Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello. I am using QB Online . A few months ago I issued an invoice to a customer and now they would like a refund. I would like to know if it is possible to issue a refund to a customer who paid via credit card? Or should I issue the refund directly from my bank and then record it in QB?

Solved! Go to Solution.

Greetings, @Anonymous.

It's a pleasure to have you in the Community. I'm here to share some information about issuing a refund to your customer's credit card.

To answer your question, Yes, it is possible! But before we proceed, please note that QuickBooks Payments will only allow you to process a refund within six months from the date of the sale. After this period, you can provide a refund using cash or check.

To process a refund, here's how:

1. Log in to your QuickBooks Payments account.

2. Choose Reverse a Transaction on the Processing Tools drop-down, then fill out the fields and select Search

3. Pick the Invoices you want to refund, then Submit.

That should point you in the right direction. For more information, you can also check out this article for future reference: Void or refund transactions in QuickBooks Payments.

Please let me know how it goes by posting a comment on this thread. I'll be here should you have any other concerns or if I can be of additional help. Take care and enjoy the rest if the week!

Greetings, @Anonymous.

It's a pleasure to have you in the Community. I'm here to share some information about issuing a refund to your customer's credit card.

To answer your question, Yes, it is possible! But before we proceed, please note that QuickBooks Payments will only allow you to process a refund within six months from the date of the sale. After this period, you can provide a refund using cash or check.

To process a refund, here's how:

1. Log in to your QuickBooks Payments account.

2. Choose Reverse a Transaction on the Processing Tools drop-down, then fill out the fields and select Search

3. Pick the Invoices you want to refund, then Submit.

That should point you in the right direction. For more information, you can also check out this article for future reference: Void or refund transactions in QuickBooks Payments.

Please let me know how it goes by posting a comment on this thread. I'll be here should you have any other concerns or if I can be of additional help. Take care and enjoy the rest if the week!

Dear FritzF

Thank you for the feedback. It was very useful.

Best,

LSA Um

You're always welcome, @Anonymous.

I'm happy to know that those steps helped you with the refund process.

Please post again should you need further assistance or if you have follow-up questions. I'm always here to help. Have a good one!

Where do I find "Processing Tools"? I have searched all menus and cannot find anything by that name.

Thanks for joining this thread, Borg54,

I'm here to help you today. The Processing Tools can be found on your QuickBooks Payments account.

You'll want to sign in through this link, http://merchantcenter.intuit.com/. Then, click Processing Tools next to Home. See the attached screenshot below for your visual guide.

On the other hand, if you need to record a refund from, you can refer to this page, Record a customer refund in QuickBooks Online. It provides instructions and detailed steps for your guidance.

Stay in touch if you have follow-up questions. Just tag my name and I'm always right here to help.

Hello,

How do I process a partial refund on a credit card payment?

Thank you

Hello,

How do I process a partial refund on a customer credit card payment?

Thank you!

Good morning, AFF2020.

Thanks for joining this thread. I'd be glad to show you how to process a partial refund to your customer in QuickBooks Online.

This can be done with a Refund Receipt. Here's how:

1. Click the +New button.

2. Select Refund Receipt.

3. Choose the customer you want to refund from the Customer ▼ dropdown menu.

4. Fill in the necessary info from the original sale. Only add the items or amount you want to give a partial refund toward.

5. Select Save and close.

The following linked article provides additional details about this process: Void or refund customer payments in QuickBooks Online

With this info you'll be able to issue a partial refund to your customer. Please don't hesitate to reach back out if you have any other questions.

I try to issue the refund but I receive the following message: We couldn't process this card. Please re-enter the card details and try again.

Thank you for joining on this thread, @wgppe.

I appreciate following the detailed steps provided by my colleagues above on how to process a refund in QuickBooks Online.

Let's make sure to select the correct Payment method and Refund From in the Refund receipt page. If you get the same error, I'd suggest contacting our Customer Care support. They can access your account in secure surroundings and help get rid of the message.

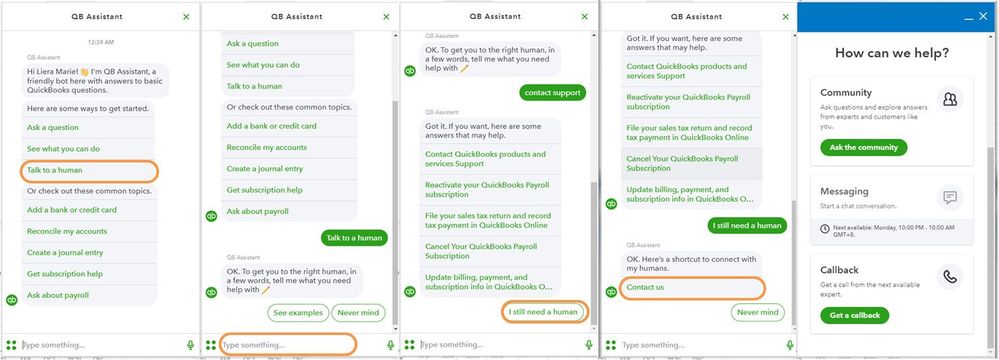

Here's how:

To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays. For more information, check out our support hours and types.

