Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy now(Quickbooks for Mac) Here's the scenario. Received online payments without invoices. We use Sales Receipts to capture the settlement amounts each day. I needed to issue a refund to one of our credit card customers so I did so on credit card merchant site. Now I need to capture that refund settlement that posted to my bank account. Since I cannot create a "negative" sales order, I created a credit memo, then I clicked the icon at the top of the window which said Refund when I hovered over it. That opened a check window prepopulated with the customer name and credit amount. The account defaulted to Accounts Receivable. I issued the "check" so the amount was removed from the bank account. When I run the Open Invoices report, both the credit memo and the refund are showing as open. I researched other questions and tried receiving customer payments and checked both checks items and clicked apply credits, but that only removed the 2 check items from the open invoices report and the credit memos still show as open invoices. I'm stumped as to how to resolve this one.

Solved! Go to Solution.

You left the dollar amount at 0.00 when applying the credit?

Once the credit is applied you'll see the check and the credit memo linked through the transaction history from the credit memo.

You followed this?

You'll see the amount of the credit included in the Existing Credits field and the refund check in the bottom section of the window.

If you now choose Customers > Create Credit Memos/Refunds to display the credit memo you just entered and click Tx History, you should see the refund check listed in the Transaction History - Credit memo window.

Yes, That's what I was referring to in my post. When I did those steps, the checks fell off the open invoice report, but the credit memos remained.

Did you change the account on the refund check or leave it as assigned by QB?

Left it as assigned by QB.

You left the dollar amount at 0.00 when applying the credit?

I think that did the trick! When I tried before, I checked the two items which created a payment amount. This time, I just clicked apply existing credits and auto apply. Everything fell off my reports. I do not see a new transaction anywhere though, so if I ever do this by mistake in the future, I have no idea how to reverse it. Can you shed light on that?

Once the credit is applied you'll see the check and the credit memo linked through the transaction history from the credit memo.

I just discovered a credit memo from 2015 created by a predecessor. I want write a refund check but if I do that without connecting it to the credit memo, the credit won't go away. Here are the instructions with my comments in parenthesis.

You'll see the amount of the credit included in the Existing Credits field and the refund check in the bottom section of the window. ("Existing Credits" doesn't exist. The title is just "Credits" but the Credit Memo shows up. The refund check does not "appear in the bottom section of the window" or anywhere else in this window.)

Select the Apply Existing Credits checkbox. (This option does not exist either so none of the rest of this makes any sense.)If you now choose Customers > Create Credit Memos/Refunds to display the credit memo you just entered and click Tx History, you should see the refund check listed in the Transaction History - Credit memo window.

Thanks for providing detailed information about your concern, @ICT.

