Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen I enter the fees into the deposit screen like shown above, it is creating credits for that customer. Why is this happening?

Hello kmpgc,

Entering the fees through the deposit window doesn't create credits to the customer's account, unless you choose Accounts Receivable account. Here's what we need to do so you can have the same result on the video above:

Here's how you can review the Preferences:

After paying the invoice, here's how to add the fee when creating a deposit:

Let me know how this goes.

I checked my preferences and it was already set to undeposited funds. From the customers & job tab on the left it shows they are PIF, but when I click on the customer invoice that's where it shows "balance due" and the fee, instead of $0.00. I attached a picture.

The girl before me had been adding fees under the discount tab but our P&L has a discrepancy so I am trying to go back, fix, and re-reconcile everything, using this way to enter fees. Also, not sure if this has anything to do with it but we are a cash basis company when it comes to reports.

I think I figured it out. I didn't uncheck and check after I changed the payment to the full amount so it was still showing up as the old amount paid (fee taken out).

THANK YOU!!

Hello there, kmpgc.

Thanks for sharing us how you're able to figure it out. This will help a lot of customers who are also having the same issue.

Please know that the Community is always here anytime you need help about QuickBooks. You can post anytime if you have questions or want to share your best practices using the product.

@ intuit guys, I have recently switched from the Mac 2016 version to Windows Pro 2018 and I have to say that the credit card fee process as described above is a big step BACKWARDS from the Mac workflow. In the Mac version, you add the customer payments, then enter the net deposit amount, and QB proposes the net difference as an expense to the CC fees account. Boom, hit "save". Very simple and intuitive. Just a suggestion for process flow improvement in the windows product.

(PS There are several features in Mac QB that would be nice to have in Windows QB that simplify and speed up work...)

Hello jck667,

Thanks for letting us know about your feedback. We'll take of it. For now, let me share some articles that'll help you run your business with QuickBooks for Windows:

You're always welcome to post some more questions. We'll be glad to help.

Thank you!

I download my banking transactions online so card sales come through at the net amount. From the "bank deposit" screen I adjust the bank deposit to increase the amount to the original sale price (before processing fees) then add the processing fee as a negative... so the amount still balances to the original bank deposit. My concern is that the card purchases don't show on the list of expenses. Is that a concern?

Thanks for joining this thread, @Tyler123.

Your transactions may have not yet cleared by your bank, which is why the expenses aren't showing on your bank feeds.

Once cleared from your bank, you can manually update your bank account to add the expenses.

Here's how:

Please refer to this article to learn more about downloading sales and expenses from your financial institution: Download Bank Feed transactions.

Should you need anything else, don't hesitate to reply to this post. I'm always around whenever you need help.

Thank you, this is awesome. I could not find the answer in QB and have been doing it he hard way for years.

I have followed the directions given in the video, but I am now seeing this issue:

1. When I reconcile the payments to my bank account, I am seeing the full amount paid by the customer in my deposits column, rather than what was deposited to my account (customer paid amount less the processing fee). I do not have the fee listed in the withdrawals column to offset the incorrect deposit amount.

Keep in mind, my bank does not connect to Quickbooks. So, I am responsible for adding everything manually.

Thanks for any help!

Thanks for joining this thread, @pinkgeek1313.

You can create an expense to record your processing fees that included the payment amount. Let me guide you how.

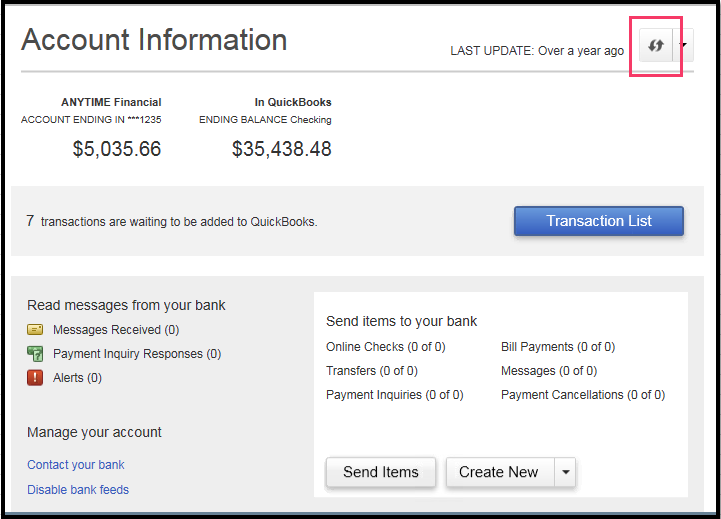

Please see the screenshot below:

To learn more about your bank feeds and also for the bank transactions such as reconciling your bank account, you can visit our QuickBooks Desktop Help Article for the guidance.

Leave a comment if you need anything else. I’m more than happy to help. Have a good one!

Hello,

What if my customer approved to charge his credit card for $500 and the credit card processing of 3%, which is now a total of $515. The invoice still has a balance. How do I tell quick books that the $15 is a charge I cc processing fees, will this be an income or expense account?