You can access the Transaction List by Customer report, then customize the report to show the specific details.

See the sample screenshot for your reference:

You also have an option to send the refund receipt to your customer by going to the Customers page, then choose Transaction List, and click the Send button under Action.

Please let me know if I can be of further assistance. I'll be around to help you out. Have a great day!

I followed this process for issuing a refund to a customer's credit card, but will this record in QB Online or will I also need to record/create something to zero out the payment?

I’m here to provide insights when issuing a refund to a customer's credit card, @Anonymous-1.

Before anything else, are you trying to give a full refund to your customer?

If yes, you shouldn’t follow the steps provided by my colleague above since the instructions are for partial refund only. Otherwise, you need to use the original sale to zero out the payment. This process in QuickBooks Online is to make sure your accounting stays accurate.

Depending on the type of transaction you used, you can follow the outlined steps below:

Refund a credit card or an ACH payment for a sales receipt

Refund a credit card payment or ACH payment for a paid invoice

You can check this article to learn how to void or refund payments you process through QuickBooks Online.

Let me know if you have an additional question about the refund process. The Community team will always here to help. Have a great day ahead!

Do you get the credit card intuit charge fee returned to you if the transaction is refunded?

Hey there, @michelleakey1.

Thanks for joining in on this thread. Allow me to provide you with some information about the credit card intuit charge fee.

With refund or return transactions, you'll be charged a fee depending on your pricing plan and transaction type. You won't be able to get the charge fee returned/refunded back to you. Here's a guide that can provide further details: Am I charged a fee on refund or void transactions?

In addition, cruise on over to our tutorials page to see what other features are available to you and your business.

These details and guides should give you the answer to your question. If you have any other concerns, don't hesitate to ask. The Community and I are always here to have your back. Have a wonderful weekend!

I followed the steps to issue a refund receipts, but my customer never received a refund. I have their credit card information saved, and so, on the invoice there is a box that says "process credit card"... Do I need to have that checked? (I check that box when I process payments from my customer so I thought to issue a refund I wouldn't want it checked.... but I have no idea what I am doing.)

You're on the right track, TS3100.

When processing a refund, you'll have to place a checkmark in the Process credit card box. This way, the amount will be returned to your customer's actual bank account.

In case you're still unable to do so, I'd suggest contacting the Payments Support Team. They're also equipped with tools to determine why you can't refund your customer.

Here's how:

I also encourage understanding the fees for refunds or void transactions. This answers your questions about what you were charged for a refund.

Additionally, I've added our QuickBooks Payments FAQ article. This contains commonly asked questions that will help you when processing payments or refunds.

I'm always here if you have other questions about giving a refund to your customer. It's my pleasure to help you out. Keep safe.

You compare yourself to PayPal and say you are less expensive, however PayPal does not charge any fees on refunds. Zero charge on any refund or partial refund using PayPal. So for some of us it is better to stay PayPal.

Your refund terms are very confusing and after researching I will pay 3.40% on a keyed in payment plus 25 cents for every refund or partial refund after already being charged for the transaction. So we will be double hit with transaction fees on any sale with refund or partial refund.

I do NOT have a REVERSE A TRANSACTION under any of the options. Extremely frustrating! I look something up and my online version NEVER has the options described in these Q & A. Assistance getting my credit card deposit to MATCH should NOT be this difficult.

Thanks!

Annoyed

This is not the impression we want you to experience, seusa1.

The Reverse a Transaction option can be found on your QuickBooks Payments account. To process a refund, just follow the steps below:

You can also do an alternate method to Reverse or Void a sale y following the steps below:

You can also sign in through this link, http://merchantcenter.intuit.com/. Then, click Processing Tools next to Home. See the attached screenshot below for your reference:

Here's an article you can refer to for more details about voiding or refunding transactions in QuickBooks Payments. If you need to record a refund in QuickBooks Online, just follow the steps and details in this article: Record a customer refund in QuickBooks Online. It provides instructions and detailed steps for your guidance.

Feel free to cruise on over to our tutorials page to see step-by-step videos to learn your way around QuickBooks.

Please let me know how it goes by posting a comment on this thread. I'll be here should you have any other concerns or if I can be of additional help. You have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here