Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe owner of our company has purchased/used materials, from the company inventory, for personal use. The materials have been put onto invoices (for the sales/use tax) and the owner wants to apply the balance of the invoice to owners draw. How can we mark the invoice paid, using owner's draw? Is this possible? If not, I would appreciate any recommendations on how to record this type of transaction.

Two options:

1) receive customer payment for the full amount. Make a deposit and select that payment. Drop down a line and under account type in the owner's draw account and enter the amount as a negative so the bank deposit is zero.

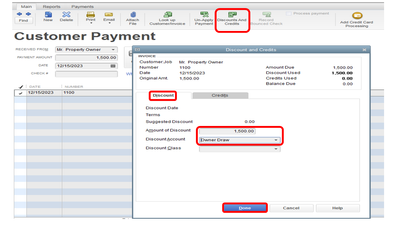

2) receive customer payment. Highlight the invoice, select discounts and credits. Create a discount and use the owner's draw account in the amount of the invoice.

Hello there, @DMJ79.

Allow me to help walk you through paying your invoices using owner's draw.

Here's how:

Feel free to the visit us here in the Community if you have other questions about recording y our Accounts Receivable in QuickBooks desktop.

Thank you for joining the thread, @chrishelle.

Let me share some ways to record payments to owners draw in QuickBooks Online.

First, record the payment to the undeposited funds then deposit it to your bank account. Then, add the owners draw account as a negative amount under the Add funds to this deposit section.

You can also reach out to a professional accountant for other ways of recording the transaction.

As always, feel free to skim through our help articles as your reference in the future.

Let me know if you have any other questions. I'm more than happy to help however I can. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here