pay bills. Here's how:

In case you already created a bill without linking your purchase order, this will leave the status of the PO open. And then if that happens, you have two options to close the PO. You can either change manually the PO status from open or pending to close or you can open the bill and then add the PO then remove the line items that are not linked to the purchase order. In case you've chose to do the second option, you'll then want to make sure that you are still getting the same total amount.

Here in QuickBooks Online, you can also use your bank or credit card to pay your bills, but in your case I can see that you don't have your bank connected to QuickBooks yet, we'll just proceed to paying your bill via credit card. For the steps, you can refer to my colleague @Rea_M's post. After you've followed the steps, it will decrease the credit card balance. With this, you'll no longer need to worry about getting duplicates with your transactions.

Additionally, I'll be adding these articles to help you in the future:

The Community is open 24/7 if you need further assistance with this. You can also click the REPLY button below if you have other QuickBooks-related concern. We'll be more than happy to provide additional assistance. Keep safe!

AGAIN...

My credit card IS NOT IN MY CHART OF ACCOUNTS.... I WILL NOT ADD IT for all the reasons I've stated previously. To add a dummy Credit Card Account to my chart of accounts DOUBLE ADDS MY EXPENSES on my balance sheet as I must still add charges and pay my credit card OUTSIDE OF QUICKBOOKS and those credit card expenses are still added to expense accounts inside QBO. Thank you for your answer, but this DOES NOT WORK for my specific situation. @Teesa66

Wow, how many times do users in this thread need to state that they DO NOT track their credit card in QB? Nevertheless, here come the instructions to "select your credit card" or "download your credit card or "pay down your credit card". Here's hoping we can get an answer for this soon.

I have the same issue and the offered solutions didn't seem to help for the same reasons as the OP. I came up with this solution that may help in your situation as well. I set the vendor bill to a wash account and created a credit for the vendor to the wash account. I used the memo to note credit card payment and date. Since we enter the cc statement similar to the OP it only shows up once in the expenses now and in the proper account because of how we enter the payment to cc.

I'm currently paying vendor thru their secure billtrust. When payment clears my bank account (accts Payable) it doesn't show that bill paid. How do I mark as paid?

Hi there, carolyn27.

It looks like you are using a third-party app for paying bills. There are two options on how you can mark the bills as paid. I'd be glad to share both options with you.

First, you can manually close the bill using the Pay bills function. Here's, how:

Second, use the Match option if your bank is connected in QBO via Online Banking. This way, the bills are automatically closed and marked as paid once the payment is matched to them.

Let me share this article for more details: Categorize and Match Online Bank Transactions in QuickBooks Online.

Allow me to share these articles in case you need more guidance when working with your banking transactions:

The Community is always here if you need anything else.

I have a similar issue. I paid an invoice by credit card and allocated the payment to correct general ledger account, but the payment doesn't show up in the vendor account. How can I do that without creating an additional expense on the general ledger account?

It's good to see you here in the Community space, @Bhbp0955. I'd be pleased to help you with the payment so you don't have to create an additional expense in your general ledger.

To ensure we're on the same page, I'd like to verify the process of recording the payment. This way, I can provide other steps to easily locate the payment so it will show up in the vendor account.

On the other hand, let's ensure that you selected the correct vendor

when applying for the payment so it will show in their correct accounts. To locate the payments received and deposited manually, you can run the Deposit Detail report.

Here's how:

I've added a reference for more details about running reports that can help you see different aspects of your business: Run reports in QuickBooks Online.

You may open these articles to help you match bank transactions and reconcile your accounts to make sure it's the same as your bank statement:

If you have any other concerns with the payments not posting to the correct vendor account, please don't hesitate to leave a reply below. I'm always here ready to lend a hand. Have a great day ahead, and take care.

I will run the report, but to clarify:

General Ledger account is solely for our annual audit. I ran the payment through my credit card, but I never posted the vendor invoice to QB. The payment was processed by credit card and the credit card balance was paid with an Expense to the GL account for our annual audit. So our accounts are balanced and the vendor was paid. I just don’t have that payment tied to the vendor account because I never processed a separate invoice. It was lumped in when I paid off the credit card balance.

Thanks for the prompt response, @Bhbp0955.

For me to provide the best resolution for you, can you please provide details about what transaction did you create to record your vendor invoices?

It would be also great if you can add some screenshots so I can have a better view of it and share the best fix for it.

I'd appreciate any additional details you can provide. I’m looking forward to your reply. Have a great rest of the day.

I will send you screenshot’s tomorrow. My point is I never entered a vendor invoice. We do not track credit card payments back to vendors. We just pay the American Express bill as if American Express is the vendor and debit the appropriate expense account (ie supplies, audit services, utilities, etc) I could adjust the original journal entry to audit expense, add a new bill for the auditor and mark it paid by credit card so everything balances out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here