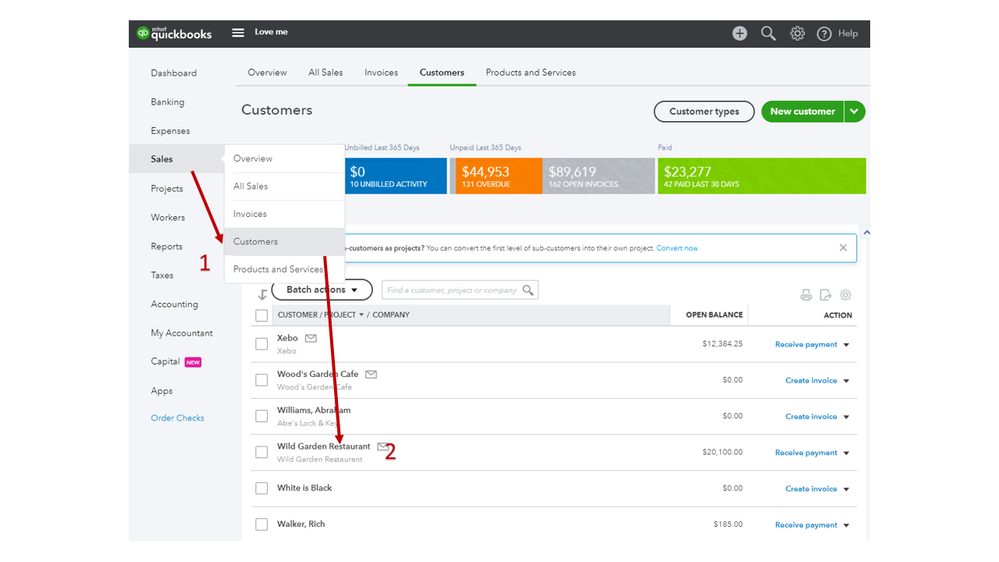

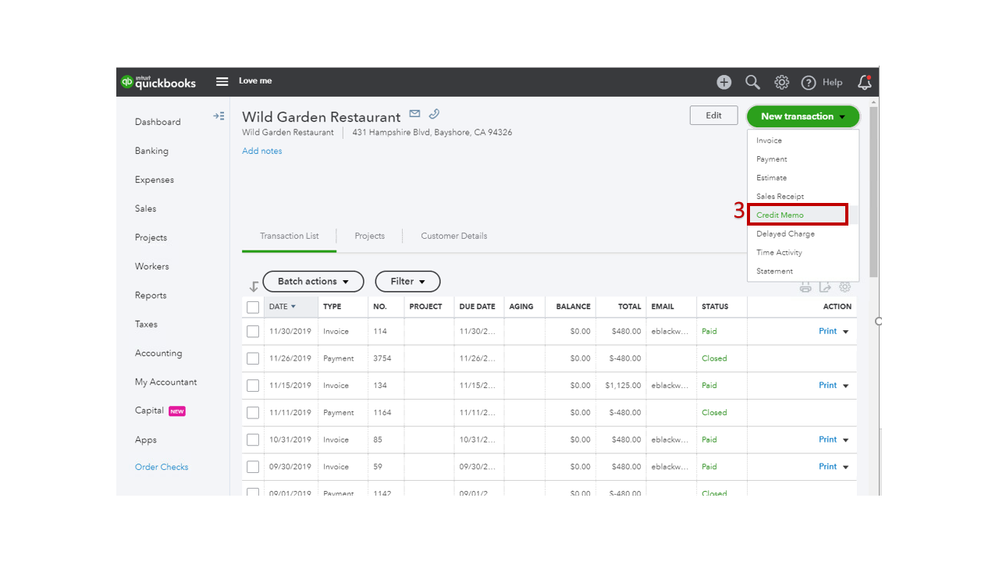

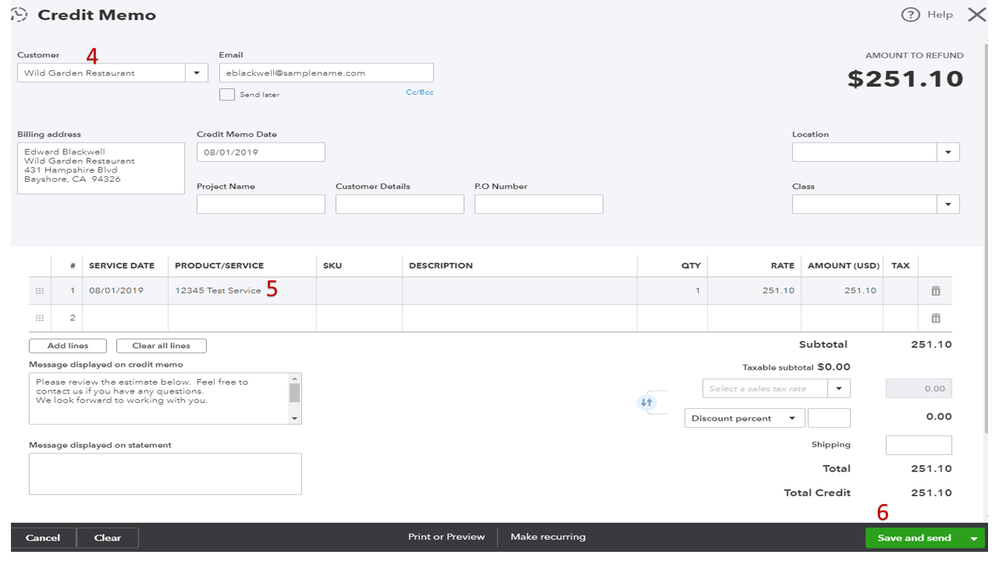

Based on the description provided, it looks like you’re using the online version. Let’s create the credit memo in your account and then go to the Receive Payment window to apply transaction.

Once the credit memo is created, you can now apply it to the invoice. Here’s how:

For additional information how to apply and enter a delayed credit and credit memo, check out this article: Credit memo or delayed credit.

Leave a comment below if you have other question or concerns. Please know I’m here to help.

The Credit Memo already exists. It was created by a predecessor in 2015. Since then, they created several invoices without reducing the amount by the amount of the credit. All subsequent invoices have been paid in full. On July 1 of this year, I created an invoice for the full amount due, not being aware of the credit. If QB indicated that there was a credit I didn't see it. The recent invoice was paid in full and that's the first time I saw the credit. When I went to "receive payment," QB assumed that the payment was for the full amount less the credit. I had to manually insert the full payment, leaving the credit in place. I assume that's what my predecessors did as well.

So, there is no outstanding invoice. My question is how to tie a CHECK to the Credit Memo. You said:

Once the credit memo is created, you can now apply it to the invoice. Here’s how:

So, I followed Step 1 but there is no "Outstanding Transactions section" and even if there were, there is no Invoice to mark.

Hello ICT,

You can create a check using the A/R account. Then, link it to your credit memo. Let me guide you through how to do it.

Once done, go to (+) Create and then Receive Payment to link the transactions.

You can read this handy article for more information: Write off customer and vendor balances.

You might also want to visit our page for future reference: Income and expenses.

Reach out to us anytime if you have questions.

Thank you for this. I am following the steps below but when I enter the amount, it gets wiped out before I can save. Also, there is no check box off to the left. Not sure what I can do here. Super frustrating! Credit memo shows up in list of transactions for this customer but the status still shows "unapplied".

I can share some troubleshooting steps so that you can get back to work, robynbrad.

When we use the browser, we may run into trouble with the browser's cache. Occasionally your browser will load your cached info instead of updated portions of the page that you are desiring to view. This can cause a slowdown, error, or unusual behaviors in QuickBooks.

We can start by opening a private window and use it to access QBO. You can press Ctrl + Shift + N for Google Chrome or Ctrl + Shift + P for Mozilla Firefox and Internet Explorer. Once done, let's try to link the credit memo again. If it's working fine, we'll have to go back to your regular browser and clear the cache to delete the junk files.

If you still encounter the same issue, you can use other supported browsers. It could be that the one you're currently using right now has a temporary problem with QBO.

Check out our supported browsers below:

Let me know how it goes in the comment section, as I want to ensure that you can link the credit memo.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here