I have it as an income?

thanks

Yes, it's correct to use an income account for the processing fee, Eve2019.

You can create a service item and add the processing fee to your invoice.

Here's how:

You can also record credit card charges directly from the Merchant Service Center. Please check out this article if you want to know more about the process: Process payments in the Merchant Service Center.

For future reference, you'll want to categorize bank transactions in QuickBooks.: Categorize And Match Online Bank Transactions In QuickBooks Online.

Let me know if you need help. I'll be here to assist you.

i fully understand how this works however my question is

when I do it this way and enter it the cc fee shows as type: Deposit and do not list the customer name

if i just match the invoice to the deposit from the online transaction screen it shows as type: Expense and shows the customers name

does it matter? other than just not liking how the report looks when i run a reprot for credit card fees??

Thank you for taking the time to explain that to us, LoriTT.

I can see that the process of matching an invoice to the deposit with a fee is confusing to you. I want to make sure we record transactions in QuickBooks and ensure the report shows the correct amounts and categories.

To be clear, can you send a screenshot of how you enter the CC fee that shows a deposit with no customer name?

Can you also provide the steps before matching the invoice to the deposit? Or a screenshot maybe of the invoice you match to the deposit that shows an Expense and the customer name.

I'll keep this post while waiting for your response. Thank you and have a great day ahead!

i have entered deposit two different ways. One the exact way described in this post. When I do and run a report for my Credit Card Fees it does not show the name of the customer of the report when i do it this way. i have realized looking futher into it that it will only show the customer name if there is one deposit if there is multiple credit card deposits on the same deposit the report does not show the names.

If there is only one invoice to match to the deposit i just match it on the transaction screen. I do not receive payment and then bank deposit. I just select (categorize MATCH Record as transfer) from the banking screen then select which invoice then on the bottom I select resolve deposit and take the fee from there. when I do this way it show up on my credit card fee report as type: expense and not a deposit and show the customers name. I am having a hard time getting a print screen and formatting it to the page. sorry

I can share some information that can help you with adding recording your transactions, @LoriTT.

You may consider adding this credit card fee as an Expense.

Here's how:

Check out this article for more information: Enter and manage expenses in QuickBooks Online. I'll guide you with recording, editing, and deleting expenses.

From here, you can run the Deposit Detail report managing bank deposits. Here's how to run and customize this report: Run reports in QuickBooks Online.

Let me know if you need further help in recording your transactions. I'm always here to help. Have a great rest of the day!

After I did this, the transaction did not show up under vendor's account, only show in the chart of account under expenses, Is there a way to have this payment show up under vendor's account? Thank you

Hi:

I did the way that you showed, after finished Step 3. but the credit card charge did not show up under (credit card fee) vendor account, is there a way to have this credit card fee show under vendor account as well?

I also create a credit card fee invoice, and paid the invoice when deposit from Undeposit account to A/P, but there is no payment link to vendor as well, only shows the balance to 0 .

Certainly, Sue2751. You can have the payment show up under the vendor's account and let me help you how:

Once you've correctly linked the transaction to the vendor, it should show up under the vendor's account in the Expenses by Vendor report or when you view the vendor's profile.

Additionally, you can explore these helpful articles to manage and customize your report and overall financial management:

Furthermore, you may want to explore QuickBooks Live Bookkeeping to streamline your accounting processes, ensure accuracy in your financial records, and provide expert support, allowing you to focus more on growing your business.

I'm glad we could clarify the process for you. Please reach out if you have any further questions or need additional support. I'm here to help make your QuickBooks Online experience smooth and efficient. Have a great day, and rest assured that your financial management is in good hands.

Hi JorgetteG:

thank you so much for the notes, I'm using QB desktop, and I enter credit card fees (like Paypal fees) as negative amount in the deposit transactions, below is a screen shot of what I'm working on, I have setup a vendor name "credit Card Fees" in the vendor profile, but the fees I entered in the deposit do not appear in the vendor file. They can only be find in the expenses report.

I tried to create an invoice under the vendor file and paid it using Vendor / 2100 A/P, the the payment still does not show up in the vendor file, only balance appear as 0.

Thanks for providing those additional details, @Sue2751. It's great to see you proactively managing your vendor profile to track these transactions.

When you enter credit card fees as negative amounts in your deposit transactions, they decrease the total deposit amount. This is why these fees don’t appear as expenses in the vendor profile. Instead, they're reflected in your expense report, where QuickBooks tracks the actual costs incurred.

To clarify, the vendor profile will show transactions such as purchase orders, item receipts, bills, bill payments, checks, credit card activities, and sales tax payments. Negative amounts in deposits won't be included.

For more information on generating bank deposits, visit this article: Record and make bank deposits in QuickBooks Desktop.

If you want to manage payments in your Undeposited Funds account before finalizing deposits, check out this article for guidance: Deposit payments into the Undeposited Funds account in QuickBooks Desktop.

The thread is always open if you need more tailored advice, Sue. I'm here to help you maximize your QuickBooks experience. Stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here